The market is in severe turmoil due to the coronavirus. Simon Property Group (SPG) has not been spared. The coronavirus is anticipated to have a meaningful impact on the economy and people are advised to avoid large gatherings and crowded places like malls, theaters, stadiums, etc. At the time of writing, the DOW is pacing for its worst weekly point loss ever, the Russell 2000 is down more than 20% this week, the S&P circuit breaker kicked in the for the second time this week. The drama is set to continue. SPG is now trading below $90, down ~40% YTD.

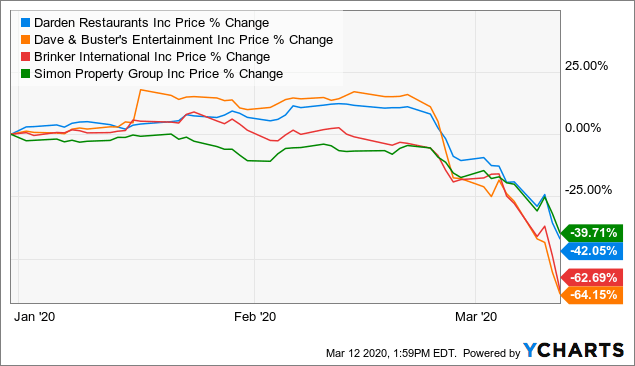

The US is starting to come to grips with the new reality. The NBA, MLS and ATP all have been suspended, entertainment venues like cinemas, theme parks, etc are expected to suffer, restaurants are considering social distancing, etc. Just look at the collapsing share prices of restaurant companies like Dave & Busters (PLAY), The Cheesecake Factory (CAKE) and Brinker International (EAT), which also have presence in malls (and their outparcels).

Data by YCharts

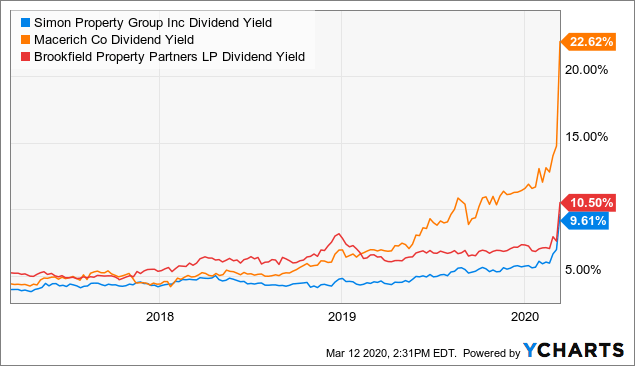

Data by YCharts

To be fair, most stocks are heavily correlated at the moment. Simply put, pretty much everything is falling right now. We are still waiting for a US stimulus plan and comprehensive domestic response, while the Fed has made some moves like cutting interest rates and adjusting bond buying to support the treasury market. However, as many point out, an interest rate cut or market intervention will not really help what’s happening at casinos, cinemas, hotels, restaurants, theaters, conference centers, etc. What we need is a drastic medical response, as this is a health problem. Until we get it (or at least get some sort of indication) the market will be in severe panic mode. As time passes by and the number of coronavirus cases keep on increasing, venues like restaurants, malls and theaters will suffer more and more.

SPG’s success is ultimately a function of the success of its tenants, who need to be in a healthy situation to pay rent. I am not sure how retailer business interruption insurance enters the equation, but the more this situation drags on, the higher the pain. How will the market react if a city in the US goes into lockdown (like in Italy) or if stores, restaurants, bars, theaters, etc are forced to close for weeks as part of local or nationwide containment efforts?

Coronavirus aside, SPG is the best in the mall space, by any measure. In fact, SPG is firing on all cylinders, as outlined in my previous article in September 2019. To summarize:

- debt is the lowest in the space and will remain low even following the Taubman (TCO) acquisition

- sales PSF are consistently on the rise, with roughly 1/3 of properties producing sales PSF in ~$900 zone (international properties are doing even better than the US, in the +$1,000 zone)

- occupancy has consistently remained high (95% zone) despite anchor replacements, retail bankruptcies and the so-called retail apocalypse

- comparable property NOI continued its upward trend

- consistent dividend growth, with a high dividend coverage ratio

When I wrote my previous article, SPG was trading just above $150 and the dividend yield was ~5.5%. Following the recent sell off, the dividend yield is just under 10%. Who would have thought that SPG will be trading at a 10% dividend yield? Other A-mall names like Macerich (MAC) and Brookfield Property (BPY) are currently trading at dividend yields of 22.5% and 10.5%, respectively (note BPY is more diversified as it has exposure to other real estate segments). However, the difference is that SPG’s dividend safety is no way near of being at risk. The same cannot be said for MAC and BPR. Even if SPG decides to cut the dividend, as a response to preserve liquidity due to the coronavirus, I am confident that it will be restored shortly thereafter. The same cannot be said for its peers.

The chart above shows how distressed the situation is, with the sudden jump in yields. Things are very fragile right now. That said, I am buying more of SPG at prices below $90, to bring down my average price. However, it is important to remain disciplined and not over do it. It is prudent to buy in phases, as it is very likely that we will get much lower prices. The way things are heading, it is possible that we will see SPG trade at a dividend yield above 15%, which implies a share price of below $56. In this market, anything is possible. Again, it is important to remain disciplined and buy in phases. I feel confident that locking in SPG’s higher dividend yield today will be a sustainable move, resulting in attractive and growing income for many years to come. Simply put, SPG is not the typical ‘high-yield’ name. This is a market anomaly that will eventually fade away.

Disclosure: I am/we are long SPG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am also long MAC and BPY

Be the first to comment