BernardaSv

Investment Thesis

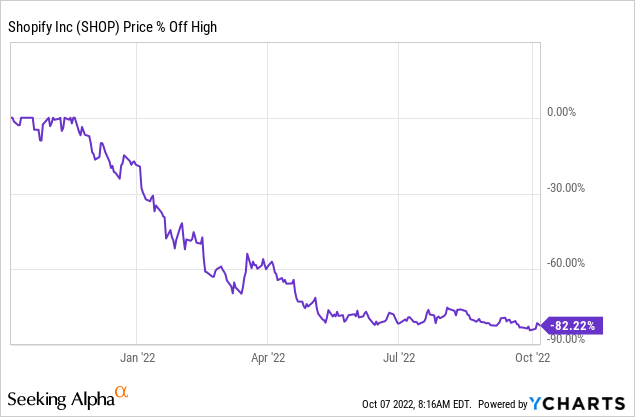

Once a darling of the stock market, Shopify (NYSE:SHOP) shares have fallen an eye watering 80% in 2022 so far, in a market that has brutally sold off many richly valued tech businesses. Over that time, I have read a multitude of articles, reports, and Twitter (TWTR) threads confidently asserting that the growth story for Shopify is well and truly over – but I think it’s time to challenge some of the bearish conventions surrounding this business.

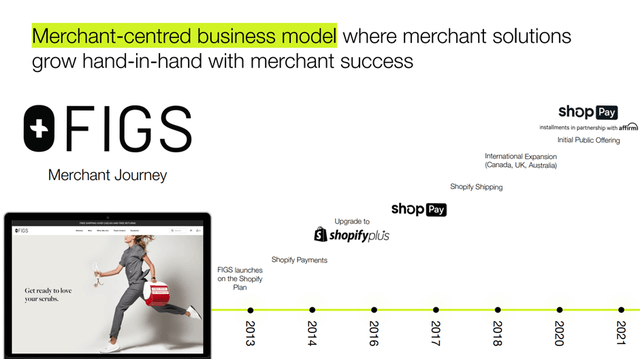

Firstly, I’ll outline my personal investment thesis for Shopify (which can be found in more detail in a previous article). I believe that Shopify has a business model with some incredibly powerful economic moats, with the most notable one being high switching costs. Once a company has set up its ecommerce presence using Shopify’s platform, it’s unlikely to go through the hassle of leaving. Once these companies are all set up, then they often take up more and more of the services offered by Shopify – as demonstrated in its Q1’22 investor presentation with FIGS (FIGS).

Shopify Q1’22 Investor Presentation

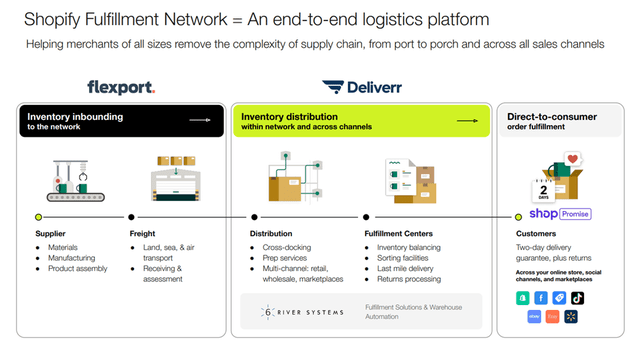

Another extremely attractive trait when it comes to Shopify is its ability to continually roll out and upsell new products and services to its already sticky customers. The latest development is its growing fulfilment network, which could enable Shopify sellers to compete with the logistical brilliance of Amazon (AMZN) by offering two-day delivery guarantees, plus returns.

Shopify Q2’22 Investor Presentation

The opportunity within ecommerce remains large and growing, and Shopify continues to be the platform of choice when it comes to creating an ecommerce presence. It has operated at approximately breakeven free cash flow for years (excluding 2020 and 2021, when it accidentally started oozing FCF), which is no issue because it has a pristine balance sheet. The company also has a founder-CEO with plenty of skin-in-the game in Tobi Lütke, who owns over 5% of all shares in the company. Basically, Shopify ticks a lot of boxes that I look for, and appears to be set up for long-term success.

Yet if the share price is anything to go by, it would appear that investors do not have the same level of optimism as me.

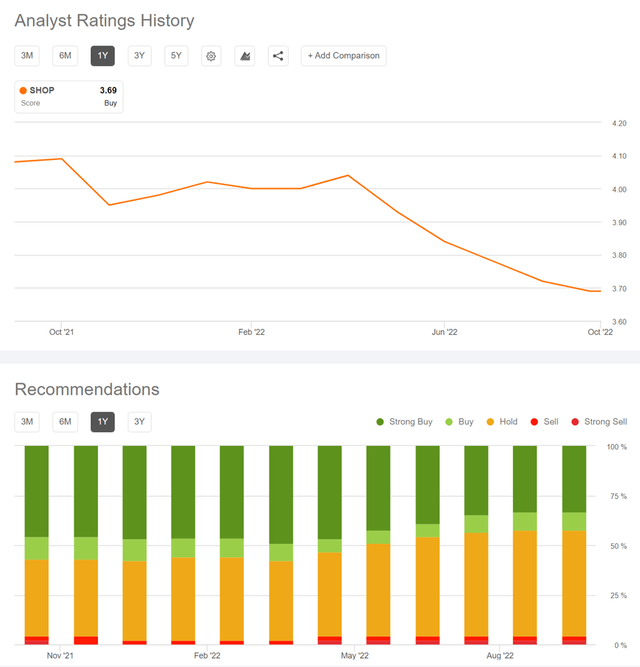

I will say at the outset that peak valuations were insane, but it feels to me as if the share price is currently driving the narrative for Shopify. Taking a brief glance at the changes in Wall Street’s opinion of Shopify over the past 12 months paints a clear story.

Funnily enough, it would appear that Wall Street was a lot more comfortable giving ‘Strong Buy’ recommendations to Shopify back in late 2021, when its market capitalisation exceeded $200B.

Fast forward 12 months, and the current market cap of $40B appears to merit substantially fewer ‘Strong Buy’ ratings. Hardcore value investors may get upset at me for quoting Benjamin Graham in a Shopify article, but here is something that Wall Street seems to have forgotten:

The intelligent investor realizes that stocks become more risky, not less, as their prices rise-and less risky, not more, as their prices fall.

However, there is a time when this is not necessarily applicable: if the share price is falling due to a failing business. Given many of the bear arguments surrounding Shopify, investors would be forgiven for thinking that this was a company in disarray, with no chance of recovery.

Well, in this article, I plan on dismantling some of the most common bear arguments piece by piece – demonstrating why now truly is the time to be greedy when others are fearful (okay now the value investors are really mad).

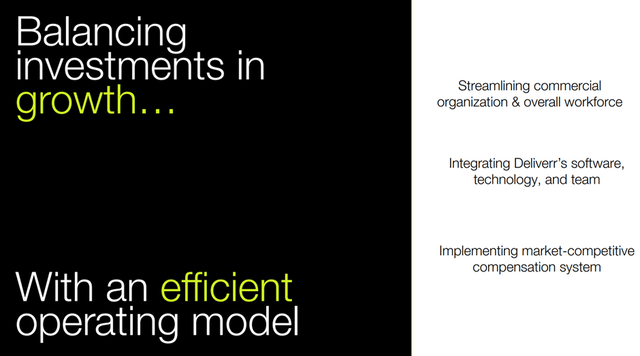

Bear Argument: Slowing Growth

One of the most common bear arguments I see against Shopify is that growth is slowing rapidly for this business – as the following extract from a recent article demonstrates:

The first problem is that growth is dramatically slowing down for SHOP. SHOP grew its revenue in 2021 by $1.68 billion or 57.43% YoY to $4.61 billion from $2.93 billion. After Q4 2019, SHOP’s quarterly revenue increased in 3 of the next 4 quarters in 2020 compared to Q4 2019. SHOP had a similar trajectory in 2021, as each quarter in 2021 represented consecutive QoQ growth since Q4 of 2020.

In 2022, SHOP has broken its trend, and this is now the first time in the past 2 consecutive years where growth is not just slowing, but reversing. SHOP had 7 quarters of consecutive QoQ revenue growth from Q1 2020 thru Q4 2021, and now the revenue growth has disappeared.

There is certainly a fear among investors about Shopify’s growth rates, which is understandable – if you’re investing in a ‘growth’ company, you want it to be growing, right?

Response: Pretends To Be Shocked

Perhaps this is a tad blasé, but of course Shopify’s growth rates have been slowing down in 2022. The last few years have been extraordinary for ecommerce businesses, as they saw a boom in 2020 courtesy of lockdowns, with this boom continuing into 2021 thanks to a combination of lockdowns and an overheated economy.

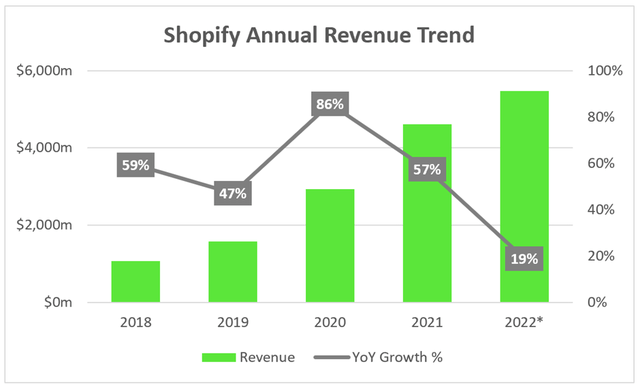

As can be seen in the below infographic from Insider Intelligence, YoY growth rates for US ecommerce in 2020 and 2021 were 36.4% and 17.8% respectively – quite staggering figures!

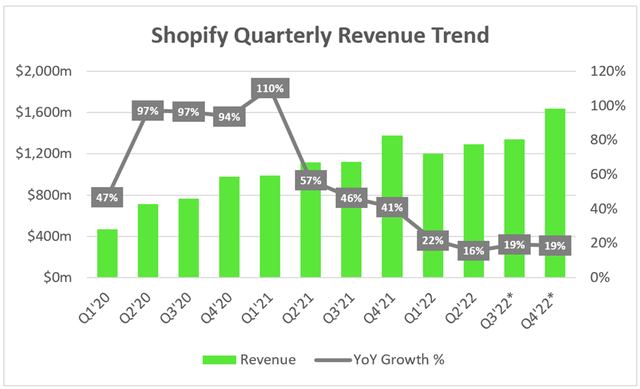

Now take a look at that figure for 2022: a measly 9.4%, indicating a huge slowdown from the boom of 2020 and 2021. Yet nobody should be surprised by this; the economy of 2022 has inflation running rampant, an overhanging threat of a recession, and US consumer confidence hitting record low in 2022. Unsurprisingly, this host of headwinds are all reflected in Shopify’s revenue figures below – with analysts’ estimates for Q3’22 and Q4’22 included.

Shopify / Investing.com / Excel

In fact, Shopify’s revenue trends basically tell the story of the last few years for ecommerce: an astounding 2020 with momentum carried into 2021, but a rapid deceleration as the economy goes from a boom to a recession. But when looking at the annual revenue figures, it’s clear that Shopify’s forecasted FY22 growth rate of 19% greatly outpaces the 9.4% US ecommerce growth forecasted by Insider Intelligence.

Shopify / Investing.com / Excel

Simply put, there are a number of headwinds facing Shopify’s revenue growth that are very much out of the company’s control. Despite these, and coming off the back of some astounding growth years with difficult YoY comps, Shopify continues to substantially outperform the ecommerce market in terms of growth.

To me, this demonstrates the growth slowdown to be very much a macro issue – and once macro sorts itself out, and Shopify gets some nicer YoY comps in FY23, then I think investors could be in for a very pleasant surprise. As Shopify has shown over the years, this is a high-quality business with plenty of growth in the tank; I don’t think that growth is anywhere near finished yet.

Bear Argument: Uncontrolled Spending and Poor Profitability

One recent article spoke a lot about Shopify’s ‘Terrible Unit Economics’, highlighting the excessive spending from Shopify on its operating costs compared to its revenue and gross profit.

Before going into this, I would like to point out that I have complete respect and admiration for anyone who is willing to publicly state & explain their investment stance on companies, especially fellow Seeking Alpha authors. I may use other articles in this piece in order to illustrate my bullish counterarguments, but I can always see the point of view of my fellow authors.

With that said, lets take a look at an extract from the article:

That is looking at Shopify’s gross profit as compared to its R&D + Sales and marketing expenses. Thus, we’re only talking about costs related to attracting new clients and improving the platform. This calculation doesn’t include general overhead, interest, taxes, losses on bad transactions and so. Just R&D + marketing spend versus gross profit.

In Q2 of 2021, Shopify earned a total gross profit of $621 million. Against that, it had $385 million of R&D + sales and marketing expenses, leaving almost $250 million to the good to take care of Shopify’s other costs.

In Q2 of 2022, the picture dramatically darkened. Gross profit rose a paltry 6% to $656 million. Meanwhile, R&D and sales and marketing expenses absolutely exploded to $673 million. This left Shopify running at a loss even before getting to basic overhead, taxes, and other such matters.

Needless to say, when you increase your sales and marketing budget 62% year-over-year and R&D expenses surge soar 89%, it’s utterly inexplicable and unacceptable to get a mere 6% increase in gross profits as a result in my opinion.

It’s a compelling argument, and a similar one that I have seen many times; so, should investors be fazed?

Response: Short-Term Pain

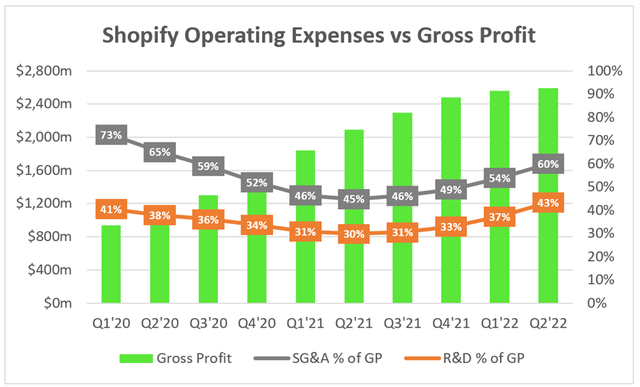

There are a few different things here that I’d like to unpick, which should help demonstrate why I’m not overly concerned about this seemingly incontrovertible point. Let’s start by taking a look at how this comparison is playing out on a trailing 12-month basis over the past few years.

Firstly, the comparison to gross profit growth rates in order to make a bear case point is clever; in reality, the comparison of SG&A (sales, general and administrative) should go against revenue in order to judge how effective Shopify’s sales are. Combine that with the fact that gross profit margins have been falling over the past few quarters, driven by a greater share of revenue coming from Shopify’s Merchant Solutions (this is a good thing, as these are the ‘upselling’ products) as well as increased investments in cloud infrastructure, and lower margins in Shopify Payments due to merchant and card mix changes. It’s worth highlighting that the Merchant Solutions gross profit remains higher than it was in FY19, despite the ongoing headwinds, and I believe this margin will continue to expand over time as Shopify continues to scale up.

Onto the increasing expenses, and it’s clear from the above chart that, from Q3’21 onwards, both SG&A and R&D continued to eat up more and more of Shopify’s gross profit. Personally I think it’s driven by a combination of two things: the decline in gross profits due to lower margins and reduced growth rates (which in my view are driven by temporary macroeconomic headwinds), and the increased reinvestment into Shopify, including substantial hiring.

It was announced in July that Shopify would cut about 10% of its workforce within recruiting, support, and sales across the entire company. CEO Lütke posted his email to employees online, and it outlined exactly why Shopify made the decision:

Before the pandemic, ecommerce growth had been steady and predictable. Was this surge to be a temporary effect or a new normal? And so, given what we saw, we placed another bet: We bet that the channel mix – the share of dollars that travel through ecommerce rather than physical retail – would permanently leap ahead by 5 or even 10 years. We couldn’t know for sure at the time, but we knew that if there was a chance that this was true, we would have to expand the company to match.

It’s now clear that bet didn’t pay off. What we see now is the mix reverting to roughly where pre-Covid data would have suggested it should be at this point. Still growing steadily, but it wasn’t a meaningful 5-year leap ahead. Our market share in ecommerce is a lot higher than it is in retail, so this matters. Ultimately, placing this bet was my call to make and I got this wrong. Now, we have to adjust. As a consequence, we have to say goodbye to some of you today and I’m deeply sorry for that

Firstly, I do appreciate a CEO who can hold their hands up and admit to making a mistake. Furthermore, this was a tough blow for a lot of Shopify employees, and my sympathies are with those who lost their job as a result of this decision.

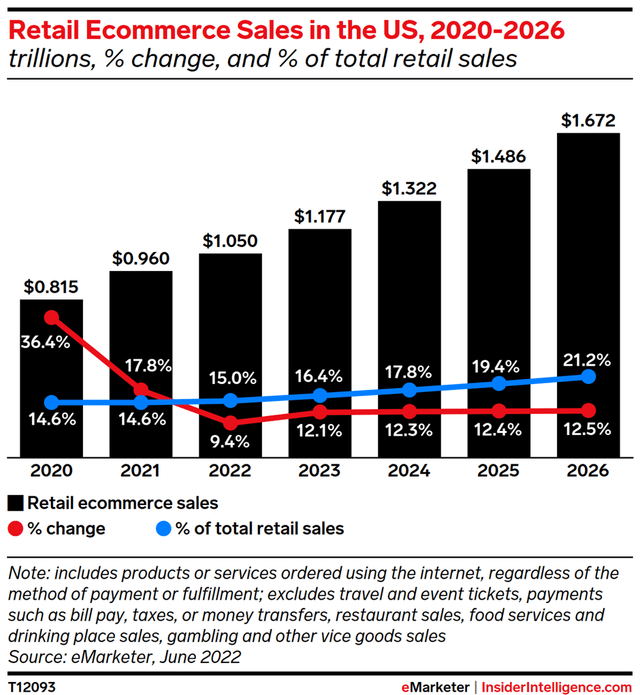

The explanation from Lütke certainly goes some way to explaining why costs have continued to rise at a more extreme rate than revenues. Shopify was preparing for continued rapid growth post-Covid, but the exact opposite happened – resulting in a substantial disconnect between the number of staff and the revenue the company was bringing in.

I understand management’s decision to hire aggressively in 2021; with a huge opportunity in front of it, the last thing Shopify would want is to be left severely understaffed and unable to capture as much of this market as possible. Since this continuation of rapid growth did not happen, and Shopify as a result decided to cut 10% of its headcount, I can see the current disconnect being short-term only. Once the fall in expenses from the headcount reduction plays out, and Shopify regains some better YoY growth rates into FY23, then I expect to see this trend reverse.

Shopify Q2’22 Investor Presentation

Also, investors should not forget that Shopify is a company that likes to reinvest virtually every dollar of gross profit back into the business, and for good reason. Investing a ton into sales makes sense when you have an extremely sticky platform; customers might cost a fair bit to acquire, but they can have such substantial lifetime values, especially when you consider the length of time they’ll use Shopify for combined with the fact that they’ll likely take up more and more other Shopify products.

In short, I’d probably make this exact same point if I were to write a bearish article on Shopify – but I think it is overemphasizing the short term, and ignoring both the company-specific decisions and macroeconomic climate that should cause this trend to reverse within the next year.

Bear Argument: Heavily Overvalued

The final bear argument that I’ll look at relates to valuation, and this is probably the most popular argument against Shopify. Once again, I’ll take an extract from a previous article which I feel sums up investors’ feelings towards Shopify’s valuation:

Based on the current analyst forecasts, Shopify will earn just 5 cents per share in 2023 and 16 cents per share in 2024.

At those levels of earnings, Shopify would be trading at 532 times ’23 earnings and 171 times ’24 earnings. This still seems to be a bubble valuation for a company whose revenue growth has come down to below 20% per year going forward.

Sure SHOP stock is down 80% off the highs. And buying a stock at 532x projected forward earnings is slightly better than buying at a 2,000x forward P/E ratio last year. But both are still suboptimal financial decisions.

Now a 532x P/E doesn’t sound too appealing, right? I think that’s the point…

Response: P/E or P/S Ratios Are Both Simplistic and Inadequate

This is probably the easiest bear argument to refute: a price-to-earnings ratio is completely useless when it comes to Shopify. P/E ratios are appropriate for companies who are optimized for profitability, or a least are on the road to it. As mentioned, Shopify is likely to continue reinvesting virtually all its gross profit back into the business in order to get more customers on board and come up with new, innovative products to upsell to them; hence, it is certainly not trying to optimize itself for profitability.

That makes it tough to value, and I see many people talk about price-to-sales ratios… and I truly hate this metric. It fails to take into account the quality of a business, the potential future growth rates, the margins of the business, the potential for future margin expansion, the levels of cash and debt… need I go on?

So, I’ll give it my best shot at a more holistic valuation for Shopify.

Now don’t get me wrong – as with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Shopify is insanely overvalued or undervalued, but it should at least be more useful than an arbitrary P/S or P/E ratio.

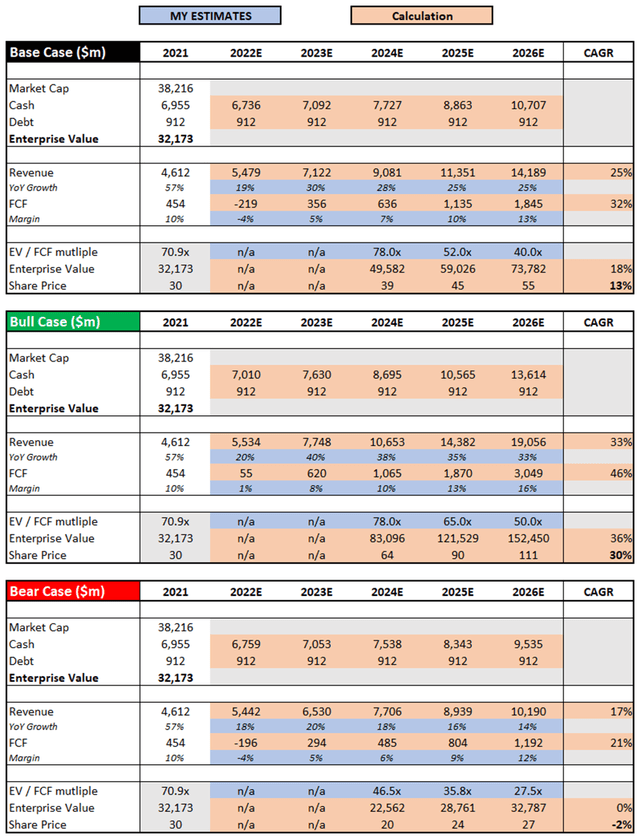

I have changed my valuation model slightly from my previous article, in order to give a better idea of the potential upside and downside in my respective bull and bear case scenarios.

In my model, the base case scenario is effectively my minimum expectations for Shopify over the upcoming few years. I have stuck with analysts’ consensus estimates for 2023 revenues, and have assumed a rebound in YoY growth in 2024 as the economy recovers a bit and Shopify faces much less difficult YoY comparisons. Given that Shopify’s revenue CAGR from 2016-2021 was 64%, and there is still a huge growth opportunity ahead, I don’t think my assumed base case revenue CAGR of 25% is unreasonable – and, as I show in my bull case, I see a future where Shopify exceeds it.

I have also assumed that free cash flow begins to return and grow over the upcoming years, particularly as 2022 highlighted the importance to management of showing some form of margin expansion. Given the nature of Shopify’s business, it certainly has room to grow margins with scale. I’ve also assumed that the total number of shares outstanding over the period will increase by ~19%, as Shopify loves its stock-based compensation, and I have used what I believe to be an appropriate EV / FCF multiple.

Taking a look at my bull case scenario, I assume that Shopify can return back to strong growth following an economic recovery and a normalization of ecommerce growth trends. It has a habit of continually rolling out new products and services, which I believe will lead to much higher revenue growth, achieving a CAGR of 33% through to 2026. Likewise I have assumed slightly better margin expansion, as 2020 and 2021 showed that Shopify can be a free cash flow machine when scale is on its side.

My bear case scenario essentially assumes the complete opposite; that a recession continues to severely hamper growth, and the current rut that Shopify appears to be in ends up being prolonged. This is a good time to point out that most risks associated with investing in Shopify have been covered by the bear case arguments within this article, and I think my bear case valuation demonstrates that there is a future where Shopify may not succeed, and investors will be stung if this future transpires.

Put all that together, and I can see Shopify shares achieving a CAGR through to 2026 of (2%), 13%, and 30% in my respective bear, base, and bull case scenarios. In short, I believe the current share price represents an attractive entry point for a company that should excel over the upcoming decade, once these cloudy skies have cleared.

Bottom Line

Sometimes in investing, price truly can drive the narrative. I believe that happened with Shopify shares one year ago when they were skyrocketing, and it is happening now following their fall from grace.

Yet amongst all the negativity, I believe there is an incredibly compelling case to be made for Shopify as a great long-term investment. In my eyes, the arguments touted by bearish commentators are obviously temporary macro headwinds – about as obvious as the temporary macro tailwinds Shopify saw in 2020 and 2021.

Were the bears correct a year ago?

Absolutely.

Are they correct now?

I think you can guess my answer.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment