curraheeshutter

Investment Thesis

Sitio Royalties Corp (NYSE:STR) is a pure-play oil, natural gas, and royalty company focusing on acquiring high-growth energy-weighted rights. The company has recently completed two significant acquisitions, increasing the production and total assets by more than 30%. The company estimates the dividend payments to grow by 15% after the acquisition, which can give the 14% dividend yield at the current share price levels.

Company Overview

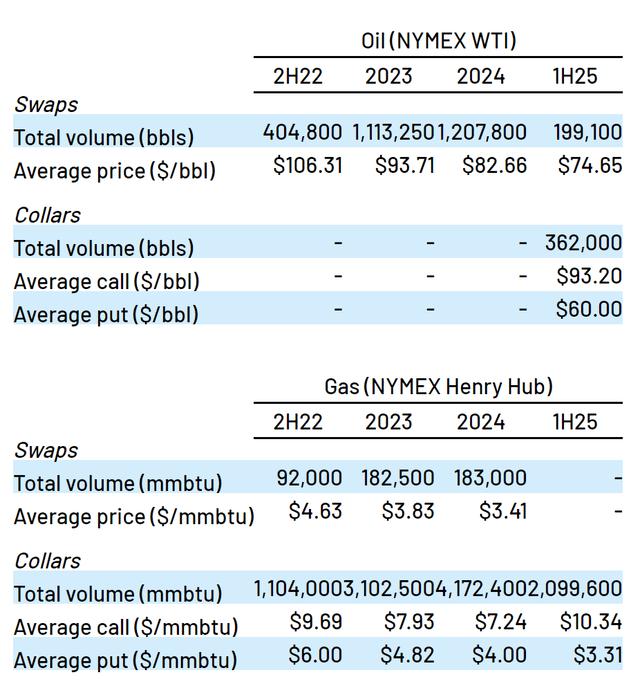

The company operates in the oil and natural gas industry with the acquisition of royalty interests, mineral interests, non-participating royalty interests, overriding royalty interests, and primarily royalty properties located in Eagle Ford Shale and Permian. The properties consisted of Royalties underlying approximately 256,000 gross unit acres. All the drilling locations are feasible for North America, and the company produces oil under a break-even price of $35 per barrel. The company operates in 4 segments: oil, natural gas, liquid natural gas, and lease bonuses. The company generated 69% of its revenue from the sale of oil and 19% from the sale of natural gas, 10% from the sale of liquid natural gas, and 2% from lease bonuses for the fiscal year that ended on December 31, 2021. Oil and natural gas production has depleted, but the average selling price of all products has increased more than 70%, which has led to strong quarterly results in FY2021. The oil and natural gas prices reached all-time high levels in the first half of the FY2022 due to the supply chain disruption and supply scarcity because of the Russia-Ukraine war. Recently, oil and natural gas prices have decreased due to the economic slowdown. Still, I believe as compared to historical levels, the prices may remain higher as the scarcity of the supply is still there. It might increase in the coming period as European Union has decided to stop accepting all oil and natural gas exports by the end of FY2022. The company will be one of the beneficiaries of the rising prices in FY2022 and FY2023. The company has acquired 19,700 net royalty acres (NRAs) in the Permian Basin to increase production. It has also entered into a derivative contract to hedge the volatility in the market and improve the cash flow certainty.

Hedge Contracts of Sitio (FY2021 Annual Report)

Accretive Permian Basin Acquisitions

Recently, the company announced the acquisition of more than 19,700 NRAs in the Permian Basin from Foundation Minerals, a Quantum Energy Partners subsidiary. The deal was executed for $323 million and was funded using borrowings under the company’s credit facility and unsecured loan facility. The company has also acquired more than 12,200 NRAs in the Permian Basin from Momentum Minerals, which is based in Houston. The company has completed the deal for $224 million, which will be funded by debt financing, and it is expected to close in Q3 FY2022. After the complete integration of both acquisitions, the company estimates the production to increase by more than 30%, which is 3,500 boe/day. If the company maintains the traditional 65% dividend payout ratio, both acquisitions will add approximately 15% to the dividends per share in the second half of FY2022. With this acquisition, the company’s assets in Permian Basin have increased by more than 30%, and the total assets of the company have increased by more than 22%, standing at 173,000 NRAs. The company has grown its NRAs by 300% since the June of FY2021. After closing both acquisitions, the pro forma leverage is expected to be 1.5x. I believe that with the increased production, the company is well positioned in the industry and could be one of the beneficiaries of rising prices due to supply scarcity which can increase the dividend payments in the coming quarters.

Solid 10.79% Forward Dividend Yield

The company is currently paying an annual dividend of $2.51, which is equivalent to a dividend yield of 9.44% compared to current levels. After this acquisition, the company estimates a dividend growth of 15%, provided the company keeps the dividend payout ratio of 65% intact. The estimated annualized dividend payment is $2.88, which gives the forward dividend yield of 10.79% at the current share price. The dividend rise is sustainable as oil and gas prices are still high compared to the historical levels, and they will remain in a higher bracket till supply is scarce in the global market.

What is the main risk faced by STR?

Fluctuations in Oil and Natural gas prices

Oil and natural gas spaces are highly volatile, and price fluctuations are a prevalent theme in this space. STR is greatly affected by the price fluctuations in these commodities as the royalties earned by the company are based on the oil and gas prices at that point in time. The company takes some measures to reduce exposure to high price fluctuation and hedge its position by entering into derivative contracts for future oil production. Some of these contracts are fixed price swaps, collars, and basis swaps. The company has successfully managed to mitigate the volatility through its hedging activities, but it is a risk permanently associated with oil and natural gas space and cannot be ignored.

Technical Analysis and Fundamental Valuation

Technical Analysis Chart (Investing.com)

STR has recently crossed the 50-day weighted moving average (WMA) and is currently trading at its 100-day WMA. This indicates that the stock has good momentum and can see a big upside from current price levels if the stock can sustain above the 100-day WMA. The RSI indicator is showing no divergence at the moment, but the stock is consolidating in the 50-60 band. This suggests that the stock is in buy territory. Overall, the technical indicators are positive for the stock and reflect a buying opportunity.

STR is trading at a P/E multiple of 11.37x with full-year EPS estimates of $2.35. I believe the stock is trading at an attractive valuation at the current stock price. Considering the strong dividend yield of 9.44%, the stock becomes even more attractive for investors looking for a stable and high dividend yield. I believe the stock has good upside potential given the recent purchase of the Permian basin, which is expected to drive significant growth for the company. Given these factors, I believe the stock can trade at a higher valuation of 14x in the near future, and this gives us a target price of $32.9, a 22.8% upside from the current price of $26.7.

Conclusion

The purchase of the Permian basin is expected to boost significant royalty growth for the company in the coming quarters. The company has a dividend yield of 9.44%, which is very attractive given the growth prospects of STR. It faces the risk of fluctuation in Oil and Natural gas prices, but it has managed to mitigate that risk with effective hedging strategies. The company is a great investment opportunity for investors looking for high dividend stock at an attractive valuation. I recommend a buy for STR after considering all the growth and risk factors.

Be the first to comment