Olemedia

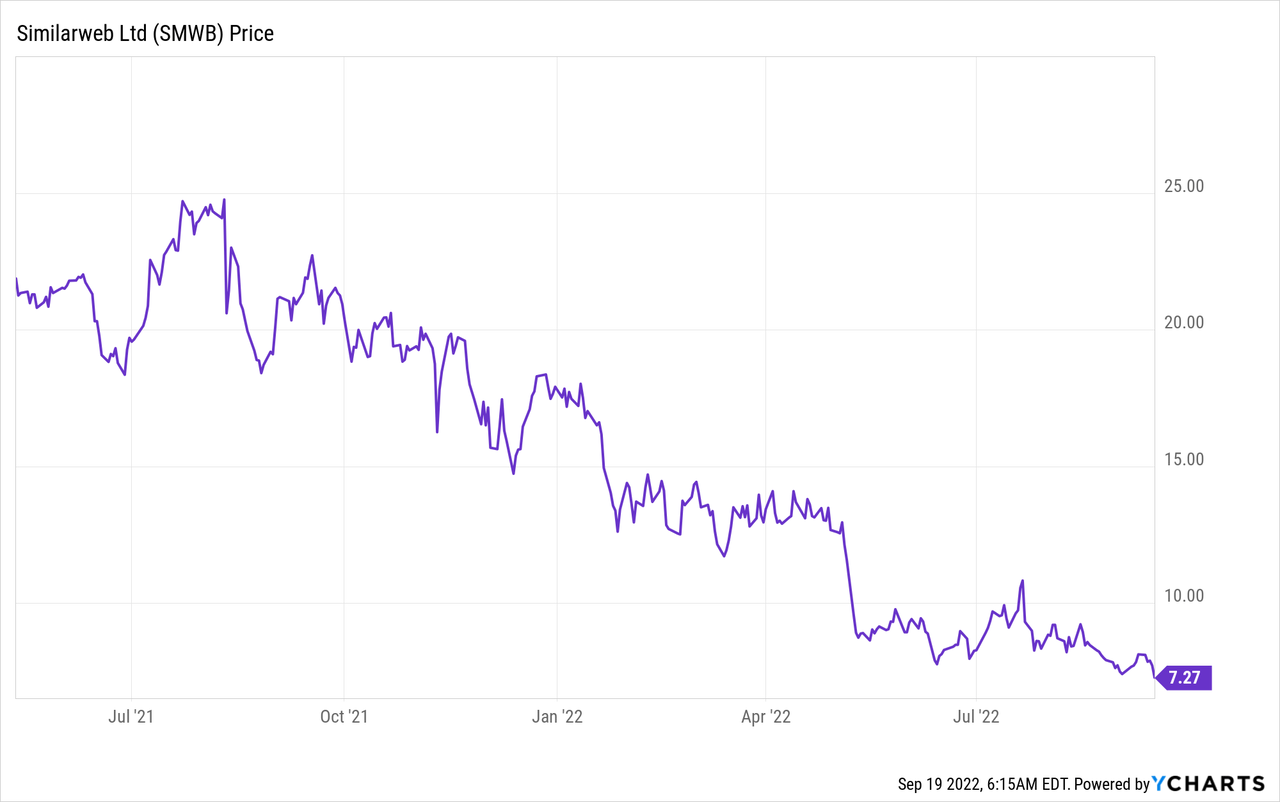

Similarweb (NYSE:SMWB) is a leading provider of competitor and market intelligence from websites and online platforms. The global big data market is forecasted to exhibit a 14% compounded annual growth rate and be worth $116 billion by 2027, Similarweb is poised to ride this trend. The company went public in May 2021 and since then the stock price has been butchered by ~66%. The good news is this has mainly been driven by the high inflation and rising interest rate environment which has compressed the valuation multiples of most “growth stocks”. In addition, Similarweb has recently produced strong earnings for the second quarter of 2022, beating both revenue and earnings estimates for growth. Thus in this post, I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Business Model

Similarweb is a leading market intelligence provider, according to G2 reviews. The company’s software product enables businesses to see detailed information about their competitors. This includes website traffic estimates, keyword traffic ranking, referral websites, and much more. This is extremely powerful as it enables insights to be gained into competitor activities, and strategy to be adapted.

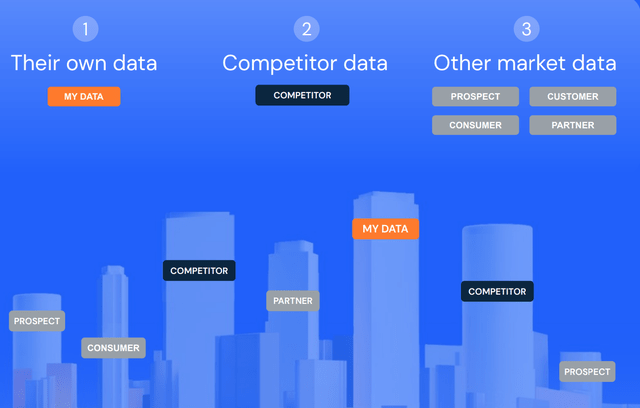

Most companies tend to invest heavily into understanding their own data, which is of course first priority. However, by also understanding competitors, managers can gain a wider view of the landscape.

Similarweb Data (Investor presentation)

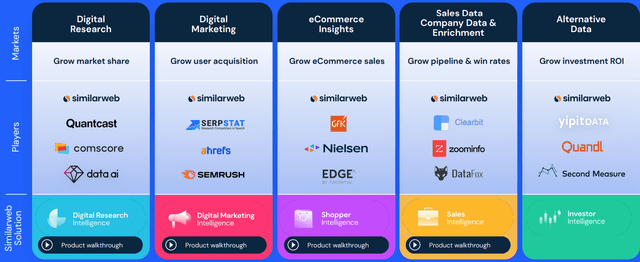

Similarweb has expanded its platform to offer 5 main solutions these include: Digital Research Intelligence, Digital Marketing Intelligence, Sales Intelligence, Investor Intelligence, and Shopper Intelligence. For example, I have used its investor alternative data tool, to identify an e-commerce company’s website traffic before an earnings call. Thus this helps me to make a rough estimate of sales, up or down trend and expected earnings figures. This isn’t a “silver bullet” solution but does give a useful indication of traffic.

Solutions (Investor presentation)

Similarweb has over 3,800 customers across a plethora of industries from travel to retail. The big name brands include: Walmart, Booking.com, Google, Adidas, Adobe, CNN and more.

Similarweb Customer Verticals (Investor presentation)

Similarweb has also recently scored a partnership with data AI, formerly known as App Annie in order to enhance its App intelligence solution.

Growing Financials

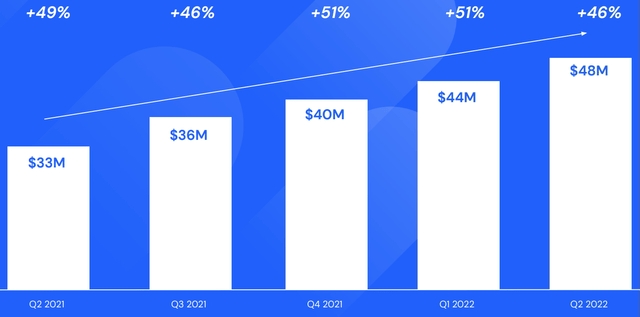

Similarweb generated total revenue of $47.6 million, which beat analyst estimates by $1.57 million and popped by a rapid 46% year over year.

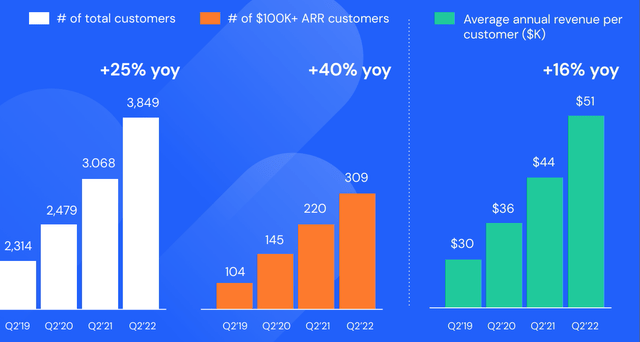

This revenue growth was driven by a solid 25% growth in customers year over year to 3,849. In addition, the average annual revenue per customer increased to $50,700, up 16% year over year.

Customer Growth (Investor Presentation Q2 ’22)

Similarweb has also been growing its “high ticket” customer, with Annual Recurring Revenue of $100,000 or more to 309, this increased by 40% year over year.

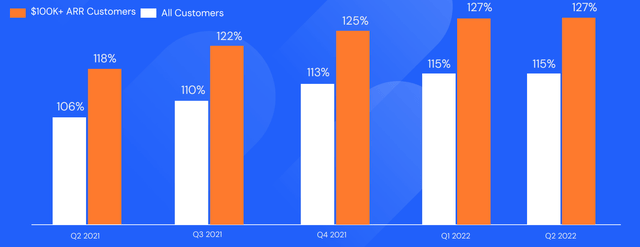

Dollar-based net retention rate, increased to 115%, vs 106% in the equivalent quarter of 2021. This is a great sign as it means customers are staying with the platform and spending more. Its larger “high ticket” customers also showed a greater ARR of 127%, which means “growing upmarket” looks to be a great strategy moving forward.

Similarweb (Investor Presentation 2022)

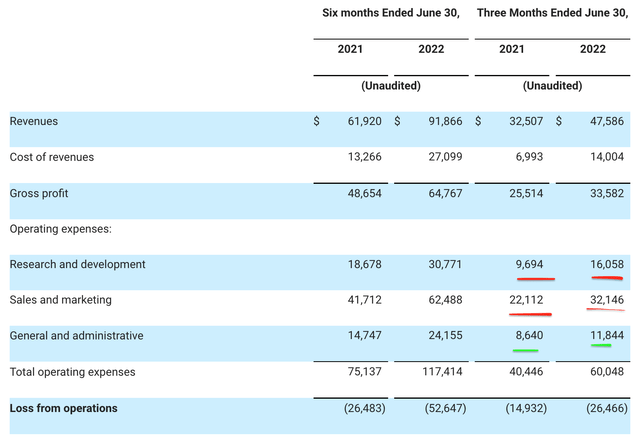

Similarweb is still operating at a loss and generated earnings per share [EPS] of negative $0.29, but this still beat analyst estimates by $0.06. To a traditional investor, any loss may seem bad but when I dive under the hood it is clear that the great expenses are part of the growth strategy. For example, the company increased its Sales and Marketing investment by ~45% year over year to $32 million, as they invest aggressively for growth. Now of course over time, we want to see Sales and Marketing spend making up a lower portion of revenue over time which would demonstrate efficient growth. I personally believe this is very achievable for Similarweb given their low capex SaaS model. In addition, the company has outlined a 15-month payback period for its cost of customer acquisition. As a sales/marketing data company, I have faith in their estimates for long-term profitable growth.

Income Statement (Q2 earnings report)

Similarweb also increased its Research and Development investment by 65% year over year to $16 million. Again, I don’t believe this is a negative as continuous improvement of its product is essential. In addition, the businesses which invest lots into R&D tend to produce greater shareholder value long term, think Amazon (AMZN), Google (GOOG), Meta (META). For its General and Administrative expenses, I would like to see these reducing over time as a proportion of revenue.

The company has a solid balance sheet with cash and cash equivalents of $93.9 million, with just $48.8 million in total debt.

Moving forward, management is guiding for total revenue of $196 million to $197 million for the full year of 2022, which equates to ~43% growth year-over-year at the midpoint of guidance.

Advanced Valuation

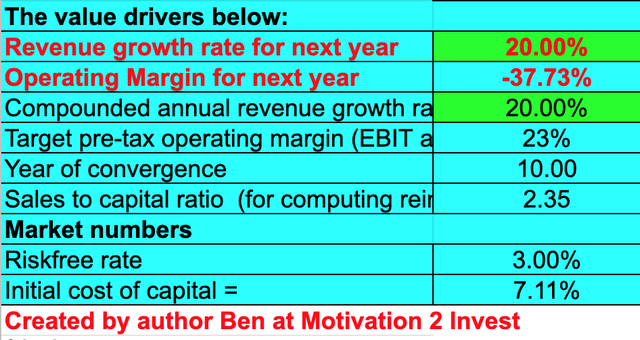

In order to value Similarweb, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation.

I have forecasted a conservative 20% revenue growth per year over the next 5 years. As the business continues to expand to different industry verticals with its new products.

Similarweb (created by author Ben at Motivation 2 Invest)

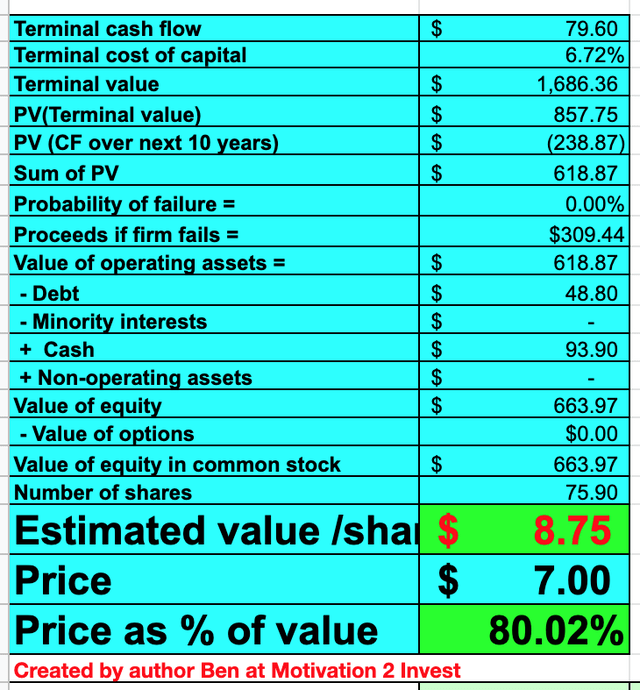

I have also forecasted the business operating margin to increase to 23% over the next 10 years, which is the average of the software industry. I expect this to be driven by the business’s low capex software model and the continued trend of growing upmarket.

Similarweb (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $8.75 per, the price at the time of writing is ~$7 per share and thus the stock is 20% undervalued on a conservative basis.

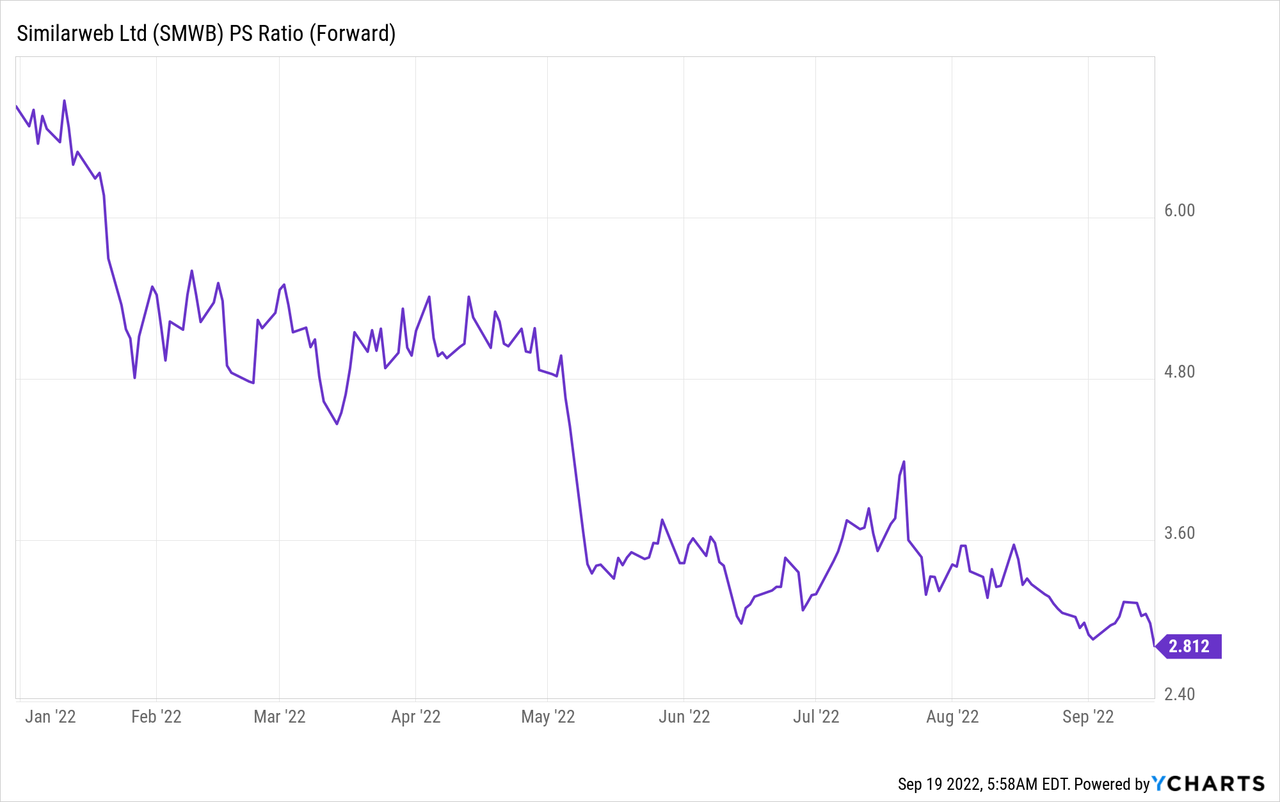

As an extra datapoint, Similarweb trades at a Price to Sales Ratio = 2.81 which is cheaper than its historic average over PS over 5.

Risks

Competition

Similarweb is a leader in competitor and market intelligence but they are not the only game in town. The company competes on the keyword/SEO side with tools such as SEM Rush, Ahrefs, Moz, and more. While on the website traffic checking side, there are many free or low-cost competitors online, such as sitechecker.com, Ubersuggest, and more. Now although I believe Similarweb has the greatest user interface and the most extensive and reliable data, the company doesn’t have a strong moat around its business. The good news is they do have strong traction with enterprises and are continually advancing its platform capabilities, through strong R&D investments.

Recession/IT spending Slowdown

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. Therefore it is likely that many companies will reject or delay spending on new tech platforms, especially if not necessary. With Similarweb in particular I find myself using the platform occasionally but it is not a platform I use daily and would consider essential.

Final Thoughts

Similarweb is a leading provider of data on competitors and the market. The platform offers key insights and the most advanced software on the market. The stock is undervalued intrinsically and relative to historic multiples and thus looks to be a great buy for the long term.

Be the first to comment