retouchman/iStock via Getty Images

The past few months have been very volatile, just like most of the year has been. During this time, there have been countless winners and countless losers. But for the most part, the broader market has been only marginally positive. One company that has fared particularly well as of late is Silgan Holdings (NYSE:SLGN), a producer and seller of metal containers, dispensing systems, and other products, as well as an operator of metal and plastic closure operations. Driven by strong fundamental growth on both the top and bottom lines, shares in the company have appreciated nicely. Add on top of this the fact that shares still look cheap on an absolute basis even though they might be near the higher end of the range compared to similar firms, and I do think that some additional upside exists for shareholders moving forward.

Great results so far

Back in early September of this year, I wrote an article that took a bullish stance on Silgan Holdings. I talked about how well the company had done over the prior year, with strong revenue growth and improving profitability pushing shares up 9.9% at a time when the S&P 500 was down 11.6%. Even after that increase, though, I felt as though fundamental growth warranted a bit more upside for investors. This led me to change my rating on the company from a ‘strong buy’ to a ‘buy’ to reflect my positivity and to acknowledge that the easy money had likely already been made. Since then, the company has continued to outperform. While the S&P 500 is up by only 0.9% since the publication of my most recent article on Silgan Holdings, shares of the enterprise are up 12.3%.

To understand why this return disparity exists, we need to only cover fundamental performance for the third quarter of the company’s 2022 fiscal year. This is the only quarter for which we did not have data on previously that we now have data on. During that time, sales came in strong at $1.97 billion. That’s 19.3% higher than the $1.65 billion the company reported the same time last year. Although the company experienced growth across the board, the greatest growth in revenue came from its metal container operations. Revenue under this segment skyrocketed from $942.1 million to $1.21 billion. This was driven largely by management’s ability to push through higher raw material and other inflationary-related costs onto its customers. But it’s also true that, despite these cost increases, the company also benefited from higher unit volumes in some parts of the enterprise. Most notably, in the dispensing and specialty closures segment, volumes increased and the mix of products sold helped the company’s top line. But for the metal containers operations alone, the 28.6% rise was driven by higher selling prices even at a time when unit volumes dropped by roughly 9% and when foreign currency translation impacted the company negatively to the tune of $19 million.

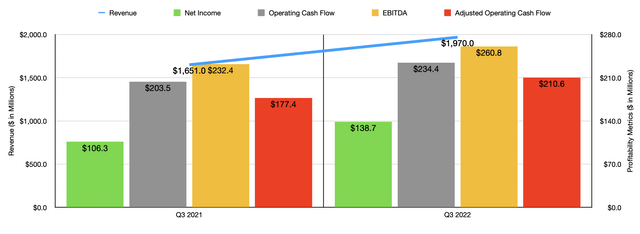

With this rise in revenue came a nice uptick in profitability. Net income of $138.7 million beat out the $106.3 million reported the same time last year. Other profitability metrics followed suit. Operating cash flow, for instance, increased from $203.5 million to $234.4 million. If we adjust for changes in working capital, it would have risen from $177.4 million to $210.6 million. Meanwhile, EBITDA for the company also improved, climbing from $232.4 million to $260.8 million year over year.

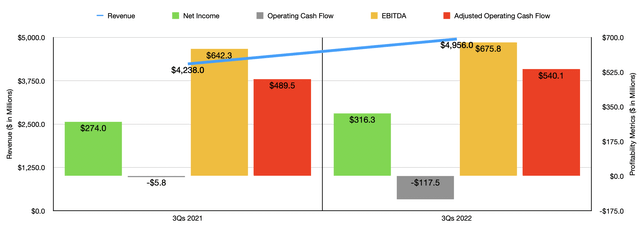

The results achieved in the third quarter were not a one-time event. For the first three quarters of the 2022 fiscal year as a whole, revenue came in at $4.96 billion. That’s 16.9% higher than the $4.24 billion reported in the same window of time last year. Net income grew from $274 million to $316.3 million. Admittedly, operating cash flow did worsen, falling from negative $5.8 million to negative $117.5 million. But if we adjust for changes in working capital, the metric would have risen from $489.5 million to $540.1 million. Over that same window of time, EBITDA for the company also improved, climbing from $642.3 million to $675.8 million.

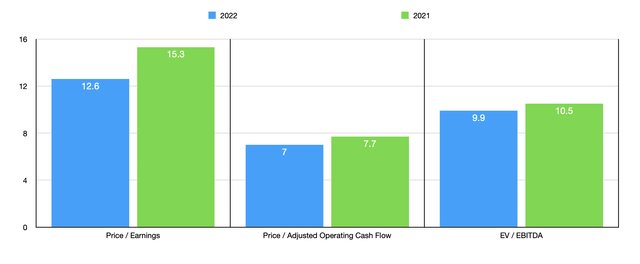

Clearly, the fundamental picture for Silgan Holdings has never been better. When it comes to the 2022 fiscal year as a whole, management seems to be rather optimistic. Earnings per share are forecasted to be between $3.90 and $4. At the midpoint, that would translate to net income of $437.4 million. That compares favorably against the $359.1 million reported in 2021. If we annualize results experienced so far this year, we would get adjusted operating cash flow of $785.5 million and EBITDA of $913.3 million. Given these figures, the company is trading at a forward price to earnings multiple of 12.6, a forward price to adjusted operating cash flow multiple of 7, and a forward EV to EBITDA multiple of 9.9. By comparison, using the data from 2021, these multiples would be a bit higher at 15.3, 7.7, and 10.5, respectively.

On an absolute basis, I would make the case that shares of Silgan Holdings are still quite attractive. Having said that, the stock does look a bit lofty compared to similar firms. On a price-to-earnings basis, five similar companies I looked at had multiples ranging from 4.2 to 29.7. Meanwhile, they were trading at EV to EBITDA multiples of between 4.3 and 12.9. In both of these scenarios, four of the five companies were cheaper than our prospect. Meanwhile, using the price to operating cash flow approach, the range was between 7.3 and 370.5, with our target being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Silgan Holdings | 12.6 | 7.0 | 9.9 |

| Ardagh Metal Packaging S.A. (AMBP) | 11.4 | 14.7 | 7.6 |

| AptarGroup (ATR) | 29.7 | 17.2 | 12.9 |

| Berry Global Group (BERY) | 9.7 | 7.3 | 7.8 |

| Greif (GEF) | 11.2 | 8.4 | 7.7 |

| O-I Glass (OI) | 4.2 | 370.5 | 4.3 |

Takeaway

Getting into a space like what Silgan Holdings operates in may not seem all that exciting. It’s certainly not the type of company that you would likely discuss at a dinner party to impress your friends. Having said that, fundamental performance achieved by the business has been robust and the upside for shareholders from a share price appreciation perspective has been appealing as well. I still do believe that the easy money has been made by this point. But given where shares are priced today, I would make the case that they do have some additional upside to go from here. As a result, I have no problem keeping it at the ‘buy’ rating I had previously.

Be the first to comment