Spencer Platt/Getty Images News

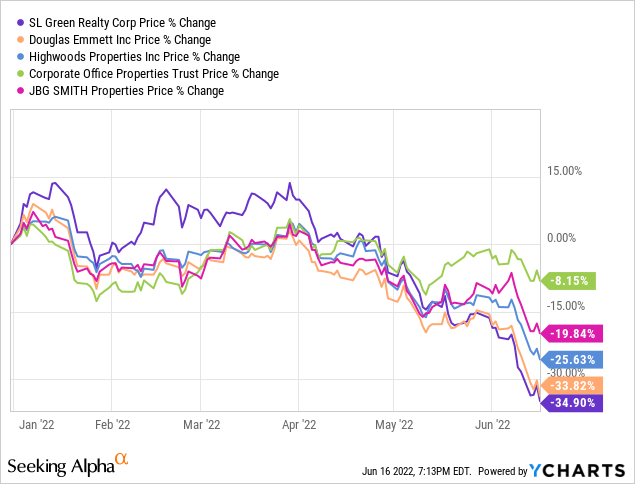

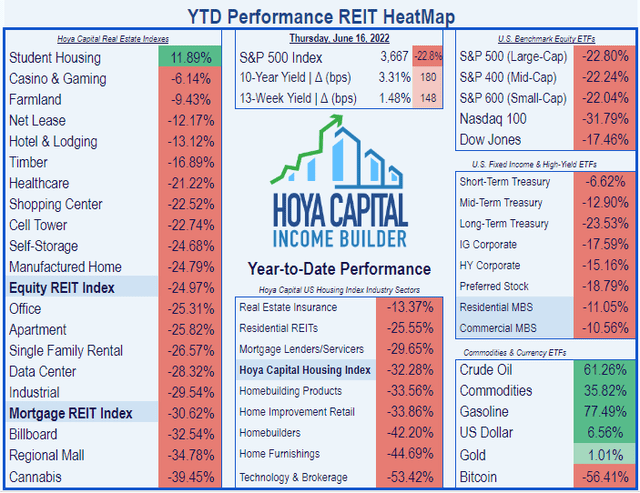

I expected Office REITs to slightly underperform the REIT average this year, and that is exactly what has happened so far, according to the chart from Hoya Capital shown below.

New York-focused SL Green Realty (NYSE:SLG) has lagged both the REIT average and the Office REIT sector average thus far this year, with a share price decline of (-37.70)%.

Among its four closest Office REIT peers by market cap, SL Green started the year strongest, but has recently gone from first place to last.

SLG sports an attractive yield, massive upside, and temptingly low price per FFO, but also carries considerable debt.

What is going on with this company, and which way is it headed?

Meet The Company

SL Green Realty

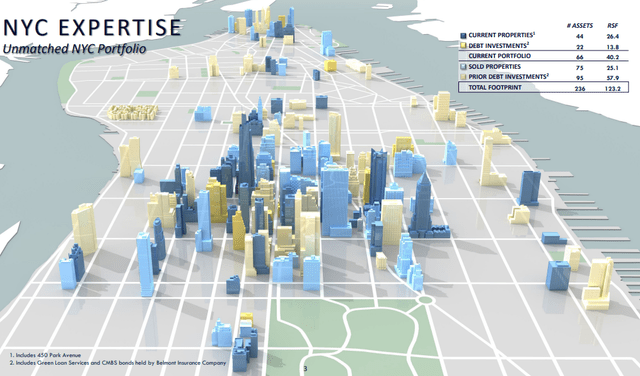

If you ever walked down the street in Manhattan, and thought to yourself, “New York, just like I pictured it. Skyscrapers . . .,” chances are good you were seeing at least one building owned by SL Green (SLG). Founded by Stephen L. Green in 1997 and headquartered in New York City, SLG owns and manages interests in 66 buildings totaling 40.2 million rsf (rentable square feet), making SLG Manhattan’s largest office landlord.

In addition to buying, selling, and managing office real estate, the company also engages in lending, loan servicing, and asset management, and is targeting at least $200 million in loan originations this year, at 8%.

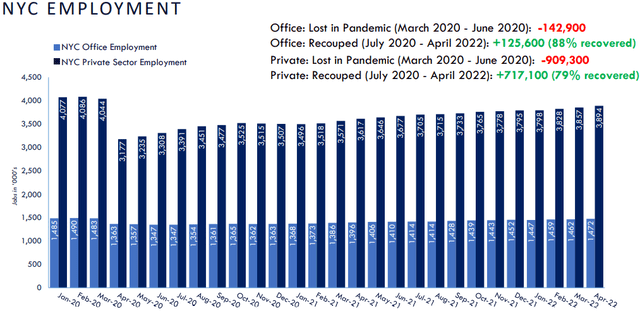

The pandemic of 2020, the work-from-home trend, and the outmigration to the Sunbelt all dealt a serious blow to employment in New York City, as the graph below shows. Through April of this year, office headcount has recovered only 88%, and private employment in general has recovered only 79% of the lost jobs. This is a significant headwind for SLG. Manhattan office occupancy for the company stands at approximately 93%, and the company hopes to get that to 94.3% this year.

CEO Marc Holliday said on the Q1 2022 earnings call that:

full recovery [in office employment] is projected by OMB to occur by middle of 2023 with 24,000 office-using jobs expected to be created in 2022 alone.

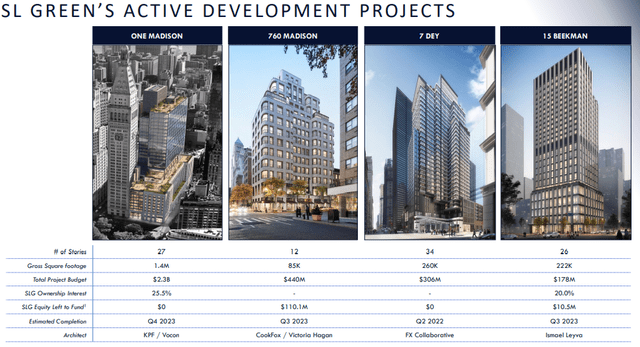

Despite its deep indebtedness, the company continues with four active development projects. One is expected to be completed this summer, a 260,000 square foot, 34-story building at 7 Dey. Completion dates on the other three are projected in the latter half of next year. Total investment for these four skyscrapers is about $3.22 billion.

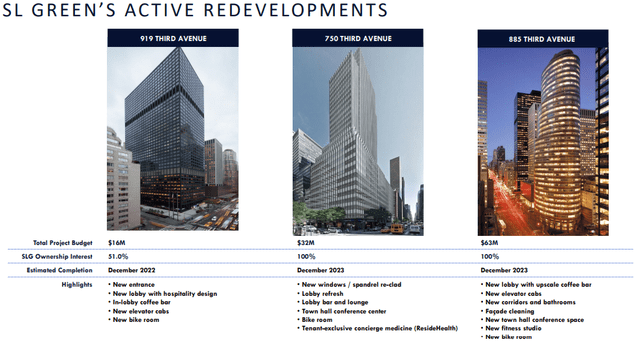

The company is also pursuing three redevelopments it expects to be accretive. Renovations to the property at 919 Third Avenue are expected to be completed late this year, with a new entrance, lobby, elevator cabs, and bike room, as well as an in-lobby coffee bar. SLG owns a 51% share in that property. Similar renovations on the other two buildings, 100% owned by SLG, are expected to finish in December 2023. Total tab for the three projects is $111 million.

Latest Quarterly Results

CEO Marc Holliday’s upbeat assessment of the company’s situation was as follows on the earnings call:

SL Green’s portfolio is dramatically outperforming the overall Manhattan office market, reaffirming its place as New York’s leading commercial real estate company and demonstrating its ability to adapt to an ever-changing market.

Here are the highlights of the hard numbers, however:

- Revenues $188 million, down 17% YoY (year over year)

- Expenses $168.7 million, down 19% YoY

- Net income $13.5 million, up $17 million YoY

- Total equity of $4.94 billion

- Net cash from operations $81.4 million, up a whopping 338% YoY, but down a whopping 68% from Q4 2021

- FFO of $115.8 million, up 7% from Q4 2021

- Issued 1.1 million new shares, down 79% from the number issued in Q1 2021.

- Bought back 1.97 million shares at an average price of $76.69 per share, as part of a multi-year ongoing buyback plan,

SLG intends to buy back about $250 million worth of shares this year, according to their investor presentation.

The company 10-Q lists 22 joint ventures as well, worth $17.9 billion, which operated at a loss of (-$4.7) million in the first quarter.

More Recent Developments

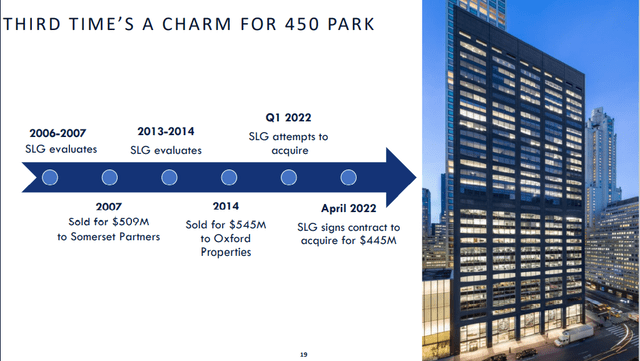

After eyeing the property for 16 years, SL Green successfully acquired the building at 450 Park Avenue for $445 million in April. It is a 33-floor, Class A office tower, encompassing 337,000 rsf, with nice views of the midtown Manhattan skyline, home to high-end financial services and luxury tenants. It was 82% occupied upon acquisition with 6.1-year weighted average lease term, earning a going-in cap rate of 4%. The company plans to invest another $33 million in renovations to the building.

SL Green also sold a vacant office condo on Fifth Avenue for $100.5 million earlier this month. No word on the rate of return achieved.

Growth Metrics

Here are the 3-year growth figures for FFO (funds from operations), TCFO (total cash from operations), and market cap.

| Metric | 2018 | 2019 | 2020 | 2021 | 3-year CAGR |

| FFO (millions) | $606 | $606 | $563 | $481 | — |

| FFO Growth % | — | 0.0 | (-7.1) | (-14.6) | (-7.41) |

| FFO per share | $6.62 | $7.00 | $7.11 | $6.83 | — |

| FFO per share growth % | — | 5.7 | 1.6 | (-4.0) | 1.05 |

| TCFO (millions) | $441.5 | $376.5 | $554.2 | $256.0 | — |

| TCFO Growth % | — | (-14.7) | 47.2 | (-53.8) | (-16.61) |

| Market Cap (billions) | $6.61 | $7.27 | $4.32 | $4.59 | — |

| Market Cap Growth % | — | 10.0 | (-40.6) | 6.3 | (-11.45) |

Source: Hoya Capital Income Builder, TD Ameritrade, CompaniesMarketCap.com, and author calculations

Due to the sell-off thus far this year, market cap has slumped to $3.1 billion as of this writing. Thus, SLG has fallen out of the market cap sweet spot, into the lower mid-cap range. Though the market cap shrinkage looks bad from the table above, it is actually worse.

Meanwhile, FFO and TCFO are suffering significantly, at 3-year CAGRs of (-7.41)% and (-16.61)%, respectively, but FFO per share is actually slightly positive, at 1.05%, thanks to buybacks.

Meanwhile, here is how the stock price has done over the past 3 twelve-month periods.

| Metric | 2019 | 2020 | 2021 | 2022 | 3-yr CAGR |

| SLG share price June 16 | $92.85 | $57.03 | $83.13 | $48.13 | — |

| SLG share price Gain % | — | (-38.6)% | 45.8 | (-42.1) | (-19.67) |

| VNQ share price June 16 | $89.70 | $83.38 | $103.68 | $87.04 | — |

| VNQ share price Gain % | — | (-7.1) | 24.3 | (-17.0) | (-1.00) |

Source: MarketWatch.com and author calculations

The pandemic dealt SL Green a serious blow to share prices, from which it recovered nicely, only to tank seriously again this year. The average REIT, as represented by the Vanguard Real Estate ETF (VNQ), has been essentially flat over the past 3 years, while SLG has lost an average of (-19.67)% per year in valuation.

Balance Sheet Metrics

SLG’s liquidity ratio of 1.92 is solid, well above the median for the Office REIT sector, but its debt ratio of 51% and Debt/EBITDA of 12.7 are a serious concern.

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

| SLG | 1.92 | 51% | 12.7 | BBB- |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

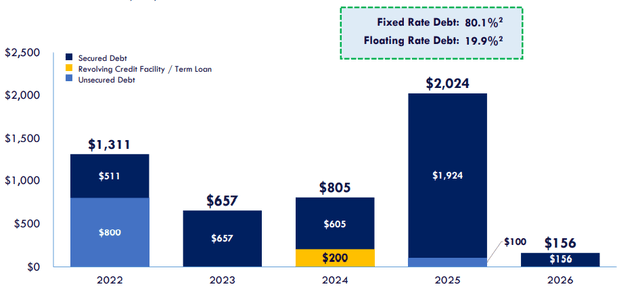

And the company is taking it seriously. Here is the maturity schedule, with a formidable $1.3 billion due this year, and easier levels of $657 million and $805 million the next two years, followed by a big gulp of $2.0 billion in 2025, and a sharp drop to just $156 million in 2026.

If annual revenues for 2022 equal Q1 revenue times 4, then the $1.3 billion due in 2022 is almost double projected revenues of $752 million.

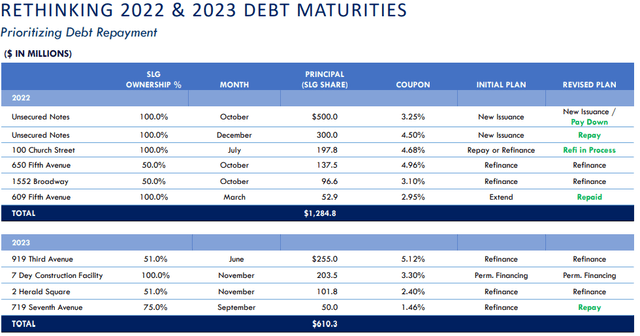

SLG is taking responsible steps toward repaying and refinancing these debts. They plan to repay all $300 million in unsecured notes held at 4.5% this year, and pay down the $500 million held at 3.25%. Of the 8 properties on which they owe for the next two years, they are refinancing five (totaling $787.7 million at a current weighted average interest rate of 4.38%) and paying off one ($50 million), with one ($52.9 million) fully repaid and one ($203.5 million) permanently financed at 3.30%.

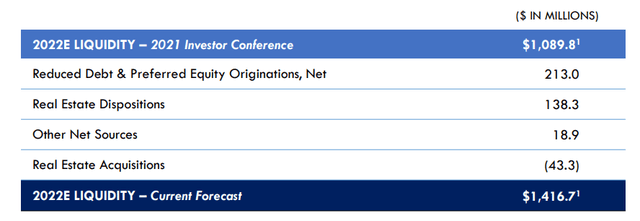

They also intend to increase their liquidity by 30%, from $1.09 billion to $1.42 billion, partly by selling about $85 million more in assets than they buy. They are targeting some $138 million in sales and $43 million in acquisitions.

Whether or not they can execute on these plans will go a long way toward determining their future viability. The company reported $307.3 million in cash and equivalents thru Q1, down $94 million YoY. Total indebtedness measures $4.13 billion.

Dividend Metrics

Thanks in large part to the sell-off in shares this year, SLG now sports a 7.60% Yield. Although the company grows its dividends more slowly than the average REIT or the average Office REIT, its Dividend Score of 8.02 is more than double the Office REIT average. Meanwhile Seeking Alpha Premium rates the dividend a perfectly safe C.

| Company | Div. Yield | Div. Growth | Div. Score | Payout Ratio | Div. Safety |

| SLG | 7.60% | 1.8% | 8.02 | 60% | C |

Source: Hoya Capital Income Builder, TD Ameritrade, Seeking Alpha Premium

Dividend Score projects the Yield three years from now, on shares bought today, assuming the Dividend Growth rate remains unchanged.

Valuation Metrics

Office REITs are cheap right now, and SLG is really cheap. Coupled with its 52% discount to NAV, and its high Yield, this company may look really good to value investors right now.

| Company | Div. Score | Price/FFO | Premium to NAV |

| SLG | 8.02 | 7.2 | (-52.4)% |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

However, research by Hoya Capital has shown that cheap REITs tend to stay cheap. REITs trading this much below the overall REIT average are often in trouble, and tend to underperform on total return.

What Could Go Wrong?

Being focused in New York City is not as advantageous as it used to be, thanks to two distinct trends that have taken shape over the past two years.

- There has been a significant U.S. population shift from large urban areas to the Sunbelt and smaller cities.

- The WFH (Work-From-Home) trend, decreasing the demand for office space nationwide.

Further increases in interest rates could make profitable acquisitions more difficult to find.

Continued increases in labor costs, and supply chain disruptions, could drive up the cost of new development, renovations, and capital expenditures.

Investor’s Bottom Line

Despite its prime locations, SLG is a potential yield trap. Despite its high Yield and low Price/FFO, the erosion in share values could easily outweigh the Yield, until the company gets its debt situation under control.

I think they have a fighting chance of doing that, so I consider this company a Hold. That puts me in company with 14 of the 19 Wall Street analysts that cover this firm. Four consider it a Buy and one calls it a Sell. The average price target is $74.79, implying a sizzling 52.5% upside, which is odd. If the upside is that strong, you would think it would be rated a Buy. One more reason I don’t take price targets very seriously.

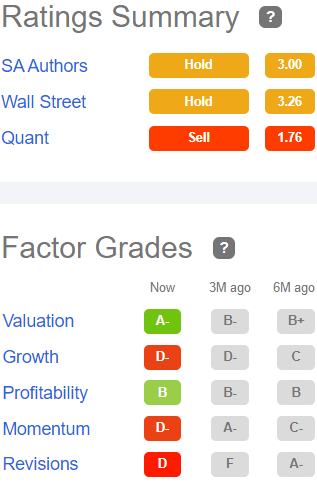

Seeking Alpha Premium

Since March 4, the Seeking Alpha Quant ratings consider SLG a Sell, especially concerned about the rapid erosion in the company’s expected Return on Equity. TipRanks rates the company Outperform, while The Street and Ford Equity Research both consider it a Hold. Zacks rates it a Sell. You decide.

Be the first to comment