Joe Raedle

Loan growth will likely support the earnings of Popular, Inc. (NASDAQ: NASDAQ:BPOP) through the end of 2023. On the other hand, a dip in non-interest income will likely restrict earnings growth. Overall, I’m expecting Popular, Inc. to report adjusted earnings of $10.48 per share for 2022, down 8.6% year-over-year. For 2023, I’m expecting the company to report earnings of $10.87 per share, up 3.7% year-over-year. Compared to my last report on the company, I’ve barely changed my earnings estimates. Next year’s target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Popular, Inc.

Reducing The Non-Interest Income Estimate

Popular, Inc. sold its ownership stake in Evertec during the third quarter, which resulted in a gain on sale of $226.6 million, according to details given in the latest earnings release. Due to this sale, income from Evertec will get eliminated in the future, thereby reducing non-interest income. Moreover, Popular has eliminated account overdraft fees, which will reduce non-interest income going forward. The company had also waived some other banking fees up till October 31, 2022, due to Hurricane Fiona, as mentioned in the earnings release.

The management has reduced its non-interest income estimated run rate to $150 million from the previous estimate of $155 to $160 million, as mentioned in the conference call. Considering the factors given above and management’s guidance, I’m expecting the company to report a non-interest income of $605 million for 2023. In my last report on Popular, I estimated a non-interest income of $647 million for next year. I’ve reduced my estimate because of the Evertec sale and fee elimination.

Topline Growth To Compensate For A Dip In Other Income

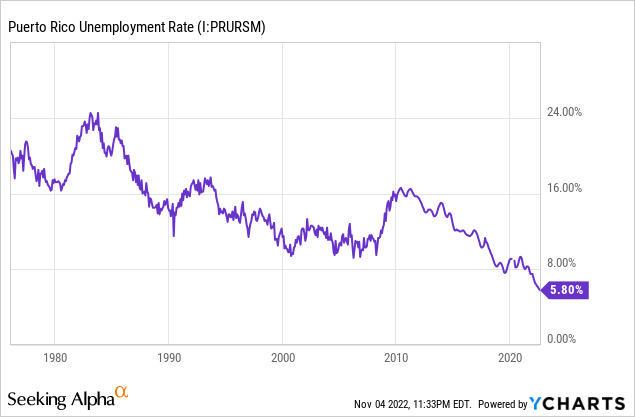

Popular’s loan growth continued to accelerate in the third quarter of 2022. The portfolio has grown by 8.0% already in the first nine months (10.6% annualized), which is higher than in previous years. Going forward, the rapid improvement of Puerto Rico’s economy will likely keep loan growth above the average for previous years. The region’s unemployment rate is near all-time lows, as shown below.

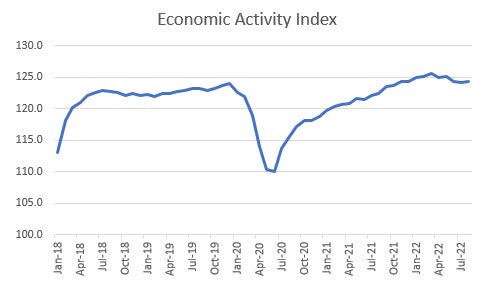

Further, the economic activity index is showing a healthy trend.

Development Bank for Puerto Rico

Considering these factors, I’m expecting the portfolio to grow by 2% in the fourth quarter of 2022, leading to full-year loan growth of 10%. For 2023, I’m expecting the loan portfolio to grow by 8%. This growth will likely be the chief driver of earnings next year.

Meanwhile, the up-rate cycle will also offer some support to the top line next year. At the end of June 2022, the results of the management’s interest rate simulation model showed that the margin was barely rate-sensitive. A 200-basis points hike in interest rates could boost the net interest income by just 0.69% over twelve months, according to the results of the model given in the last 10-Q filing.

However, the management expects the cost of public deposits to be 150 basis points higher in the fourth quarter of 2022, as mentioned in the conference call. (Note: public deposits were 26% of total deposits as of June 30, 2022). As a result, the management expects the margin to decrease in the fourth quarter before resuming the uptrend in 2023.

Considering these factors, I’m expecting the margin to decline by 5 basis points in the fourth quarter of 2022 before rising by 4 basis points in 2023.

Provisioning Likely To Remain Below Normal

This year’s hurricane season did not do much damage in Puerto Rico. Hurricane Fiona mostly disrupted the power and water supply which was restored within a month (source). Popular, Inc. is offering a moratorium on loan payments for the affected for a period of three months up till December 31, 2022, as mentioned in the earnings release. Therefore, the hurricane won’t have any material impact on provisioning for expected loan losses.

The credit quality of Popular’s loan book has improved tremendously over the past year, mostly because of the overall improvement of the Puerto Rican economy. Non-performing loans dipped to 1.4% of total loans by the end of September 2022 from 2.2% at the end of September 2021, as mentioned in the earnings presentation. In comparison, allowances were 2.2% of total loans at the end of September 2022, which means the allowance coverage is comfortable.

Overall, I’m expecting Popular, Inc. to report a net provision expense of 0.47% of total loans (annualized) in the last quarter of 2022 and the full year of 2023. These estimates are below the last five-year average of 0.64%.

Earnings Likely To Trend Upwards

Anticipated loan growth will likely drive earnings in the last quarter of 2022 and the full year of 2023. Further, a slight margin expansion will help earnings next year. On the other hand, the fall in non-interest income will restrict earnings growth.

Overall, adjusting for the Evertec transaction, I’m expecting Popular, Inc. to report earnings of $10.48 per share, down 8.6% year-over-year. On a GAAP basis, I’m expecting earnings of $13.79 per share for 2022. For 2023, I’m expecting the company to report earnings of $10.87 per share, up 3.7% from the adjusted earnings of this year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 1,735 | 1,892 | 1,857 | 1,958 | 2,172 | 2,216 | ||||

| Provision for loan losses | 228 | 166 | 293 | (193) | 73 | 160 | ||||

| Non-interest income | 652 | 570 | 512 | 642 | 888 | 605 | ||||

| Non-interest expense | 1,422 | 1,477 | 1,458 | 1,549 | 1,737 | 1,677 | ||||

| Net income – Common Sh. | 614 | 667 | 505 | 933 | 1,021 | 805 | ||||

| EPS – Diluted ($) | 6.06 | 6.88 | 5.87 | 11.46 | 13.79 | 10.87 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Popular, Inc., I estimated earnings of $10.80 per share for 2023. My updated estimate is barely changed as the reduction in non-interest income counters the favorable tweaking of other line items.

Please note that my estimates are based on various macroeconomic assumptions that may or may not get actualized. As a result of the risks and uncertainties associated with the economic outlook, actual results may differ materially from estimates.

Equity Book Value Erosion To Slow Down

Popular’s book value per share has plunged in the first nine months of 2022 mostly because of the rising rate environment. As interest rates have risen, the market value of the available-for-sale securities has fallen, leading to unrealized mark-to-market losses. These losses bypassed the income statement and flowed into the equity accounts through other comprehensive income. Popular’s book value per share declined to $49 by the end of September 2022 from $75 at the end of December 2021. This fall hurts Popular’s stock market valuation as many investors use the price-to-book value multiple to determine the fair price of banking stocks.

However, Popular has recently transferred $6.5 billion worth of securities (22% of total securities) from the available-for-sale portfolio to the held-to-maturity portfolio, as mentioned in the earnings release. This action will reduce the impact of rising interest rates on other comprehensive income and the equity book value account. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Financial Position | ||||||||||

| Net Loans | 25,939 | 26,929 | 28,489 | 28,549 | 31,436 | 34,028 | ||||

| Growth of Net Loans | 7.2% | 3.8% | 5.8% | 0.2% | 10.1% | 8.2% | ||||

| Other Earning Assets | 17,818 | 21,268 | 33,594 | 42,796 | 34,668 | 35,720 | ||||

| Deposits | 39,710 | 43,759 | 56,866 | 67,005 | 65,305 | 67,957 | ||||

| Borrowings and Sub-Debt | 1,538 | 1,295 | 1,346 | 1,155 | 1,314 | 1,327 | ||||

| Common equity | 5,385 | 5,967 | 6,007 | 5,947 | 2,989 | 3,131 | ||||

| Book Value Per Share ($) | 53.1 | 61.5 | 71.6 | 74.7 | 40.4 | 42.3 | ||||

| Tangible BVPS ($) | 46.2 | 54.3 | 63.3 | 65.6 | 29.0 | 30.9 | ||||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

High Price Upside Calls For A Buy Rating

Popular, Inc. is offering a dividend yield of 3.3% at the current quarterly dividend rate of $0.55 per share. The earnings and dividend estimates suggest a payout ratio of 20% for 2022, which is in line with the four-year average of 19%. Therefore, I’m not expecting an increase in the dividend level next year.

I’m using the peer-average price-to-book (“P/B”) and price-to-earnings (“P/E”) multiples to value Popular. Peers are currently trading at an average P/B ratio of 1.41x, and an average P/E ratio of 10.3x, as shown below.

| Peer Selection Criteria | Market Cap ($ billion) | P/E (“TTM”) | P/B (“TTM”) | |

| BPOP | 4.93 | 4.87 | 1.32 | |

| FNB | Market Cap | 4.97 | 12.58 | 0.94 |

| OZK | Market Cap | 5.04 | 9.85 | 1.21 |

| HOMB | Market Cap | 5.05 | 17.28 | 1.45 |

| HWC | Market Cap | 4.64 | 9.29 | 1.47 |

| OFG | Located in PR | 1.31 | 8.71 | 1.30 |

| FBP | Located in PR | 2.81 | 9.62 | 2.17 |

| Average | 4.11 | 10.31 | 1.41 | |

| Source: Seeking Alpha | ||||

| Note: Data extracted after market close on November 4, 2022 |

Multiplying the average P/T multiple with the forecast book value per share of $30.9 gives a target price of $43.6 for the end of 2023. This price target implies a 35% downside from the November 4 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/B Multiple | 1.21x | 1.31x | 1.41x | 1.51x | 1.61x |

| BVPS – Dec 2023 ($) | 30.9 | 30.9 | 30.9 | 30.9 | 30.9 |

| Target Price ($) | 37.4 | 40.5 | 43.6 | 46.6 | 49.7 |

| Market Price ($) | 67.0 | 67.0 | 67.0 | 67.0 | 67.0 |

| Upside/(Downside) | (44.2)% | (39.6)% | (35.0)% | (30.4)% | (25.7)% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $10.87 gives a target price of $112.1 for the end of 2023. This price target implies a 67.5% upside from the November 4 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.3x | 9.3x | 10.3x | 11.3x | 12.3x |

| EPS 2023 ($) | 10.87 | 10.87 | 10.87 | 10.87 | 10.87 |

| Target Price ($) | 90.4 | 101.3 | 112.1 | 123.0 | 133.9 |

| Market Price ($) | 67.0 | 67.0 | 67.0 | 67.0 | 67.0 |

| Upside/(Downside) | 35.0% | 51.2% | 67.5% | 83.7% | 99.9% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $77.8, which implies a 16.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 19.5%. Hence, I’m maintaining a buy rating on Popular, Inc.

Be the first to comment