Thomas Barwick

The iShares Residential and Multisector Real Estate ETF (NYSEARCA:REZ) is good hardware for getting solid real estate exposures. There is demographic support in here and there’s no exposure to something like offices whose future is more uncertain. The medium term of real estate REITs is however linked to the interest rate situation. The Fed meeting has just occurred for November and it is clear rates are going to rise as long as there’s inflation. We think we are entering a period of disinflation, and that the current inflation is indeed transitory thanks to the lack of propagating factors. Still, in the medium term the risks are to the downside.

Quick REZ Breakdown

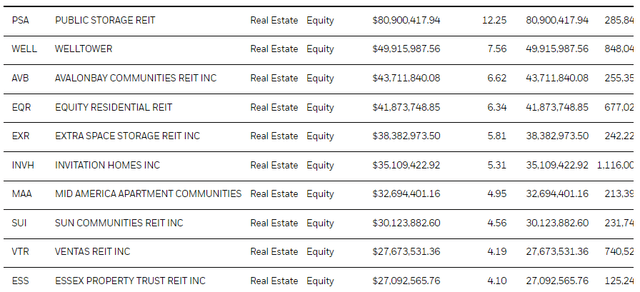

Let’s have a quick look what’s inside of REZ. We’ve covered REZ before so we’ll be brief as the holdings haven’t changed much.

REZ Top Holdings (iShares.com)

While REZ has plenty of residential exposure, there’s quite a bit of specialty REIT exposure that has had higher multiples and further to fall as allocators in the real estate space re-assess the market. Public Storage REIT (PSA) was one such example where we thought multiples were high and cap rates very low, as well as a few other self-storage REITs whose assets had been seeing reports of falling values.

Otherwise exposures like Welltower (WELL) are well positioned with respect to the favourable demographics of the US, and there is other less peculiar residential exposure within the portfolio as well. In general, the yields are pretty low in REZ. The trailing yield is 3% and the running costs are not very low at 0.48%. The markets still look somewhat extended, and that’s why the medium term could continue to look grim for REZ which has fallen 28% YTD.

Medium Term

The situation with the Fed is not favourable. There is asymmetric risk in the rate-setting approach as the Fed believes that underdoing rate hikes could mean taking steps back to fight a potentially propagating inflation, or one that could start to propagate. Therefore, and they have said this word for word, they will err on the side of overtightening rather than under-tightening. Listen to them, they’re not lying. In the medium term the values of real estate assets have been moving with the asset value rather than the situation in rent markets. REITs typically have flex to raise rates in the face of inflation, and the fundamentals of housing demand from a tenant’s point of view hasn’t changed much yet, in fact rents are some of the scarier causes of inflation which plays in the favour of residential yields. Nonetheless, a structural lift on rates is a problem for the real estate markets and will continue to drive down the price of REZ.

Longer Term

Longer term we believe that there are several forces that are putting a lid on inflation. The first is the actuality that real wages are falling, which means limited risk of wage price spiral. The second is the nature of inflation being primarily a destruction of wealth. The demand side factors are likely to have dissipated. Semiconductors went from shortage to glut. Commodities have broadly fallen except for geopolitical oil, and so have charter rates. So inflation is really just a sign of the fact that western economies are losing out to other commodity rich economies who can supply what Russia used to give the broad market. Just look at the Brazilian Real – it’s strong despite Brazil being viewed as a developing country still. The amount of wealth destruction is about equivalent to the hurt oil delivered to pocketbooks with its 10% decrease of available income. That won’t spiral, it’s happened and YoY we’ll see it until we lap. That’s what we think at least. It will also mean that the Fed will have no reason to keep rates higher. They’ll bail to an extent on these permanently higher rates and that’s when REZ will see a recovery.

Still, we wouldn’t choose REZ over other ETFs due to its lower-than-average yield and specialty exposure that muddy the waters of a residential exposure, which is vanilla and what we were looking for.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment