stockcam

Snap Inc. (NYSE:SNAP) recently reported a rather disappointing Q2 with revenue coming in below expectations and adjusted EBITDA loss getting worse. While the company did report an overall strong quarter in terms of daily average user growth, average revenue per user continues to remain challenged, especially in their faster-growth geographies.

Additionally, the company did not provide guidance for Q3 revenue or adjusted EBTIDA given the current uncertain operating environment. With the company noting that early Q3 revenue trends were flat yoy during the earnings call, I believe there still remains quite a bit of risk embedded into execution.

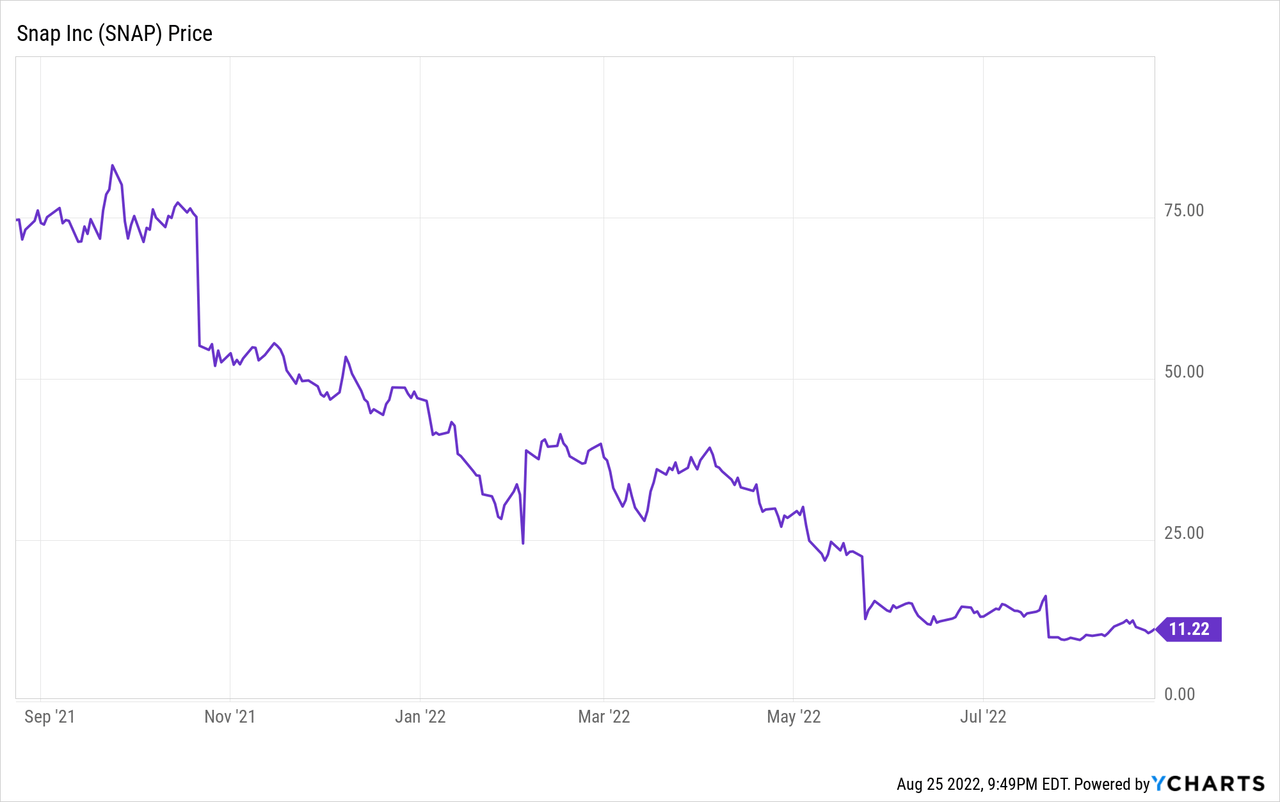

The stock initially pulled back around 40% the day after reporting Q2 results. Though it has rebounded a little bit since then, Snap still remains down around 75% year to date.

Right now, the biggest concerns are around the uncertain demand environment, path towards profitability, and increased competition within the marketplace. Given these ongoing factors, I believe the stock could remain in the penalty box over the coming quarters until Snap is able to demonstrate improved execution, especially around user monetization and operating expense controls.

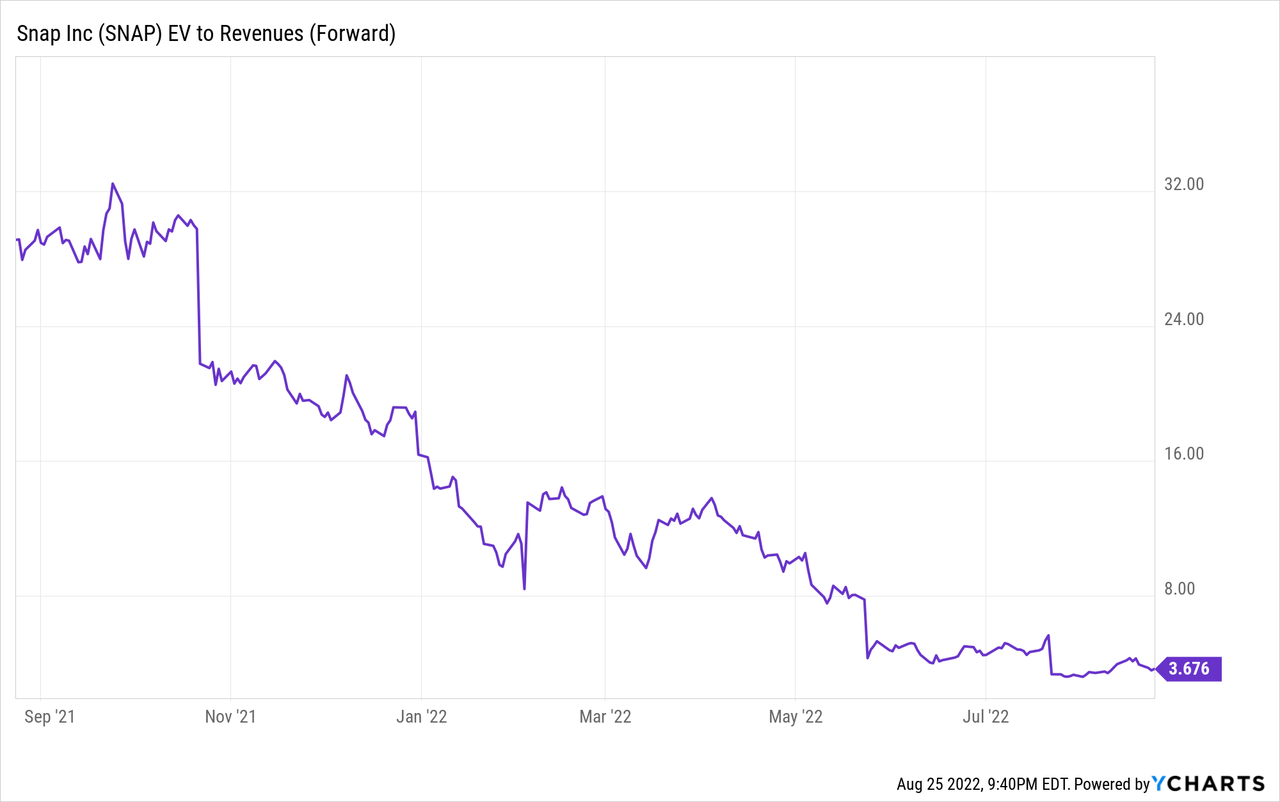

The stock currently trades just under 4x revenue, which does not screen attractive for a company with decelerating revenue and ongoing adjusted EBITDA losses.

For now, I continue to remain on the sidelines even after the relative rebound since the company reported earnings.

Financial Review and Lack of Guidance

A few weeks ago, the company reported weaker than anticipated revenue, with growth of 13% to $1.11 billion coming in below expectations for $1.09 billion. While a slight revenue miss is never good to see, Snap has been under increased pressure given declining ad rates and general pressure seen throughout the social media industry.

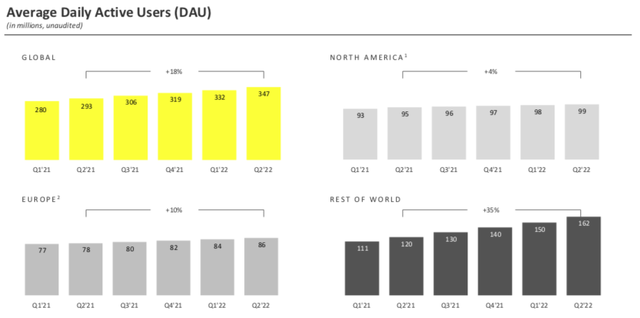

In fact, one could argue the revenue miss is not really a big deal, but the trends seen across daily active users (“DAUs”) and monetization are a bit more worrisome for investors.

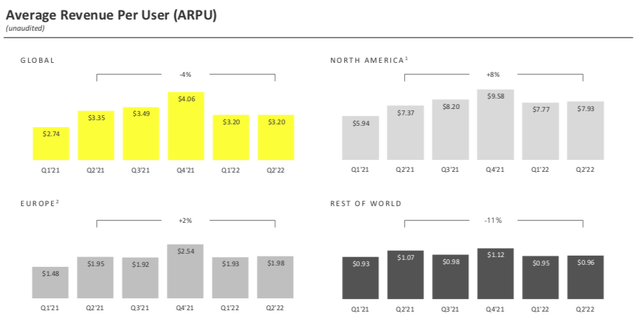

Looking at DAUs by geography is much more insightful than just the total DAU count. During the quarter, Rest of World DAUs grew an impressive 35% yoy and even though the macro environment in Europe remained challenged throughout the quarter, DAUs still managed to grew 10% yoy. However, I believe there are some concerns around the DAU trajectory in North America, which just so happens to be their highest average revenue per user geography.

The chart above shows the different levels of average revenue per user across the company’s geographies. North America ARPU was $7.93/user, which is significantly higher than any other geography. And as the DAU count continues to slowdown in this geography, this will ultimately have more pressure on revenue growth over time.

On the contrary, Rest of World ARPU remains under $1.00/user after declining 11% yoy during the most recent quarter. So even though DAU growth was the strongest at 35% yoy, monetization is much more challenged. Yes, international growth remains a significant opportunity in terms of user expansion, however, it is much more difficult to actually monetize these users. Thus, DAU growth becomes less meaningful if the growth is largely coming from geographies that are challenging to actually monetize.

Snap

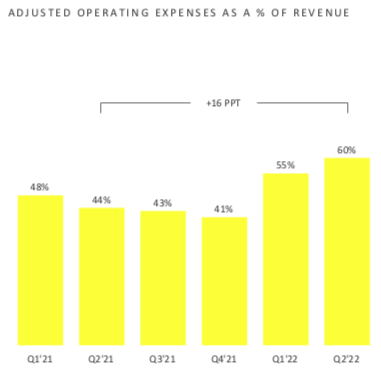

Another area of concern is how much money Snap continues to spend to drive DAU expansion. While I agree it’s important for the company to invest in growth and international expansion, they need to focus on profitable growth. Especially as fears rise around a potential recession and investors slowly turning to more defensive and profitable companies, I believe Snap will have to increase their focus on profitability metrics.

During the past quarter, adjusted operating expenses actually increased to 60% of revenue, which was significantly higher than what they company had seen over the past several quarters. In fact, adjusted operating expense have increased sequentially the past two quarters from 41% of revenue in Q4, to 55% of revenue in Q1, and then up to 60% of revenue this past quarter.

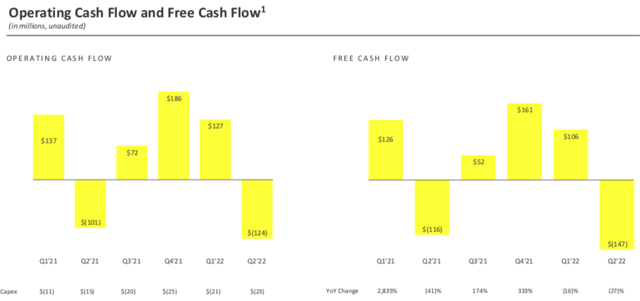

While it’s no surprise that free cash flow (“FCF”) was weak during the quarter, the near-$150 million FCF loss during the quarter was worse than the year-ago period. As mentioned above, Snap will need to place increased focus on improving profitability. And management mentioned some steps they are taking during the recent earnings call.

First, I think it’s clear, our rate of revenue growth has slowed considerably, and we are acknowledging we must adapt our investment strategy accordingly. So first, we intend to substantially slow our rate of hiring to effectively pause growth in our headcount, which is a significant portion of our Opex. In addition, we’ll be looking at the rate of operating expense growth that is non-personnel-related in order to stem the rate of growth in our overall operating expenses. The objective there being to get to a place where we can carve out a path to free cash flow breakeven or better even at reduced rates of top line growth.

Also during the quarter, the company announced a $500 million stock repurchase authorization. While this does provide some flexibility in terms of offsetting share-based compensation dilution, I do believe the company will need to first improve their profitability before they spend additional capital on share repurchases. Snap also said they will look to split the stock if the share price hits $40 within 10 years.

As we look toward Q3, we are pleased with the momentum we have observed in our community, and we estimate that DAU will be approximately 360 million in Q3. Thus far in Q3, revenue is approximately flat on a year-over-year basis. Forward-looking visibility remains incredibly challenging, and it is unclear how the headwinds we observed in Q2 will evolve as we move through Q3. Given this, we do not intend to provide financial guidance for Q3. That said, it is clear that our rate of revenue growth has slowed considerably and we must adapt our investment strategy. We intend to substantially slow our rate of hiring, as well as the rate of operating expense growth. We will reprioritize our investments and drive a renewed focus on productivity.

In a bit of a shock, Snap did not provide guidance for Q3 revenue or adjusted EBITDA given the ongoing uncertainties within their operating environment. With the company noting that their revenue growth has slowed considerably, management also mentioned that so far during the quarter (as of July 21), revenue was approximately flat yoy, clearly demonstrating a deceleration of growth.

The company also talked about the current demand environment, which remains very fluid and uncertain. With the company noting that clients can quickly turn off their advertising spend, this enables greater uncertainties over the future spending environment.

Valuation

To no surprise, the company’s stock fell nearly 40% the day after reporting earnings. Investors quickly pivoted away from the company given the uncertain operating environment and ongoing losses.

Yes, the company said they will make steps to improve their operating expense profile and start pushing their eye towards profitability. However, given the ongoing losses, revenue deceleration, and challenging demand environment, this stock could remain in the penalty box for a few quarters until they can demonstrate a return to sustainable growth.

Year to date, the stock is down around 75% with investors no longer willing to place such a premium multiple on the company’s forward revenue valuation. Currently, the stock is trading around 3.7x forward revenue, which does not screen cheap relative to their financial profile.

As of the company’s earning’s call, Q3 revenue was trending towards flat yoy, and with adjusted EBITDA coming off a loss of $150 million during the most recent quarter, I believe there continues to be some downside risk to valuation over the coming quarter.

With the company not providing guidance for the upcoming quarter, it will be difficult to benchmark their Q3 results. I believe the stock could remain challenged over the coming quarters as the company will likely need to beat the lowered expectations and demonstrate improved cost controls.

For now, I continue to remain on the sidelines and will wait for the demand environment to clear up and the company to start better executing.

Be the first to comment