David Gyung

A Quick Take On Guild Holdings

Guild Holdings (NYSE:GHLD) reported its Q2 2022 financial results on November 3, 2022, beating revenue and EPS estimates.

The firm provides residential mortgage loan origination and servicing services in the United States.

I’m sitting on the sidelines until I gain better insight into the direction of interest rates in 2023, so I’m on Hold GHLD in the near term.

Guild Holdings Overview

San Diego, California-based Guild was founded in 1960 to originate and service residential mortgages and has since expanded its footprint to 31 states.

Management is headed by Chief Executive Officer Mary Ann McGarry, who has been with the firm since 1984 and was previously an accountant at Peat, Marwick, Mitchell & Co.

In 2007, the company was acquired from its founder by a management-led buyout in conjunction with McCarthy Capital. They have since sought to expand the company’s operations beyond the West Coast U.S.

The firm pursues new client relationships through its loan officer network and tracks the full client lifecycle through its ‘Guild 360’ custom client relationship management system.

Major competitive or other industry participants include:

-

Rocket Companies (RKT)

-

loanDepot (LDI)

-

Fairway Independent Mortgage Corp.

-

Caliber Home Loans (HOMS)

-

Guaranteed Rate

-

Movement Mortgage

-

CrossCountry Mortgage

Guild Holdings’ Recent Financial Performance

-

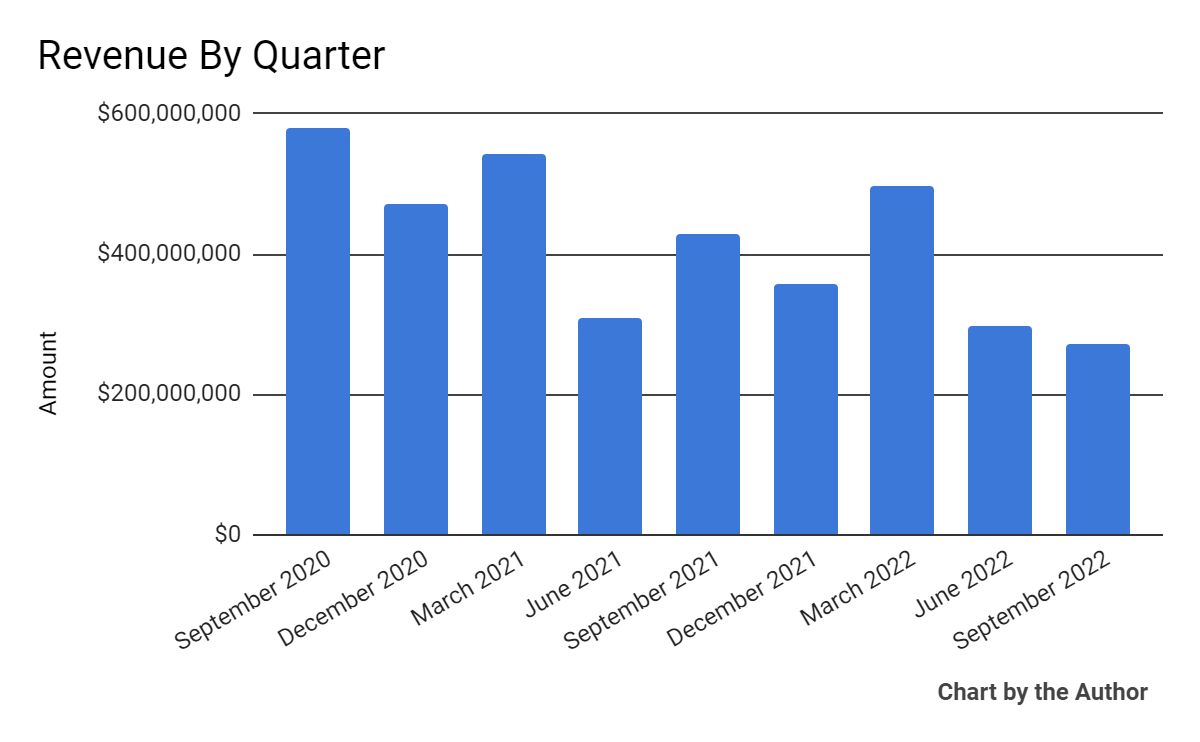

Total revenue by quarter has fallen according to the chart below:

Total Revenue (Seeking Alpha)

-

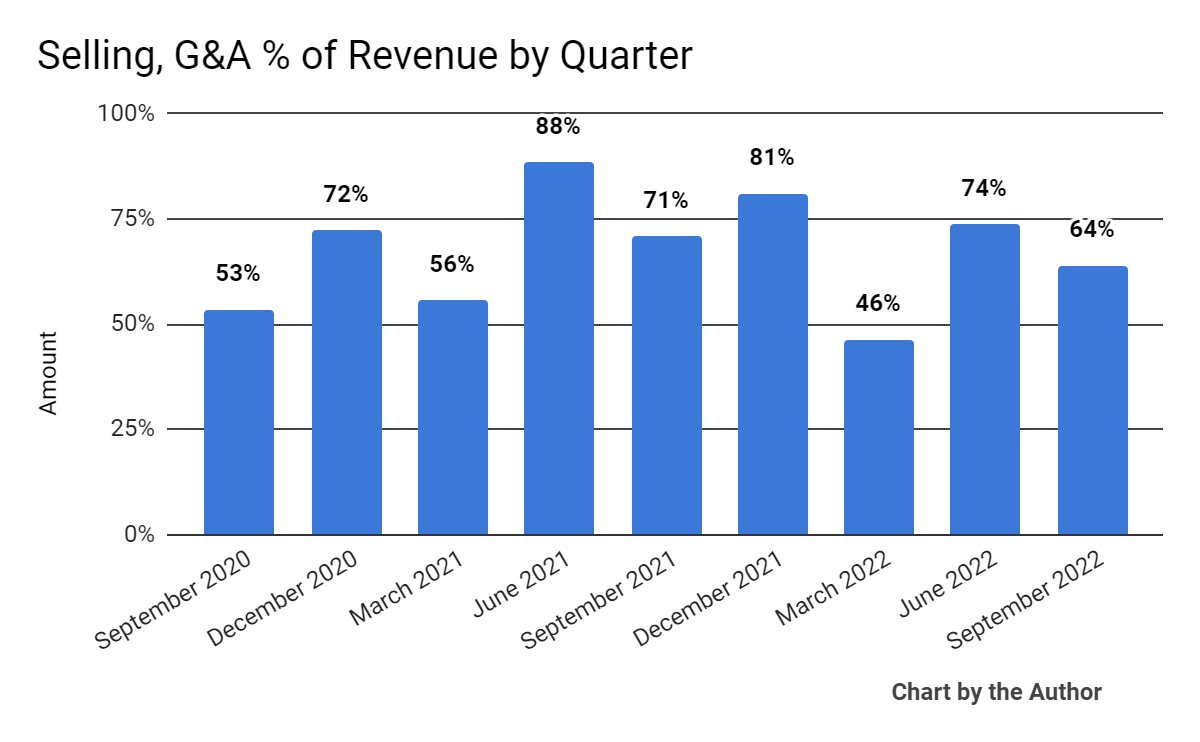

Selling, G&A expenses as a percentage of total revenue by quarter have varied as shown here:

Selling, G&A % Of Revenue (Seeking Alpha)

-

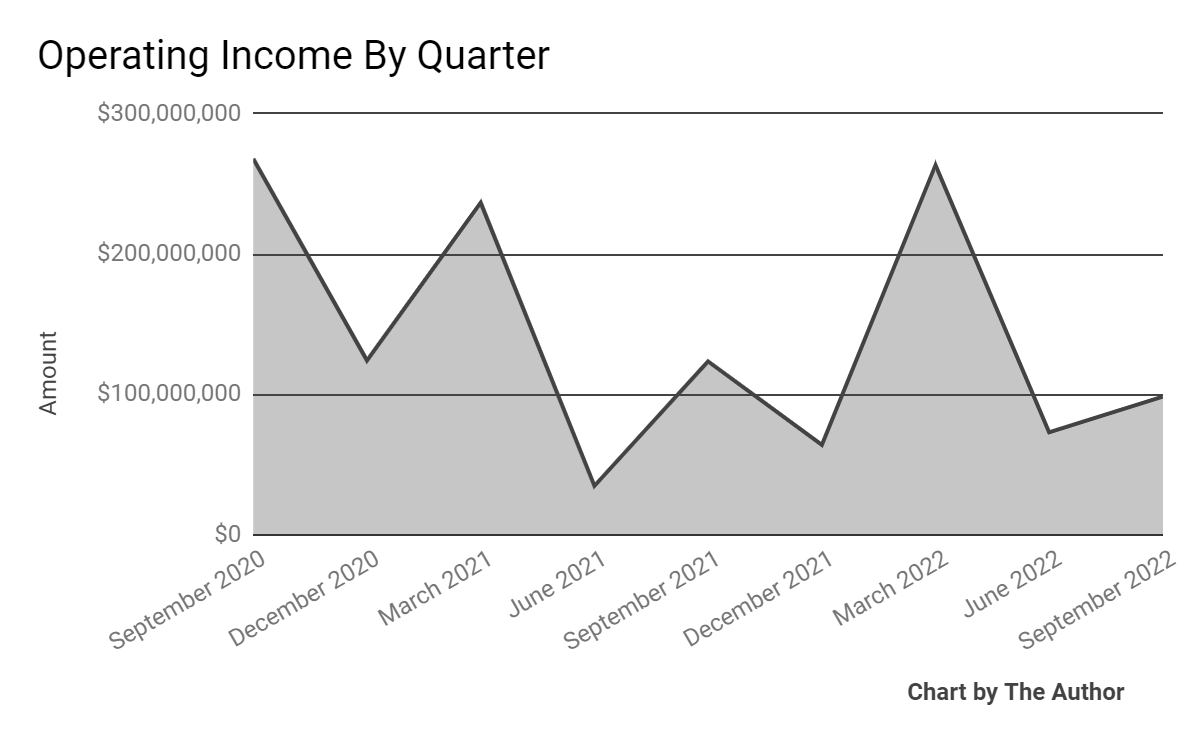

Operating income by quarter has trended lower:

Operating Income (Seeking Alpha)

-

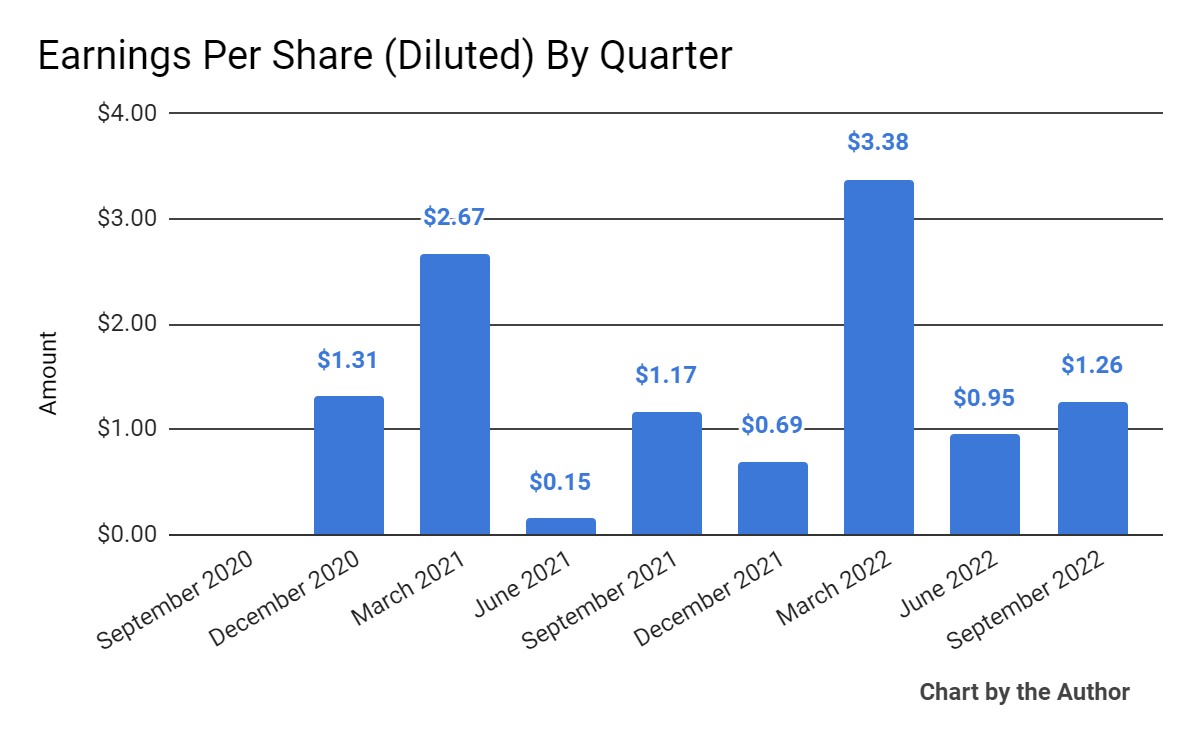

Earnings per share (Diluted) have fluctuated sharply:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

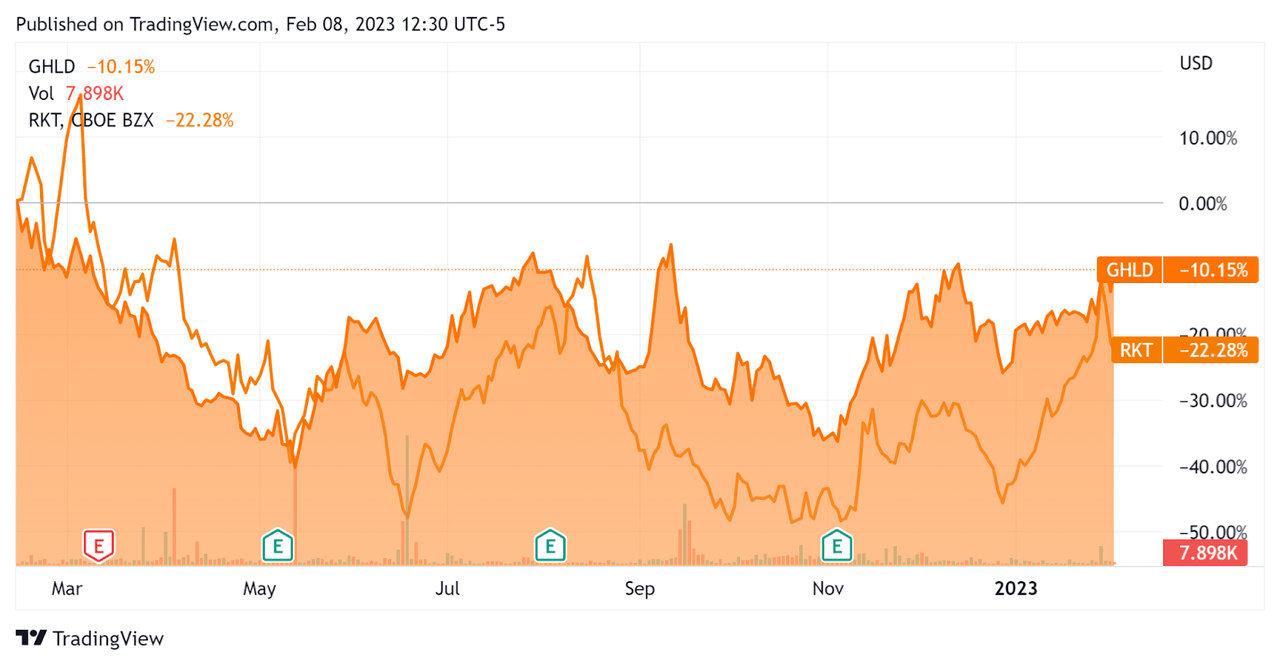

In the past 12 months, GHLD’s stock price has fallen 10.2% vs. that of Rocket Companies’ drop of 22.3%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Guild Holdings

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.5 |

|

Enterprise Value / EBITDA |

4.3 |

|

Price / Sales |

0.5 |

|

Revenue Growth Rate |

-18.6% |

|

Net Income Margin |

27.1% |

|

GAAP EBITDA % |

36.1% |

|

Market Capitalization |

$732,801,660 |

|

Enterprise Value |

$2,199,437,570 |

|

Operating Cash Flow |

$1,092,226,940 |

|

Earnings Per Share (Fully Diluted) |

$6.28 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Rocket Companies; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Rocket Companies |

Guild Holdings Company |

Variance |

|

Enterprise Value / Sales |

2.5 |

1.5 |

-38.4% |

|

Enterprise Value / EBITDA |

7.8 |

4.3 |

-45.0% |

|

Revenue Growth Rate |

-46.8% |

-18.6% |

-60.3% |

|

Net Income Margin |

1.4% |

27.1% |

1860.9% |

|

Operating Cash Flow |

$14,010,000,000 |

$1,092,226,940 |

-92.2% |

(Source – Seeking Alpha)

Commentary On Guild Holdings

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted how ‘market dynamics across the industry remained challenging during the third quarter’ as mortgage rates went higher.

However, since the end of Q3, rates have since dropped materially.

Inventories were constrained putting downward pressure on origination volumes.

Management also highlighted its business model that ‘leverages in-house loan officers who build and maintain strong relationships with customers and referral partners in local markets.’

The firm believes that its purchase market focus will improve as ‘buyers are waiting on the sidelines’ due to volatile conditions and will return once those conditions stabilize or improve.

As to its financial results, total revenue dropped 36.4% year-over-year and in-house loan originations decreased 24% sequentially.

SG&A as a percentage of total revenue continued to trend lower, a positive signal the firm is becoming more efficient over time and as the industry is contracting.

Earnings per share rose year-over-year to $1.26 in Q3.

For the balance sheet, the firm ended the quarter with $162.3 million in cash, equivalents and short-term investments and $1.54 billion in total debt.

Over the trailing twelve months, free cash flow was $1.09 billion, of which capital expenditures accounted for only $4.2 million. The company paid only $6.3 million in stock-based compensation in the last four quarters.

Looking ahead, management said it has a strong balance sheet which will enable it to take advantage of a consolidation period as the industry contracts and weaker players are forced to sell at lower valuations than previously contemplated.

Regarding valuation, the market is valuing GHLD at lower multiples than competitor Rocket despite GHLD’s lower revenue contraction rate and higher net income margin.

The primary risk to the company’s outlook is the continued volatility in mortgage rates during an uncertain period as inflation recedes but the U.S. economy still exhibits material labor tightness.

The market has also punished GHLD less than RKT over the past 12-month period, so interested investors who believe interest rates will continue to fall as 2023 progresses may wish to put GHLD on a watch list for further consideration.

I’m sitting on the sidelines until I gain better insight into the direction of interest rates in 2023, so I’m on Hold for GHLD in the near term.

Be the first to comment