FG Trade/E+ via Getty Images

Investment thesis

Smartsheet (NYSE:SMAR) reported good results for the FY23Q1 quarter coupled with slight uncertainty around billings growth. I think investors should not read much into this. Future growth prospects remain strong, while management makes its best to take advantage of this. Although this results in continuing losses, the path towards profitability seems to be clear, and it’s not even far on the horizon. Despite the strong fundamental picture valuation seems to be really conservative, which leaves ample room for the share price to increase.

A shorter-term positive catalyst could be Smartsheet’s next earnings release, which could sooth investors’ nerves around billings growth. A longer-term catalyst for shares could be FCF margin turning into positive territory, which based on seasonal patterns could happen in the back half of the year.

Smartsheet’s revenue hit, billings dip

Smartsheet shares fell ~7% on the 8th of June after its FY23Q1 earnings release, while the Nasdaq Composite (IXIC) fell 0.7% on the same day. This showed that the initial reaction for quarterly results has been quite negative, which was caused by the softer than usual billings print for Q1. In the following I want to show that according to my analysis investors should not read much into this small dip in billings, as both current and long-term growth prospects remained healthy.

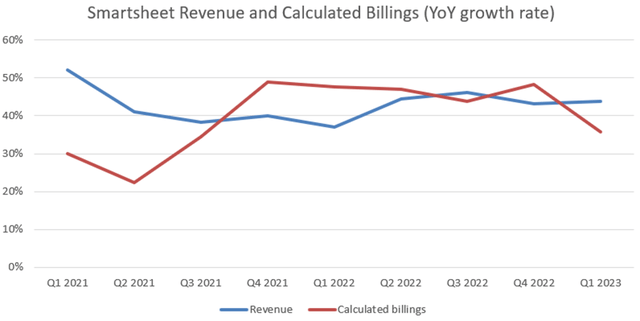

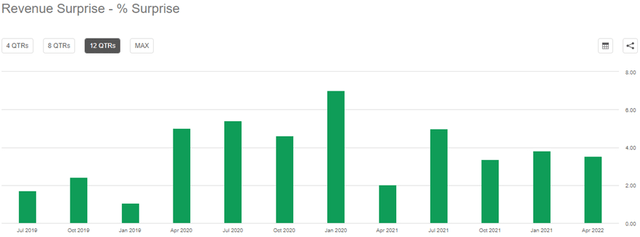

At first glance Smartsheet continued its strong revenue growth trend in FY23Q1, reaching revenues of $168.3, growing 44% YoY. This was a beat of ~3.5%, which was in line with previous quarters:

The 44% revenue growth rate resembled that of previous quarters, which is an encouraging sign. However, calculated billings – which is a better underlying measure for subscription sales activity as it adds the quarterly change in deferred revenues to revenues as well – grew “only” 36% YoY after growing 47% on average in the past four quarters. As calculated billings are a leading indicator for revenues, this could foreshadow significantly slowing top line growth in the year ahead. The question is whether this has been a rather one-time unusual slowdown or are we going to see even lower growth rates for calculated billings in the upcoming quarters?

Well, according to the management of Smartsheet, the quarter exactly played out how they planned. Besides seasonality, the slower growth in billings was mainly due to reorganization of their sales territories and a global sales kick-off event at the beginning of the year, which obviously limited sales capacities. A proof of management confidence is their billings guidance of $910-$925 million for FY23. This implies 39% YoY growth at the midpoint even with some baked-in conservatism for a possible macro related backdrop, for which there is currently no evidence. If we factor in that Smartsheet used to beat its billings guidance by 7-10% on average during FY22, we could see billings still grow at FY22’s 47-48% rate in the remainder of FY23.

Based on the above, as shown on the graph below the current disconnect between revenue and billings growth could be just a short-lived noise and 40%+ revenue growth could continue during the year:

Created by author based on data from SeekingAlpha

Something like this is baked also into Smartsheet’s FY23 guidance, which implies 37.5% YoY revenue growth at the midpoint, also with baked-in conservatism. Another sign that the sudden dip in billings growth is just a one-time event could be, that remaining performance obligations – which also include contracted but not yet invoiced business – grew 46% YoY last quarter, a little down from preceding quarters’ 50%.

Based on my experience the management of Smartsheet is very transparent and do not try to avoid provocative questions of analysts with generalizations. This has characterized the latest FY23Q1 earnings call as well, which gives me confidence in the company’s guidance and their steady progress towards their long-term goals.

Finally, the same phenomenon that I have described for billings was also somewhat present in the growth of the number of new customers. I assume this could have its root cause in the same underlying reasons, which was also confirmed by management in the Q1 earnings call.

Strong multiyear growth prospects

Although Smartsheet is almost a $700 million annualized revenue run rate company I think that they are just in their early innings to penetrate an already large and increasing market. Based on different sources the market for Project and Portfolio Management (PPM) services is expected to grow at a CAGR of somewhere between 6.7–13.4% in the upcoming 5 years from its current size of ~5 billion. This makes up one of Smartsheet’s core offerings.

With their recent acquisition of Brandfolder they entered the Digital Asset Management (DAM) market, which according to one source is expected to grow at a CAGR of 13.6% in the next five years from its already impressive market size of $4.2 billion. In the latest earnings call Smartsheet provided a good illustration for the Brandfolder use case, where the McLaren F1 Team adopted Smartsheet’s PPM and DAM solutions parallelly, becoming a deeply integrated customer.

Furthermore, there are other core use cases of the Smartsheet platform as well, which belong under the broad umbrella of Collaborative Work Management (CWM) applications, which market is also expected to experience growth of ~13% in the upcoming years.

Based on its FY22Q2 earnings call Smartsheet is only at the early stages to penetrate these markets. Most of their business comes from greenfield opportunities or from replacing legacy players in the market. According to management they only face direct competition in ~10% of the cases, and as they climb up the ladder in complexity, this number decreases significantly. This combination of a steadily growing, large addressable market with lot of greenfield opportunities, in the hands of a market leading company which already serves more than 90% of Fortune 100 customers is a really convincing one in my opinion.

The usual dilemma: Future growth vs current profit

Since growth stock valuations in the current high inflation environment collapsed everyone is worried about the profitability of these companies. I think that if a company sees the opportunity to entirely change the way how a given market works, which is coupled with substantial first-hand experience of successful customer journeys, it would be a mistake to sit on possible profits and underinvest. This is exactly the case for Smartsheet in my opinion.

The company has now 33 customers with an ARR over $1 million, while 3 customers who have more than 125,000 Smartsheet users. Dollar based net retention was 133% in FY23Q1, while 149% for customers above ARR of $500,000. This shows that the way towards large enterprise clients adopting the companies’ solutions at a large scale is already paved, which thousands of other companies could still follow. This, coupled with a large TAM which is mostly untapped, makes the case for investing aggressively into the future and focusing less on current profitability.

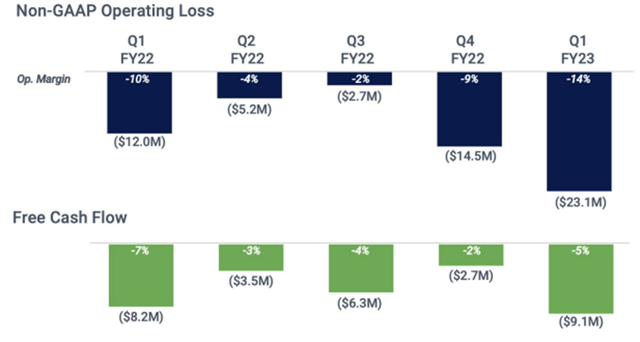

Smartsheet thinks the same way, which can be evidenced in the sinking of non-GAAP operating and FCF margins deeper into the red at the beginning of the year. Non-GAAP operating margin reached negative 14%, while FCF margin negative 5%:

Smartsheet FY23Q1 earnings presentation

However, due to seasonally strong H2 and outperformance in FY23Q1 Smartsheet currently projects that for FY23 the company will reach breakeven FCF margin. This is a slight improvement after previous quarters’ forecast of negative 1-2%. This shows an encouraging trend in my opinion after FCF margin was -10%, -8% and -4% in FY20, FY21 and FY22, respectively. Operating margin could follow this trend as it is a lagging metric compared to FCF margin, where billed but unearned revenues are also taken into consideration.

Beside the obvious positive trend in FCF margin there is another fact that gives me good level of confidence that the strategy of Smartsheet will pay out well. This is their excellent and still improving LTV to CAC ratio of 13, which management revealed in the FY22Q4 earnings call. The ratio compares the Lifetime Value of a Customer (LTV) to Customer Acquisition Costs (CAC) and shows, whether S&M spending produces the desired level of ROI for the company. In general, a ratio of 3 is considered to be a minimum threshold, which shows that the company is efficiently investing into new customer acquisition. The ratio of 13 at Smartsheet tells me that now is not the time for overemphasizing profitability, even if the current market environment signals something else. Or the way Mark Mader, president and CEO put it on the FY22Q4 earnings call: “…this is not the time to be a 20% grower with 20% op margins.”

In conclusion, I think the path towards profitability is clear and it is even not that far on the horizon. On top of that, Smartsheet has good reasons to invest now and put more emphasis on profitability later. Once they come to that point, they will be able to reach impressive FCF and operating margins in my opinion, which is foreshadowed by their current 79% gross margin.

SMAR stock valuation: Investors clearly prefer profit over growth

I have written my first analysis on Smartsheet at the end of January this year, where I already recommended to buy the shares for the long run. Since then, their price has halved with no deterioration in fundamentals. So, at his point I can only repeat myself with additional conviction that for the next 3-5 years shares of Smartsheet are an excellent investment opportunity.

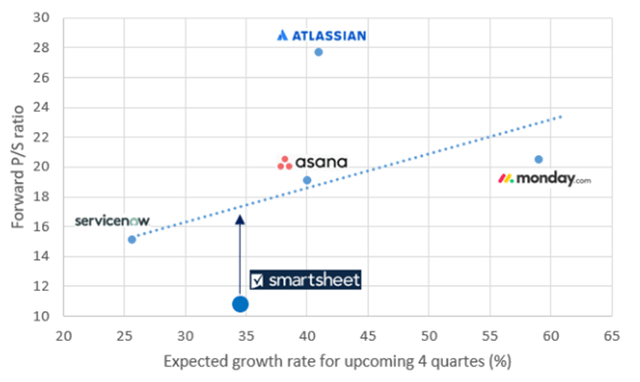

Another, very interesting thing that happened since the end of January is the rearrangement of the valuation matrix in the workforce and project/portfolio management sector. The matrix in my analysis for the 31st of January looked as follows:

Created by author based on company fundamentals

We could have observed that time, that Smartsheet with its conservative valuation was an outlier to the downside, while Atlassian (TEAM) with its aggressive valuation was an outlier to the upside. Otherwise, the valuations of ServiceNow (NOW), Asana (ASAN) and monday.com (MNDY) increased with their increasing expected growth rates hand in hand. Based on this we can say that the market has rewarded higher expected growth rates with richer valuation multiples that time. Now let’s look at the valuation matrix as of the 15th of June:

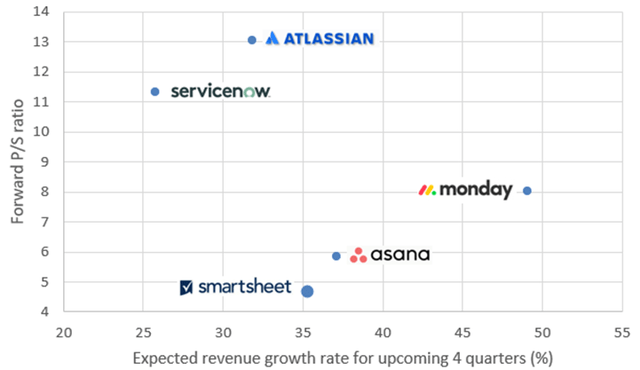

Created by author based on company fundamentals

If we take a closer look, we can see that the three fastest growing companies (monday.com, Asana and Smartsheet) are priced cheaper than the two slower growing ones (Atlassian, ServiceNow). This makes me conclude that, currently, investors do not care as much about the future strong growth prospects of a company. Instead, they tend to put additional emphasis on current profitability, which can be evidenced in the ~11 forward P/S ratio of ServiceNow, a company already profitable for the past three years.

Although Smartsheet grows its revenues almost 10%-points faster than ServiceNow, investors pay less than half the price for one unit of Smartsheets revenues. I think this is a strong exaggeration, which partly resulted from the recent panic-like sell-off in unprofitable growth stocks. On top of that, Smartsheet shows a clear path towards profitability in recent years, which is even coupled with a higher gross margin than that of ServiceNow (79% vs 77%).

If I compare Smartsheet’s forward P/S ratio of 4.69 with the ratio of 2.31 of the S&P500 I come to the same conclusion, that the shares of Smartsheet are extremely undervalued at current levels. If I assume that Smartsheet revenues will grow at an average of 30% for the next four years, while that of the S&P500 8%, both would have a forward P/S ratio of ~1.65 in four years’ time, leaving current market prices constant. I think even conservative investors would pay significantly more for a company in four years’ time, which is already profitable and grows revenues at a ~30% YoY rate rather buying the S&P500 index for the same price. Based on this I think Smartsheet shares could outperform the S&P500 significantly over the coming years.

Risk factors

One important risk factor, which I have discussed in the first paragraph is the billings growth rate of Smartsheet, which experienced a larger than usual slowdown in FY23Q1. As I have shown in my analysis, I think this was a one-time dip, but it’s worth to pay extra attention to this metric in the upcoming earnings release. If the slowdown is prolonged it could lead to another round of negative re-rating of the shares in the current growth-off stock market environment.

Another important risk factor is a possible global economic slowdown, which could result in tech budget cuts for companies. As I analyzed the current earnings releases of tech companies, they typically confirmed, that currently they don’t see any sign of such a phenomenon. However, price pressures still prevail globally, interest rates increase, so things can easily get worse. It’s worth to keep an eye on this factor as well.

Conclusion

Smartsheet is a leading company in the steadily growing, underpenetrated PPM and CWM space. Its impressive revenue growth is coupled with a clear path towards profitability. Despite the strong fundamental picture shares are valued by the market very conservatively. I haven’t found any good reason for this phenomenon, which makes me say that there is huge upside potential in the shares from current levels. Once the market realizes that Smartsheet is also able to generate a stable profit like ServiceNow, its valuation gap should significantly narrow. I think this is not far on the horizon, as the company expects to reach breakeven FCF margin this year.

Be the first to comment