Getty Images

For those who drive regularly, especially with long commutes, one of the most popular companies has got to be Sirius XM Holdings Inc. (NASDAQ:SIRI). Although the broader market has faced a lot of uncertainty as of late, this particular player has generally seen its financial results improve over time. This is not to say that the firm is immune to volatility. It does see some itself. But for investors who want a business that is capable of generating strong and growing cash flows, and that is trading at a reasonable price, this might be a great prospect to consider.

God gave us two ears for a reason

One of the most memorable quotes I have come across over the years has been, “God gave us two ears and only one mouth for a reason.” Although this quote is meant to imply that we should listen to others more than talking, it’s also true that hearing is an incredibly important sensation for other reasons as well. Music is one such example. The overwhelming majority of the people on the planet have a love for music in common. This is not just me saying it. According to one source, between 90% and 93% of people across the globe listen to music, making it something of a universal language for our race. Capitalizing on this, Sirius XM Holdings has built for itself a rather large enterprise with two distinct businesses at its foundation.

The first of these is Sirius XM, a service that is distributed through the company’s two proprietary satellite radio systems and streamed via applications for mobile devices, home devices, and other consumer electronic equipment. These satellite radios the company produces are distributed through automakers, retailers, and even its website. Then, using a subscription service, the company broadcasts music, sports commentary, entertainment news, comedy, talk news, traffic, weather channels, and other sorts of content like podcasts and infotainment services, to its millions of subscribers. This particular business also has other offerings, such as its connected vehicle services that it provides to automakers, and its data services that include graphical weather, fuel price delivery, sports schedule delivery, and more.

The second business under the Sirius XM Holdings umbrella is known as Pandora. Acquired years ago, Pandora operates as a music, comedy, and podcast streaming platform that provides a personalized experience for each of its listeners. It utilizes the data it collects from listening habits to determine what other songs and content its listeners might enjoy. Just like Sirius XM, Pandora offers subscription services. One of these, called Pandora Plus, is a radio subscription service, while the other, Pandora Premium, operates as an on-demand subscription service. It also generates revenue through its ad-supported radio service. This enterprise also includes other operations, such as podcast distribution, ad sales representation, and more.

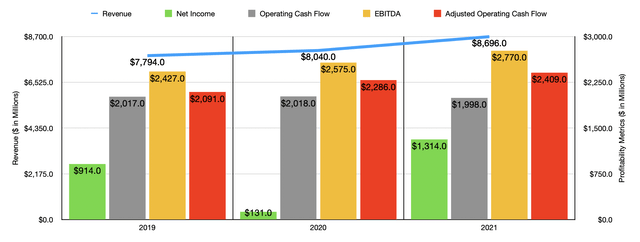

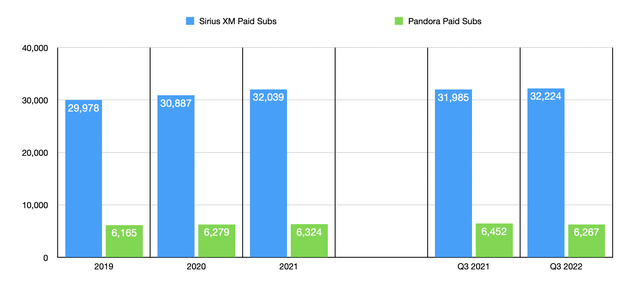

Over the past few years, Sirius XM Holdings has exhibited consistent growth. Between 2019 and 2021, revenue at the company rose from $7.79 billion to $8.70 billion. This increase was driven by a couple of factors. For starters, the number of paid subscribers under the Sirius XM umbrella grew from 29.98 million to 32.04 million. At the same time, the ARPU per month for this service rose from $13.82 to $14.76. In addition, the company also saw the number of paid subscribers under the Pandora offering climb from 6.17 million to 6.32 million. ARPU here rose more modestly from $6.61 to $6.69.

The bottom line for the company has been more volatile. For instance, net income fell from $914 million in 2019 to $131 million in 2020. In 2021, it shot up to $1.31 billion. Operating cash flow stayed roughly a level at just under $2.02 billion in 2019 and 2020. Then, in 2021, it dipped slightly to just under $2 billion. But if we adjust for changes in working capital, we would have seen an increase year after year, climbing from $2.09 billion to $2.41 billion. And over that same window of time, we also saw EBITDA improve, rising from $2.43 billion to $2.77 billion.

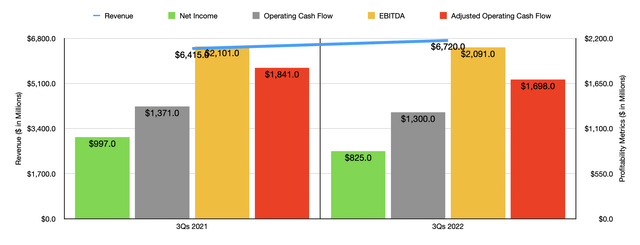

When it comes to the 2022 fiscal year, results for the company have been somewhat mixed. For the first three quarters of the year, for instance, sales rose from $6.42 billion to $6.72 billion. This increase was driven by a rise in paid subscribers from 31.99 million under the Sirius XM brand to 32.22 million. The increase in the ARPU for the company from $14.57 to $15.63 was also very helpful. At the same time, however, the number of paid subscribers under the Pandora brand shrank from 6.45 million to 6.27 million. Even though revenue increased nicely, profits for the company shrink. Net income fell from $997 million to $825 million. At the end of the day, there were multiple contributors to this decrease in profits. For instance, the company did see the revenue share and royalties paid under the Pandora brand rise by 11% year over year even though revenue increased by just 5%. The company also saw a 21% surge in programming and content costs, as well as a 16% rise in sales and marketing expenses under the broader operations of the company. These factors and others were instrumental in other profitability metrics coming in lower year over year as well. As an example, operating cash flow fell from $1.37 billion to $1.30 billion. On an adjusted basis, it declined from $1.84 billion to $1.70 billion. Even EBITDA worsened, falling from $2.10 billion to $2.09 billion.

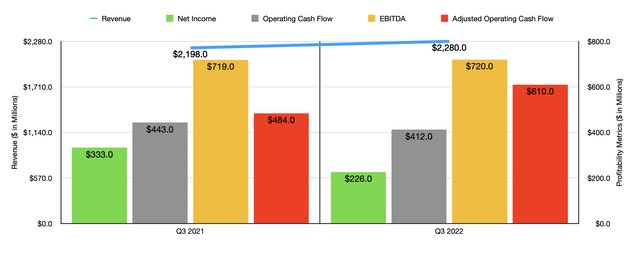

On November 1st, management also announced financial results covering the third quarter of its 2022 fiscal year. These results came in very similar to what we saw for the first nine months of the year as a whole. Revenue rose, climbing from $2.20 billion to $2.28 billion. This sales figure actually matched what analysts were anticipating for the quarter. Net income came in at $226 million. This was down from the $333 million reported one year earlier, once again on higher costs. On a per-share basis, the company reported profits of $0.07, matching what analysts were anticipating for the quarter. Other profitability metrics also came in mixed. For instance, operating cash flow for the company dropped from $443 million to $412 million. Though if we adjust for changes in working capital, it would have actually risen from $484 million to $610 million. Meanwhile, EBITDA for the company barely budged, inching up from $719 million to $720 million.

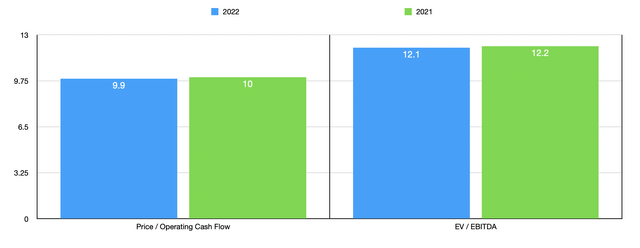

When it comes to the 2022 fiscal year as a whole, management expects revenue to come in at around $9 billion. This increase of roughly 3.5% should be driven by the number of self-paid net subscribers increasing year over year. They are also forecasting EBITDA of $2.8 billion. Applying that same number to the operating cash flow for the company, and we would get a reading of $2.44 billion for the year. Based on these figures, the company is trading at a forward price to adjusted operating cash flow multiple of 9.9 and at a forward EV to EBITDA multiple of 12.1. If, instead, we were to use the data from 2021, these multiples would be 10 and 12.2, respectively.

As part of my analysis, I also compared the company to some other similar businesses. But in truth, the word “similar” should be used lightly in this context. There are no great comparable firms to look at. So instead, I focused on entertainment and broadcasting companies more generally. On a price to operating cash flow basis, these companies ranged from a low of 1.1 to a high of 10.6. In this case, four of the five companies were cheaper than Sirius XM Holdings. Meanwhile, using the EV to EBITDA approach, the range was between 7 and 9.1, with our target being the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Sirius XM Holdings | 9.9 | 12.1 |

| Shaw Communications (SJR) | 8.5 | 8.1 |

| DISH Network (DISH) | 3.0 | 7.7 |

| Cable One (CABO) | 7.7 | 9.1 |

| Altice USA (ATUS) | 1.1 | 7.0 |

| WideOpenWest (WOW) | 10.6 | 8.8 |

Takeaway

Fundamentally speaking, Sirius XM Holdings strikes me as an appealing prospect that should continue to do well in the long run. Revenue continues to expand. Having said that, I do recognize that profits this year could be better. But it does look like that, for the year as a whole, the picture might end up slightly better than what it was in 2021. If that is the case, shares of the company do look cheap on an absolute basis even though they might be pricey compared to the closest comparables I can find.

Again, I would take the comparable analysis with a grain of salt given how different those firms are fundamentally from our key prospect. In addition to buying shares of Sirius XM Holdings outright, one other option investors have is to buy the stock indirectly by acquiring shares of Liberty Media (LSXMA, LSXMB, LSXMK), a diverse holding company that owns 82% of Sirius XM Holdings anyway, accounting for $19.4 billion of Liberty’s $26 billion market capitalization. Irrespective of how you buy shares of the business though, I do think that the stock is cheap enough and the operation is of a high enough quality to warrant a “buy” rating at this time.

Be the first to comment