monsitj

After several tortuous weeks of abnormal volatility and a directionless trading environment, stocks are finally poised to enjoy a long-awaited – and overdue – summer rally. Here we’ll discuss what we can likely expect to see in the way of upside potential, as well as the sectors where most of the strength currently resides.

In the last few days, sentiment has been buoyed by a welcome string of positive headlines, including rumors that the Federal Reserve is likely to raise the benchmark interest rate 75 basis points at its meeting next week instead of the widely feared 100 basis point rate hike that was previously expected.

Also boosting trader sentiment was last a consensus-beating U.S. retail sales report, which showed a 1% increase on both the headline level as well as excluding auto sales for June. The report suggested that consumer spending held up in spite of inflation pressures, which Wall Street was happy to hear.

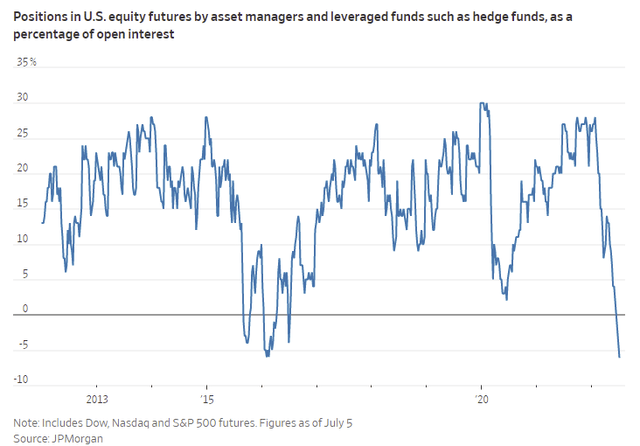

A more likely explanation for the latest rally, however, is short covering – and lots of it. By any number of measures, the equity market is as wound up with bearish trading positions as it has been in years. This consideration by itself has created a tenuous situation in which sellers can be easily spooked into unwinding some of those positions based on positive economic headlines.

For instance, according to a July 15 Wall Street Journal article:

Asset managers and hedge funds recently stepped up bearish bets against U.S. stocks to the highest level since 2016, when fears about a global slowdown were on the rise….The average active investor has steadily pared her stock exposure this year and dropped equity allocations to one of the lowest levels since the start of the pandemic, according to a survey by the National Association of Active Investment Managers, which primarily polled registered investment advisers.

The above-mentioned WSJ article also mentioned that short sellers recently added almost $9 billion to their positions against the popular market-tracking ETF, the SPDR S&P 500 Trust (SPY), over the four weeks through July 15, according to data from technology S3 Partners. This marked the highest amount of short interest against the SPY since early March 2021 (which, incidentally, proved to be a major short-term bottom for the S&P).

It was elsewhere stated by Benzinga that there’s currently $241 billion in aggregate ETF short interest in the U.S. market – a level not seen since at least around the time of the bottom of the 2020 crash. The SPY, moreover, remains the most heavily shorted U.S.-listed ETF.

All told, the historic short interest buildup of the last couple of months strongly suggests that a potentially powerful rally could be ahead in the next few weeks for the major averages – and indeed, has likely already begun.

The areas of the market that look poised to lead the next sustained rally are the energy and healthcare sectors. And of the two, the latter looks stronger right now than the former.

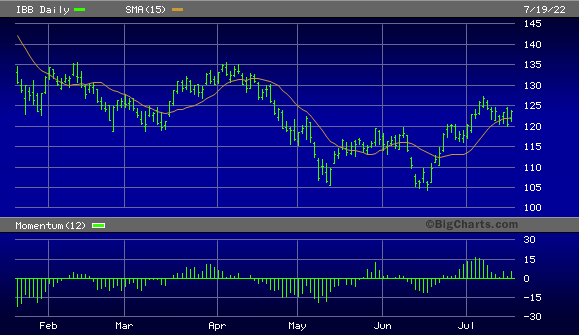

Indeed, if there’s one sector that’s primed to benefit from an extremely “oversold” market condition in the coming weeks, it’s healthcare. Healthcare stocks – particularly biopharmas – are looking increasingly vulnerable to a sustained short-covering rally. Note, for instance, the distinctive bottoming pattern being established in the iShares Biotechnology ETF (IBB) below. It’s also worth noting that the short interest in IBB is an unusually high 14%, which makes it particularly vulnerable to a short-covering rally.

BigCharts

For the last several months, healthcare stocks took it on the chin – particularly the drug stocks – as the new 52-week lows on the Nasdaq in particular were heavily populated with drug developers and biopharma names up until last month’s correction low. That dynamic has since changed, as fewer healthcare names are showing up on the new lows list while many have begun a turnaround based on short covering and other technical factors.

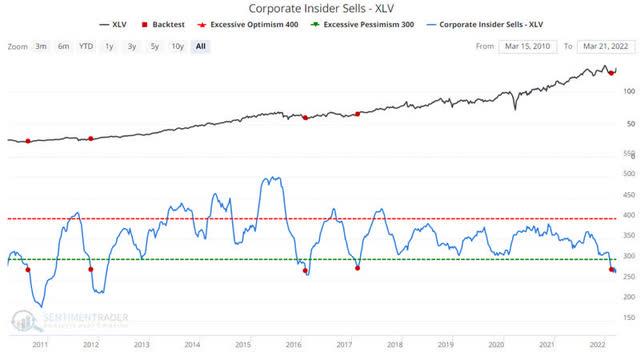

But the rebound in healthcare stocks is about more than just technical considerations. Seasonal factors are also coming into play, as Jason Goeopfert of SentimenTrader has observed. He recently observed that corporate insiders “have greatly pulled back on open market sales, especially in Technology and Health Care sectors,” further noting that seasonality suggests a potentially favorable environment for the health care sector in the weeks and months ahead.

Not only seasonal considerations, but breadth and insider trading factors are also supportive of the healthcare arena in the foreseeable future. The following graph illustrates the collapsing levels of insider selling among healthcare executives in recent weeks, based on the Health Care Select Sector SPDR ETF (XLV).

What’s interesting about this chart is that it was patently clear that insiders were selling heavily in the months preceding the January-February market decline. For months on end, a substantial portion of the daily new 52-week lows on the Nasdaq (and even on the NYSE) were comprised of biotech and pharmaceutical companies. This dynamic has quickly reversed, however, as the healthcare sector has come back into favor among “smart money” traders.

These are becoming increasingly common occurrences as the healthcare sector is fast becoming a favorite among institutional investors during the market’s shift to short covering. For this reason, I’m recommending that aggressive traders who don’t mind the volatility risk focus on healthcare stocks that are showing relative strength versus the S&P 500.

Beyond the likelihood of a sustainable summer rally kicking off right now, the August-to-September timeframe is lurking, which is historically the weakest period of the calendar year for equities (based partly on seasonal factors). There are reasons, particularly rising interest rates, for believing there could be some final selling pressure in late summer before the final low of this bear market is seen, which I believe will occur by early in the fourth quarter.

For now, though, the opportunity to profit from what looks to be a worthwhile relief rally are abundant enough to warrant some exposure to the beaten-down healthcare sector stocks.

Be the first to comment