Feng Li/Getty Images News

It has been a few months since the Chinese oil and gas giant China Petroleum & Chemical Corporation (OTCPK:SNPTY) voluntarily delisted from the NYSE. I warned about this risk in my initiating article on Sinopec, so it certainly was not a surprise.

I was recently asked by the Seeking Alpha editors to write a follow-up article on my recent thoughts regarding China and Sinopec.

(Author’s note, since delisting, the shares now trade on the pink sheets under the ticker “SNPTY”. Since I did not own shares, I am not sure whether investors who owned the NYSE ADRs got their shares converted to Hong Kong listed H-shares with the ticker “386”, or continued to own the pink sheet ADRs.)

While I have a contrarian view on Chinese equities – I believe investors are overly bearish on China’s prospects, I think investors who want to participate in this thesis should look at funds like the Templeton Dragon Fund (TDF) that purposely avoid controversial companies like Sinopec. Alternatively, investors can buy global energy producers such as the Energy Select Sector SPDR ETF (XLE) that can benefit from a re-opening sparked commodity rally, without the idiosyncratic risks of owning Sinopec.

Brief Company Overview

For those unfamiliar with Sinopec, it is one of the largest oil and gas companies in China. As of December 31, 2021, Sinopec had proved oil and gas reserves of 2.8 billion BOE, split between oil reserves of 1.4 billion barrels, and gas reserves of 8.4 trillion cubic feet. In 2021, Sinopec produced 273 million barrels of oil and 1.1 Tcf of natural gas. It is also one of China’s largest refiners of petroleum products, and owns over 30,000 Sinopec-branded service stations.

Dirt Cheap Valuations

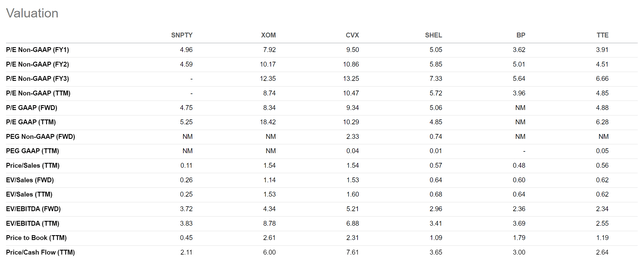

There’s no denying that Sinopec trades at dirt cheap valuations. Sinopec shares are currently trading at a Fwd P/E multiple of only 5.0x. However, in the context of its global peers such as BP p.l.c. (BP) and Shell plc (SHEL), the low valuation is not out of line (Figure 1).

Figure 1 – Sinopec peer valuations (Seeking Alpha)

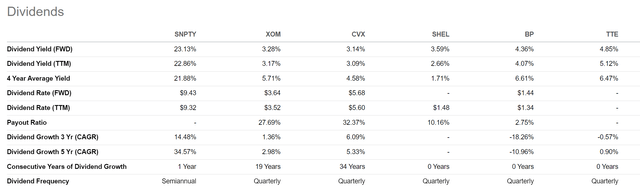

I believe what really attract investors to the Sinopec story (judging from the comments I got in my prior articles), is its dividend yield. Seeking Alpha lists Sinopec’s trailing dividend yield at 22.9%, among the highest in the world and far above the 3-4% dividend yield of its peers (Figure 2).

Figure 2 – Sinopec peer dividends (Seeking Alpha)

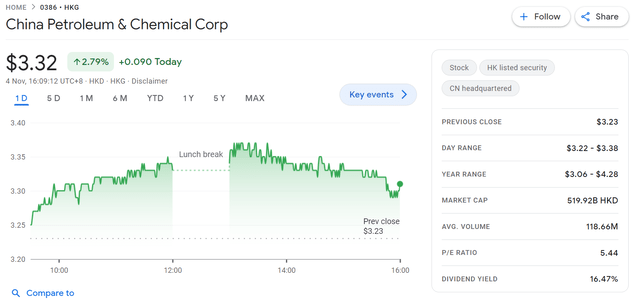

However, I’m not sure the dividend yield figure is accurate. According to Google Finance, Sinopec’s H-shares currently have a dividend yield of 16.5% (Figure 3). According to the company’s website, each Sinopec share was paid RMB 0.47 in dividends in 2022, which works out to the 16.5% dividend yield on the H-shares.

Recall each ADR is equivalent to 100 H-shares. Since the ADR is trading at ~$42, which is equivalent to the H-shares’ HKD$3.32 share price, I don’t see why the dividend yield on the ADRs should be 23% instead of 16.5%.

Figure 3 – Sinopec H-shares price and dividend yield (Google Finance)

Furthermore, investors considering Sinopec because of its dividend yield should think about withholding taxes on foreign investments and consult a tax expert.

China Re-thinking Zero COVID Policies

In a recent article on the Templeton Dragon Fund (TDF), I laid out a contrarian bullish view on Chinese equities. Basically, the negative drivers against owning Chinese equities are well known: a deep housing crisis, draconian zero-COVID policies, and U.S. sanctions and embargoes. Sentiment is so bad regarding Chinese equities that the slightest improvement in any of these factors could cause a massive squeeze as investors rush to cover their shorts and add exposure.

So far, my thesis is playing out regarding the zero-COVID policies, as China is lifting penalties for airlines carrying COVID positive passengers. Local governments are also ending free COVID tests. In addition, German chancellor Olaf Scholz says China has agreed to approve the BioNTech (BNTX) COVID vaccine for foreign residents, and is looking to approve it for the broader populace. These are all positive developments that were inevitable, in my opinion. China cannot remain a closed economy indefinitely.

Can the same theme be applied to Sinopec shares?

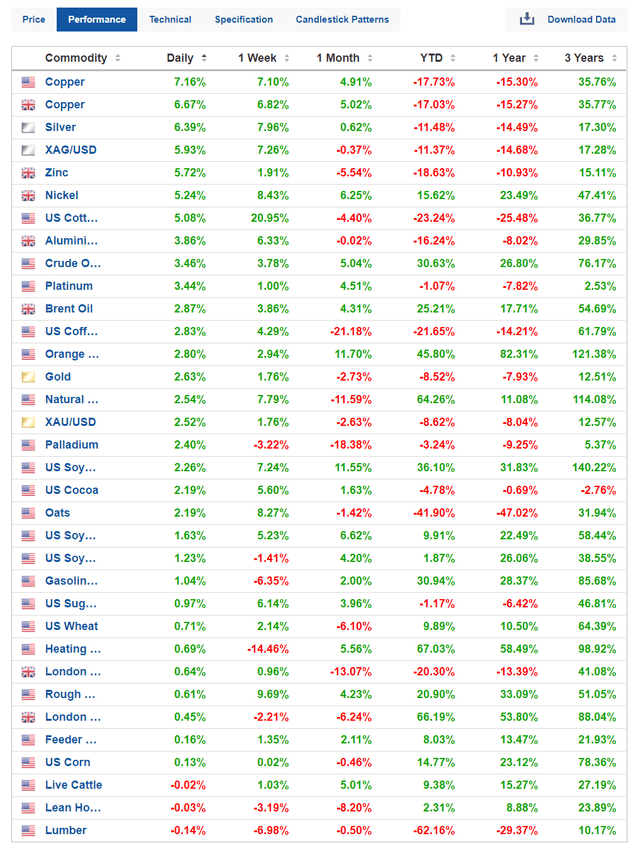

China is the largest oil consumer in the world, consuming 15.4 million boe/d in 2021. However, the IEA recently forecasted the first YoY decline in Chinese oil demand since the 1990s due to the draconian zero-COVID restrictions. If China is loosening these restrictions, then we could see a large response in the commodity sectors, with energy leading the charge.

Indeed, this is exactly what we are seeing, with most commodities staging large rallies in the last few days based on Chinese re-opening hopes (Figure 4). Sinopec, as one of the largest energy producers in China, should stand to benefit.

Figure 4 – Commodities are staging large rallies on Chinese re-opening hopes (investing.com)

However, I think Sinopec is still a company investors should avoid. I have laid out my operational concerns in my initiation article on Sinopec. Essentially, Sinopec’s margins are much lower than its global peers. I suspect this is because Sinopec is used by the Chinese government to promote price stability, as well as act as an employment agency to keep unemployment figures low.

More importantly, geopolitical risks are ratcheting higher with the U.S. recently banning the export of high-tech semiconductor chips and equipment to China. It is not hard to imagine future sanctions being placed on strategic companies like Sinopec, much like how the U.S. essentially crippled Huawei’s global expansion plans with chip sanctions a few years ago.

Sinopec Continues To Underperform; Investors Are Better Off Buying Global Energy Companies

Since my initial article in late July, SNPTY has delivered negative price returns of ~9% (SNPTY was over $46 / share when I wrote the article compared to the current $42 / share on the ADR) plus a dividend payment of $4.7158 according to Seeking Alpha. The $4.7158 dividend payment looks odd. According to the company’s website, Sinopec paid a RMB 0.16/share dividend in September, which works out to $2.23 /ADR at current exchange rates.

Regardless of what the dividend payment was, the XLE ETF has vastly outperformed Sinopec with total returns of over 28% in the same time frame (Figure 5).

Figure 5 – XLE has outperformed Sinopec massively since late July (Seeking Alpha)

If China’s reopening does spur a rally in commodities, investors are much better off investing in energy companies outside of China, which can participate in the commodity rally without the idiosyncratic risks of owning Sinopec.

Conclusion

In conclusion, while I have a contrarian bullish view on Chinese equities as I believe investors are overly bearish on China’s prospects, I think investors who want to participate should look at funds like the Templeton Dragon Fund (TDF) that purposely avoid controversial companies that may be deemed to be Communist Chinese Military Companies. Alternatively, investors can buy global energy producers such as those found in the XLE ETF that can benefit from a commodity rally, without the idiosyncratic risks of owning Sinopec.

Be the first to comment