Olemedia

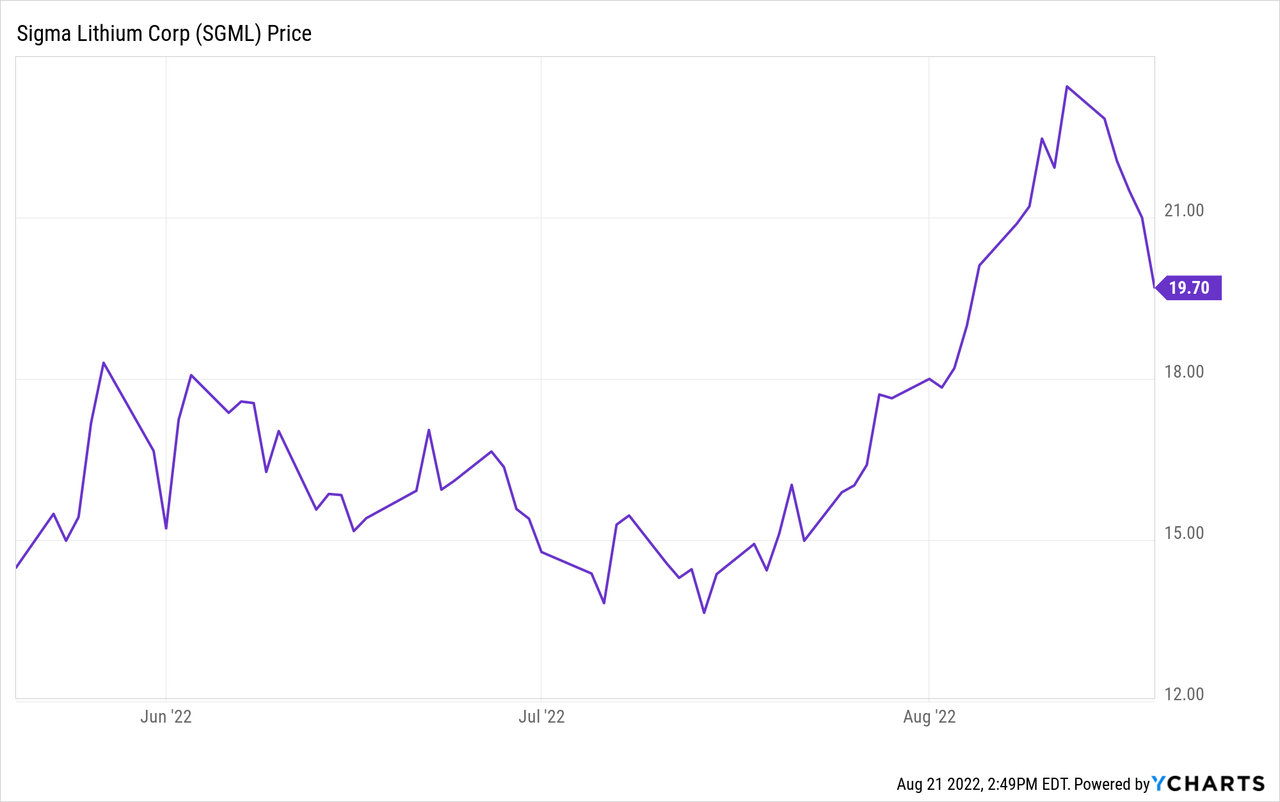

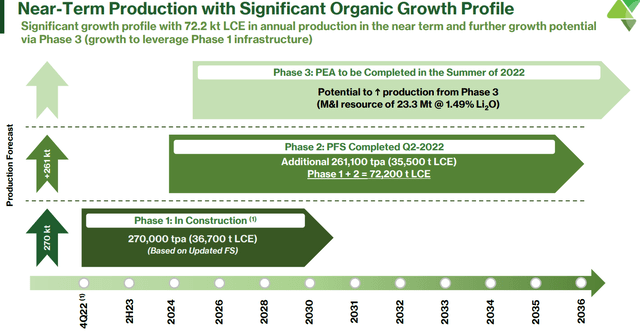

I first wrote about Sigma Lithium Corporation (NASDAQ:SGML) this past May. In the piece, I discussed the company’s impressive Phase 1 and Phase 2 projections, as well as management’s ambitious construction schedule. Since then, construction has continued smoothly and the company is on track to start commissioning Phase 1 of its Grota do Cirilo, Brazil Project by December of this year.

However, over recent months the company also came out with some good news. While the announcement of a significant upgrade to the company’s resource size was initially ignored by the markets, the stock price is beginning to tick up as investors have started to more thoroughly re-evaluate the company. This rising trend is likely to continue as the mine gets closer to production.

Resource Upgrade

In late June, Sigma announced the addition of 27Mt to its reserve at an average grade of 1.49% lithium oxide. This brought its total to 85.7Mt, of which 73.6Mt are Measured and Indicated at an average of 1.43% Li2O. That was an almost 50% increase from the company’s prior 58.9Mt number. Surprisingly, though, the stock barely reacted and the company’s share price even fell steeply during the first weeks of July.

I believe the reasons for this are twofold, with the first being a general pullback in the broader market brought about by changing macro factors. But the second reason has more to do with lithium’s longer-term price outlook.

Lithium’s Long-Term Price Outlook

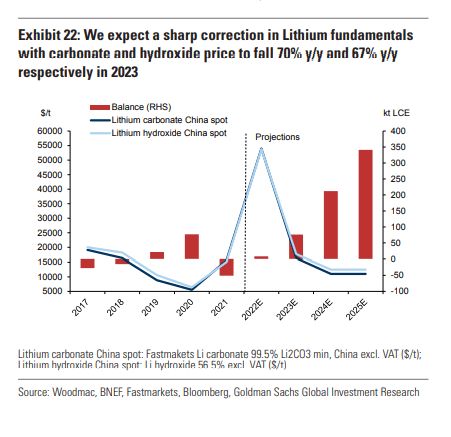

Back in May, Goldman Sachs put out a bearish report in which it predicted 70% and 67% year-over-year declines in the prices of carbonate and hydroxide by next year. They also forecasted prices to stay relatively low in the years to come, as they believe supply coming to the market will outstrip demand growth.

Goldman Sachs Report (Goldman Sachs)

The report had quite an impact on the industry, causing market participants to re-evaluate their lithium price forecasts for the middle and latter parts of the decade. It was unfortunate timing for Sigma, as they announced that the added resource would be extracted in the third phase of their project. From a pricing perspective, it wasn’t the best time to announce that most of your 27M additional tonnes would begin to be extracted in 2025, at the earliest.

SGML 3 Phase Plan (Investor Presentation)

The good news, however, is that four months have passed since Goldman put out its report and lithium prices are still trading near record highs. Also, other well-respected firms, such as Benchmark Mineral Intelligence, have put out their own reports disputing Goldman’s assumptions and making plausible cases for continued strength in the lithium market.

Judging from the recent rally in a lithium stocks, it appears the market is again beginning to price-in tightening lithium supply for years to come. That should continue to benefit Sigma and its newly-expanded resource.

Staffing Up

On the operational side, everything appears to be running smoothly. When the company released its Q2 results last week, it had C$123.3M in the bank and management said that the company was still on track to begin commissioning Phase 1 by December. Currently, about 1/3 of the project has been built.

Also announced, was the hiring of Brian Talbot as Chief Operating Officer. A key appointment as the company gets ready to initiate production. Talbot held a number of senior positions at Allkem Limited (OTCPK:OROCF) (formerly Galaxy Resources) and seems to be a solid candidate for the job.

A Small Point of Contention

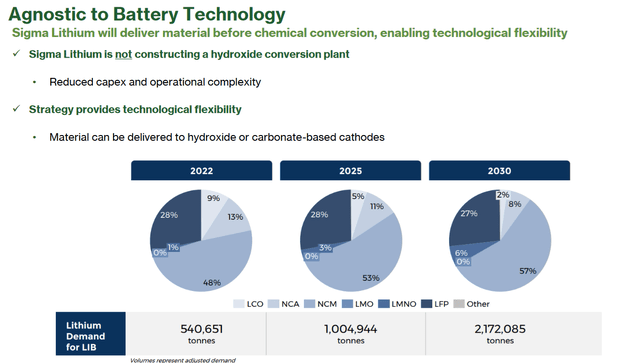

In a recent investor presentation, Sigma answered a question that’s frequently put to every junior lithium miner; that being whether or not they plan to build a conversion facility. In response to this ever-present question, the company was very clear and stated that they are not constructing a hydroxide conversion plant.

In their presentation, the company paints this as an advantage. Stating that the absence of a conversion plant will allow them to be “agnostic to battery technology.” However, this is where, as investors, we would do well to remember that investor presentations are both informational as well as marketing documents. And not building a conversion plant is not an advantage. Just ask Elon Musk, who recently said that lithium refining is a “license to print money.”

Granted, Sigma is not alone as most junior lithium miners coming onstream in the next few years have no plans to build conversion facilities. Most plan to ship their concentrate to China for conversion, where the bulk of the world’s lithium is processed.

But one can also easily picture a scenario whereby geopolitical tensions between the United States and China could lead to these processing facilities being cut off. This would then lead to a situation similar to the one recently encountered in U.S. oil industry, where there was a sufficient amount of crude oil being pumped but not enough refining capacity to process it. However, this is a minor point and applicable to many industry participants. It certainly doesn’t detract from Sigma’s overall value.

Conclusion

But small details aside, the big picture view for Sigma continues to look good. Construction of Phase 1 continues apace, and management is obviously also thinking about the long-game as they lay the groundwork for the eventual build out of Phases 2 and 3. This points to the gradual rise that has occurred in the stock over the last year continuing into the foreseeable future.

Risks

A fall in the price of lithium is always a risk when investing in the lithium sector. But another risk that’s more specific to the company, are the pending Brazilian elections this fall. While the country recently cut red tape for lithium exporters, both of the major electoral candidates have adopted populist rhetoric during the campaign. This may result in mining companies facing greater regulation and higher taxes when a new government is chosen.

Be the first to comment