anton5146

I’m in the process of writing a new book, REITs For Dummies, that should be published in late summer 2023. I’ve always wanted to become a “dummies” author and this book will be my fourth finance book to date.

I suppose my love for books can be traced back to the 1970s when my father would always give me a new set of World Book Encyclopedias.

Back then, there was no such thing as the internet, so World Book was the best way for me to explore real estate around the globe.

Of course, REITs were just getting started in the 70s (they were formed in 1960) so I didn’t know what a REIT was until I became a real estate developer decades later.

When I was in college, I read as many finance books as possible, and one of my professors encouraged me to subscribe to The Wall Street Journal (which I did). Side Note: My oldest daughter now works for the WSJ.

I’m now in the process of reading the Sixth Edition of Stocks for the Long Run by Jeremy J. Siegel and Jeremy Schwartz. I’m enjoying this book and I recently posted this on Twitter:

Source: @rbradthomas

I always highlight key sentences in every book I read, and I thought I would provide readers with a few takeaways that are also relevant to my article today –

“Data have shown that attempting to time the market is a fool’s errand, and the buy-and-hold approach is the best strategy.”

The co-authors are spot on here, as I always insist on the buy-and-hold approach. Market timing is a dangerous way to make money, and I continuously preach these same words of caution here on Seeking Alpha.

“The fundamental source of asset values derives from the expected cash flows that can be obtained from owning that asset. For stocks, these cash flows come from dividends or their cash distributions resulting from earnings or the sale of the firm’s assets.”

Once again, I agree 100% with the co-authors, although I’m amazed at how so many investors continue to chase the next shiny new toy. Why in the world would someone want to buy shares in AGNC Investment Corp. (AGNC) that’s now yielding 14.4%?

I can assure you the thrill of victory is not worth the agony of defeat!

“The historical evidence is overwhelming that the returns on stocks over long time periods have kept pace with inflation. Stocks are claims on the earnings of real assets, particularly physical capital, and, and intellectual property.”

The last quote is perfect for digressing into the primary topic for this article – 3 Bargain REITs for the Long Run.

While all three of these companies have been beaten down over inflation fears (and rising rates), I rate them as high conviction picks that are much better alternatives than any sucker yielding residential mREIT.

Realty Income (O)

When you think of companies that “treat you right” you tend to look at companies that are both high-quality and have been consistent over the years.

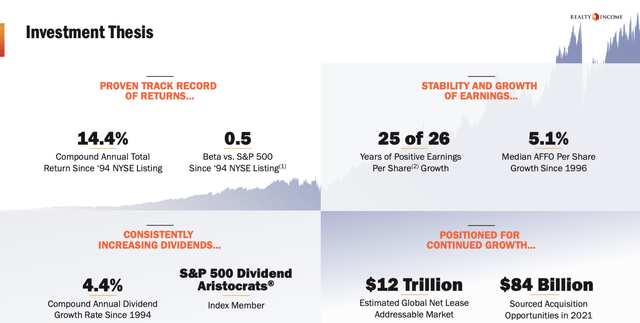

It is hard to argue with the consistency of Realty Income, which went public back in 1994. Since going public, Realty Income has a compound annual total return of 14.4%. In their 26 years of being public, the company has generated positive earnings EVERY year except for one.

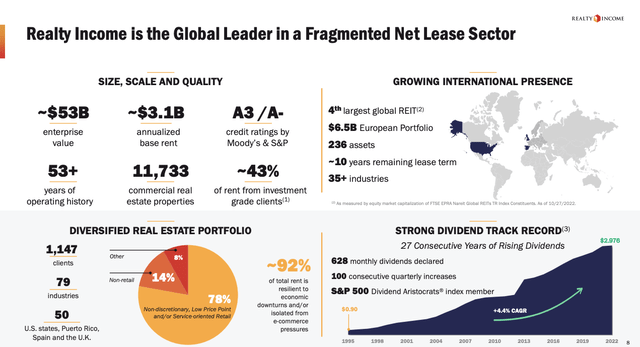

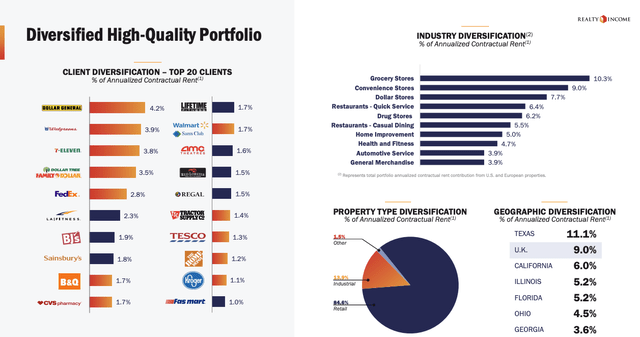

Today, Realty Income is within the top 5 in terms of largest REITs, with over 11,700 properties, nearly 1,150 customers within 79 industries. The company has a well-diversified portfolio of high-demand properties in all 50 states.

The company is one of the most, if not the most popular REIT among income-producing investors. Much of the popularity came from their monthly dividend, one in which they have now recently declared their 629th consecutive common stock monthly dividend.

The portfolio is very resilient to economic downturns as well as the threat of e-commerce, given their exposure to the retail sector. This is evident in their tenant quality.

Realty Income has a high-quality portfolio, but where they really separate themselves from the field is the strength of their balance sheet. O is one of only seven REITs to obtain an A credit rating.

The company’s fortress balance sheet has a net debt of 5.2x to annualized Pro-forma adj. EBITDAre along with a 5.5x fixed charge coverage ratio.

Their outstanding debt has a weighted average term to maturity of 6.3 years. The strong credit rating has allowed the company to maintain a low cost of capital, which is a huge advantage as the company continues to expand and grow.

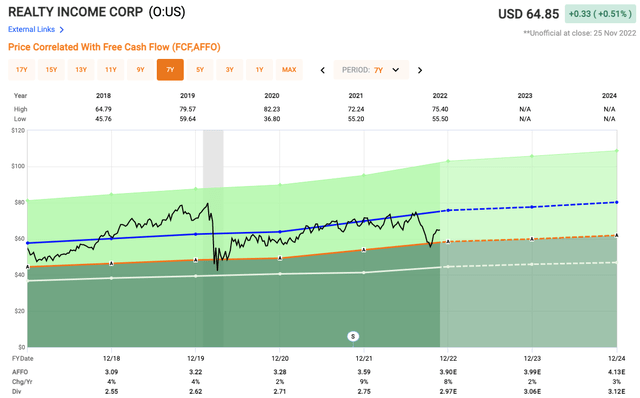

Looking at valuation, Realty Income is trading back at 2020 levels. The concerns around a pending recession and the rising interest rate environment has provided investors a great opportunity to add shares of this blue-chip REIT.

O shares currently trade at 16.2x next year’s AFFO expectations. However, over the past five years, shares of O have traded at an average AFFO multiple of 19.5x.

This allows you to buy a high-quality REIT on the cheap, while earning a 4.6% dividend yield that is paid out on a MONTHLY basis.

VICI Properties (VICI)

VICI is very different from Realty Income in many ways as they are the dominant player in the gaming and hospitality space, especially when it comes to Las Vegas, where VICI is now the largest landlord on the Las Vegas strip.

The interesting thing when it comes to VICI and their industry is the fact that it is a space Realty Income recently entered. In February 2022, Realty Income announced a $1.7 billion transaction with Wynn Resorts, which was the REITs first of the sort in terms of gaming real estate.

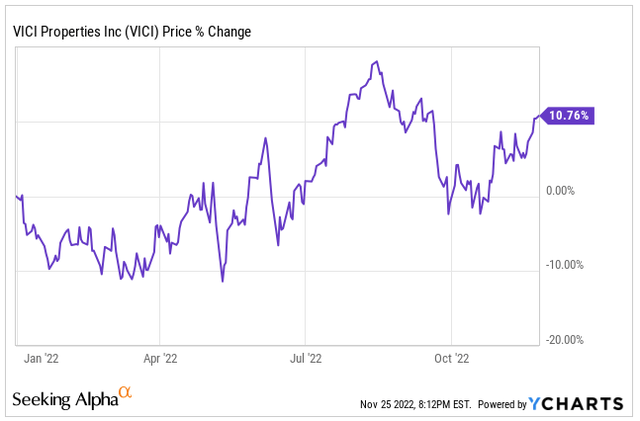

VICI shares broke out over the summer as shares were up over 15% on the year before falling into negative territory after fears of a nearing recession and continued monetary tightening from the Fed sent shares falling. However, shares have rebounded over the past month and are now up over 10% on the year.

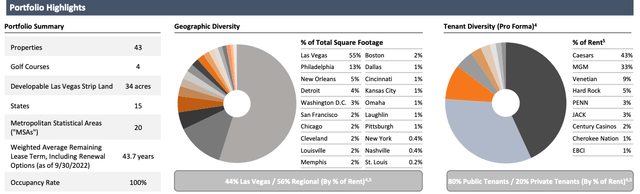

VICI owns 43 properties, with ~45% of the company’s annual base rent coming from Las Vegas alone. In totality, the company has properties within 15 states.

One reason to like VICI is the fact that the gaming and hospitality sector has a very high barrier to entry. It is not easy to build a casino, especially on the Las Vegas strip and it is also not easy to move a casino. The company enters into very long dated leases with a weighted average lease term of 43.7 years.

The company also works with high-quality tenants or operators, which is highlighted by the fact that VICI sports a 100% occupancy rate, something that remained unchanged through the global pandemic.

Some of the properties VICI owns on the Las Vegas strip include:

- Caesars Palace

- MGM Grand

- Venetian

- New York New York

- Mandalay Bay

- Luxor

- Excalibur

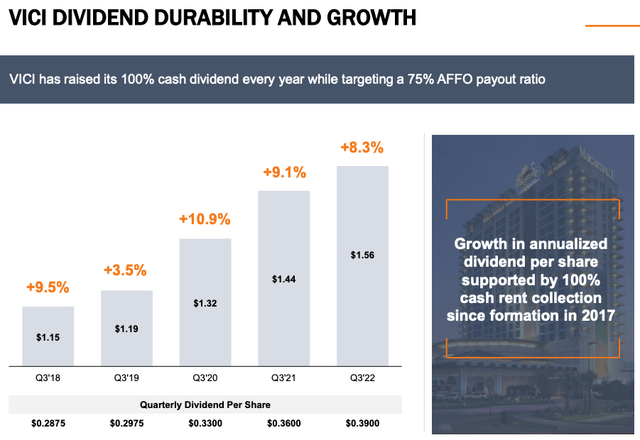

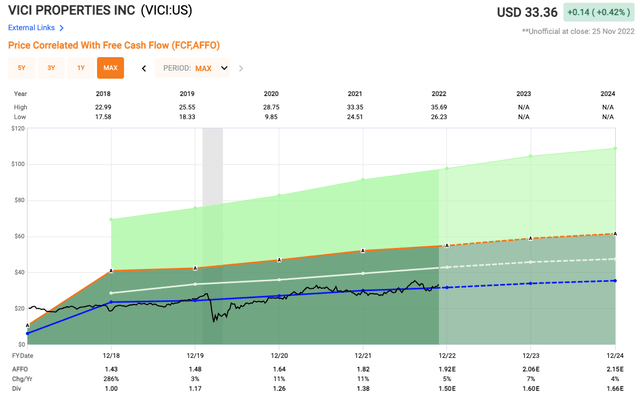

VICI has only been public for nearly five years, but during that short period of time they have been expanding the portfolio, generating higher operating income, which has led to growing dividends. Here is a look at how the dividends have grown every year.

In terms of valuation, as I mentioned VICI is new(er) to the public markets, so investors are still calculating what type of multiple to place on a company like VICI.

Analysts are looking for AFFO of $2.06 next year, which indicates growth of 7% and places the current valuation at 16.2x. Since going public, VICI shares have averaged an AFFO multiple of 16.5x, so shares are trading right in-line with that.

VICI has a strong portfolio, growing dividends, which currently has a dividend yield of 4.7% that is well covered with 100% cash collections, all making VICI a great investment.

Simon Property Group (SPG)

The final REIT we will discuss is one that has certainly treated investors very well over the long haul. Simon Property Group is the premiere mall landlord on the market today.

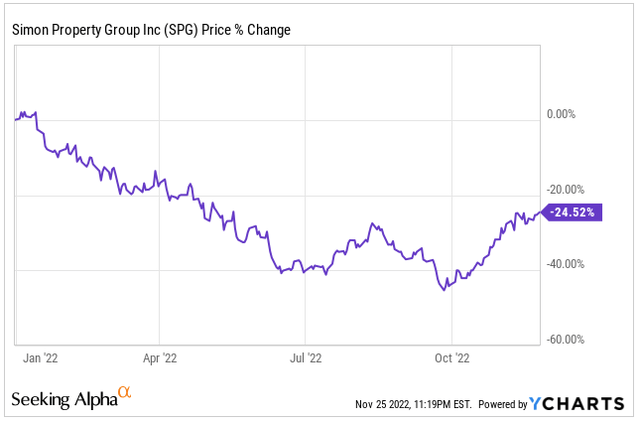

However, year-to-date shares of SPG have fallen nearly 25%.

There has been a big disconnect between the stock performance and the company performance of late. However, the stock market is forward looking, so investors are under the impression tougher times are ahead for the mall giant.

During the company’s most recent quarter, they beat on both the top and bottom lines. In addition, management increased the full year guidance while also increasing the dividend for the third consecutive quarter.

SPG shareholders have been on a roller coaster of a ride since the start of the pandemic that saw shares plunge, before bouncing back in a big way in 2021, before pulling back again this year.

The bear thesis around Simon Property Group has been the same for many years, which focuses on the threat of e-commerce. E-commerce is an area that continues to grow and will continue to grow, but that does not mean physical stores will die off.

One must remember that Simon Property Group owns the strongest performing malls around. The malls that have been forced to close down over the years have been C and D rated malls (which is determined based on sales per square foot). Simon Property group has a high-quality A rated mall portfolio, meaning tenants that lease space at their malls tend to perform well.

Simon Property Group was forced to cut their dividend at the start of the pandemic in order to preserve cash, but like I mentioned earlier, they have been eager to return it to its prior level of $8.40 per share.

The current forward dividend stands at $7.20 per share, which equates to a dividend yield of 6%. The dividend is well covered with a payout ratio of just 60%, meaning there is plenty of room to continue hiking.

Like Realty Income, SPG is one of the few REITs with an A- credit rating, backed by a fortress balance sheet and a very strong management team that has been through these economic hardships before.

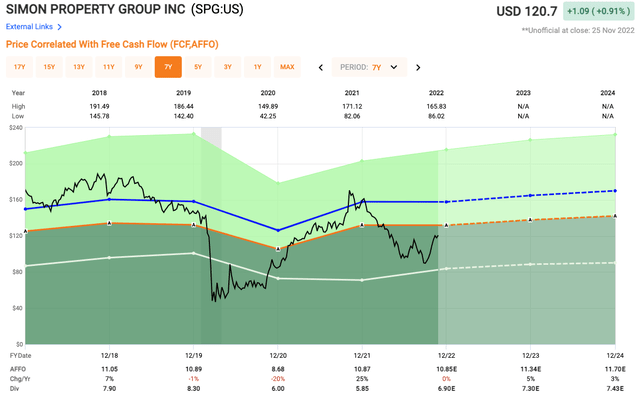

The mall REIT currently trades at a forward P/AFFO of just 10.6x. Analysts are looking for 5% AFFO growth in 2023. Over the past five years, the REIT has traded closer to an AFFO multiple of 14.5x, suggesting shares in this blue-chip REIT are very undervalued.

The headwinds are evident with the economy potentially entering into a recession in 2023, but SPG has been here before and investors who enter at these favorable valuations have been rewarded both from a growth standpoint as well as an income standpoint.

In Closing…

“My favorite holding period is forever”.

– Warren Buffett

As the author of “Stocks for the Long Run” explains,

“The main thesis of this book, that stocks represent the best way to accumulate wealth in the long run, remains as true today as it was when I published the first edition of Stocks for the Long Run in 1994.”

I own around 40 REITs and it’s likely that I will own all three REITs referenced in this article “for the long run”. I continue to accumulate shares in all three, adhering to certain sector rules (I follow) while also maintaining responsible risk management practices.

As always, thank you for reading and Happy Holidays!

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment