Dragon Claws/iStock via Getty Images

Silver speculators know that China is a major silver producer and also a major user. With speculation now increasing about China’s reopening from Covid restrictions, things could get interesting because this could stimulate global growth again which will likely increase demand for silver and many other metals.

Silvercorp Metals (NYSE:SVM) boasts being one of the largest domestic primary silver producers in China, the second largest silver-producing country in the world. Most other primary producers in China are small-scale operations run by local companies which has provided Silvercorp the opportunity to consolidate the silver mines in the Ying district of the Silver Triangle.

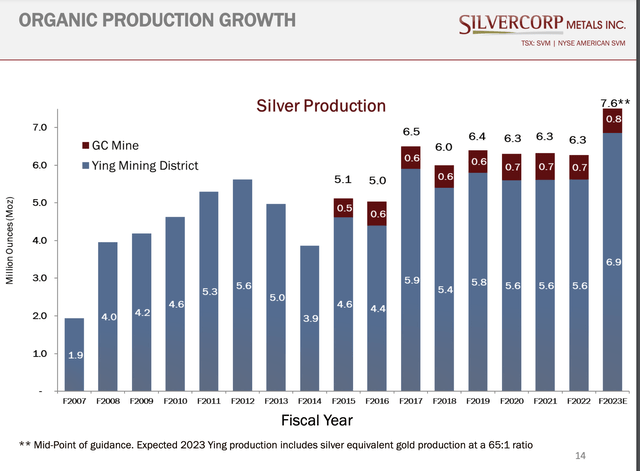

The following chart shows Silvercorp’s large and growing silver production in the Ying district of China’s silver triangle.

Silvercorp Ying Mines (Silvercorp)

With speculation now increasing about China’s reopening from Covid restrictions, things could get interesting because this could stimulate global growth again which will likely increase demand for silver and many other metals. Increasing demand with sustained silver production typically means higher silver prices which could translate to increasing revenues and profits for Silvercorp.

The recent slowing of inflation has already generated more optimism in the markets about the possibility of slowing interest rates which has resulted in short-term rising stock prices and metals prices. Higher silver prices certainly bode well for Silvercorp.

As the dominant miner in China’s Silver Triangle, Silvercorp favors using ongoing merger and acquisition efforts to unlock value whenever possible and with adjacent Muzhu Mining (MUZU: CSE) (Canadian Stock Exchange) claims right in their back yard, investors might be asking if Silvercorp may want to buy them out before they become too deeply entrenched and established. Muzhu share price and market cap are 13 cents and $3.25 million respectively.

Early this year Muzhu Mining announced:

Muzhu Mining Ltd. is pleased to provide additional material on the Xiao Wa Gou property adjacent to Silvercorp Metals Inc. located in Henan Province, China where Muzhu can earn up to an 80% interest (MUZU press release dated November 22nd, 2021)

The silver-lead-zinc XWG Property covers an area of 213 hectares and is situated in the Xiayu Township, in the southwestern part of Luoning County, Henan Province, in the People’s Republic of China. The Property offers near term potential for the production of silver, lead, zinc and copper due to the presence of numerous mineralized veins and its proximity to a number of operating mines owned by Silvercorp Metals Inc.

The XWG Property is located in China’s “Silver Triangle” comprising the Tieluping Silver District to the east, the Ying Silver Mine to the west and the HPG Project to the north, and is surrounded by several other producing mines including the TLPsilver-lead mine, and the LM silver-lead mine, all owned by Silvercorp. The TLP and LM mines are immediately adjacent to the northeast of the XWG Property.

Samples were taken during a 2018 exploration program that exhibit highly anomalous grades of Silver, Lead, Zinc and Copper. Some samples returned values as high as; 1,500 g/t Ag, 3.88 % Pb, 6680 ppm Zn and 7% Copper.

The company also published information about the geology of the claims.

If Silvercorp acquires Muzhu, it could add significant resources and production to their already robust production. Even if Silvercorp does not acquire Muzhu, their large resource holdings pretty much guarantee massive production for years to come.

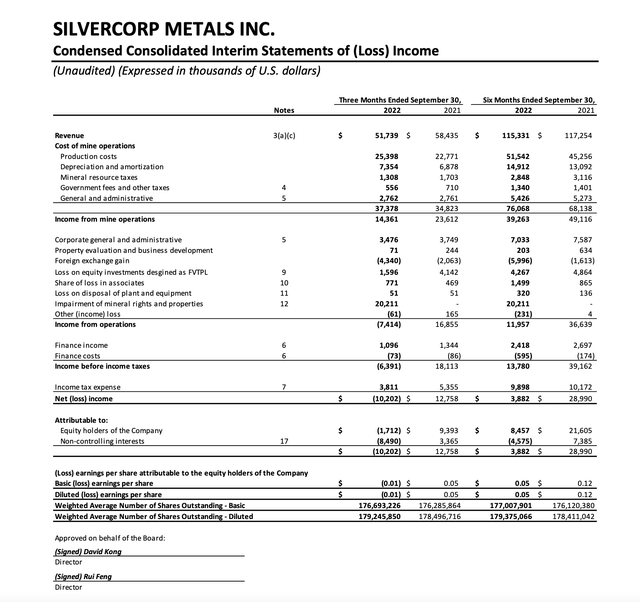

Silvercorp recently reported net income of $6.7 million for Q2, 23. It should be noted that a non-recurring impairment charge of $20.2 million against the La Yesca Project was reported in this quarter which still left a hefty $6.7 million for the quarter.

I would like to underscore a few significant highlights for Q2 2023. Cash flow was an impressive $14.1 million with in cash and cash equivalents. And Silvercorp owns $111 million in associates and other companies. Silvercorp is also spending substantial sums for drilling, underground development, and increased milling operations. All things to increase production.

Highlights For Q2 Fiscal 2023

- Mined 290,981 tonnes of ore, milled 291,643 tonnes of ore, and produced approximately 1.8 million ounces of silver, 1,200 ounces of gold, 18.0 million pounds of lead, and 6.0 million pounds of zinc;

- Sold approximately 1.8 million ounces of silver, 1,200 ounces of gold, 17.3 million pounds of lead, and 5.9 million pounds of zinc, for revenue of $51.7 million;

- Realized adjusted earnings attributable to equity shareholders of $6.8 million, or $0.04 per share. The adjustments were made to remove impacts from impairment charges, share-based compensation, foreign exchange, mark-to-market equity investments, and the share of associates’ operating results;

- Reported net loss attributable to equity shareholders of $1.7 million, or $0.01 per share, with the loss mainly due to an impairment charge of $20.2 million against the La Yesca Project;

- Generated cash flow from operating activities of $14.1 million;

- Cash costs per ounce of silver, net of by-product credits, of $0.77;

- All-in sustaining costs per ounce of silver, net of by-product credits, of $8.25;

- Spent and capitalized $2.9 million on exploration drilling, $9.4 million on underground development, and $1.2 million on construction of the new mill and tailings storage facility;

- Spent $1.2 million to buy back 503,247 common shares of the Company under its Normal Course Issuer Bid; and

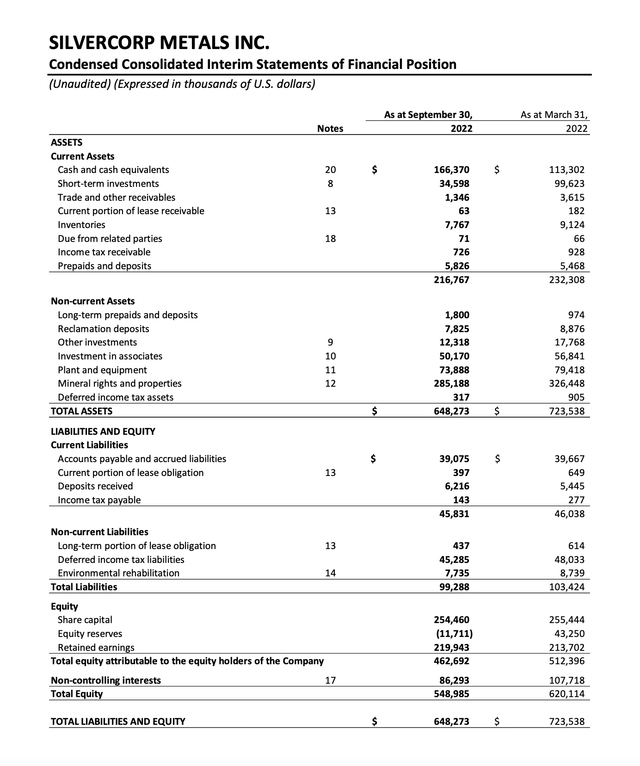

- Strong balance sheet with $201.0 million in cash and cash equivalents and short-term investments. The Company holds further equity investment portfolio in associates and other companies with a total market value of $111.0 million as of September 30, 2022.

One really big lever of course is the price of silver that fluctuates every day. After seeing a low this year of about $16 per ounce, silver is gradually recovering and is about $21 per ounce today. I believe China will be reopening the economy from Covid soon and when they do, economic activity is expected to pick up and the price of silver and most metals will rise again. I believe Silvercorp is well positioned to report continued high growth for all the above reasons. An acquisition of neighboring claims would be a thick layer of icing on an already big cake.

Recent financials show that Silvercorp has no debt and is sitting on a strong cash position of $211 million while at the same time the company is expanding processing capacity that will increase production. All of these factors combined with stable or rising silver prices point to steady growth for a major silver producer. An acquisition of neighboring claims while they are cheap can add even further to Silvercorp growth.

Silvercorp financials

Silvercorp Income Statement (Company Filings) Silvercorp Balance sheet (Company Filings)

Risks

Silvercorp has been stable for years but being in a foreign country always carries risks of unforeseen new taxes, and worst of all, expropriation. International currency swings can also have a big impact on earnings. The price of silver is of course a major factor that so far is working in favor of Silvercorp. For a more extensive list of risk factors, see the 2022 Annual Report.

Conclusion

Silvercorp is strongly positioned to enjoy prolonged revenue growth based on unusually high-grade silver mining in the Silver Triangle of China. Their undiscovered neighbor, Muzhu Mining also enjoys similar grades that could add significantly to Silvercorp production and earnings. China is not only the second largest producer of silver in the world, but is also one of the largest users. As China reopens from Covid and as the global economy resumes record growth, Silvercorp with some of the highest grades of silver encountered could represent a very promising high-grade silver play that exceeds most known silver producers. I believe Silvercorp is positioned to enjoy substantial growth in the short and long term which could be exacerbated by acquiring their neighboring Muzhu Mining while it is cheap and by rising silver prices if the global economy resumes normal growth which has been the underlying trend for centuries.

Be the first to comment