simona flamigni/iStock Editorial via Getty Images

Introduction

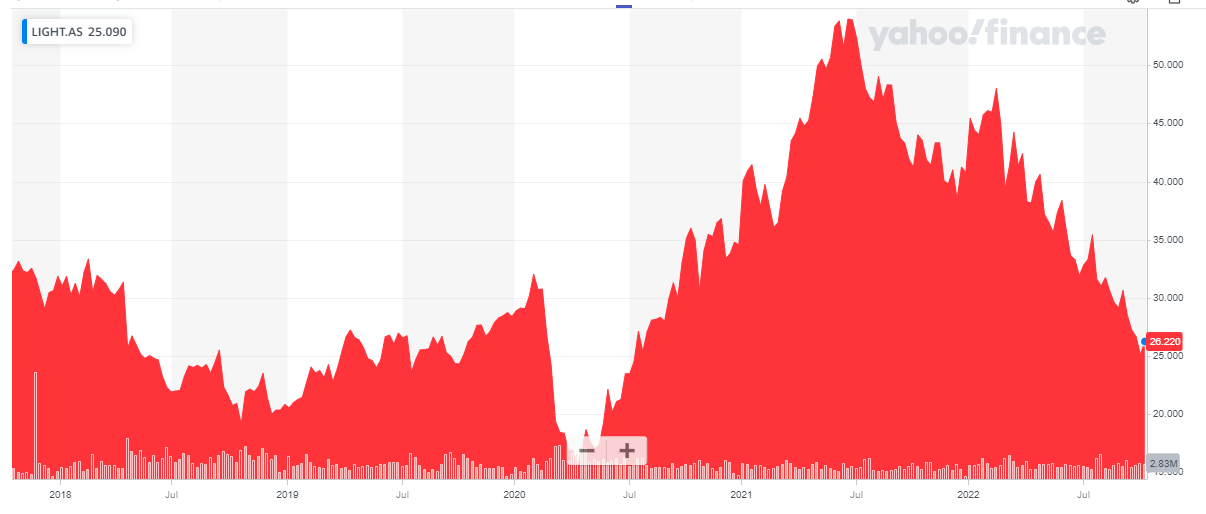

In June 2020, I discussed Signify (OTCPK:PHPPY) (OTCPK:SFFYF) as this lighting company, which was a spin-off from Philips (PHG) worked on a UV-C light which killed 99% of the COVID-19 virus within seconds. The technology is now rendered a bit obsolete as the initial panic reaction surrounding COVID-19 is over, but UV-C lighting is obviously still in wide use for instance to sterilize operating rooms, which also was the main application before COVID. As the annual capital expenditures are pretty low, Signify has always been a cash cow and the company’s share price bounced back from under 22 EUR per share in June 2020 to a high of almost 55 EUR per share in the summer of last year before losing about 50% of its value again. A real roller coaster and I wanted to check if it could be a good idea to pick up shares around the current share price level of 26 EUR per share.

Yahoo Finance

The company’s main listing on Euronext Amsterdam is much more liquid, with approximately 575,000 shares being traded on a daily basis. The current market capitalization is about 3.25B EUR based on 125M shares outstanding. Signify used to be an avid buyer of its own shares, but a $1.4B acquisition a few years ago meant a shift in priorities to debt reduction and balance sheet strength. Signify is still buying back stock but at a slow pace, and only to cover the option plans.

The sale of real estate will help this year’s reported free cash flow

The main business of Signify is obviously still everything connected to lighting. And that’s not just producing light bulbs or LED lights, but also solutions for professional environments, like using UV-C lights to sterilize rooms and equipment (as the UV-C radiation breaks down the DNA of micro-organisms).

Signify is definitely feeling the impact from the Ukraine-Russian war and the lockdowns in China this year as those elements had a negative influence on the Q2 and H1 results. The company was obviously hit by the inflation and supply chain issues in the first half of this year, but when it announced its Q2 results in August, it mentioned it expected the margin headwinds to ease in the second half of the year, so that’s encouraging.

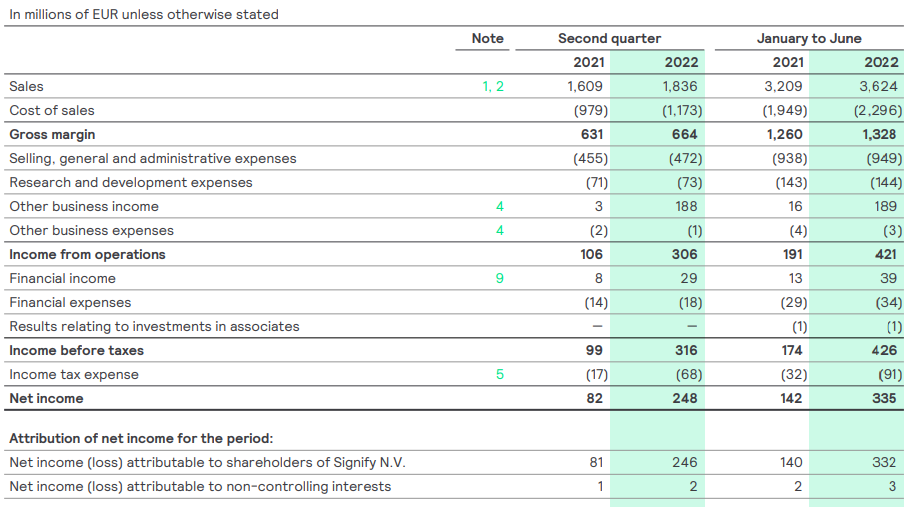

Signify reported a total revenue of just over 3.6B EUR, an increase of almost 13% compared to the first half of last year. As expected, the COGS increased at a faster pace (more than 15%) resulting in a gross margin increase of just 5% to 1.33B EUR. That’s obviously still pretty good, and I was pleasantly surprised to see the relatively small increase in the SG&A and R&D expenses (both were up approximately 1%).

Signify Investor Relations

The operating income exploded, but this was entirely related to the “other business income” which included the non-recurring gain on the sale of real estate assets. Signify sold real estate to the tune of approximately 194M EUR while the book value of these assets was just a few million Euros as it had already been almost fully depreciated over the past years.

This obviously also boosted the pre-tax income and after-tax income which came in at 335M EUR of which 332M EUR was attributable to the shareholders of Signify. Considering there are approximately 125M shares outstanding, the net profit per share was approximately 2.66 EUR. But of course, the net income increase is entirely thanks to the gain on the real estate assets.

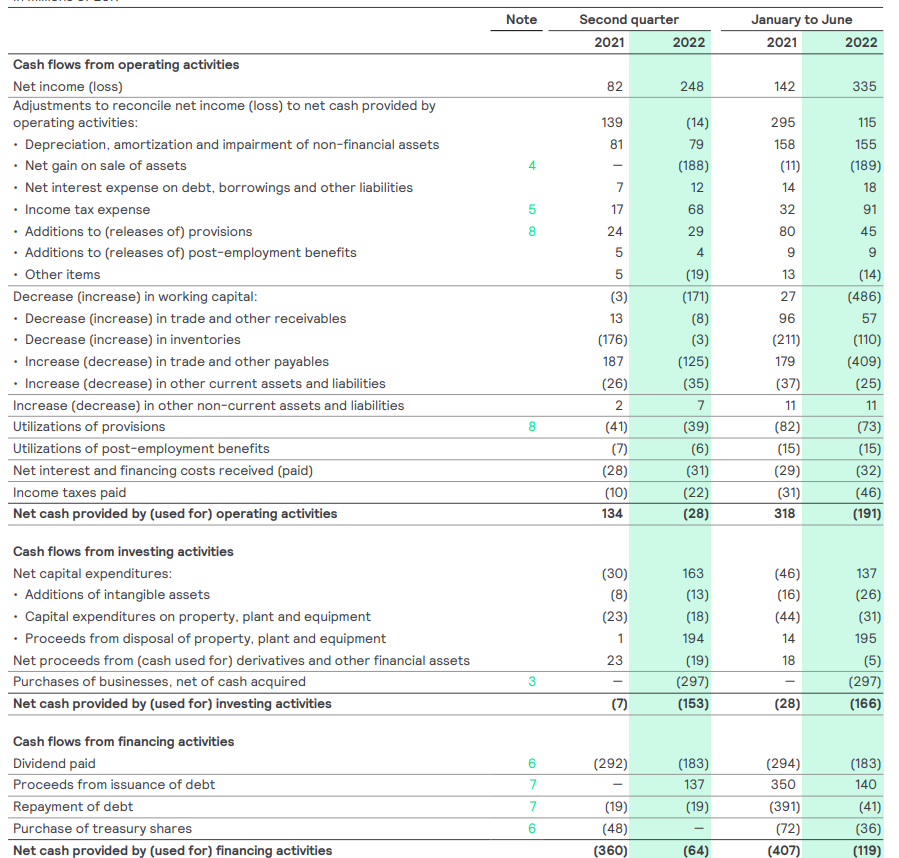

Back in 2020, I based my investment thesis on Signify’s cash flow profile and the traditionally very low capex, so it’s only fair to judge Signify once again based on its cash flow profile. The reported operating cash flow in the first half of the year was a negative 191M EUR. But as you can see below, that was entirely caused by a 486M EUR build-up in the working capital position. You’ll also see the total tax pressure was just 46M EUR, and I will keep that number unchanged as I want to figure out how much free cash flow Signify is generating excluding the non-recurring asset sale.

Signify Investor Relations

So on an adjusted basis, the operating cash flow before changes in the working capital position was approximately 295M EUR (including the cash payments to the retirement fund and the utilization of provisions. That’s almost exactly the same result as the 291M EUR in H1 2021. The total capex in the first half of this year was 57M EUR (of which 26M EUR was spent on intangibles), resulting in a net free cash flow result of 238M EUR. Divided over the 125M shares outstanding, the underlying free cash flow in the first half of the year was approximately 1.90 EUR per share. And that excludes the gain on the sale of real estate assets and the changes in the working capital position.

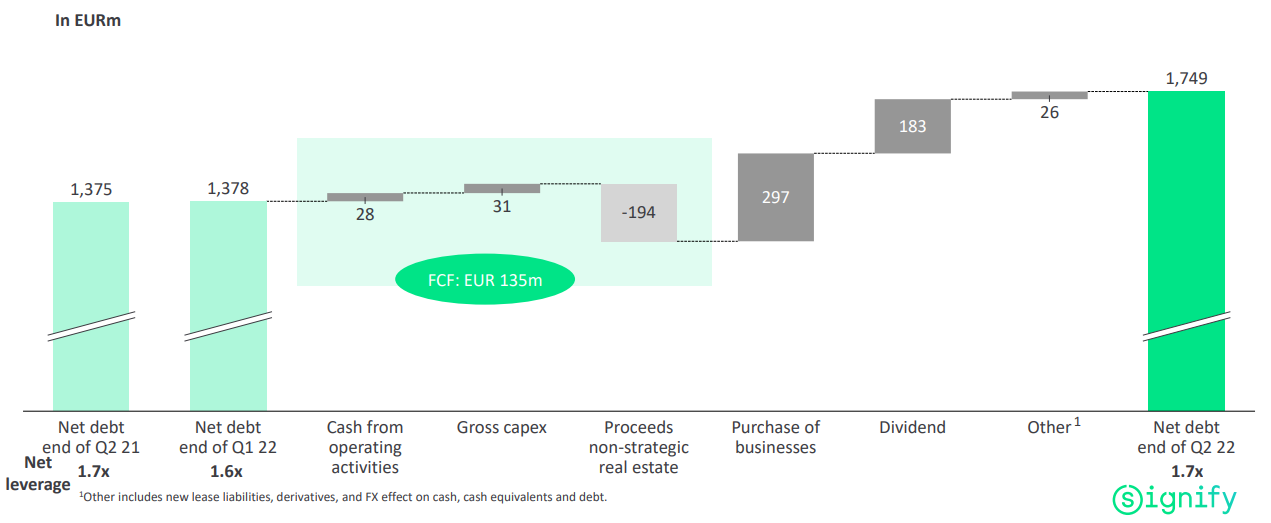

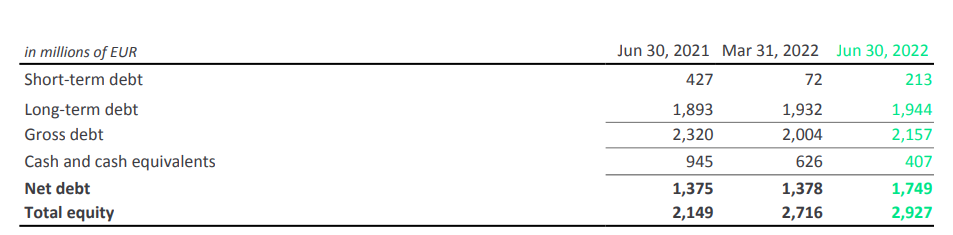

As of the end of June, the company had a positive working capital position of approximately 840M EUR. The balance sheet also contained 407M EUR in cash while there is about 2.15B EUR in financial debt, resulting in a net debt level of 1.75B EUR.

Signify Investor Relations

The net debt increased due to the working capital changes as well as the almost 300M EUR Signify spent on acquisitions. This should have a positive impact on the remainder of this year and as I expect the full-year EBITDA to come in at in excess of 800M EUR and perhaps even closer to 900M-1B EUR if Signify can indeed improve its margins again, the net debt level doesn’t bother me as the debt ratio remains firmly below 2.

Signify Investor Relations

Dissecting the official outlook for this year

For the entire financial year, Signify is guiding for a 3%-6% comparable sales growth but has reduced its adjusted EBITA margin (excluding the depreciation expenses) of 11-11.4% due to the weaker second quarter of this year.

For the entire financial year, Signify expects free cash flow to be 5%-7% of total revenue, including the cash contribution from the sale of the real estate assets. Assuming the full-year revenue will be 7.5B EUR (compared to 3.6B EUR in H1), the free cash flow result will be 375M-525M EUR, of which 195M EUR will be contributed by the asset sales. This means the underlying free cash flow will be 180M-330M EUR. That’s still a very wide guidance, and I expect to see Signify narrowing it down when it reports its Q3 results.

Investors are warned Signify’s guidance includes changes in the working capital position, so it’s a bit tricky to base investment decisions on the official guidance as we don’t exactly know how the working capital will fluctuate.

The longer-term guidance is a reversal to an 8% free cash flow margin based on the revenue as soon as supplier lead times ease. That sounds great, but as the world economy is a bit shaky, I expect Signify will need a few more years to reach that 8% mark. And while this still includes working capital changes, those WC investments should ease out over time and the underlying free cash flow will be pretty close to the reported free cash flow.

But should Signify indeed reach that 8% margin on what will be an 8B+ EUR annual revenue once the acquisitions are fully digested, the guidance implies a free cash flow result of in excess of 640M EUR which is in excess of 5 EUR per share. If Signify is indeed able to deliver on this promise, Signify is currently trading at a forward free cash flow yield of 20% so the current free cash flow yield is definitely sustainable.

Investment thesis

Once the uncertainty around the supplier lead times improves, I do expect Signify to restart its share repurchase program. The shares are trading pretty cheap as the H1 FCF result was already almost 2 EUR per share and H2 could perhaps be slightly better. And just to avoid any issues with seasonality: The adjusted free cash flow in FY 2020 and FY 2021 was respectively 553M EUR and 588M EUR, which translates to 4.42 EUR and 4.70 EUR per share. This means that even when the stock was trading in the mid-50s, it actually wasn’t outrageously expensive.

I think it could be interesting to start building a position in Signify again. The company paid a 1.45 EUR dividend based on its FY 2021 results representing a 5.5% dividend yield which is a nice compensation to wait for the share price to turn around.

There’s no rush, but weakness could be opportunities.

Be the first to comment