greenbutterfly/iStock via Getty Images

As predicted in prior research, NXP Semiconductors (NASDAQ:NXPI) remains perfectly positioned in the booming auto semiconductor market while other parts of the semiconductor space struggle to even grow. The stock hasn’t collapsed like other tech stocks, but record numbers should contribute to higher prices while NXP Semiconductors has fallen $50 from the highs. My investment thesis remains bullish on the stock, as growing chip supply still can’t keep up with strong demand.

Another Big Quarter

NXP Semiconductors just reported another strong quarter in Q2’22 with revenues growing 28%. Considering the stock was already cheap, the company beating EPS estimates by a strong $0.10 on a GAAP basis and much higher on a non-GAAP basis just makes the stock a bigger bargain.

The CEO had this to say about the market dynamics pointing to strong demand and an improving supply situation:

Notwithstanding the clear macro-economic cross currents, NXP continues to perform well. Customer demand within the Auto and Industrial & IoT end-markets continues to exceed our incrementally improving supply, even as we risk-adjust our long term orders.

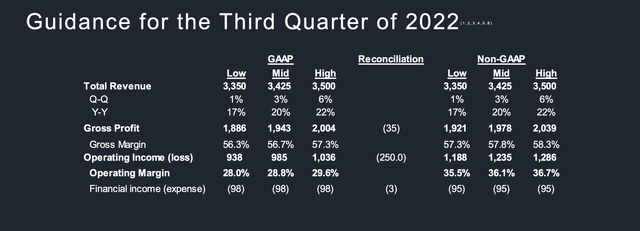

The guidance for Q3’22 is just as strong with revenues targeted at $3.43 billion at the midpoint and the consensus analyst estimates at only $3.33 billion. NXP Semiconductors guided to operating margins of 36.1% after hitting just 36.0% in the prior quarter and 33.5% last Q3.

Source: NXP Semi. Q2’22 presentation

The Semiconductors company earned $2.84 per share last Q3 and the consensus estimates for $3.36 in Q3’22 appear very low after the big beat and guide up. Just a 3 percentage point boost in operating margins would contribute over $0.30 in additional profits. The company could hit a $4 EPS in the quarter with revenue growth approaching 20% in the quarter.

Long-Term Play

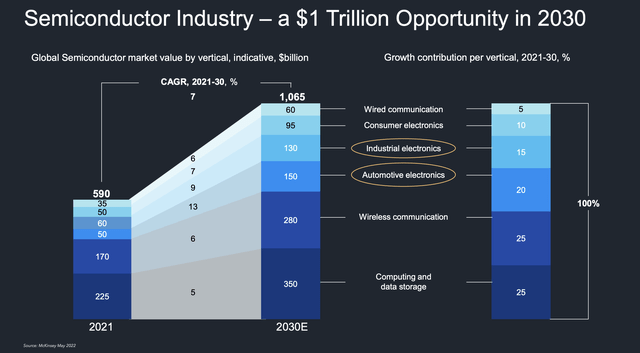

In no surprise, the Semiconductors industry is expected to continue years of strong growth into the future. The current slowdown in parts of the sector doesn’t alter the strong long term view.

The McKinsey forecast has the global Semiconductors market nearly doubling in size from $590 billion in 2021 to $1,065 billion in 2030. The sector is set to add nearly $500 billion in additional revenues with the biggest boost coming from the automotive sector where NXP focuses.

Source: NXP Semi. Q2’22 presentation

The auto Semiconductors demand is forecast to surge from only $50 billion last year to $150 billion in 2030 with the revenue figure actually appearing small considering the advancement of autonomous driving technology that will occur in the next 5 years. NXP could easily exceed the forecasted 13% growth rate in the sector.

The stock only traded at 12x 2022 EPS targets of $13.73 per share. These numbers will no doubt get a large boost with EPS targets for the year heading above $14 now. The flat targets for 2023 should jump above $15.

With the targeted financial model of 10% CAGR, the stock should easily trade at 15x EPS targets and possibly higher. The auto Semiconductors market is forecast to grow at higher rates providing the opportunity for NXP to reach the top end of the forecast revenue growth rates of 12% with even faster earnings growth due to share buybacks and margin expansion. At just a 15x multiple of what could easily be a $15+ EPS in 2023 would place the stock at $225, up ~$50 or 30% from the current price.

In Q2, NXP only returned $222 million to shareholders via the dividend payment that yields 1.6%. In prior quarters such as Q1’22, the company spent $550 million on share buybacks to exceed the capital returns for dividends so far to date in 2022.

NXP hosts an earnings call at 8am on the 26th before the stock market opens. An investor should always listen to such calls to see if a company provides additional information that differs from the highlights in a short earnings release.

Takeaway

The key investor takeaway is that NXP remains a bargain in the Semiconductors sector and the Q2’22 earnings call only reinforces the previous view. Investors should see any weakness in the stock caused by fears in the sector as an opportunity to load up on NXP Semiconductors.

Be the first to comment