AmnajKhetsamtip/iStock via Getty Images

The British-based medical device manufacturer Smith & Nephew (NYSE:SNN) continues to offer an attractive long-term prospect in my opinion.

My most recent piece on the company in June, Smith & Nephew: Fair Price For An Attractive Medical Devices Supplier, gave the company a buy rating. Since then, the shares are down a fifth. But I think the investment case remains intact. I therefore continue to rate the company as a buy.

Smith & Nephew’s Business Performance has Improved but Challenges Remain

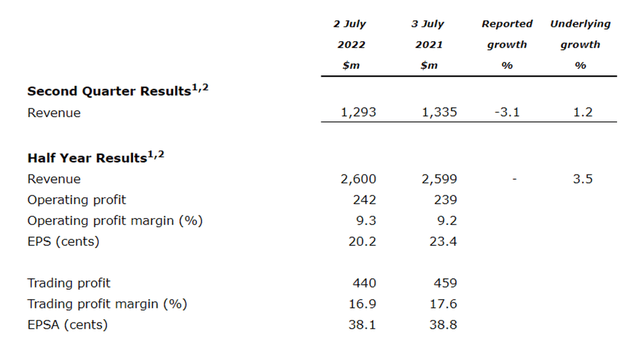

The company’s half-year report was a mixed bag. Revenues and trading profit slipped slightly compared to the equivalent prior year period but that reflected exchange rate swings as the dollar strengthened. Supply chain challenges were also cited as a reason for soft performance in the orthopaedics division.

Source: company half-year report

I think the Smith & Nephew investment case is pretty straightforward. The business has a strong, established business in areas that typically see strong demand likely to grow over time, in which it has pricing power. Historically that had made for solid business performance and I expect that to be the case in future too.

Risks to performance such as the supply chain, inflation and currency fluctuations have reared their head obviously and I expect them to continue to weigh on results. On top of that, I remain to be convinced by the company’s vaunted “Strategy for Growth” as it seems to expect improved performance versus the historical norm without convincing me of the reasons. Inflation will now help, in the sense that it could lead to revenue growth even on flat volumes. At the profit level, inflation also exists, and so that revenue growth will not necessarily translate into improved profitability.

I see this as an urgent challenge for the newish chief executive to address. If he is serious about long-term structural revenue growth above the historical norm, what about the business and its approach is likely to deliver it? For now I remain sceptical about this until we see some proof of the pudding and price Smith & Nephew on the basis of its actual business rather than putative growth prospects.

The Dividend is Decent but Stagnant

One piece of news in the half-year report I saw as negative was an interim dividend held at last year’s level. It explained that this was consistent with the company’s formula of paying an interim dividend equal to 40% of the prior year’s annual dividend.

But this is the third year in a row in which the interim dividend has been flat and I think that may also turn out to be the case for the final dividend. For a long time, one of the attractions to owning Smith & Nephew shares was the fact that its dividend increased most years (something I examined a couple of years back in my piece Smith & Nephew: A Long-Term Buy And Hold In Medical Devices). Earnings cover remains strong: last year basic earnings of share came in at 59.8c, which covered the dividend of 37.5c per share 1.6x. So there is no compelling financial reason for the firm’s recent reticence in raising the dividend, especially last year when business got closer to its pre-pandemic norm. It remains to be seen whether this is in effect a deprioritisation of dividend growth by management. If it is, I expect that to weigh negatively on the share price.

Meanwhile, the yield of 3.2% is still attractive in my opinion even without a raise, although given the elevated nature of many blue chip U.K. yields right now it is not among the most attractive FTSE 100 yields by some distance.

Valuing SNN Stock

I rated the company as a buy at the start of June but it has since fallen 20% in value. Does that reflect growing concerns about the business environment for U.K.-based companies, such as a weakening exchange rate, or are there more fundamental valuation concerns behind the fall?

Since then the only trading news from the company has been that in its half-year report, which while mixed I felt was broadly positive. The company’s guidance for the year remains unchanged, with revenue growth of 4% to 5% (though with inflation where it is I see this as an unchallenging target). The company did say it expects the full-year outlook for trading profit margin to be around 17.5%, reflecting the “prolonged impact of the inflationary environment and continued external supply challenges”. That is not good news in my view, but it does reflect what I see as essentially short- to –medium term challenges. I expect the supply chain challenges to be resolved over time, while along with its peers, at some point the company’s pricing ought to be fully adjusted to absorb cost inflation.

So the long-term investment case remains broadly as it did in the Summer, in my view. One possible explanation for the share price fall is yet another new chief executive being appointed this year. However, I see that as neutral for now in terms of company valuation as I have no particular reason to assess him as being better or worse than his predecessors in the role. Time will tell, if he stays in role long enough to let it do so.

The company currently trades on a price-to-earnings ratio of 20, which I regard as acceptable for a quality company with what I see as the long-term potential of Smith & Nephew. With its 3.2% dividend yield and long-term growth prospects, I would be happy to tuck the shares in my portfolio now for the long-term.

Be the first to comment