Luis Alvarez

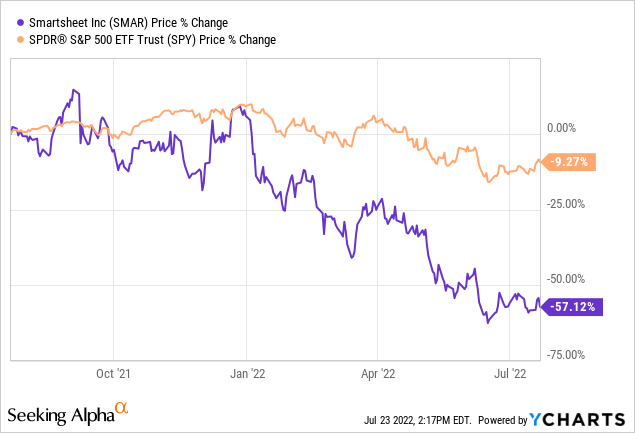

Smartsheet (NYSE:SMAR) is a SaaS company that offers collaboration and work management tools. It has been well-known in the industry for its tabular interface. Like many other tech companies, SMAR stock has been hammered and underperforms the S&P 500. While the work management market is growing fast, especially in the post-COVID era, I think SMAR faces some challenges. In this article, I would like to share some of my thoughts.

The overall landscape of work management software

For work management software, no companies can serve businesses of all sizes. There are three sectors with different levels of competition.

1. The Enterprise market has companies requiring systems of records for different functions. These include Workday (WDAY), Salesforce (CRM), CRM, and HRS systems. ServiceNow (NOW) is a rising star that wants to compete in the CRM business and push hard. They have more user-friendly and flexible architectural designs. However, the market is generally stable, and most companies will still do well.

2. The mid-market is where SMAR, Asana (ASAN), Monday (MNDY), AirTable, etc. focus. They are lightweight low-code applications to help drive the digital transformation of midsized companies. This market is evolving and growing fast. People all want to have their pie, but some companies will disappear in the following years. Asana and Smartsheet already have their lead and likely stay in their positions.

3. The Small and mid-business (SMB) market has become a commodity-like sector. It is very competitive and has a high churn. Most customers are price sensitive, and ample options are available since they don’t require many complex tools. Other than SMAR, Asana, and Monday, I know Freshworks, Zoho, Trello, Pipefy, Gusto, SugarCRM, and Clickup are well used. I am sure there are many others.

The use cases for SMAR

As a relatively older company, SMAR has some early mover advantage as it has more years of marketing and customer relations. SMAR is also known for its similarities with spreadsheets which are classic and beautiful architecture for doing pretty much everything. It just works. Moreover, everybody knows about spreadsheets, so it is easier for SMAR to educate its customers and training. That is absolutely a strength.

Many types of works are perfect for spreadsheet-type systems such as finance and operations. Especially for finance, I think SMAR will always find its place in that vertical.

SMAR is not unique

I think SMAR does have a neck-to-neck contender. That is AirTable. It already went through 735M series F Funding and values at 11B (almost three times than SMAR). So AirTable has no lack of financial support, and it looks like they are more aggressive in terms of developing better product interfaces and functions. There is a possibility that AirTable could catch up and be a better version of SMAR. This is not going to be good news for SMAR.

SMAR has shown signs of slowing down compared to Asana

SMAR’s numbers look great. It guided 37% revenue growth, and customers with >50K annual contract value grew to 2,516 (Asana is only 979). However, when you look at the customers with >5k annual spending, Asana already surpassed SMAR (16,689 vs. 15,879). These 5k customers are the growth pool of future 50K and 100K customers as they will keep expanding their adoption at a 130% retention rate (similar for both companies).

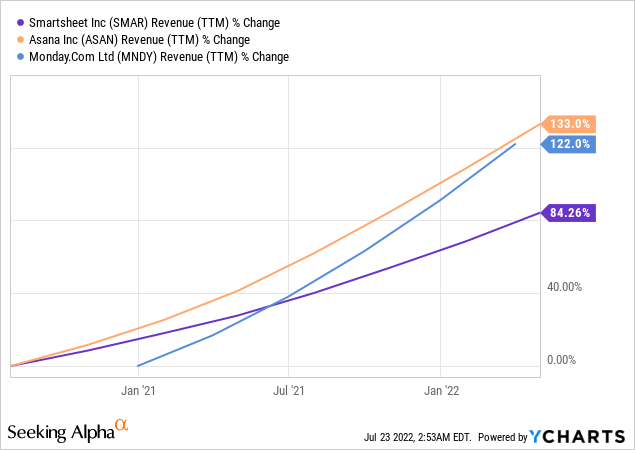

SMAR’s sales are not growing as fast as on Asana and Monday (As shown in chart below). Its RD spending is lower with 30% of revenue comparing Asana’s 50%. In my opinion, it looks like the company is not aggressive enough on innovation, which is the most important thing for its growth.

On product development, Asana’s pace of innovation is always ahead of the curve. As its CEO stated in the last call:

Speaking of products, we launched more than 200 features last year, a rate of more than four features every week. We also have a large and rapidly growing Asana Together Community, now representing more than 3,800 Asana ambassadors worldwide.

Moreover, Asana’s forum is very active. You can see a true community there with people asking about business adoptions, new functions, different use cases, etc. I see most of the conversations on SMAR’s forum is about formulas, cell linking, etc.

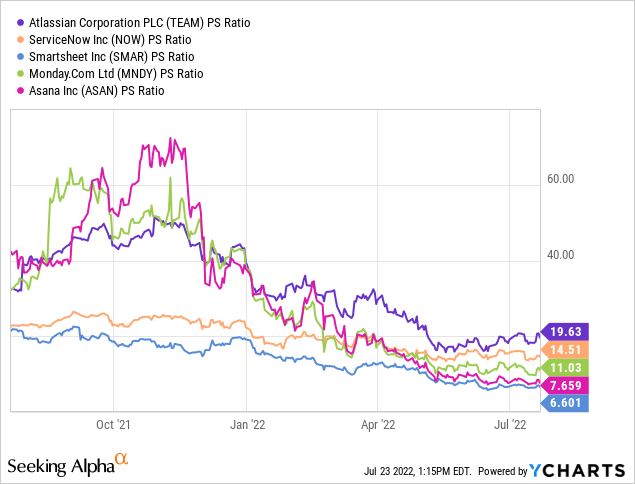

The stock looks cheap compared to others. However, durability is the key

As shown in the chart below, SMAR’s PS ratio is the lowest across its peer group at 6x. However, a low valuation doesn’t mean it deserves to return to the mean of the peer group. I think stock prices are a function of the market confidence in a company’s future. SMAR has some parts that the market doesn’t appreciate, so its valuations are always lower.

I think ServiceNow will be the most stable company in the peer group with an 11x PS ratio. However, should SMAR’s PS multiple almost half of NOW’s (6x vs. 11x)? Here, I laid out some scenarios using a 10-year timeframe:

Assumption: NOW’s CAGR of sales stays steady at 20% (very likely), and NOW will 6x its sales in Year 10. Then, the current market cap will only have a PS ratio of 1.8x.

1. SMAR’s CAGR of sales for the next ten years is the same NOW at 20%. Then SMAR’s current market cap will have a PS ratio of 1.06x at year 10.

2. SMAR’s CAGR of sales for the next five years is the same NOW at 20%. Then its business slowed to 10% CAGR from year 5 to 10. Therefore, SMAR’s current market cap will have a PS ratio of 1.83x at year 10.

Scenario 2 ends up with the same future PS valuation as NOW. This is more realistic since I don’t think SMAR will outperform NOW in a ten-year time frame.

Bottom line

Overall, SMAR is still a high-quality company offering competitive products in specific market verticals. SMAR will have its space in the work management industry for sure. However, will it become a niche product or mainstream? I am especially worried about its spreadsheet-type design, although it may also be a strength in the short term. I don’t think SMAR products are revolutionary enough to defend tech giants like Microsoft (MSFT) and Google (GOOG) (GOOGL) that should have more resources and know-how.

Be the first to comment