270770

Introduction

In April, I wrote an article on SA about China-focused silver miner Silvercorp Metals (NYSE:SVM) in which I said that it was my top pick for the current high-inflation environment.

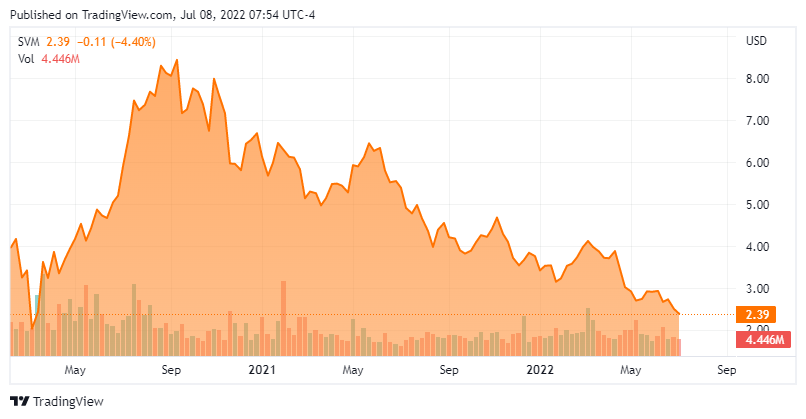

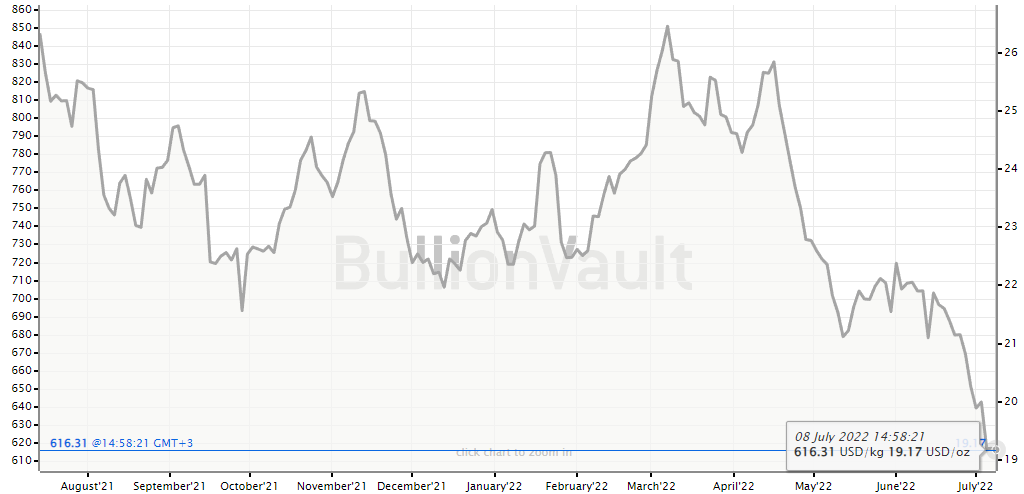

Less than three months later, the company’s share price is down by 35% as silver prices have slumped from $24.60 per ounce to $19.20 per ounce due to the strong U.S. dollar.

In my view, this is a very good time to open a position in Silvercorp as FY22 results were strong and the sum of the company’s cash and market equity investments is getting close to its market valuation. Let’s review.

Overview of the recent developments

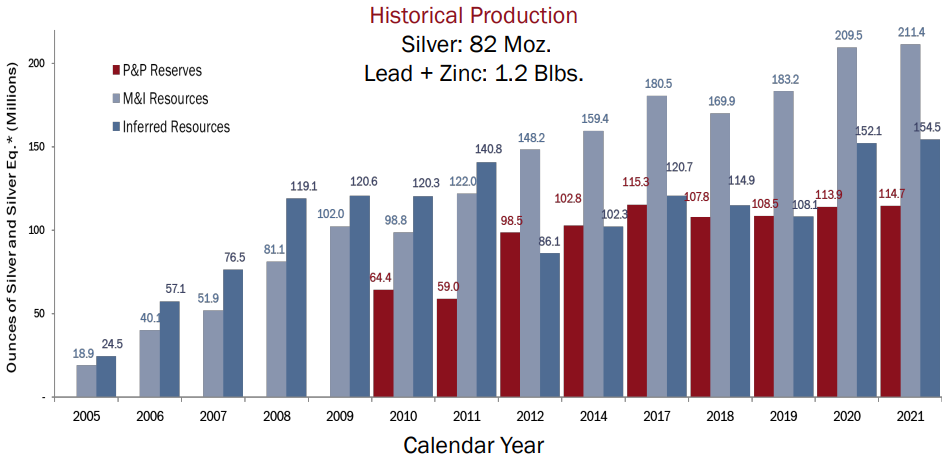

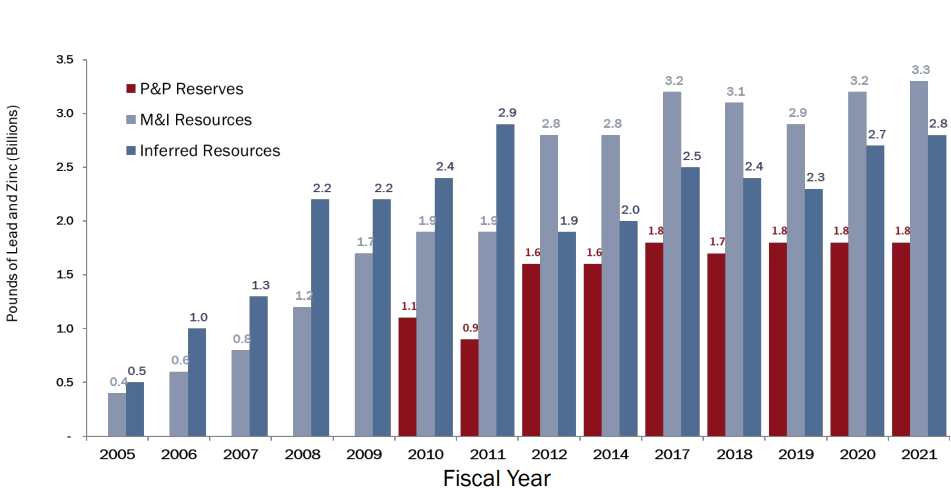

In case you haven’t read my previous articles on Silvercorp, here’s a brief description of the business. The company’s main assets include the Ying Mining District and GC Mine silver projects in Eastern China which currently have combined reserves of 114.7 million ounces of silver and 1.8 billion pounds of zinc and lead. Over the past 16 years, Silvercorp has produced about 82 million ounces of silver and 1.2 billion pounds of zinc and lead. Yet, reserve replacement is top-notch here and reserves have increased significantly over the past several years. They can currently support a mine life of over 15 years, which is very high for the silver mining sector.

Silvercorp Silvercorp

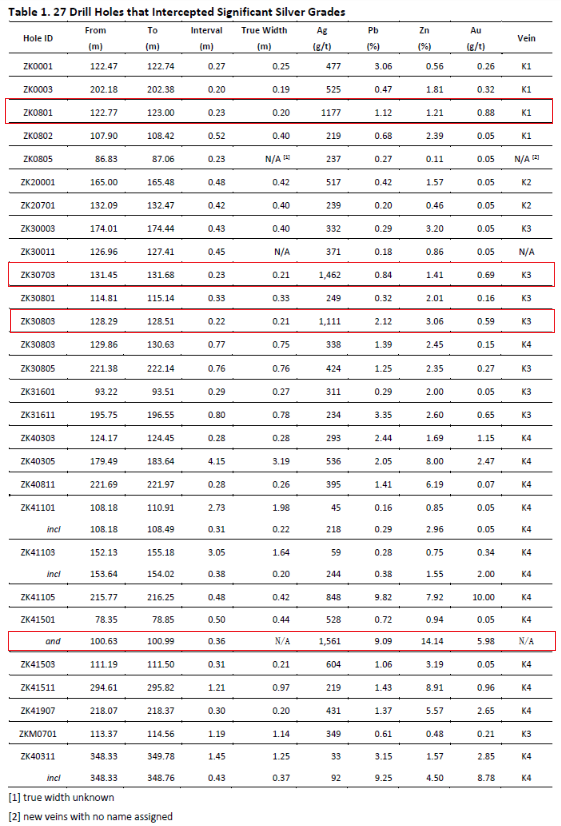

Silvercorp also owns the mothballed BYP Mine gold project in Hunan Province, which has measured indicated resources of 421,000 ounces. And in October 2021, the company won an auction for the Kuanping silver-lead-zinc-gold project with a $13.5 million bid. This project is located about 33 km north of Ying Mining District which means that ore could be trucked to the mill there. Previous drilling there has defined six silver-lead-zinc vein structures and one gold-silver vein structure. Historical assays look good, with several drill interceptions of over 1,000 g/t silver.

Silvercorp

Silvercorp plans to initiate a 12,000-meter drill program at Kuanping in 2023, and I think that this project can boost the life of mine of Ying Mining District by a couple of years.

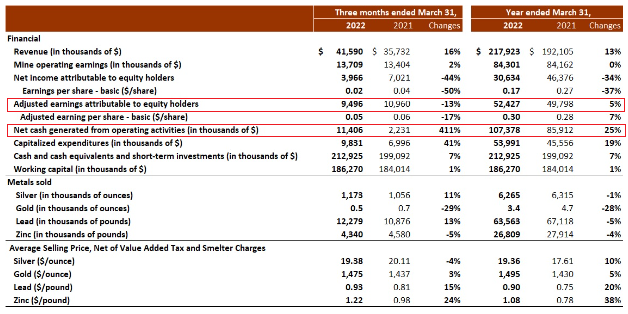

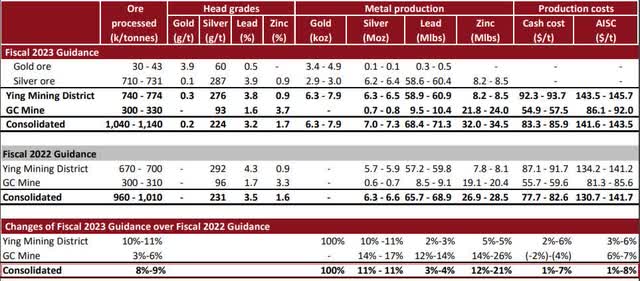

Turning our attention to the results for FY22 which ended on March 31, I think that investors can be pleased. The company sold a total of 6.3 million ounces of silver, 63.6 million pounds of lead, and 26.8 million pounds of zinc and cash flow from operations rose by 25% to $107.4 million. All-in sustaining costs (AISC) per ounce of silver net of by-product credits came in at just $8.77 per ounce. Adjusted earnings attributable to equity holders were $52.4 million, compared to $49.8 million a year earlier.

Silvercorp

Looking ahead, Silvercorp is currently building a new 3,000 tpd mill at Ying Mining District and expects to produce a record 7-7.3 million ounces of silver, 68.4-71.3 million pounds of lead, and 32-34.5 million pounds of zinc in FY23. Unless metal prices decline, the financial results of the company should improve substantially.

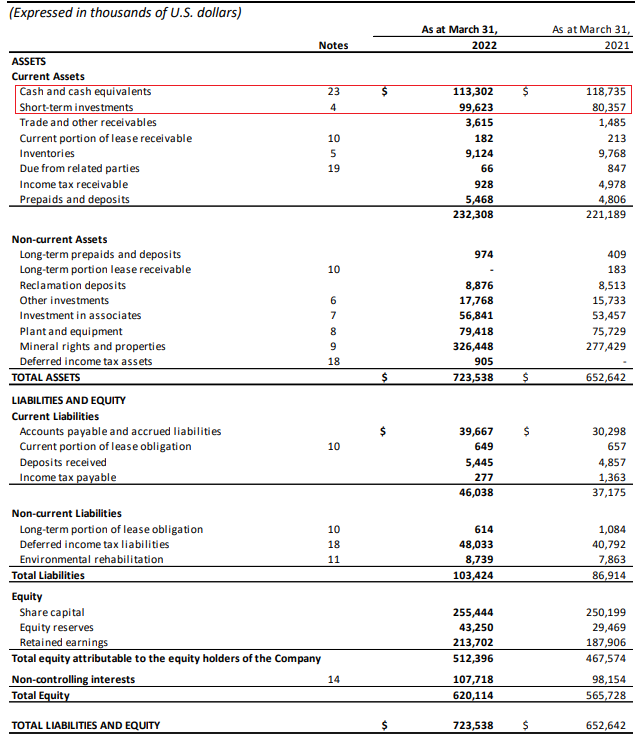

Turning our attention to the balance sheet, the situation looks good as Silvercorp had $212.9 million in cash and short-term investments (bonds and money market instruments) as of March 2022. There were no debts.

Silvercorp

In addition, Silvercorp owns 44,042,216 shares of New Pacific Metals (NEWP), which are valued at $116.3 million as of the time of writing. The company also holds 15,514,285 shares of Whitehorse Gold (OTCPK:WHGDF), which are valued at $6.2 million as of the time of writing.

Overall, Silvercorp’s cash, short-term investments, and interests in New Pacific Metals and Whitehorse Gold alone are worth $335.4 million at the moment. Considering the market capitalization of the company stands at $414.6 million as of the time of writing, it’s like investors are getting the Ying Mining District and GC Mine almost for free.

So, if production and financial results are so good, why has the share price of Silvercorp been sliding for months now?

Seeking Alpha

Well, my theory is that there are two main factors. First, tensions between China and Taiwan are high following the Russian invasion of Ukraine. China recently sent dozens of warplanes into the skies of Taiwan, and there are speculations in the media that war is inevitable. Second, global recession fears and a strong U.S. dollar are putting pressure on commodity prices, and this has also affected silver. The metal has lost over 20% of its value since I last wrote about Silvercorp and there is no relief in sight.

BullionVault

Overall, I think that Silvercorp is now significantly undervalued, and the recent selloff provides a good window of opportunity to open a position. In my view, only a Chinese invasion of Taiwan could derail the bull case here, and this seems highly unlikely.

And it seems that Silvercorp itself is willing to provide support for its share price as the company revealed in its annual report that it bought back 200,000 of its own shares in April and May 2022. In 2021, the company announced a normal course issuer bid under which it can buy back up to 4% of its stock, but it didn’t repurchase a single share in FY22.

Investor takeaway

Silvercorp boosted its mineral reserves and booked strong financial results for yet another year, but its market capitalization has been declining rapidly over the past several months. I think the main reasons behind this include high tensions between China and Taiwan as well as weak silver prices.

In my view, the company looks cheap at the moment considering it has $335.4 million in cash, short-term investments, and market equity investments at the moment. The production and cost guidance for FY23 looks good, and Silvercorp has started buying back its shares.

I think that this is a good time to open a position here but keep in mind that the share price could remain under pressure if China attacks Taiwan or silver prices continue to slide. I rate this one as a speculative buy.

Be the first to comment