8vFanI

Looking for attractive dividend income from the private sector?

You should investigate business development companies, BDCs, which offer retail investors exposure to the private sector. They invest in non-publicly traded companies in a variety of ways, either through debt or equity, or both.

Profile:

Sixth Street Specialty Lending (NYSE:TSLX) is a BDC focused on providing flexible, fully committed financing solutions to middle market companies principally located in the US.

TSLX provides senior secured loans (first-lien, second-lien, and unitranche), unsecured loans, mezzanine debt, and investments in corporate bonds and equity securities and structured products, non-control structured equity, and common equity to companies with an enterprise value between $50M and $1B or more, and EBITDA between $10M and $250M.

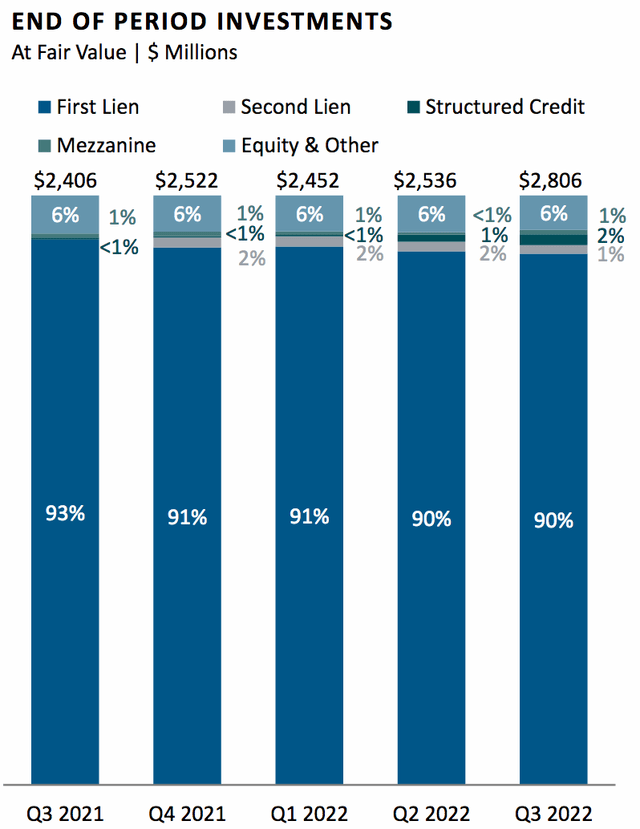

TSLX’s debt investments are 90% 1st Lien, 29% Loan to Value, and 99% Floating Rate, a good place to be in the current rising rate environment.

There’s also an equity component of 6% in its portfolio, which has been steady over the past four quarters, as well as small positions in 2nd Lien, Structured Credit and Mezzanine Debt.

As of 9/30/22, the weighted average total yield of debt and income-producing securities at fair value (which includes interest income and amortization of fees and discounts) was 12.3%.

Earnings:

In Q3 ’22, total investment income was $77.8M, up 9.3% vs. Q3 ’21. The increase was primarily the result of higher interest from investments driven by increased all-in yields. NII was up slightly, to $37.2M, vs. $36.5 a year ago, due to higher interest expenses. NII/share was down -6%, to $.47, vs. $.50 in Q3 ’21. Total investments grew to $2.8B, up from $2.5B in Q2 ’22, due to higher net funding activity.

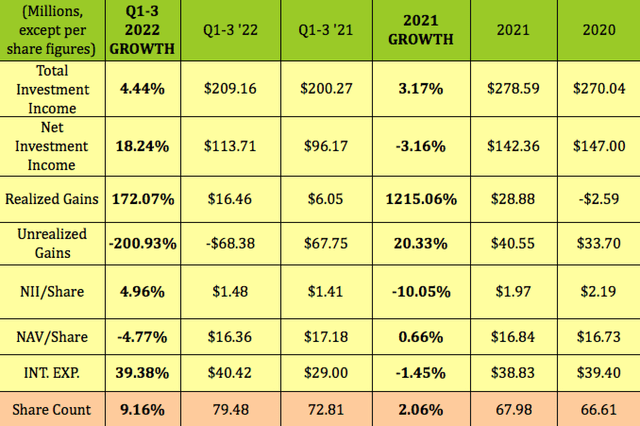

Q1-3 2022: Total Investment Income has continued to trend up so far in 2022, rising 4.4%, after rising 3.2% in 2021. NII has had a big 18.2% jump in Q1-3 ’22, bouncing back from a modest -3% decline in 2021. NII/Share only rose ~5%, due to a 9% rise in the share count from the conversion of maturing convertible notes that resulted in the issuance of ~4.4 million share. NAV/Share was down -4.8%, ending at $16.36 as of 9/30/22, vs. $17.18 one year earlier.

New Commitments and Fundings:

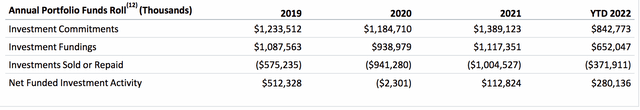

TSLX had its best quarter in three years for Net Fundings in Q3 ’22, with $259M. There were 25 new investments and 6 upsizes to existing portfolio companies. As of Sept. 30, 2022, TSLX had investments in 75 companies.

Management commented on the effect of the current economic environment on TSLX’s portfolio on the Q3 ’22 call: “New issued leveraged loan volumes are down 86% in Q3 relative to the same period last year and high-yield bonds year-to-date reached its lowest level since 2008. In addition to the limited number of deals getting done in the public credit markets, we are also seeing a pullback from banks as they focus on satisfying regulatory-driven capital ratio requirements.

With fewer financing options available for borrowers, we’re seeing a shift towards a more lender-friendly environment. Not only are we seeing higher overall yields, driven by higher base rates, spreads have also widened as well.”

In August, TSLX closed a $375M term loan commitment to support an operational turnaround by Bed Bath & Beyond (BBBY), the 25th retail ABL transaction that TSLX has completed since its IPO, with a total of $1.1B of capital deployed. (ABL=Asset Backed Loan.)

Dividends:

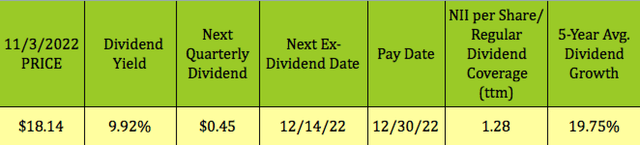

TSLX’s Board of Directors declared a $0.03/share increase to its Q4 ’22 base dividend/share, going from $0.42 to $0.45 to shareholders of record as of Dec. 15, 2022, payable on Dec. 30, 2022.

“The increase reflects the Company’s updated view on forward earnings, which incorporates the anticipated positive impact of the interest rate environment on the Company’s income statement.” (TSLX site)

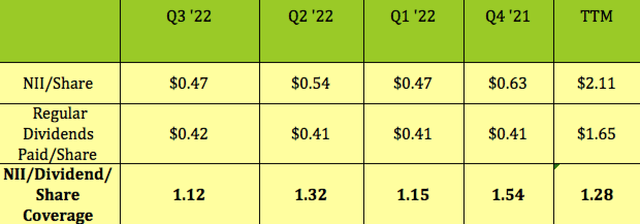

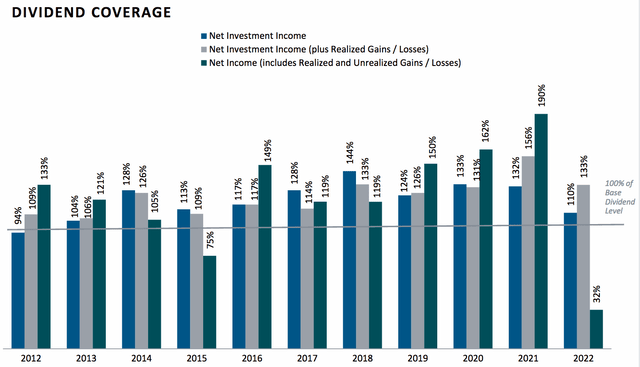

TSLX’s regular dividend coverage was solid, at 1.12X in Q3 ’22 – it swings each quarter, hitting 1.32X in Q2 ’22 and 1.54X in Q4 ’21, with a trailing dividend coverage ratio of 1.28X, one of the strongest coverage ratios in the BDC industry.

In addition to paying regular dividends, TSLX has a long history of paying supplemental and occasional dividends each year. That very high 19.75% five-year dividend growth rate listed in the dividend schedule table is due to the $3.27/share in supplemental and occasional dividends it has paid since 2017.

Holdings:

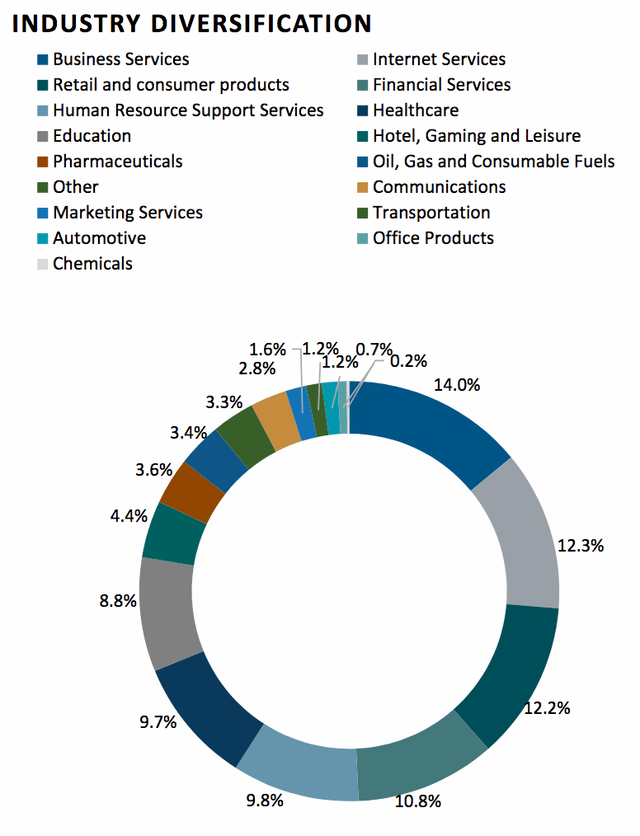

TSLX’s top five industry exposures are Business Services, Internet Services, Retail & Consumer Products, Financial Services, Human Resource Support Services, and Healthcare, totaling ~70% of its portfolio:

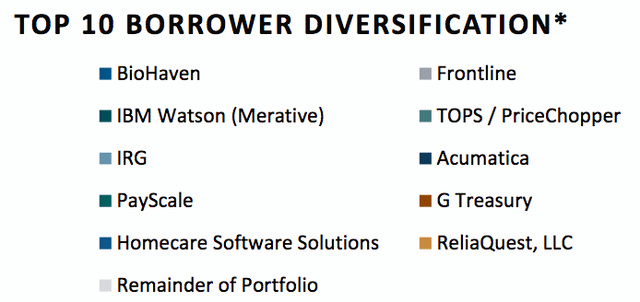

As of 9/30/22, TSLX’s top 10 was comprised of positions sized from 2.2% to 3.1%, totaling ~25% of its portfolio, with 3.1% in BioHaven, to 2.2% in ReliaQuest. However, in October, Biohaven and Frontline were both paid off.

TSLX has only one portfolio company on non-accrual, representing less than 0.01% of the portfolio at fair value, with no new names added to non-accrual during Q3 ’22. Its portfolio’s weighted average performance rating was 1.12, on a scale of 1 to 5 with 1 being the strongest, a positive change from Q2’s rating of 1.13.

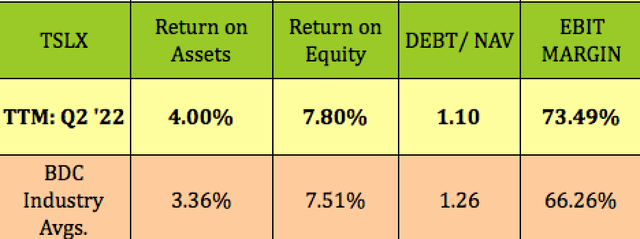

Profitability and Leverage:

TSLX’s ROA and ROE are both a bit higher than BDC industry averages, as is its EBIT Margin, whereas its Debt/NAV is a bit below average.

Debt and Liquidity:

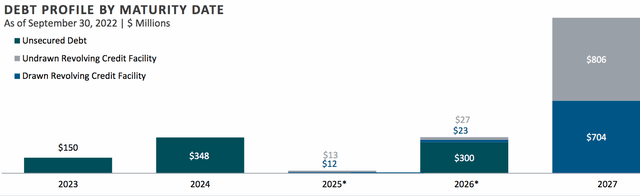

TSLX’s next debt maturity is in 2023, $150M in unsecured debt comes due, followed by $348M in 2024. Total principal debt outstanding at 9/30/22 was $1.5B. As of 9/30/22, TSLX had $846M of unfunded revolver capacity and $30M in cash.

TSLX’s debt is rated Baa3 (stable) by Moody’s, and BBB-(stable) by S&P.

Valuations:

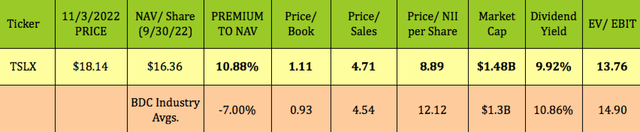

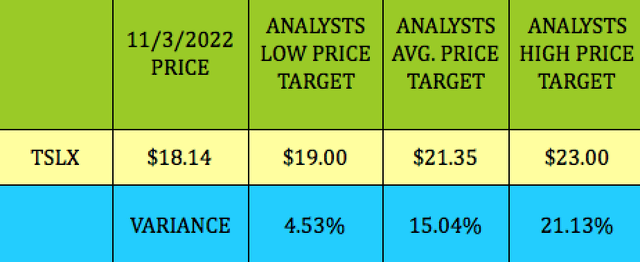

At its 11/3/22 $18.14 price/share, TSLX was selling at a 10.88% premium to NAV, vs. the BDC industry’s average 7% discount to NAV/Share. However, its Price/NII was just 8.89X, much lower than the 12.12X BDC industry average. Its EV/EBIT of 13.76X is a bit lower than average, while its 9.92% forward dividend yield was lower than the 10.86% industry average.

However, given management’s track record of paying supplemental dividends, TSLX’s overall dividend yield may end up being higher than 9.92%.

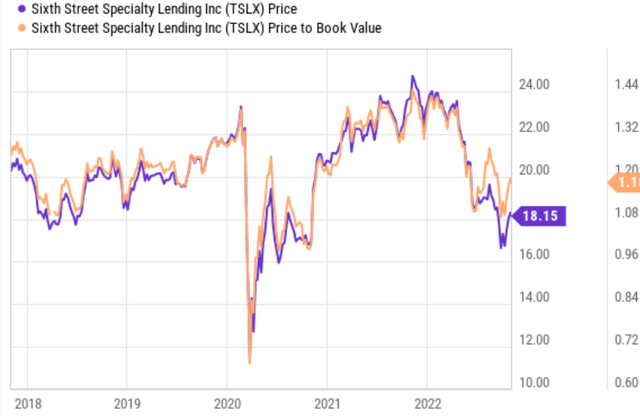

Excluding the March-April 2020 Covid Crash, TSLX has mostly traded at a premium to NAV over the past five years, reaching above 1.4X in late 2021.

Performance:

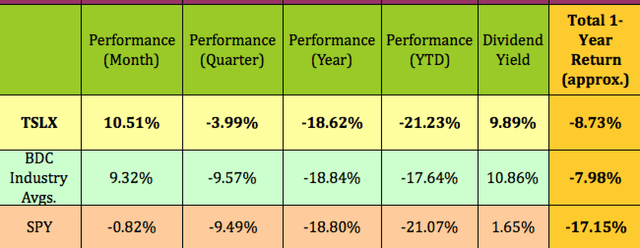

TSLX has outperformed the BDC industry and the S&P over the past month and quarter, and is roughly even with the S&P over the past year and so far in 2022. However, it has greatly outperformed the S&P over the past year, on a total return basis.

Analysts’ Price Targets:

At $18.14, TSLX is 4.5% below analysts’ lowest price target of $19.00, and 15% below the $21.35 average price target.

Parting Thoughts:

TSLX has strong dividend growth and a well-covered, attractive dividend yield, but is selling an 11% premium to NAV, albeit a lower premium than it has had previously. Add it to your watchlist, and wait for the next market meltdown before grabbing some shares.

All tables by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment