RHJ/iStock via Getty Images

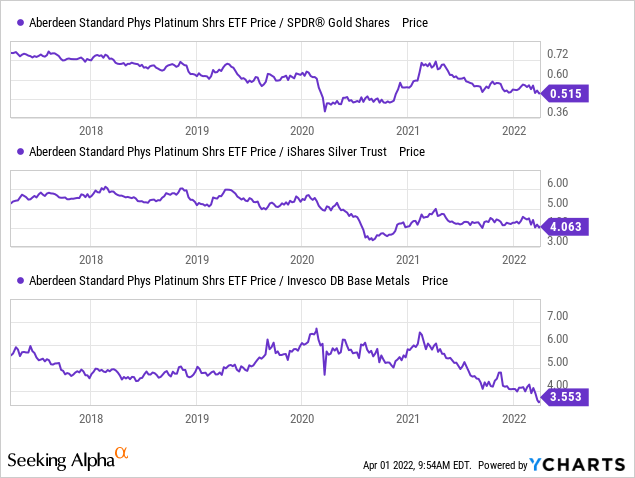

While most global commodities are in a severe shortage, a few, such as platinum, are still in a glut. Today, as many commodities are soaring, the international price of platinum remains the same as in 2016. Weakness in platinum is due to various factors, including solid production in South Africa and weak global vehicle production (the primary use of platinum), stemming from the semiconductor shortage. By comparing the price ratios of platinum to other metal prices, we can see platinum is exceptionally cheap today:

Overall, the relative price of platinum is near all-time-lows compared to both precious metals and base metals. The fundamentals for platinum remain lackluster as high palladium prices ensure platinum production in South Africa should remain strong (as the two are usually mined together). Russia is the second-largest global platinum producer, albeit at only ~17 tons compared to South Africa at ~130 tons, so the global platinum supply may not remain so strong.

The simple fact that platinum’s price has not risen while all other metals have skyrocketed makes the metal intriguing. While the vehicle production slowdown may be weighing on platinum’s short-term fundamentals, long-term investors looking to hedge inflation may benefit from gaining exposure to the metal. One easy way is through the platinum ETF (PPLT); however, better results may be found by looking at diversified mining companies with strong platinum production. An attractive potential bullish opportunity is the third-largest global platinum producer Sibanye-Stillwater (NYSE:SBSW).

Sibanye-Stillwater Has Proven Resilience

As recently detailed in “Hedging Against A Shifting World With These 2 Portfolios“, investors would be wise to increase allocation to pro-inflation assets that are not heavily reliant on fiat currency strength. “Portfolio resilience” cannot be obtained by simply buying bonds, as was before, since rising inflation and rate hikes are causing bonds to crash, giving them poor risk-reward profiles. Accordingly, safety in light of the storm may be better found in more volatile assets such as metal miners, which directly benefit from fiat currency weakness. In my view, Sibanye-Stillwater is a solid example of such a firm.

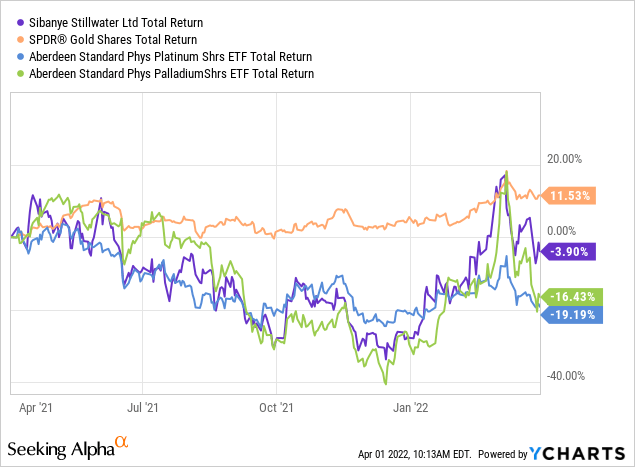

I covered Sibanye last in April of 2020, right after the massive global stock market sell-off in “Strike Risks Loom, But Sibanye-Stillwater Is Incredibly Cheap Today.” Since then, the stock has risen by 160% and has had a total return of ~200% after accounting for its strong 8% dividend yield. While its platinum operations have been lackluster, its palladium, gold, and other metal segments have become highly profitable. As I suspect, if platinum rises too, then Sibanye’s earnings would increase even higher. The stock is also down around 15% from its highs, having slipped during March, so it may also be trading at a short-term discount. See below:

Sibanye tends to track the price trends of platinum and palladium closely. In particular, both of these metals, palladium, rose dramatically at the onset of the Russian invasion since many investors believed Russia would struggle to export its metals. However, during March, it became clear that European and Asian countries were not necessarily on board with ultimately ending metal imports from Russia and that higher prices would cause demand to decline. Still, Russia’s recent request that commodity sales be made in rubles may cause a decline in exports regardless. Considering South Africa-based Sibanye produces many of the metals Russia exports, such threats are bullish for Sibanye.

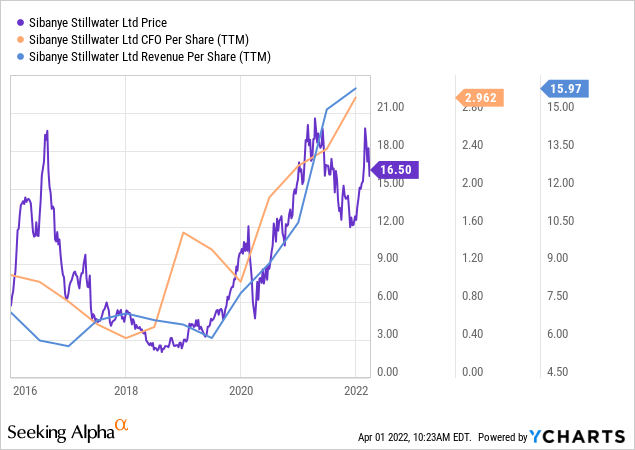

Even if Russia’s platinum and palladium production and exports remain strong, the fact remains that many investors are looking for inflation hedges. Platinum may be one of the last undersaturated inflation trades left. In my view, Sibanye’s stock may be superior to outright ownership of platinum or other metals since it has exposure to those metals. Still, it also has seen its cash flow and sales rise dramatically in recent years despite the global tumult. The firm’s overall metal production has been increased while many of its peers have seen production decline, and the company has improved margins through expanding its processing capacity. As you can see below, this has resulted in stellar sales and cash-flow growth:

SBSW currently has an extremely attractive “Price-to-cash-flow” ratio of merely 5.6X and a “P/E” of only 5.3X. Most companies with valuations at such levels are struggling to remain afloat and are facing negative sales and earnings growth trends. Sibanye, on the other hand, has seen its sales and EPS rise despite the global supply-chain woes and is expected to see its EPS rise in 2022 to $4.22 and again in 2023 to $4.40. Accordingly, its forward “P/E” is at merely 3.9X. Most stocks in the Nasdaq 100 have lower EPS growth and “P/E” ratios around 45X. Sibanye is even cheaper than other PGM-centric miners, having the highest dividend yield in the industry and the lowest valuation (excluding the nanocaps).

Fundamental Risks Facing Sibanye

Looking across today’s mining industry, Sibanye appears to be one of the most attractive stocks on the market. It is a large established miner with a proven track record. The company has substantial platinum mining operations, which I believe may fuel surprise earnings growth if platinum rises toward its peers, as I suspect. The firm also has been improving its “battery metals” segment, making it a potential green-energy benefactor. Sibanye’s stock has an extremely low valuation compared to the market and its peer group, with a stellar dividend yield of 8%. Additionally, the company has a strong cash position and a healthy debt level with plans to lower CapEx spending over the coming years, improving its distributable cash flow further.

Despite this, there are still some negative factors facing the company. Sibanye is profitable partially due to its generally low production costs, but rising oil and general prices have threatened its bottom line. Once again, the company is facing a significant strike following a recent failed wage deal with its primary South African unions. So far, two unions forming the strike coalition have accepted deals, but the other two remain on strike, causing some of its gold production to grind to a halt. Sibanye’s recent labor strike will impair its gold production until it is resolved and, I suspect, will see its AISC rise after since it seems the unions will not back down easily.

Sibanye’s labor issues are its seemingly never-ending source of difficulties. The firm was struggling with strikes when I covered it two years ago, and while COVID lockdowns temporarily slowed this unrest, the core issue remains. From a long-term standpoint, these strikes signify that the company may face above-inflation annual labor expense growth. Considering metal prices have been rising faster than inflation, this does not impair Sibanye’s earnings potential so long as it avoids such shutdowns. However, this is not guaranteed and, when combined with South Africa’s instabilities, is a potential risk factor for the firm. In my opinion, these risks are not acutely significant enough to justify SBSW’s extremely low valuation, but if South Africa’s social unrest spirals, Sibanye may be best avoided.

The Bottom Line

Overall, I am bullish on SBSW and believe it is substantially undervalued given its strong cash-flow growth. While there are no guarantees that platinum will catch up to other precious metals, the tumult in Russia and a surge in investors looking for inflation hedges may cause a much-needed rebound in platinum. If so, I would not be surprised to see SBSW rise dramatically in value as it is one of the few established “inflation hedge” stocks available today.

Investors may want to avoid excessive exposure to the stock due to its idiosyncratic risk factors stemming from its ongoing labor issues. The yield curve is now inverted, which is historically quite bearish for most stocks. Precious metal miners such as Sibanye tend to be among the few stocks with strong recession resilience. Still, the social and political tumult that could occur with a global recession could certainly trigger production issues for the company. Still, looking at precious metal mining companies, I believe Sibanye has a superior overall risk-reward profile to its peers, with formidable upside potential.

Be the first to comment