metamorworks/iStock via Getty Images

We are moving wireless player Skyworks Solutions, Inc. (NASDAQ:SWKS) to a Buy rating. We were previously bearish on SWKS and Qorvo (QRVO), as we expected demand headwinds in the smartphone market to pressure both companies. Our expectations of macroeconomic headwinds and inflationary pressures in the smartphone market are playing out. We’re more constructive on SWKS now because we believe the stock has now priced in most of the demand headwinds in the smartphone market. Hence, we are moving SWKS to a buy based on our belief that SWKS is better positioned to outperform expectations and the peer group in 2023.

We expect the company will see demand tailwinds in 2023 from content growth in the 5G and Wi-Fi markets. SWKS’s biggest customer, Apple Inc. (AAPL), is updating the 5G on its iPhone product lines, and we expect SWKS will benefit from 5G demand as an RF front supplier.

YTD, the stock is down almost 45%. We still expect that near-term macroeconomic headwinds could make the stock price volatile. Yet despite headwinds, SWKS’s 4Q22 earnings reported revenue of $1.41B, achieving a 7.6% Y/Y growth. We believe SWKS provides an attractive entry point at current levels and expect the company will grow meaningfully in 2023.

Content Growth in 5G and Wifi Markets

To quickly recap, SWKS designs and manufactures semiconductor equipment for front-end modules and radio frequency systems. SWKS derives its revenue from two segments: mobile and broad (automotive, industrial, Internet of Things (IoT), Infrastructure, and Cognitive Audio and Gaming). The following graph outlines SWKS revenue across mobile and broad markets.

We were previously hold-rated on the stock because of the global decline in smartphone shipments forecasted to decline by 6.5% in 2022. SWKS is highly exposed to the smartphone market as it derives most of its revenue from its mobile segment. We now believe the smartphone weakness has been priced into the stock for the most part. We’re more constructive on SWKS in 2023, as we expect demand tailwinds from continued content growth in the 5G and Wifi markets. The following outlines what we expect to be SWKS’s growth drivers in 2023.

- Mobile segment increased content growth

We expect SWKS to enjoy demand tailwinds for 5G from its biggest customer, Apple, contributing almost 56% of total revenue in 2021. We believe SWKS is well-positioned to benefit from AAPL’s 5G update cycle as it remains the company’s strategic RF front supplier for the foreseeable future. AAPL and SWKS customer Samsung (SSNLF, SSNNF) is facing increased pressure to roll out upgrades to support 5G in India. Many nations are still expanding their 5G broadband infrastructure, and we expect this to create more demand for SWKS’s mobile segment. We believe SWKS’ s customer base makes it better positioned than the peer group to benefit from demand tailwinds in 5G and Wifi going forward.

- Growth in the EV market in China.

In the board market segment, we expect SWKS to benefit from growth in China’s electric vehicle (“EV”) market on the MediaTek (TPE: 2454) platform. MediaTek utilizes SWKS RF expertise for their 5G platforms. Among its other businesses, MediaTek operates in the frontier of the automotive segment providing automotive solutions: in-vehicle communication systems, in-vehicle infotainment (IVI) systems, Vision Advanced Driver Assistance Systems (V-ADAS), and mmWave radar solutions.

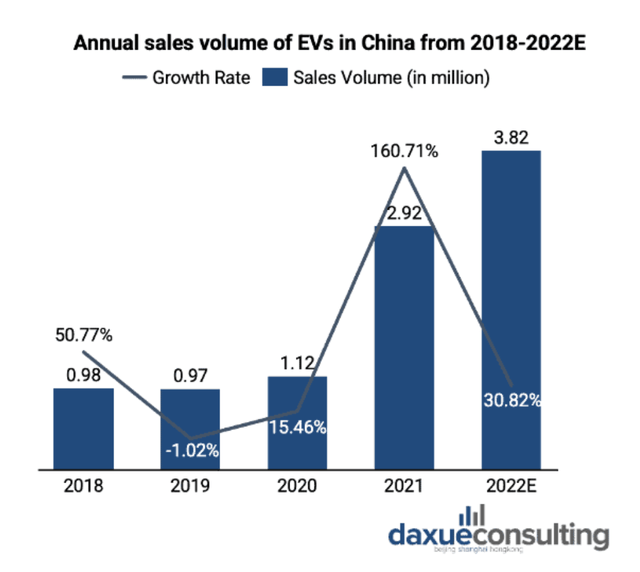

We expect SWKS will be able to take advantage of the EV demand in China through its MediaTek platforms as the automotive sector is gradually adopting 5G connectivity. China consumers are showing a fast-paced adoption of EVs compared to other countries. We expect demand tailwinds in the EV market to reflect tailwinds in SWKS’s broad market segment, which accounts for 36% of total revenue.

The following graph outlines the annual sales volume of EVs in China.

Valuation

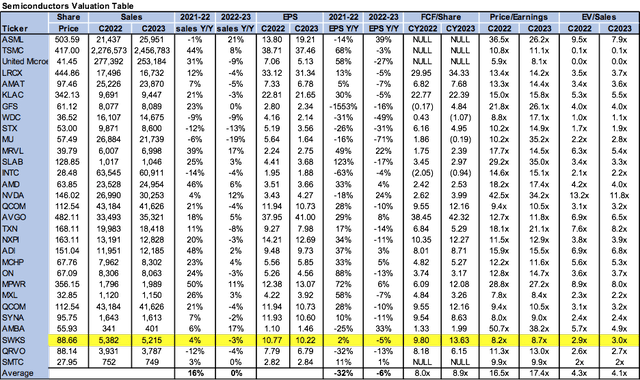

SWKS is relatively cheap, trading at 8.7x C2023 EPS $10.22 on a P/E basis compared to the peer group average at 17.4x. On the EV/Sales metric, SWKS is trading at 3.0x C2023 versus the peer group average of 4.1x. We expect SWKS to outperform the peer group in 2023 and recommend investors buy the stock at current levels.

The following chart illustrates SWKS’ s valuation relative to its peer group.

Word on Wall Street

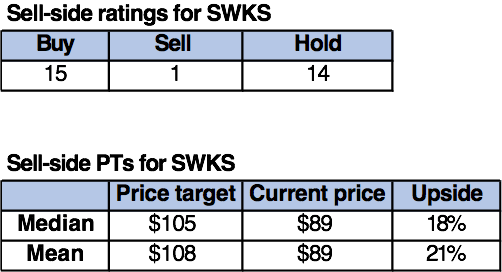

Wall Street is divided in its ratings on SWKS. Of the 30 analysts covering the stock, 15 are buy-rated, 14 are hold-rated, and the remaining are sell-rated. SWKS is trading at $89. The median and mean price targets are set at $105 and $108, respectively, with a potential upside of 18-21%.

The following chart indicates the sell-side ratings and price targets.

TechStockPros

What to do with the stock

We are moving SWKS to a buy, as we expect the company to outperform the peer group and expectations due to its unique customer base and demand tailwinds in 5G adoption on mobile and automotive fronts. We believe the stock’s 45% drop YTD creates an attractive entry point to invest in Skyworks Solutions, Inc.’s 2023 growth.

Be the first to comment