JHVEPhoto/iStock Editorial via Getty Images

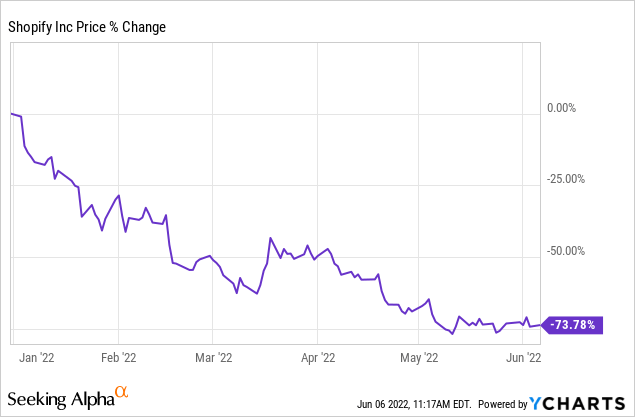

Shopify (NYSE:SHOP) fell nearly 12% on Friday despite there being no major news for the company. This is due to the strong jobs report and slowing revenue growth developing a bearish thesis among investors. Shopify grew massively during the pandemic as consumers were forced to stay at home and spend their stimulus checks. Now that lockdowns are over almost everywhere, the demand for e-commerce is slowing dramatically and Shopify is feeling the pain. Furthermore, the strong jobs report is giving the Fed the evidence needed to continue raising interest rates, which hurt strong growth companies like Shopify. The company is expecting to vote on a 10-to-1 stock split on June 7, however, it has received some backlash due to one of the provisions giving CEO Tobi Lutke too much voting power. Investors need to consider if this criticism is deserved, as well as consider rising interest rates and many other factors, before jumping into the stock.

Why Did Shopify Drop So Much?

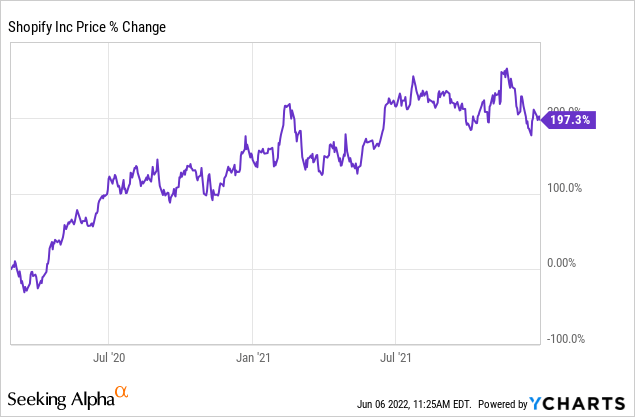

Investors all across the market are assessing current macroeconomic and microeconomic trends to come to a conclusion about Shopify, and that conclusion appears to be bearish. The first key event was the company’s poor first quarter report. Although revenues grew to $1.2 billion, which is a Y/Y increase of 22%, it’s far below the previous year’s growth rate of 110% as well as below consensus analyst estimates of $1.24 billion. The company also recorded a huge net loss of about $1.4 billion caused by losses in investments and other non-operational losses. Excluding these losses, Shopify still only recorded an adjusted EPS of $0.20 which is far below analyst estimates of $0.60 per share. The slowdown of the company’s fundamentals is coming from the fading pandemic, which severed as a strong tailwind for the company. As consumers were locked inside and stores were closed, people would spend their new stimulus checks on e-commerce items. This allowed Shopify to improve its fundamentals dramatically and cause the stock’s price to gain over 200% throughout the pandemic. Now that stores are reopening and stimulus checks are no longer coming, Shopify stores are seeing much less traffic.

The other major reason why Shopify’s stock fell hard was because of the strong jobs report on Friday. Payrolls increased by 390,000 in May, above estimates of 328,000. Although this is good news for the U.S. economy, it’s bad news for growth stocks like Shopify. The strong jobs report serves as evidence for the Fed to raise interest rates at a faster rate than first expected. This would mean serious trouble for Shopify as higher interest rates affect a company’s intrinsic value through valuation methods that take into account the time value of money, such as the discounted cash flow model. Furthermore, rising interest rates cause some investors to move out of riskier assets and into safer ones, including bonds now that the coupon rates are rising higher. If the economy continues to show signs of a strong recovery, the Fed may decide to raise interest rates quicker to combat inflation, causing the stock to drop even lower

The Upcoming Stock Split and Its Controversy

Shopify shareholders will hold a vote on June 7 to pass a 10-to-1 stock split. Normally, stock splits are favored by investors because it gives more investors access to buy shares, as well as having major success in the past for increasing shareholder value like Tesla (TSLA) and Apple (AAPL). However, Shopify’s stock split is receiving some criticism because of an added provision that would create new founder shares for CEO Tobi Lutke. These new founder shares will give Lutke 40% of the total voting power when combined with his current Class B holdings. These shares are nontransferable, would remain in place indefinitely, and would sunset if Lutke stopped leading the company or his total ownership dropped below the equivalent of 30% of the Class B shares.

This is concerning to many investors because it could cause the minority shareholders to not be represented in future votes and give Lutke and the board extreme power to run the company. Many proxy advisory companies such as Institutional Shareholder Service, or ISS, and Glass Lewis to speak out against the provisions. ISS recently recommended shareholders vote against the founder share proposal and stated:

Market best practices generally call for a following of a one share, one vote principle, with a view to alignment between economic interest and voting power at a given company… [The provision] requires minority shareholders to effectively embrace a multiple class share structure for even longer than envisioned.

Glass Lewis also recently came out against the founder shares provision and stated the company is limiting the rights of its smaller investors, leading to “inadequate protection” of the minority shareholders.

Although these firms are recommending small shareholders vote against the provision, it will still be difficult for it to be rejected as Lutke and the board of directors support the new shares. The only clear way this provision will not be passed is if large institutions vote against the provision. Currently, roughly 70% of the outstanding shares are held by institutions, and this could give the opposition the necessary voting power. Normally, these institutions use proxy advisory firms to cast votes during meetings. For investors who also oppose the founder shares, this is likely good news. Many of the large institutions use ISS, Glass Lewis, and other firms to cast their votes and since these firms are speaking out against the provision, it could mean they have enough power to reject it.

It’s important to note that the process for approving the founder shares and the overall stock split are two different votes. This means that even if Lutke’s founder shares are rejected by the shareholders, the 10-to-1 stock split will most likely still happen regardless.

Reiterating My Previous Thesis

In my previous article covering Shopify, my thesis claimed the company is prioritizing long-term profits over short-term returns. This is because in the short term, the company is facing hardships with rising interest rates and slowing fundamentals, as well as high costs as it reinvests to improve its logistics and merchant solutions.

With the acquisition of Deliverr, Shopify will be able to improve its shipping capabilities as Deliverr currently completes more than 1 million orders per month. Furthermore, the company introduced Shop Promise which allows merchants to offer quicker and more reliable shipping, as well as verification badges to ensure trustworthiness. Although this will allow Shopify to improve its long-term health, it will suffer in the short term as costs increase drastically. This will likely cause an even deeper strain on the company’s fundamentals and drive the share price lower in the upcoming periods.

On the bright side, the company’s Merchant Solutions segment is growing rapidly and becoming the key driver for revenue. Since last year, the Merchant Solutions segment has increased its revenue by 28.6% while Subscription Solutions has only grown by 7.5%. The higher growth is due to improvements to Shopify Payments and Shopify Capital. The gross payment volume penetration of Shopify Payments has increased from 46% to 51% in the first quarter of this year. Shopify Capital also is seeing major strides with total Merchant Cash Advances up 12% to $346.7 million. Although both of these will cause a financial strain in the short term, they will allow more merchants to improve their stores on the platform and further solidify Shopify as a long-term leader in e-commerce.

Valuing Shopify Stock Before and After the Stock Split

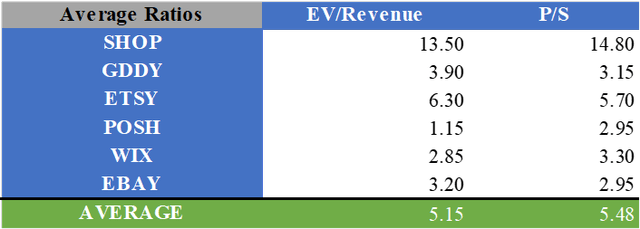

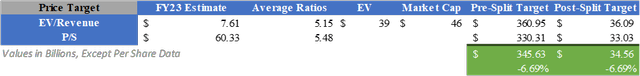

It’s important to give a fair value for the stock for both before and after the stock split. By using consensus analyst estimates for FY23 and multiplying them by the average multiples for EV/revenue and P/S of Shopify and its competitors, a pre-split fair value of $345.63 can be calculated after adjusting for the company’s cash and debt. This converts to a fair value of roughly $34.56 post-stock split and implies the stock is just about at fair value, with an implied downside of only 6.69%.

What Does This Mean for Investors?

Shopify stock fell nearly 12% on Friday due to investors developing a bearish. The bearish thesis comes from macroeconomic and microeconomic events involving the slowdown of e-commerce traffic and the possibility of faster interest rate hikes leading to uncertainty for the company’s future. The company is undergoing a vote for a 10-to-1 stock split on June 7, but an added provision that gives CEO Tobi Lutke founder shares is scaring investors as he would have 40% of the total voting power. Many proxy advisory firms are speaking out against this provision as it may cause smaller shareholders to be unrepresented in the future. It may be possible for this provision to be rejected as large institutions use these proxy advisory firms to cast their votes, which will likely be against the provision. Finally, I will reiterate my current thesis that the company is prioritizing long-term growth over short-term returns and belief that stock is around fair value. With all of this in mind, I will restate my Hold rating for the stock.

Be the first to comment