artas/iStock via Getty Images

Smith & Wesson Brands (NASDAQ:SWBI) is one of the world’s leading manufacturers of firearms and firearm related products. The company, which sells its products directly and through dealers to military, law enforcement, and individual customers in the US and throughout the world, has a 169 year legacy and is arguably one of the most storied brands in the fire-arm industry.

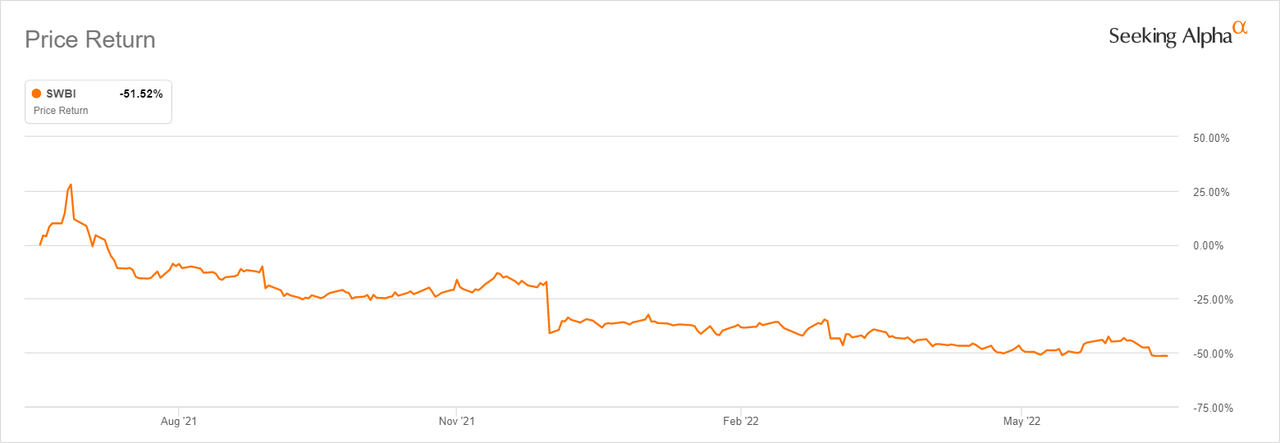

Ugly stock chart

Like other major gun manufacturers, SWBI has been overshadowed by negative sentiment in the past year in the wake of rising cases of gun violence in the US. This partly explains it’s the ugly stock chart; its down by 25% YTD and a painful 50% in the last 1 year.

SWIB 1 year chart (Seeking Alpha)

However, souring public opinion towards the firearm industry is not the only reason for SWBI’s huge slump. The industry has been weighed down by oversupply of guns following a spike in demand for firearms at the height of the pandemic in 2020.

U.S. gun sales doubled in the early days of the pandemic, rising from an average of 1 million guns sold monthly in 2019 to nearly 2 million a month in 2020, according to an NBC news report citing data from the FBI and Small Arms Analytics. While the explosion in demand was good for gun makers’ sales at first, it inevitably led to oversupply and saturation in the market– a situation that led to a decline in revenues for gun manufacturers in the latter half of 2021, triggering a sell-off in gun stocks.

SWBI’s peers in the stock market have performed dismally in the last 1 year, highlighting the impact of the changing demand/supply cycle on investors’ sentiment towards the industry overall.

AMMO, Inc. (POWW), which manufactures and sells ammunition, is down around 50% in the last 1 year while Sturm, Ruger & Company (RGR), another leading arms manufacturer that sells its products through the Ruger brand, is down 25% in the last 1 year.

SWBI’s valuation suggests downside is limited

With firearm demand trends normalizing, SWBI’s decline in the last 1 year presents a decent entry opportunity for investors who are bullish on the underlying business.

With a P/E GAAP (FWD) of 3.39X and an EV/EBITDA (FWD) 1.88x, SWBI is valued as a company on the verge of bankruptcy. This is despite SWBI being a profitable market leader with a strong balance sheet and a sound growth strategy. SWBI is also a market leader in an industry with high barriers to entry, meaning its competitive advantage is not at risk of significant erosion.

For context, the median P/E GAAP (FWD) in the consumer discretionary sector is 11.82X while the median EV/EBITDA (FWD) is 8.01X.

SWBI’s low valuation suggests there is limited downside at the current share price. In other words, investors can safely buy the stock at these levels without worrying about another precipitous fall like the one witnessed in the past one year.

Strong balance sheet and sound growth strategy

Looking at the upside potential and the catalysts that can turn this potential into reality, SWBI’s key strengths lie in its pristine balance sheet and a sound growth strategy that allows it to capture cyclical increases in demand without sacrificing margins and eroding shareholder value.

One understated strength in vice industries (alcohol, tobacco, firearms, gambling) is balance sheet strength. Raising capital in these industries can be difficult and expensive, especially now with the growing popularity of ESG investing. Having a strong balance sheet offsets this risk.

For its most recent quarter, SWBI had debt of $43.22 million vs cash of $107.27 million. SWBI’s management capitalized on the surge in demand in the wake of Covid-19 to strengthen its balance sheet and grow shareholder value through strategic capital allocation, including initiatives to pay off debt and buy back shares.

“Since the demand surge began in March of 2020, we have paid down $160 million of debt and are now debt free, bought back $200 million of stock, which reduced our outstanding shares by nearly 20%, paid nearly $20 million in dividends, invested nearly $40 million back into our business,” said the company CEO and President, Mark Smith, on the latest earnings call, underlining the smart choices the management is making to maintain the strength of the balance sheet and grow shareholder value.

Importantly, SWBI has a sound growth strategy that allows it to leverage on the strength of its balance sheet to grow in an efficient way in times of increased demand.

SWBI has a flexible strategy of absorbing increased demand for firearms and related products by outsourcing the manufacture of certain gun parts to other companies, allowing the company to avoid expensive and permanent expansions to its factory capacity.

This outsourcing strategy allowed SWBI’s manufacturing team to increase throughput by over 82% during the surge in firearm demand following the Covid pandemic, according to statements by the management team during the latest earnings call.

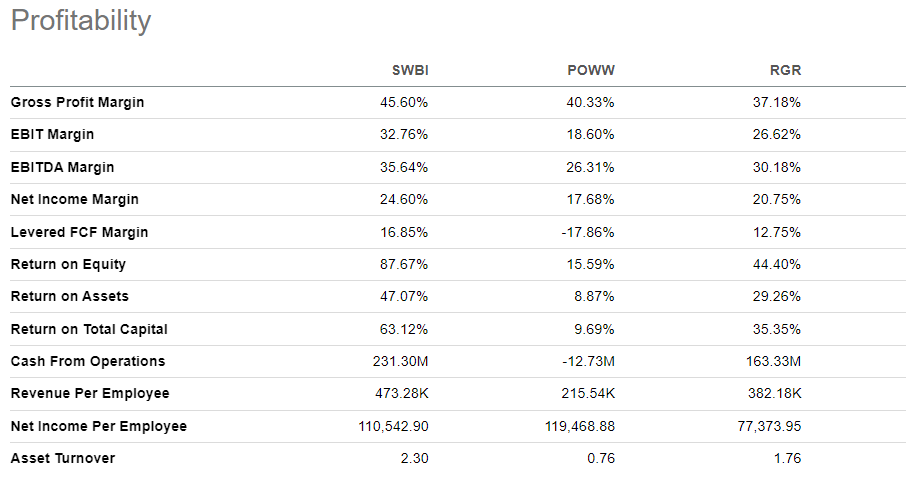

The company is essentially able to capture demand without hurting margins, explaining why it remains way ahead of its peer set when it comes to profitability. The chart below shows SWBI’s performance on key profitability metrics relative to POWW and RGR.

SWBI profitability vs peers (Seeking Alpha)

This outsourcing model allows SWBI to increase production quickly when it needs to, enabling it to retain and grow market share when times are good. When demand declines, it can reduce production without undermining the strength of its balance sheet.

Overstated regulatory risk

The key watch out for SWBI investors is regulatory risk. Although the firearm industry is already heavily regulated, lawmakers and state agencies are mulling even stricter controls in light of the unfortunate incidents of gun violence in the US.

While there is certainly need for more government oversight, the risk of outright bans on gun ownership are overstated. Not only is this unconstitutional, but it’s also not feasible from a political standpoint.

What we foresee is the erosion of immunity from suits brought by victims of gun violence. Litigation is, however, a risk that investors in vice industries need to be comfortable with. In our view, the recent public debate on gun control does not materially affect the bull case for SWBI.

SWBI is an undervalued play with a strong balance sheet, clear market leadership and sound growth strategy that prioritizes the interests of shareholders. We believe now is the time for bulls to pull the trigger for potentially exciting returns.

Be the first to comment