Sitthiphong/iStock via Getty Images

Introduction

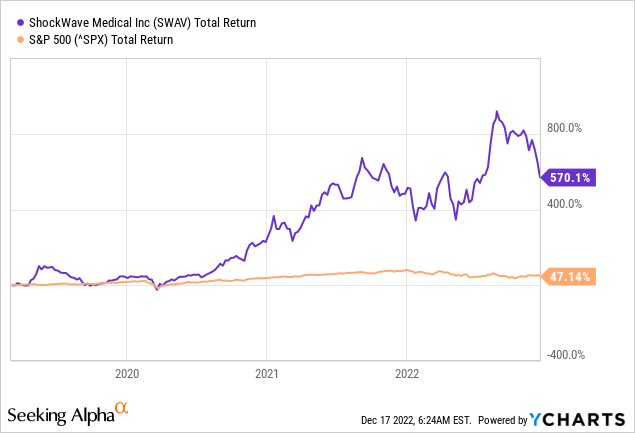

Investors who bought ShockWave Medical (NASDAQ:SWAV) stock during the IPO in early 2019 have experienced a massive 570% share price growth, representing a strong 67% annual growth rate. Share price growth is 523% higher than that of the S&P500. ShockWave is a growth stock whose earnings grew 90% annually over the same period. The company is reinvesting profits to achieve further growth. The company is also in a growing market. The projected revenue for 2022 is $487 million, while the total addressable market is a whopping $8.5 billion. As a result, the company’s market share is about 6% of TAM, and is gaining significant market share. The company clearly has a competitive advantage over its competitors.

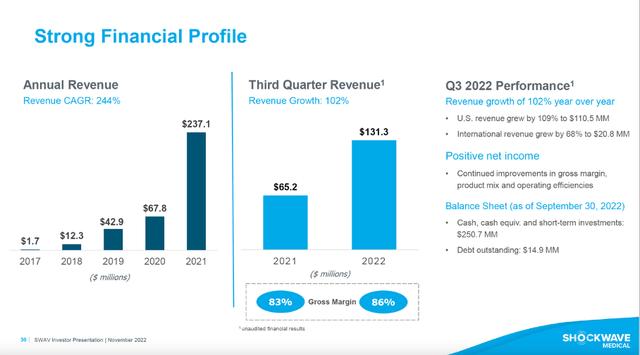

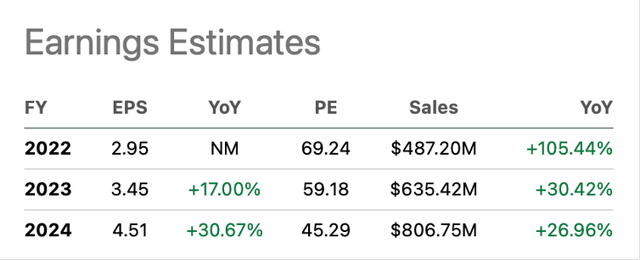

Revenues are expected to increase to $807 million for fiscal year 2024 (average annual growth rate of 28%), the valuation numbers look favorable compared to historical benchmarks but also compared to other growth stocks, and the huge gross margin of 86% makes the company highly profitable. This makes the stock worth buying.

Safest Technology To Treat Calcified Plaques In Vascular Diseases

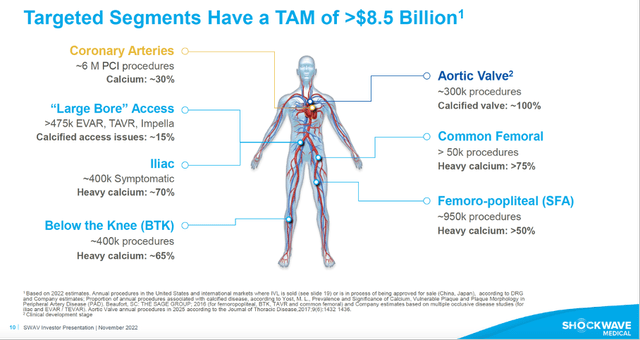

ShockWave Medical is a medical device manufacturer, specifically the development and sale of intravascular lithotripsy technology for the treatment of calcified plaques in patients with peripheral, coronary and heart valve disease.

The company supplies C2 catheters for the treatment of coronary artery disease, S4 catheters for the treatment of PAD below the knee and M5 catheters for the treatment of PAD above the knee. The total market for this segment exceeds $8.5 billion.

TAM more than $8B (SWAV 3Q22 investor presentation)

ShockWave Medical’s innovative and safe method of cracking calcium in arteries will help increase market share.

Take market share (SWAV 3Q22 investor presentation)

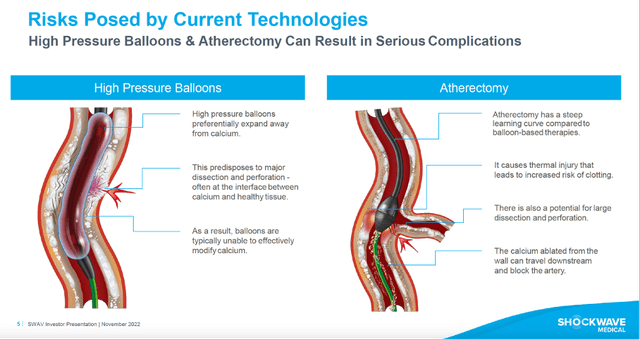

Coronary artery disease is a common problem, as ~6 M PCI procedures are performed. Risk groups include age, diabetic patients, renal failure, and hypertension. Arteries become narrowed due to the progressive growth of plaques. The goal is to open this narrowed artery, but the formation of calcium in the arteries can hinder this treatment. The formation of calcium causes further complications and an increased risk that the treatment to open the arteries will fail. Current techniques to remove calcium, such as high-pressure balloons and atherectomy, have a high-risk profile.

Risk posed by current technologies (SWAV 3Q22 investor presentation)

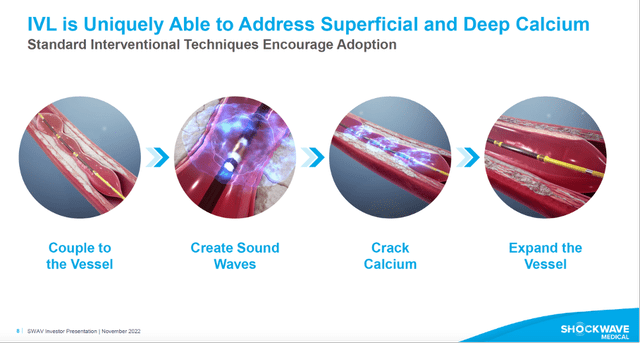

ShockWave Medical uses lithotripsy, this method has 30 years of success in removing kidney stones and uses sonic pressure waves to crack the calcium without damaging soft tissue. This method has an excellent safety profile.

Method to crack calcium (SWAV 3Q22 investor presentation)

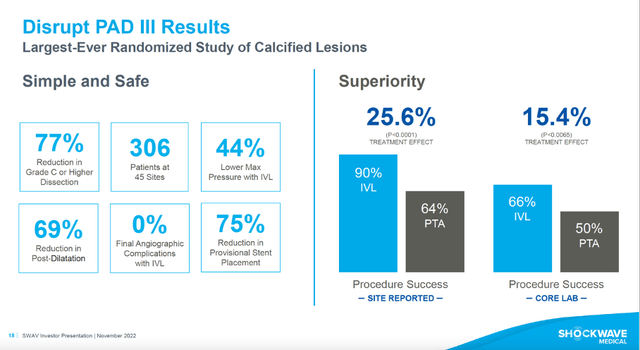

This innovative technology is superior to traditional methods. The treatment effect is 90% compared with 64% for PTA methods, offers reduced dissections, low complications, and a reduced bailout stenting.

Disrupt PAD III Results (SWAV 3Q22 investor presentation)

Third Quarter Earnings Were Strong

Earnings during the third quarter were strong as the company’s revenues increased 102% year over year. The company is highly profitable with a gross margin of 86% for the quarter. Net income was positive due to improvements in product mix and operational efficiency. The company has net cash of $235 million.

Strong financial profile (SWAV 3Q22 investor presentation)

The Seeking Alpha SWAV ticker page shows that 6/6 analysts have revised earnings per share upward. Earnings per share is estimated at $4.51 for fiscal year 2024 (forward PE ratio of 45). The PE ratio is on the high side, but as the company grows, margins should improve, boosting earnings per share sharply.

Earnings estimates (Seeking Alpha SWAV ticker page)

A Wells Fargo analyst downgraded ShockWave Medical to equal weight with a price target of $235, still implying 15% price growth. The analyst predicts that the current market price implies revenue growth of 14.3% CAGR from 2022 to 2040 and does not fully reflect the risk of new competitive IVL systems.

ShockWave’s major competitors in the IVL system market are Boston Scientific (BSX), DirexGroup, Dornier MedTech and others. Those companies all have their own technology to crack calcium, methods such as:

- Electrohydraulic

- Ultrasonic

- Mechanical

- Laser

- Pneumatic

While ShockWave Medical uses ultrasonic waves to crack calcium, Boston Scientific uses laser systems. ShockWave’s ultrasound systems are superior to Boston Scientific’s excimer laser systems. The use of excimer coronary laser atherectomy is not as common as intravascular lithotripsy with ultrasound. Laser atherectomy may have less success in severely calcified lesions and is most appropriate for lesions with moderate calcification. Quoted from British Cardiovascular Society:

ShockWave lithotripsy appears set to revolutionise the approach and management of severely calcified coronary lesions. … The future looks promising.

ShockWave Medical’s technology clearly has a technological advantage over its competitors.

Valuation In Line With The General Market

A company with promising products for the future should be well-known to investors. The stock valuation of those companies is often extremely high. To benefit from the rising value of the company, the stock price must be favorably valued. The recent drop in the share price is a good opportunity to acquire the shares at a discount.

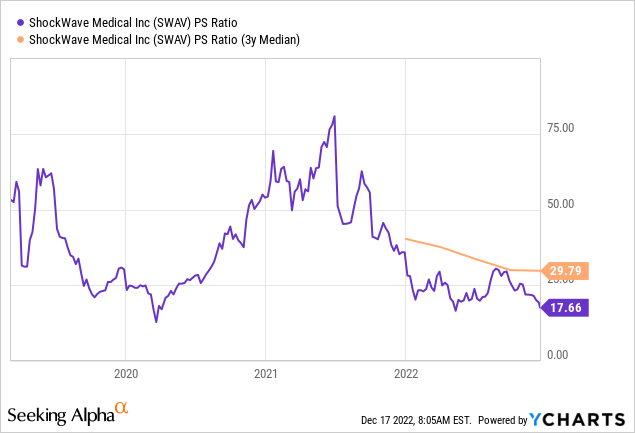

Since ShockWave Medical is a growth stock with strong revenue growth and small profits, I prefer to use the P/S ratio to gain insight in the stock’s valuation. The P/S ratio of 18 is expensive at first glance, but looking at the chart, the ratio is near its lowest level in 2020. Compared to the average, the stock is attractively valued.

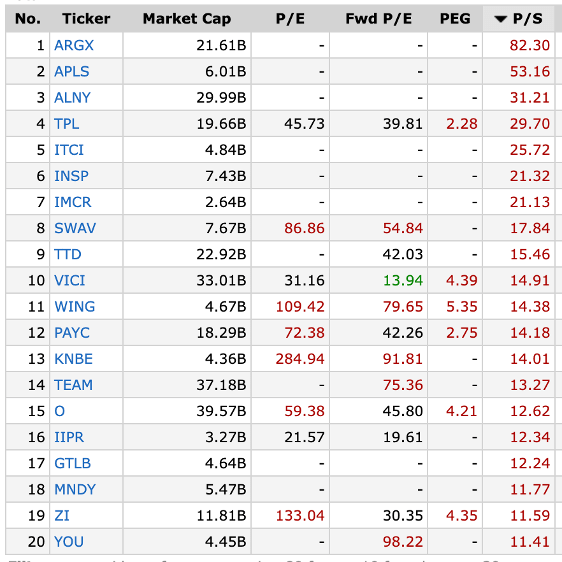

The P/S ratio of 18 sounds pricey, but the high gross margin of over 80% is more than welcome at this high PS ratio value. So how does the stock compare to the overall market? Finviz is used to gain insight in the general market. I filtered the stocks using the following criteria:

- Market cap larger than $2B

- Gross margin over 80%

- Sales growth quarter over quarter over 30%

- Price to sales ratio over 10

The result is a list of the following companies, sorted from high to low PS ratio:

List of stocks from the criteria (Finviz)

ShockWave Medical is the 8th most expensive stock on the list, slightly above the median. One caveat is that the list includes REITs, which typically have a higher PS ratio than other stocks. It is comparing apples to oranges, but it also gives a picture of the company in the overall market. This is important because when interest rates rise (as they are doing now), the stock market tends to decrease in value.

The stock is historically cheaply valued, and the company is averagely valued compared to the overall market.

Conclusion

ShockWave Medical is growing strongly, as evidenced by its astounding stock returns since its IPO. The total market is a whopping $8.5 billion and projected revenue for 2022 is only $487 million. The company is gaining market share because it offers the best-in-class method of cracking calcium in arteries. Several medical articles claim that ShockWave’s technology provides a competitive advantage over others. Their innovative technology by cracking calcium using ultrasound is also superior to traditional methods. The treatment effect is 90% compared to 64% for PTA methods, offers fewer dissections, few complications and less stenting.

Earnings in the third quarter were strong, as the company’s revenue increased 102% year over year. With its high gross margin of 86%, the company is highly profitable. 6/6 analysts on the Seeking Alpha SWAV ticker page have revised upward earnings per share estimates. The stock’s valuation is historically low and in line with the overall market. Since the company clearly has a competitive advantage, strong revenue growth, high growth prospects and an attractive valuation, the stock is worth buying.

Be the first to comment