GaryMuth

Over the last couple years, I have been adding REITs to my Roth IRA, but it was primarily focused on net lease REITs. Since STORE Capital (STOR) announced their acquisition and I made my contribution for 2022, I have been looking to add new REIT sectors to the portfolio. Yesterday I wrote an update on STAG Industrial (STAG) and explained why I prefer some of the alternatives in the industrial REIT sector, specifically Terreno Realty (TRNO). Today will be my first article on National Storage Affiliates (NYSE:NSA). I have been looking for a storage REIT to add to my portfolio, and National Storage Affiliates looks like a prime candidate to be the first addition in the storage sector.

Investment Thesis

The storage REIT sector has been a consistent outperformer over the last couple decades. A large selloff in the whole sector has made it more attractive as valuations have come down. National Storage Affiliates is no exception and shares are down more than 40% YTD. I like the whole sector, and plan to add a couple storage REITs to my portfolio over time, but NSA looks like the best option right now due to its relatively cheap valuation and its large 5.6% yield.

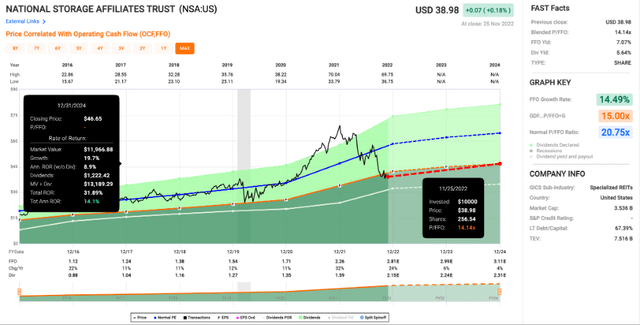

The price/FFO multiple of 14.1x is well below its average multiple of 20.8x, and it is cheaper than competitors like Public Storage (PSA) and Extra Space Storage (EXR). NSA frequently uses PROs (participating regional operators), which are set up to incentivize regional property managers and align their interests with NSA. They have had impressive growth since their IPO in 2015, and that is set to continue. Buying shares under $40 today sets up investors for double digit returns from potential multiple expansion, FFO/share growth, and a juicy dividend.

Business Overview

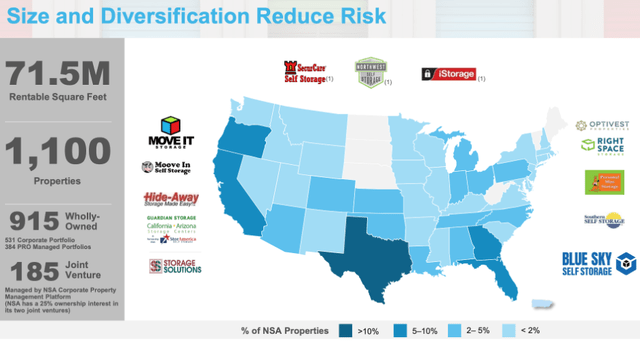

NSA owns a diversified portfolio of 1100 self-storage properties across the US. 915 of these are wholly owned. Of those properties, 384 fall under the participating regional operators. 185 fall under the joint venture umbrella, where NSA owns a 25% interest. As you can see below, NSA has significant exposure to Texas, California, Oregon, Georgia, and Florida (all over 5%).

NSA Portfolio Overview (nationalstorageaffiliates.com)

The PRO program gives NSA a significant avenue for external growth. The company has been busy in the first nine months of 2022, with 43 acquisitions for $529.3M. Two of these acquisitions were from the PROs for $14.6M. While I expect the acquisitions to continue at a solid clip, the 43 acquisitions in 2022 is a significant step down from 229 properties acquired in 2021. While growth may slow down a bit in coming years, the valuation is enough reason to be bullish on NSA.

Valuation

Just about every asset class has had a rough 2022, and the storage REIT subsector is no exception. NSA has had it the worst though, with a YTD decline over 40%. While NSA has average double-digit growth since 2015, FFO/share growth is projected to slow down to the mid-single digit range over the next couple years. Looking at the operating history of NSA, I think they could surprise on the upside when it comes to growth, but the valuation is attractive anyway.

Shares currently trade at a price/FFO of 14.1x, which is well below the 20.8x average multiple. I think it’s only a matter of time before we see multiple expansion, but even if we only see shares trading at a 15x multiple, it would be double digit returns due to the large dividend. If we head towards a 20x multiple, that will put shares above $60 in a couple years, providing very attractive returns for investors.

Dividends & Buybacks

While they haven’t hiked the dividend in a couple quarters, the yield now sits at 5.6% after the large share price decline. I think they have the capacity to continue with the dividend hikes as their payout ratio for the last twelve months is under 50%. The chart below shows the yield on shares of NSA.

The yield has bounced around that 4% line, and the only spike up above 5% turned out to be a great buying opportunity in the 2020 panic selloff. I think the current yield above 5% will also turn out to be a buying opportunity. For example, if we see shares reprice to a 4% dividend yield over the next couple years, that would be very attractive returns for investors. Even if the quarterly dividend stays at $0.55, it will put shares at $55. If we see dividend growth, a 4% yield means we start pushing towards $60.

The other thing that stood out to me while I was skimming the most recent 10-Q was the company’s recent approval of a share buyback program. In July, they approved a $400M buyback authorization, which is significant for a REIT with a market cap of $4.8B. As you probably know, most REITs use equity issuances to fund new property acquisitions. When a REIT has a large buyback program like this, it sticks out like a sore thumb. In Q3, they proved it wasn’t just for show either, as they repurchased 954k shares for approximately $50M.

Conclusion

This year I have added several new REITs to my Roth IRA, from NewLake Capital Partners (OTCQX:NLCP) to Terreno Realty (TRNO). The newest addition is going to be National Storage Affiliates, which I view as a very attractive buy under $40 a share. I like how the company uses its PROs to incentivize regional property managers, but it also provides an external growth pipeline for the REIT. The whole storage REIT subsector looks attractive to me, but I singled out NSA for a couple reasons. The first two (and most obvious) reasons are the cheap valuation at 14.1x price/FFO and the dividend yield of 5.6%. These are attractive not only compared to NSA’s historical averages, but to other competitors in the storage REIT sector.

The other reasons to be bullish on NSA is the potential for multiple expansion combined with dividend growth and share buybacks. I think the current multiple is far too cheap, especially if FFO/share growth surprises on upside and dividend growth continues. Throw in a decent buyback program, something that isn’t typical for REITs, and I think NSA is an investment with an attractive risk/reward profile.

Be the first to comment