Marc Dufresne

Another Tech Blowup

Last night, Zoom Video Communications (ZM) reported earnings that beat street estimates but issued Q4 guidance that lagged expectations. The stock, which was down 56% year to date and 68% for the previous twelve months heading into the print traded off over 5% on the subsequent market open.

As of November 21st, ZM was the largest holding of ARK Innovation Fund (NYSEARCA:ARKK), whose parent firm ARK Investment Management, was the fifth largest holder of the stock when all fund holdings are taken into account. ARKK is the firm’s largest ETF, so I’ll focus on it for this article.

Just about anyone who has followed the investment landscape or watched CNBC with any regularity the past few years is familiar with ARKK and its fund manager Cathie Wood. She has preached ARKK as an active ETF that invests in “disruptive innovation” companies. She generated volatile if cumulatively middling returns until 2020, when she shot to fame as ARKK returned over 150% thanks to oversized bets on Tesla (TSLA) and some Covid beneficiaries such as Block (SQ), Roku (ROKU), and Zoom (ZM). The fund and the firm’s AUM grew to tens of billions of dollars. Wood was hailed as a savant.

The last two years have been a different tale. ARKK’s biggest bets and former highest fliers have nearly all crashed and dragged the fund’s returns with them. Just going through ARKK’s top holdings is like combing through a financial murder scene. As of this writing, year-to-date ZM is down ~59%, TSLA is down ~52%, ROKU is down ~76%, EXAS is down ~46%, and SQ is down ~61%.

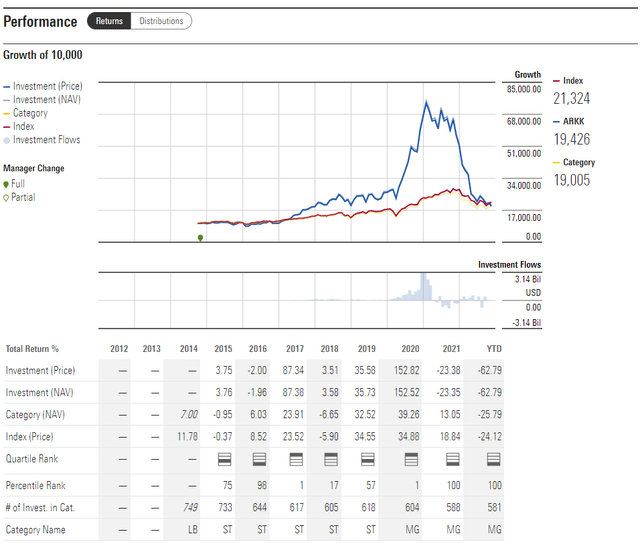

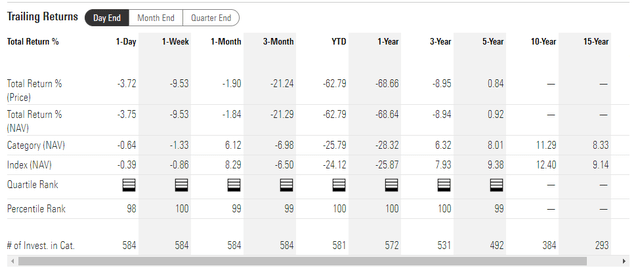

This bloodbath has cost investors dearly. ARKK shares are down ~63% year to date. As you can see below, the fund has gone from “hero to zero” status in Morningstar, dropping from the top percentile in 2020 to the bottom percentile in 2021 and so far this year and earning itself just 1 star.

Morningstar Ratings on ARKK (Morningstar)

The losses this year and last year are so dramatic, they wipe out the benefits of 2020, putting it in the bottom percentile for the fund’s three-year track and the bottom 2% for the five-year period.

Morningstar Time Series Ratings of ARKK (Morningstar)

It doesn’t take careful examination to conclude that this performance is AWFUL. Cathie Wood and her supporters repeat ad nauseum that the fund’s portfolio of “disruptive” bets is placed with a five-year time horizon. I call nonsense (being polite) on both of these claims.

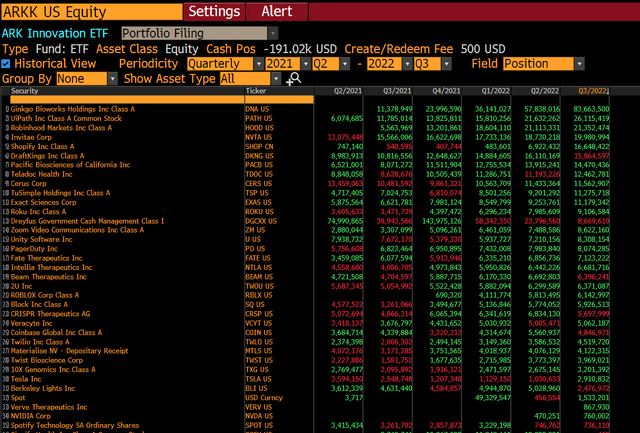

Simply looking at ARKK’s top holdings at the end of each quarter, large fluctuations in position sizes. Remember, this is an “active” ETF. Position changes are decided by management, not by following an index.

ARKK Quarter End Holdings (Bloomberg)

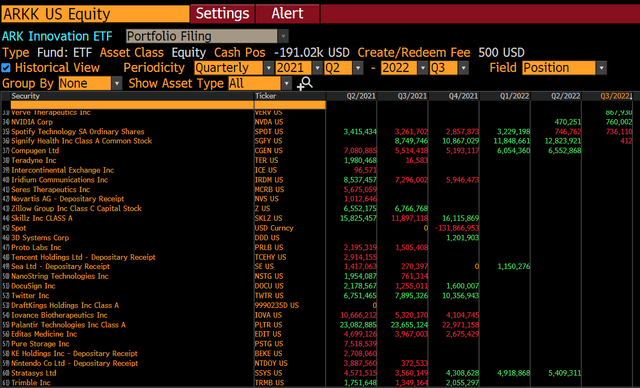

In addition, the above does not count the positions that the fund completely exited over the same time frame. That list runs to twenty-five different investments just since Q2 of 2021 as you can see below.

ARKK Exited Investments by Quarter (Bloomberg)

Not including cash, there are currently thirty-one holdings in ARKK, yet the fund completely exited twenty-five investments over the previous six quarters, nearly 80%. That does not sound like a five-year horizon to me.

Moreover, I fundamentally question whether composing a successful basket of truly disruptive companies is even possible. Not only are disruptive companies exceedingly rare, figuring out where disruption will occur, and which companies will win is even harder. Just three years ago, I heard very few people talking about how much Tik-Tok could disrupt the dominant social media companies. In an even more glaring example, only a few months ago Sam Bankman-Fried was being hailed as the JPMorgan of crypto, whose model was going to disrupt both banking and fiat currencies.

The point is, identifying truly disruptive companies in fast-moving industries (or any industry for that matter) is extremely difficult. The idea that one could assemble a portfolio of thirty such investments is laughable.

The Original Sin of Fund Management

I can somewhat understand bad fund performance if one’s strategy is out of favor for a while. For example, if you’re a long only emerging market bond manager who has to be invested at a high percentage, finding any place to park money consistent with your mandate would be very difficult. So absolute poor performance can be excused somewhat. Relative poor performance like ARKK has experienced is harder to excuse. Even harder to accept is money lost by poor risk management, exemplified by adding to rather than cutting losers. That is the original sin of fund management.

As you can see in the holdings table above, Cathie Wood has increased positions throughout the year in money-losing trade after money-losing trade. Just looking at the current top 5 holdings of the fund: ZM, TSLA, ROKU, EXAS, SQ. All have been terrible performers, and Cathie Wood has steadily acquired them all year.

Remarkable Flows

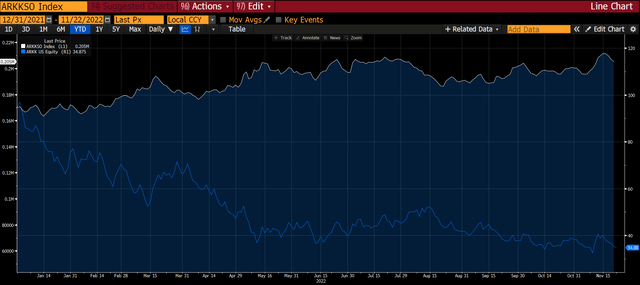

ETF’s shares are created as money is invested in the fund. As a testament to Cathie Wood’s marketing prowess, ARKK has taken in money this year. As you can see in the table below, ARKK shares outstanding have increased (white line) even as Cathie Wood and her team have been destroying shareholder value by over 60% (blue line). While Cathie Wood has lit investor money on fire dollar-cost averaging on her money-losing stocks, her investors are giving her more fuel for the fire by dollar-cost averaging on her money losing fund.

ARKK Shares Outstanding vs Share Price (Bloomberg)

Conclusion

I normally don’t write about funds or ETFs. Most of my shorts are individual companies with a catalyst. I have been short ARKK for the better part of a year based on my belief that her investment style enjoyed a once in a generation (if not lifetime) moment where investing without regard to risk or valuation was celebrated to a remarkable degree. Cathie Wood’s ARKK is the poster child for that moment in time.

I don’t know anything about Cathie Wood personally nor do I care to. I have nothing personal against her or ARKK, (although I do find the complete lack of contrition for investor losses distasteful). I am simply marveling at frequency and scale of the losses from the stock selection in ARKK, the poor risk management in my opinion and yet the continued inflows into a fund with such terrible performance. Perhaps the past two years have just been a cold spell and brighter days are ahead. Judging by recent earnings outlooks from the fund’s biggest holdings, I wouldn’t count on it.

Be the first to comment