BOB WESTON/iStock via Getty Images

The name Sisecam Resources LP (NYSE:SIRE) (“Sisecam”) may not sound familiar to readers, but this is actually the new name of Ciner Resources LP, which I discussed numerous times on this website. I’ve always liked the cost advantaged nature of the business, which consists in the production of soda ash from natural trona in Wyoming, but I warned that its partnership structure could create conflicts of interest between the majority owner and the common unitholders.

One such conflict of interest may have just arisen, with the parent’s offer to buy out minority holders at a price of $17.9 per unit (6x our estimate for 2022 net earnings) – which in my opinion is far from reflecting the value of the business. In fact, Sisecam’s business has been firing on all cylinders, and its prospects are supported by secular tailwinds, derived from growing demand and a strengthening cost advantage.

The Offer

After a rather difficult couple of years, during which distribution cuts (to fund a future capacity expansion) and Covid-19 weighed on the unit price, things were looking up for unitholders. Strong performance since H2 ’21 enabled the resumption of distributions, and the unit price started to recover. However, on July 6, the majority owner announced a buyout offer which, if it materialized, has the potential to deprive minority investors of the upside:

On July 6, 2022, Sisecam Chemicals Resources LLC (“SCR”), delivered a non-binding proposal (the “Proposal”) to the Board of Directors of Sisecam Resource Partners LLC, the General Partner of Sisecam Resources LP (SIRE) (the “Issuer”) to acquire all of the outstanding common units, representing limited partner interests in the Issuer not already owned by SCR or its affiliates, in exchange for $17.90 per issued and outstanding publicly held common unit of the Partnership, which represents the thirty day volume weighted average per share, as of July 5, 2022.

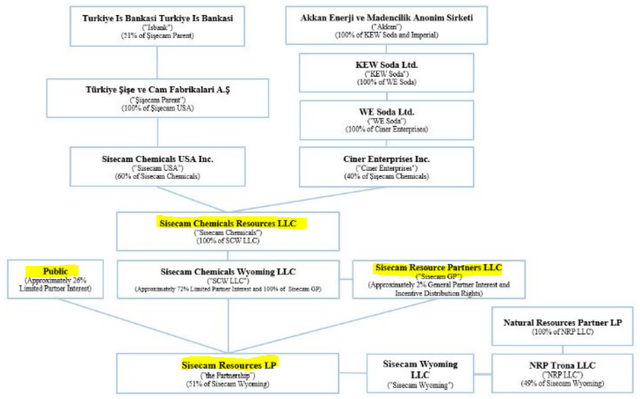

We will discuss valuation later in this article, but let us first take a look at the organization chart:

Sisecam Resources 10K

The public, including this author, owns about 26% of the MLP (which in turn owns a majority stake in the operational entity Sisecam Wyoming LLC). The other 74% of the MLP units are controlled by two Turkish groups, Ciner and Sisecam, through their joint venture Sisecam Chemicals Resources LLC (in detail, they own a 72% limited partner interest and a 2% interest as the General Partner).

My understanding is that, at this stage, the offer (which remains to be confirmed) is not compulsory. However, based on the Partnership Agreement, if the Turkish groups (acting as the General Partner) were to gain ownership of 80% of the units, they could use their Limited call right to force minority holders to sell their units:

If at any time our general partner and its affiliates own more than 80% of the outstanding common units, our general partner will have the right, but not the obligation, to purchase all of the remaining common units at a price equal to the greater of: • the average of the daily closing price of the common units over the 20 trading days preceding the date three days before notice of exercise of the call right is first mailed; and • the highest per-unit price paid by our general partner or any of its affiliates for common units during the 90-day period preceding the date such notice is first mailed. Please see “The Partnership Agreement—Limited Call Right.”

Source: Partnership Agreement

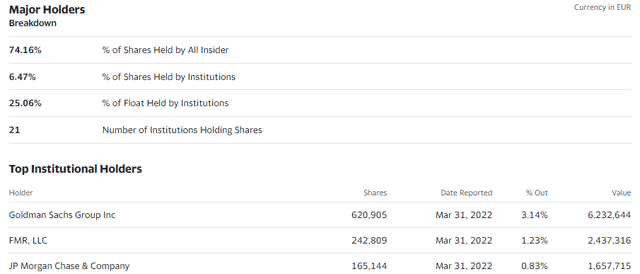

Can they get to 80%? Among the 24% not currently owned by the General Partner, a few institutions will surely be aware of the lowball nature of the offer – however this cannot be considered as an indicator of whether or not they will sell their stake.

Yahoo Finance

Why The Offer Does Not Reflect The Fundamentals

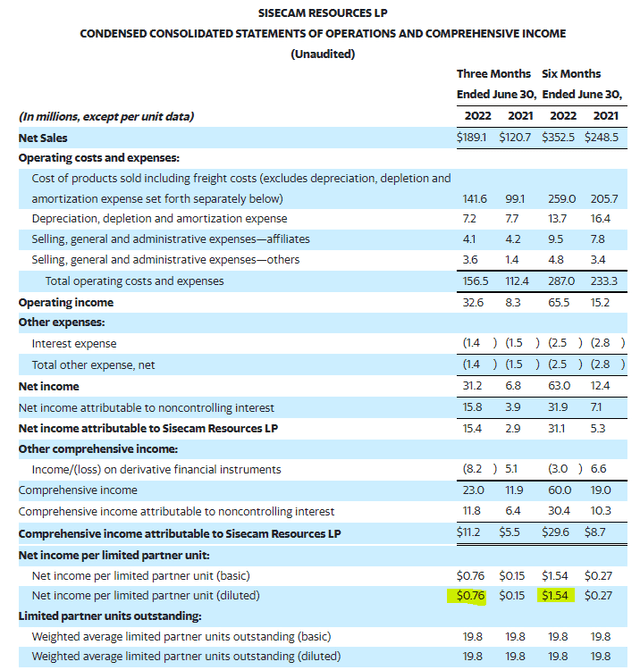

It’s no coincidence that the buy-out offer comes just as the business is starting to live up to its potential – the General Partner is fully aware of the tremendous value offered by the units at this point. A look at the H1 ’22 results confirms this: earnings for the half-year reached $1.54 per unit on a net income basis (and a similar amount of distributable cash flow per unit).

Sisecam Resources LP 10Q

On an annualized basis, net earnings should be in the region of $3 per unit. On that basis, the offer price of $17.90 equates to an outrageously cheap 6x net income multiple. Moreover, what’s interesting in this release is that the numbers provide evidence of the tailwinds that will support Sisecam going forward: the already sizable advantage of the natural process (soda ash from trona ore) over the synthetic production is getting bigger.

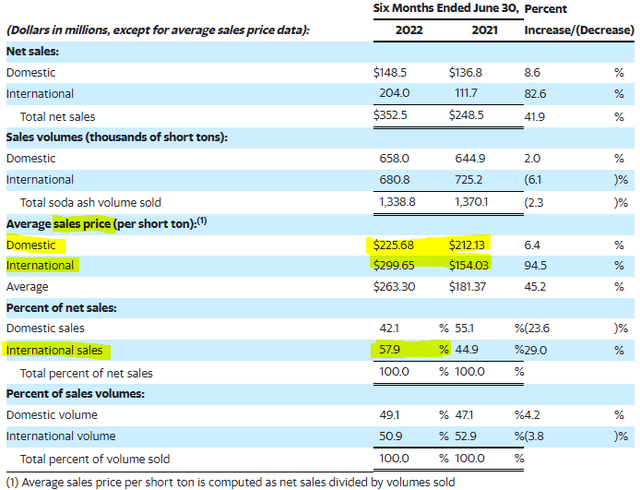

Indeed, the synthetic process most global producers resort to is energy-intensive, which in the current context of high energy prices puts them at a huge cost disadvantage against the Green River basin producers like Sisecam (not to mention environmental considerations). As a result, Sisecam can export its low-cost production and enjoy global prices that have soared since the same period last year:

Sisecam Resources LP 10Q

Could it be that we are seeing peak demand and that soda ash is cyclical, like most commodities? Actually, this doesn’t seem to be the case, as shown by the track record of the MLP’s earnings (2020 was an outlier).

|

Dec 2014 |

Dec 2015 |

Dec 2016 |

Dec 2017 |

Dec 2018 |

Dec 2019 |

Dec 2020 |

Dec 2021 |

June 2022 YTD |

|

| Earnings per unit | $2.23 | $2.58 | $2.06 | $2.07 | $2.48 | $2.46 | $0.58 | $1.21 | $1.54 |

What’s more, new applications will provide further tailwinds, such as the use of soda ash in the production of lithium carbonate for batteries, and in solar panels. Readers interested in the supply-demand dynamics of soda ash can refer to the recent earnings call transcript of Genesis Energy LP (GEL). In short, this is an undersupplied market, in which natural producers enjoy a huge advantage that will only continue to grow. I would consider $30 per unit (10x the 2022 net income estimate) as fair value, at a minimum.

A Word On The Ciner/Sisecam 2021 Transaction

The reason why the MLP is now called Sisecam Resources LP rather than Ciner Resources LP is that the Ciner group sold 60% of its stake to Sisecam (a Turkish company specialized in glass production) in late 2021. The terms of the transaction were as follows:

Subsequent to the Reorganization Transactions, Ciner Enterprises agreed to sell to Sisecam USA, and Sisecam USA agreed to purchase, 60% of the outstanding units of New Resources owned by Ciner Enterprises for a purchase price of $300 million (the “New Resources Sale”)

Given that the partnership has 19.8 million common units, 74% of which were controlled by Ciner, Sisecam bought 60%*74%*19.8M = c. 8.8M units for $300 million, equating to approximately $34 per unit. This is a far cry from the $17.9 of the recent offer. Granted, the purchase included the value of the IDRs, and the goodwill for potential developments that Ciner and Sisecam might undertake jointly in the U.S. (outside of the LP structure). However, it remains obvious that the $17.9 grossly undervalues the LP in light of this transaction.

Takeaway

In our opinion, the offer reflects neither the current performance of Sisecam, nor the bullish prospects of the business, supported by its low-cost structure and increasing global demand for soda ash. I know that most minority holders feel the same, with some of them threatening legal action if a forced buy-out took place (see the comments section of this news item).

Unfair buyouts have happened before, as the MLP structure tends to offer minimal protection to common unitholders. However, there are exceptions and, despite the vast powers of the general partner per the partnership agreement, any offer still has to be done in good faith. In the case of Boardwalk Pipelines LP, the court considered that this was not the case and that unitholders were short-changed.

Sisecam’s units currently trade above $20, which suggests that the market doesn’t believe in a compulsory buyout at $17.9. I will hold on to my units, hopefully for the long run.

Be the first to comment