f9photos/iStock via Getty Images

I first found Smart Sand Inc. (NASDAQ:SND) many years ago. It seemed perfect, it was undervalued according to book value, and it involved the second most used resource on the planet behind water: sand.

After a few CNBC YouTube videos on the importance of sand and how we are “running out,” I was hooked. The problem was Smart Sand only sold frac sand, at least when I first bought it, but finally after many years this has changed.

Thesis: Smart Sand is undervalued on a book value basis. It has been aggressively acquiring assets and recently begun diversifying revenue streams away from frac sand.

Smart Sand is in a stronger position now, than it has been at any point in its history. Even with this strength, its share price lags behind times when it was weaker and entering an industry downturn.

Let’s take a look at its financials to see how undervalued it is from a balance sheet perspective.

Higher Shareholder Equity and Low Debt

I’ve been holding Smart Sand for many years now, since 2019 to be exact.

Even amid the massive industry downturn, I remained positive on the company and even noted on the possible industry consolidation leading to a favorable outcome for Smart Sand.

After a long wait, it finally revealed its potential and rewarded me for my patience. But, this is just the beginning.

For many, this may seem like an eternity but for the patient it results in market beating returns.

Two things have kept me invested throughout the years.

- Low levels of debt.

- Rising shareholder equity.

This prudence and focus on debt levels has kept me from experiencing total losses on my investments. One such investment I noted was very risky and why I backed Smart Sand in the frac sand race.

While low debt kept me from experiencing a total loss, smart acquisitions in a consolidating industry kept shareholder equity rising even in periods of revenue decline.

For astute investors you may note that shares have been used in acquisitions and shareholders have potentially been diluted. However, upon further investigation shares have actually been declining.

Smart Sand a Conservative Valuation

Smart Sand is cheap from a valuation standpoint. In the face of rising frac sand prices this is almost certainly going to result in positive earnings and translate into a higher share price moving forward.

- Share price: 3.43

- Price to tangible book: .66

- PE ratio: Negative

- Total debt to equity: 9.32%

If you are betting on Smart Sand to rise above book value like I am, then it should reach a share price of at least $5.76. However, when it regains profitability it should rocket above that price netting a nice profit for those willing to take advantage.

Management expects profitability and to be free cash flow positive in the 3rd quarter of 2022. This seems pretty conservative and I expect them to achieve this by the 2nd quarter.

On top of these rather conservative numbers, frac sand spot prices are increasing rapidly as the industry has been consolidating. They are now approaching levels of $70 a ton, nearly triple last years levels.

Sand Inventory Valuation is Understated

I often wondered how inventory was calculated with sand when it came down to putting it on the balance sheet. Apparently it only constitutes mined sand. You can imagine my excitement when I learned of this detail (I know, I’m pretty lame).

Not only is all of the sand left in the ground still apparently unaccounted for on the balance sheet, but as sand prices rise and assets are depreciated this leaves a high potential for undervaluation.

According to the recent 10K

“Sand inventory is stated at the lower of cost or net realizable value using the average cost method.”

As far as I can tell, they are calculating this at around $20 per ton. This is likely at least 50% undervalued. Keep in mind the 10K was produced before the massive sand price increases from recent geopolitical events.

Smart Sand also reconciles their books at the end of year and wrote down $2.2 million in inventory considered to be waste. As well as some Permian Basin assets.

Note: If you want to nerd out even further, Smart Sand has reports on each of their mining sites showing proven reserves. They have enough reserves at their current rate to easily mine for another 50-80 years.

Expansion into Industrial Products

For me, Smart Sand has always been a play into the sand industrials market. Investing directly into the oil market was always something I wanted to avoid, but investing in sand was always the goal as it had a lot of potential for diversification.

This diversification is now being realized and margins appear better than frac sand.

Unfortunately, the recent earnings call didn’t provide much insight into the business as a whole. This is likely because according to the 10K the profits were immaterial to the business.

After a full four quarters I believe this will change. We should see a growing portion of the overall business become dedicated to industrials.

In order to see how this will impact the overall business, let’s take a look at the overall business verticals

Smart Sand’s Business Verticals

Smart Sand currently has three sources of business revenues, all related to frac sand. Logistics are a bright spot in an otherwise undifferentiated product.

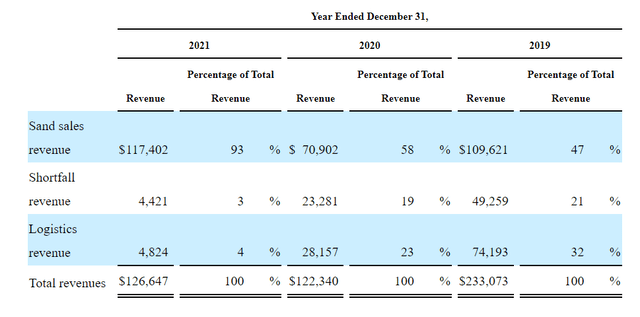

Below are the percentages of revenue over the past 3 years.

Logistics and shortfall revenue have been in an overall decline.

Logistics revenue seems to have been dominated by the smart path system which was underutilized in 2021. This led to an overall decrease in revenues for this area.

Shortfall revenue relates to extra money coming from contracts that were not fully utilized. While it’s almost like free money in times of falling sand prices, in inflationary periods this can be bad.

According to the CEO, only 20% of sales are currently under contract. With price inflation this is a good problem to have. Contracts should also be expected to increase over time and prices to stabilize.

The brightest spot is, of course, sand revenue which exceeds 2019 levels. With higher sand prices, this should prove an excellent tailwind for a diversifying company.

Risks Associated with Smart Sand

From a risk/reward standpoint, Smart Sand looks extremely safe when compared to the rewards. This does not mean that there is not risk involved.

Some Risks stated on the 10K include:

- Decline in oil and gas fracking.

- Environmental regulations.

- Customer credit risk.

The largest risk is likely a decline in oil and gas production that involves fracking. As this form of oil recovery becomes more intensive, it will become less profitable to operate and will lead to a decline in frac sand needed.

The restraint of oil companies to drill more will also cause Smart Sand to suffer. Ultimately, new avenues of revenue in industrial products alleviate this pain point, but not for some time.

Currently only 20% of Smart Sand’s customers are undertake or pay contracts, this could increase over time and in an inflationary environment led to a reduction in profit.

Smart Sand to Become Less Cyclical

I was beginning to lose hope in Smart Sand and was waiting for the frac sand cycle to be on the upswing before selling out entirely.

With the addition of the new industrial products business segment, I’m beginning to rethink this plan. If Industrial products start to rival frac sand revenues, this company can turn into a long-erm hold and a potential growth company.

I will likely hold my position until it becomes overvalued on a book basis and then sell a portion to fund other undervalued companies while retaining a portion to take part in the eventual growth.

What are your thoughts on the direction of this company and how undervalued do you believe it is currently?

Be the first to comment