M_a_y_a/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to discuss the state of the broader market as a whole. This is a reflection on how different assets and sectors have performed in the first half of 2022 and, perhaps more importantly, areas I believe could hold up well in the second half of the year. Unfortunately, this reflection is fairly negative given how poorly most corners of the market have fared. But there have been a few bright spots, and there are certainly areas I think warrant putting some cash to work.

To be fair, there are plenty of unknowns in the market right now – from war in Europe, energy supply crunches, continued above-average lead times for goods, and elevated inflation. All of these factors could weigh on returns in Q3 and Q4. All of them could actually get worse and make the end of the year quite painful. But that is a very pessimistic view, and I actually see some light at the end of the tunnel. With that in mind, I will cover a few ideas that I think will be fruitful going forward, but I would urge readers to not get too aggressive here. If you are already heavily invested and/or can’t withstand additional volatility, it may be best to wait on the sidelines. But for those who were waiting for a sell-off, can handle some more risk, or generally take a longer-term view on their investments, there are some spots that I believe we can take advantage of as retail investors.

2022 Has Been Off To A Very Poor Start

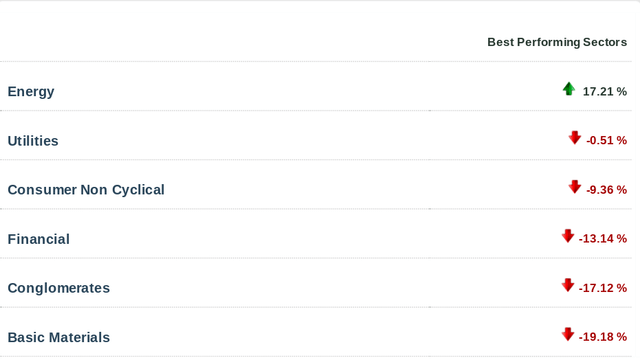

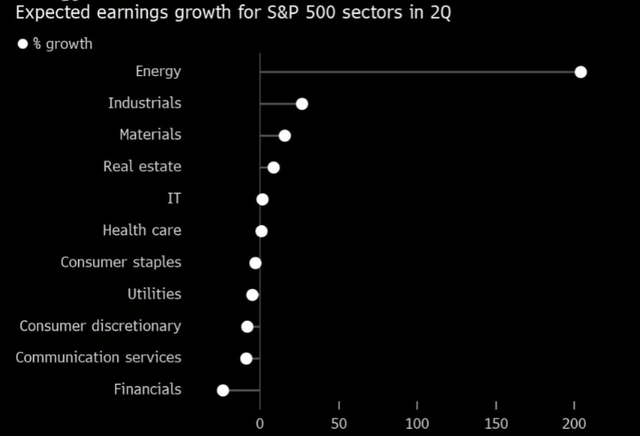

As I am sure everyone is already aware, this calendar year has been a very difficult one. On the backdrop of a strong 2021 and the prospects for reasonable growth this year, it wasn’t supposed to be this way. But challenges with inflation, supply-chains and shortages, war in eastern Europe, rising interest rates, and renewed COVID-lockdowns in China have all taken their toll. In fact, there isn’t a whole lot to be upbeat about. As a result, almost all equity sectors are heavily in the red year-to-date. This is to the point where it is really a “win” to be flat, or just slightly down (such as Utilities). With most cyclical and discretionary sectors down heavily, the one bright spot that has been fairly consistent until very recently is Energy:

YTD Performance (Various Sectors) (CSI Markets) YTD Performance (Various Sectors) (CSI Markets)

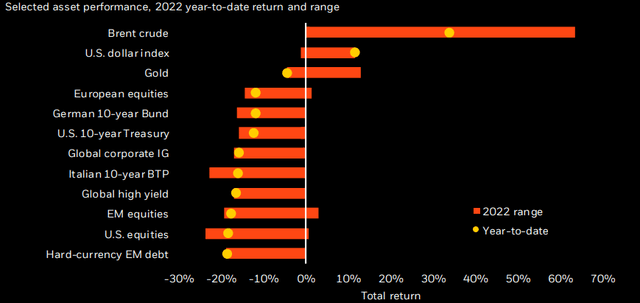

Looking past just U.S. equity sectors, we see this weakness has extended into other asset classes. While crude oil has surged (helping the Energy sector out-perform) and the U.S. dollar has risen, U.S. equity hedges like bonds, gold, and foreign stocks have all seen negative returns as well:

There isn’t a whole lot I can say except that investors have been punished this year. Worse, there weren’t many places to “hide” during this onslaught. Traditional wisdom would indicate that if stocks were performing this badly bonds would be doing well. This is supposed to offset losses and balance one’s portfolio. But 2022 has not seen that thesis play out. This is mainly because inflation has roiled bond and equity sectors alike. Even alternative asset classes such as crypto have not provided any type of hedge – which is why I see little merit to holding them now.

With this backdrop in mind I think it should give readers pause and a chance to reflect on what has actually been working and where potential value is. With almost every sector having sold-off, it is easy to see value everywhere. After all, such large drops in price typically indicate buying opportunities. But my thought is there will be continued weakness ahead in many cyclical areas and that being more selective on what to buy is the right move. I will now shift to some areas that I do believe have value, and follow that with a discussion on why other “cheap” sectors do not pique my interest yet.

Let’s Stick With Energy, Which Has Been Working Until Recently

It is easy to look-back and rehash all the things that haven’t worked in 2022. But the more important exercise is figuring out what will work in the future. Clearly, 2022 has not been kind, and there are plenty of reasons to suggest the second half of the year will be just as difficult. The macro-headwinds I mentioned above are not going to just simply go away. The global economy is in a tight spot, so selective buying will be key going forward.

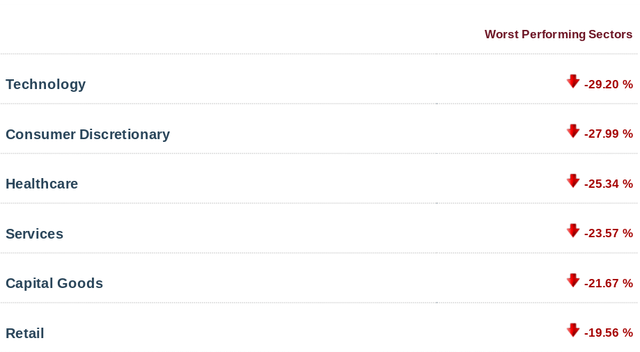

With that in mind, I continue to like Energy positions in my portfolio. This may seem too obvious, given the run the sector has had this year. But while the sector has indeed pumped out double-digit gains in 2022, we should also acknowledge the sector is actually in a bear market (defined as a 20% decline off its high). How can a sector be performing so well but be in a bear market? Because the gains in the first half of the year were so strong initially, that the sector is still up roundly despite 20%+ drops in the short-term. In fact, in the last month alone the Vanguard Energy ETF (VDE), the iShares Global Energy ETF (IXC), and the crude oil benchmark have all dropped by double-digits:

1-Month Performance (Google Finance)

With this weakness it should be logical to question why I would recommend this theme. The momentum is surely negative, but I think this is a bit unjustifiable right now.

There are multiple reasons for this. One, crude prices still remain elevated. While they have retreated a bit recently, $100+ for a barrel of crude is still very profitable for the oil majors. This will support the sector in the near term, and I don’t see a scenario where demand really falls off a cliff. Yes, recession fears are looming, but the supply backdrop remains positive (for supporting prices). Demand can fall and prices will still be higher than they were a year ago. That is positive for stocks.

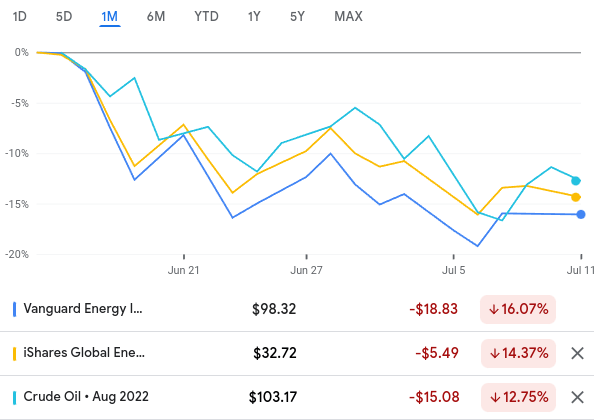

Further, earnings season is kicking-off and Energy shares are poised to shine. After such a sharp sell-off, I think this sets the sector up nicely. My point being that if stocks had kept rising and expectations were very high, selling into earnings may make sense. But the opposite is actually true at the moment. Shares have been falling and investors are pessimistic – a ripe opportunity for a contrarian play. This is supported by the fact that earnings growth for the Energy sector is expected to be quite strong in Q2. Figures should be well ahead of other sectors, offering the chance for post-earnings boosts:

Expected Earnings Growth in Q2 (By Sector) (Yahoo Finance)

My thought is I see a recent sell-off and the potential for strong earnings reports as a buy catalyst. This is a theme that has been working for most of 2022, so I see little incentive not to stay long in the second half of the year. I don’t see a big enough change in tone out of Washington to see the supply imbalance correct itself, and this is an area I actually want to add exposure to, not divest.

**My personal holdings are VDE and the ProShares Ultra Bloomberg Crude Oil (UCO), which is a double-leveraged crude oil play.

NASDAQ Rarely Has Such Prolonged Weakness

The next area I see some value may come as a bit of a surprise. This is the NASDAQ index, which has been under-performing both the Dow and the S&P 500 this calendar year. With this backdrop, it is justifiable to being cautious at this juncture. Similar to the market as a whole, the headwinds that have plagued this index are still in place. This includes growth concerns, the potential for a recession, inflation, and a general risk-off mode. So, again, I wouldn’t get carried away here. But I would use big one-day drops or prolonged weakness as buying opportunities.

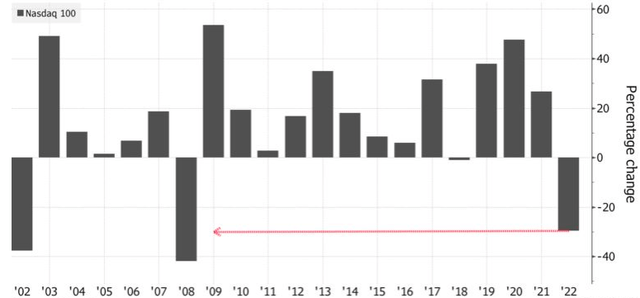

At these levels, I think one would be well-served to add to their exposure. Yes, the drop in excess of 20% this year alone is scary. But we have to remember that this type of price action is very rare. The NASDAQ almost always finishes a calendar year in the green, and the years following a similar sell-off in 2088 saw substantial gains:

Annual Returns (NASDAQ 100) (S&P Global)

The conclusion I draw here is fairly simplistic but I believe it is supported all the same. The NASDAQ’s valuation has moved into a normalized range, and its heavy sell-off suggests better days are ahead. Historical returns don’t guarantee anything, but they can be useful indicators. For me, I see the weakness as overdone, and will further down days as chances to buy, not panic.

**My personal holdings include the Invesco QQQ ETF (QQQ).

Munis Sold-Off Too Aggressively

My next topic is one that I do think investors should approach somewhat cautiously. This is a longer-term play because a key factor that has pummeled this sector is inflation, which will probably persist in the coming months. So, while I see value here, it is not going to be a straight shot upwards. Investors should buy this for tax-free income stream, and look to add on weakness, of which I am sure there is more to come.

The sector I am referring to as municipal bonds, specifically tax-exempt ones. As I mentioned, inflation has hammered the sector, which is traditionally a defensive corner of the market. With duration levels have risen too high across most ETFs and CEFs in this space, with inflation rates and rate hikes followed, share prices went broadly south.

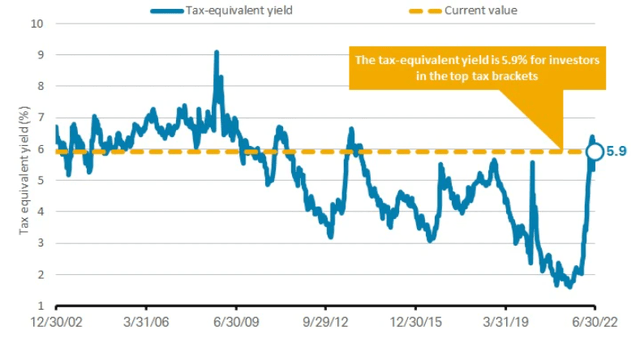

The upside is this brought about some value. Many popular CEFs in this space are seeing steep discounts to NAV. Further, credit quality actually remains strong. This has kept distributions stable and defaults rare. The reality is that the income is very high on a historical basis, especially once we adjust the yield net of tax savings:

Tax-Adjusted Muni Yields (Average) (Charles Schwab)

The takeaway here is that investors will be hard pressed to find a quality income stream in the 6% range. You can absolutely find this if you move down in credit quality, but for investment-grade debt, this is very attractive.

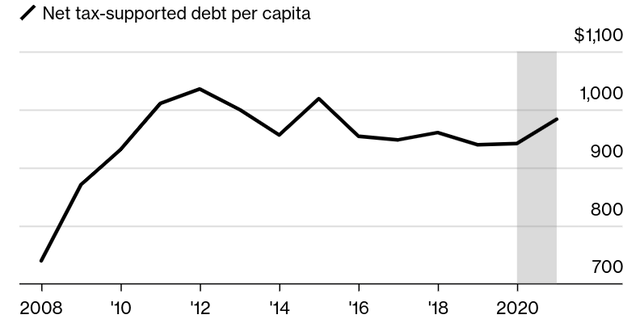

Additionally, I think concerns over state and local budgets is overblown. The current U.S. administration has made aid to the states a top priority in recent legislation. Further, while debt levels rose in 2021, I am not overly concerned because this still keeps debt burdens in-line with where they have stood over the past decade:

As my followers know this is a sector I have favored for a long-time. Yet, I took a more cautious stance about a year ago, primarily because of that duration risk I mentioned. The impact of that did come to pass, but for full disclosure I got bullish on this sector too early in 2022. I felt like I avoided to sell-off and patted myself on the back, only to see munis fall further. Fortunately, there has been a rebound recently, and my outlook remains positive from here. But I say this because I want to emphasize that duration levels remain high, and this sector has seen more volatility over the past year than is typical. This is a word of caution not to get too bold at these levels, unless your primary focus is the income (which is very attractive indeed) and you can withstand the continuous volatility I expect to see.

**My personal holdings are the Nuveen AMT-Free Quality Municipal Income Fund (NEA) and the BlackRock Taxable Municipal Bond Trust (BBN).

Retail Looks Cheap, But Maybe It Should Be

I will now shift the conversation to some corners of the market that do not spike any interest for me. I mentioned earlier that most corners of the equity market have been sold aggressively. This makes value appear almost everything, but I would steer clear of what I consider value traps for the moment.

One area that comes to mind is retail. This is a sector I have some exposure to, unfortunately, as it rallied in the aftermath of Covid-19 when consumers were flush with cash, high savings rates, and proved very resilient. Since then, the story has been categorically negative. In fact, retail, as measured by the SPDR S&P Retail ETF (XRT) is down almost twice what the S&P 500 is in 2022:

Retail vs S&P 500 (Google Finance)

This divergence could suggest a contrarian buying opportunity. In some ways, I hope it does. While I reduced my position in XRT this year, I am still long and that position is in an IRA. So I don’t benefit from tax-loss harvesting by selling it, and will simply remain long. But rather than “double-down” to recoup losses, I am going to stay patient before adding more.

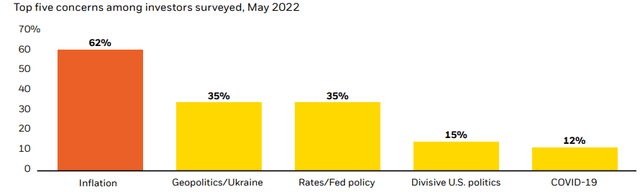

The reasons are multi-fold. Retail is getting hammered because of the macro-environment regarding consumer sentiment, inflation, and interest rates. Do you see these attributes materially changing anytime soon? I sure don’t. In fact, inflation has become a bigger worry for American households as 2022 has gone on, despite more “expert” predictions that inflation is peaking. Remember, these are the same people that told you inflationary would be transitory, so forgive me if I won’t take their word on it peaking this time around either.

Aside from the fact that even if inflation has peaked, that doesn’t mean it’s going to reverse course in a meaningful way. If inflation remains at current levels, watch out. The fact that consumers are this worried about it suggests that spending is going to be subdued for the time being. After all, if you are worried about the future and inflation, you can begin to tighten the belt a bit. With inflation far and away the biggest macro-concern among U.S. investors, this suggests a change in momentum won’t be forthcoming:

Investor Concerns Ranked (BlackRock)

The takeaway here is that I don’t see a major catalyst for a retail bump in the short-term. Similar to most sectors, there is probably some long-term value here. But I am fairly convinced I can pick this exposure up at an even better price in the months ahead. Perhaps as we can closer to the holiday shopping season I will reconsider and try to front-run that catalyst. But, for now, I don’t see a lot of merit towards pumping good money after bad with all the headline inflation risk weighting on the minds of American consumers and investors.

**My personal holdings include XRT.

Mainland Europe Is Another Avoid For Me

Another area that has value on the surface is Europe. Not surprisingly, stocks on the mainland have taken a big hit in 2022, as they are faced with not only inflation and slowing growth, but also war in Ukraine. This is a major headwind, causing fears of the conflict spreading across other sovereign borders as well as energy supply worries. The net result has been a steep sell-off in this corner of the world, with valuations touching levels not seen since the onset of Covid-19 over two years ago:

European Stocks P/E (Bloomberg)

It seems very straightforward and obvious that EU stocks should be a buy here. With nervous investors looking for value, and Euro equities sitting at historically cheap prices, it is almost a no-brainer, right?

To me, the answer is no. Anything this painfully obvious should give investors immediate pause anyway. The market is telling us something we need to at least consider. Is buying during times of stress and below-average valuations often a winning play? Absolutely. And it very well could be here. But I am concerned equities are not as cheap as they appear. Yes, the P/E is low, but the “E” part of that equation could easily sink further. If the Russia-Ukraine conflict escalates, watch out. If consumers end up being forced to pay drastically more to heat their homes this winter, watch out. If economic activity slows, watch out. All of these headwinds are very real.

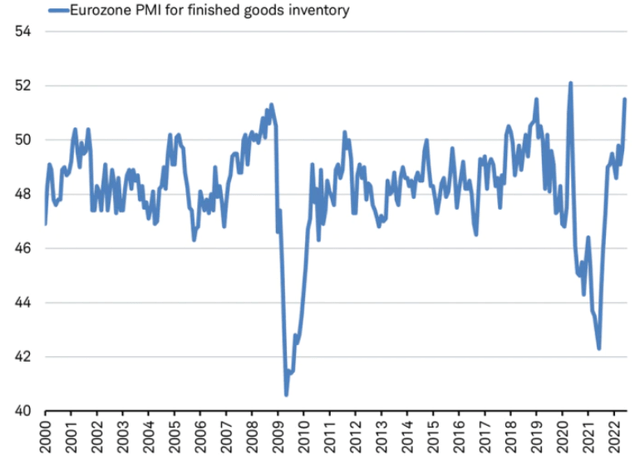

In fact, there are already signs that the macro-environment in the Euro-zone is weakening. PMI data and inventory build-up are concerning for the region’s equities, with finished goods near twenty-year highs:

Inventory Build-up (Euro-zone) (Charles Schwab)

What I want to convey here is that while Europe looks cheap, it looks cheap for a reason. That does not mean we need to panic, but I would be more discerning here. The outlook is very cloudy there – the potential for an escalation in a military conflict is not something we generally have to assess when discussing developed market equities. This is a big red flag that times have changed significantly, and investors will probably be taking on more risk than they realize even if valuations are “cheap”. For me, I would continue to look to developed markets when branching out of the U.S., but in those markets that are more removed from eastern Europe and unlikely to be drawn into a military conflict. Personally, I like Canada, Australia, and Ireland for that purpose, in that order.

*My personal holdings include the iShares MSCI Canada ETF (EWC), the iShares MSCI Australia ETF (EWA), and the iShares MSCI Ireland Capped ETF (EIRL). I also own the iShares MSCI United Kingdom ETF (EWU), but am less bullish on that option at this time given the ongoing political drama.

Bottom-line

In summary, 2022 has been a year to forget so far. We can hope that quarters three and four bring better tidings. But hope is not an investment plan. To prepare for the next few months I would suggest moving into Energy, whose sell-off is based on recession fears primarily. To me, the supply story and the rapid decline in prices both support higher prices going forward. The NASDAQ remains a risky index, but I believe buying on down days will prove fruitful in the end. I also see value in municipal bonds and developed market equities that are well removed from the geo-political risks in mainland Europe.

By contrast, I see general Euro-equities and retail stocks as places to avoid, despite being very attractively priced on the surface. I think the discounts these arenas offer are justified, and won’t be buying in until I see another leg down (which I expect). Sometimes, knowing what to avoid is just as important as knowing what to buy, and this is that type of market in my view. Ultimately, I hope this exercise gives readers some food for thought, and will help for preparation for the second half of the year.

Be the first to comment