Marko Geber/DigitalVision via Getty Images

Introduction

Even though Sleep Number (NASDAQ:SNBR) is down 56% YTD, in my personal opinion, we now have an attractive entry point to go long. First, despite high inflation and declining consumer confidence, the company is able to pass on additional costs to the end consumer. Secondly, effective control of operating expenses allows the business to keep operating profitability at a stable level. Also, according to my DCF model, the company is trading below its fair price.

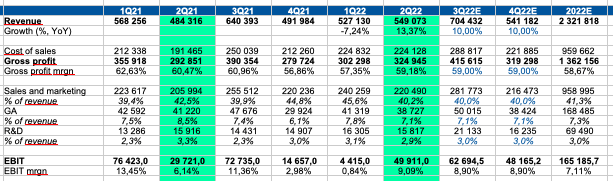

Quick survey of Q2 results

In my personal opinion, the company showed a strong report for the 2nd quarter, despite the decrease in guidance. First, the company’s revenue grew by 13% when demand fell by 12%, which suggests that consumers of the company’s products are less sensitive to changes in the price of goods. I believe that this is indeed a significant factor that supports the company’s results in an environment where most consumers are cutting their spending in the discretionary segment.

In addition, the management of the company has shown the market that it is able to effectively manage operating costs. So, we saw that sales & marketing expenses (% of revenue) decreased from 42.5% to 40.2%, general and administrative expenses (% of revenue) decreased from 8.5% to 7.1%, and on research & development (% of revenue) decreased from 3.3% to 2.9%.

Projections

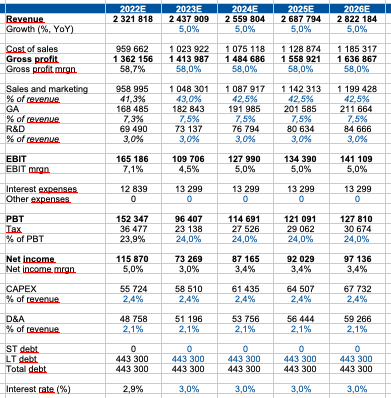

Based on the company’s historical results, company management’s statements and my own assumptions, I would like to make quarterly and annual financial forecasts for a more accurate understanding.

It is important to note that in my personal forecasts, I use fairly conservative forecasts in order not to sound too optimistic.

Revenue growth: I believe the company will continue to show revenue growth in the next quarters of 2022, I assume a conservative growth rate of 10% as the company has successfully raised prices to the end consumer. Further, I assume a conservative growth rate of 5%.

Gross profit margin: I use a stable gross margin due to low sensitivity to the price of the company’s customers in accordance with the reporting for the 2nd quarter of 2022.

SGA & R&D (% of revenue): effective actions of the company’s management to optimize operating costs have shown that the company is able to significantly reduce costs while maintaining the level of profitability. I believe operating expenses will remain flat going forward.

Quarterly projections

Personal calculations

Yearly projections

Personal calculations

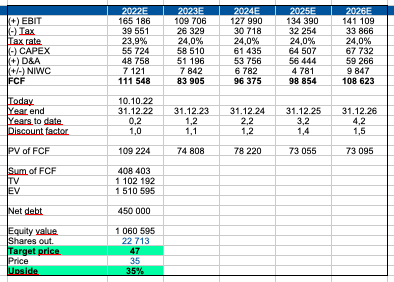

Valuation

For company valuation, I prefer to use the DCF model because:

1) We have a fairly long period of historical observation

2) The company shows stable growth and profitability trends

3) We can make assumptions about the impact of macro trends on the structure of income and profitability of the core business

I am using the following options:

WACC: 9.8%

Terminal growth rate: 3%

Personal calculations

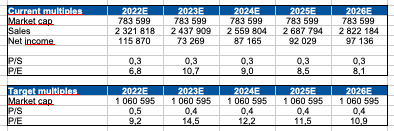

Multiples

Personal calculations

Drivers

Macro: declining inflation, rising consumer confidence and real incomes will support consumer spending in the discretionary segment, which will have a positive effect on the company’s revenue growth.

Margin: reducing cost growth and effective cost control by management can support the operating profitability of the business

Rising prices: the ability to increase product prices can support both revenue and business profitability

Risks

Macro: further tightening of monetary policy could have a negative impact on real consumer incomes, which could put pressure on business growth.

Margin: continued growth of input costs may have a negative impact on operating profitability.

Conclusion

In my personal opinion, the company continues to successfully cope with the tightening of monetary policy, rising inflation and declining consumer confidence. Despite the weak macro, the company continues to demonstrate business growth and a stable level of profitability due to the effective work to reduce operating costs. I believe that now is an attractive time to go long. According to my DCF model, currently the upside potential is 35%.

Be the first to comment