Danai Jetawattana

Investment Thesis

ShockWave Medical, Inc. (NASDAQ:SWAV) is a medical device company that has obtained approval to market and trade its product in China. I will be analyzing this event’s effects on the company’s financials. I believe the company has shown strong growth in the past five years, and with approval from the Chinese authorities, the company will continue its robust growth rate in the coming years. Despite the high growth rate, I am assigning a hold rating for SWAV, as I think the company is trading at a high valuation and the current price level is not a good entry point in the stock.

Company Overview

SWAV manufactures and develops medical devices which are used in the treatment of calcified cardiovascular disease. The company’s differentiated and patented local delivery of sonic pressure waves for the medicament of calcified plaque, which it mentions as intravascular lithotripsy, is intended to establish new standards of care for medical device treatment of atherosclerosis. With atherosclerosis, the company plans to diversify its services and believes it is an excellent opportunity. The first two indications the business focuses on with the IVL System are occlusive PAD, or the narrowing of the arteries that pass blood to the heart, and CAD, or the narrowing or obstruction of the arteries that convey blood from the heart to the extremities.

Future prospects for the business include the potential treatment of AS, a condition in which the heart’s aortic valve narrows and obstructs blood flow from the heart as it becomes increasingly calcified with aging. Although the total addressable market (“TAM”) for IVL is thought to be over $6.9 billion, the number of interventional operations and the prevalence of severe or moderate calcium differ by artery segment. The company distributes its products in 59 countries through direct sales reps in the United States, Germany, Austria, France, UK, Switzerland, Africa, ANZ, Asia, Canada, South America, and the Middle East.

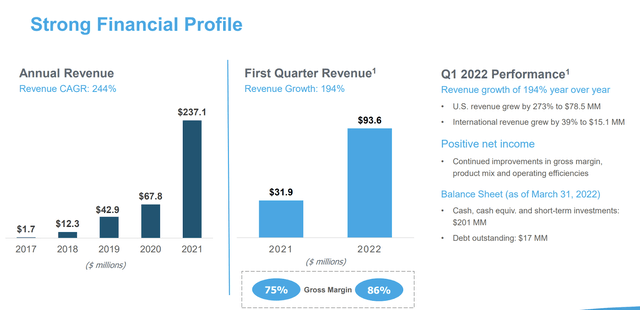

The company is currently in the high growth phase and has managed to grow its revenue at an excellent rate of 244% 5-year CAGR. Last quarter, the revenue grew by 194% and ended with a strong cash position of $201 million.

I believe the growth spree of the company will continue in the coming period as it conducts ongoing clinical programs to expand geographies. It has also received regulatory approval in China for Intravascular Lithotripsy.

Regulatory Approval in China

SWAV and Genesis MedTech formed a joint venture to distribute ShockWave’s products in China. The distribution of SWAV products is accelerated by Genesis MedTech’s Wuxi research and development. The company has recently announced that the partnership has received approval from China’s National Medical Products Administration (NMPA) to promote and trade Shockwave IVL systems with the Shockwave M5 and S4 Peripheral IVL and Shockwave C2 Coronary IVL Catheters in China. The chance of developing coronary artery calcification rises with age, with an occurrence of about 50% in people between the ages of 40–49 years and around 80% in people between the ages of 60–69 years, according to the Chinese Expert Consensus on the Diagnosis and Treatment of Calcific Coronary Lesions 2021 (Expert Consensus Statement 2021). Patients with peripheral arterial disease frequently experience the issue of calcification as well. China had a population of more than 1.4 billion people in 2020, with 50% of them being over the age of 40, as per Statista.

I think with this approval that the company will experience robust growth, as China is untapped geography with a lot of potential demand for IVL System, and it is a milestone for international expansion. I believe the company has the right partner to cater to and accelerate the demand with its research and development.

Doug Godshall, Chief Executive Officer of ShockWave Medical, stated –

Approval in China represents another milestone in the international expansion for Shockwave’s IVL technology. We are very appreciative of the work and the quick regulatory approval by the NMPA – despite the difficult conditions in China in the past months – and its recognition of IVL’s clinical value for patients in China. Genesis MedTech is a perfect partner for Shockwave in China, and this accomplishment underscores the value of its established infrastructure and local relationships. We look forward to our continued relationship as we bring IVL to physicians and patients in China for treatment of arterial calcification.

Financials

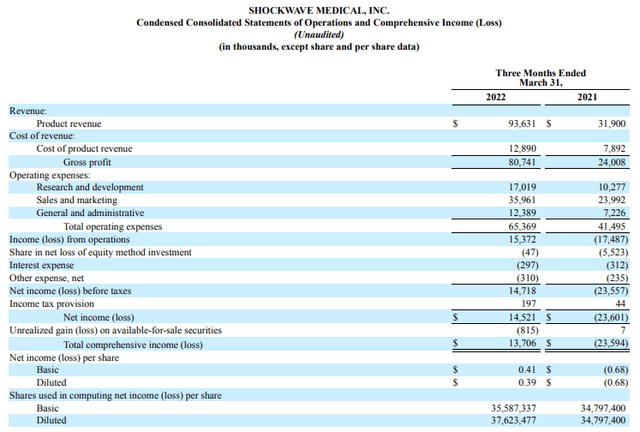

SWAV posted strong Q1 2022 results. The company reported total revenue of $93.6 million, a 194% jump compared to $31.9 million in Q1 2021. The revenue was mainly driven by the launch of Shockwave C2, a coronary product in the United States. The company reported a gross profit of $80.7 million, a solid 233% increase compared to $24.0 million in the corresponding quarter last year. The company’s gross margin increased to 86% from 75% in the year-ago period. The margin expansion was the result of product mix along with improved manufacturing efficiency. The company reported a total operating expense of $65.4 million, compared to $41.5 million, an effective 58% increase.

The increase reflects the increased sales force expansion in the United States. The company’s net income stood at $14.5, an increase of $38.1 million from a net of $23.6 million in Q1 2021. The increase in net income was majorly driven by significant revenue growth coupled with effective cost management. The company reported a diluted EPS of $0.39 in Q1 2022.

Overall, the company posted solid results, showing improvement across segments with improved profit margins. The company provided solid guidance for FY22. The company has revised the guidance for FY22 from $405 million -$425 million to $435million-$455 million, representing 83% to 92% YOY revenue growth. SWAV is on a growth track with multiple product launches and portfolio expansion.

Doug Godshall, President and Chief Executive Officer of ShockWave Medical, stated:

Our growth this quarter was driven by strong execution from our teams across the globe, despite the myriad geopolitical, health and economic challenges that continue to face us all. The exceptional progress that the Shockwave team has made this quarter continues to demonstrate what an important solution IVL has become for patients who suffer from calcified arterial disease. We look forward to continuing to partner with our customers to help them enhance outcomes for their patients.

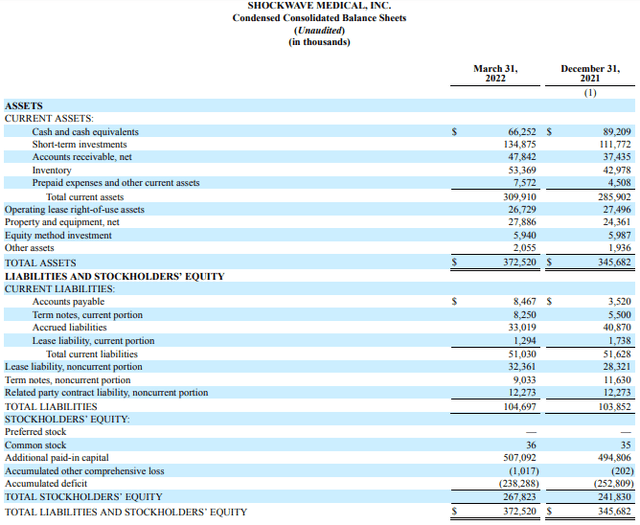

SWAV has cash and cash equivalent of $66 million and short-term liquid investments of $134.8 million. The company doesn’t have any long-term debt, reflecting a strong balance sheet. No long-term debt leaves scope for raising debt in the future without putting much stress on the balance sheet. This will help the company in future expansion and research and development activities.

Quant Rating and Valuation

Seeking Alpha

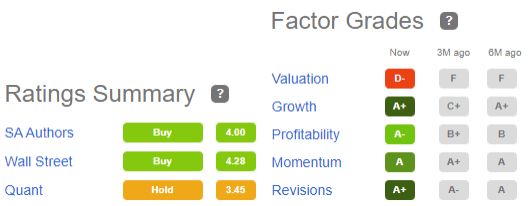

Seeking Alpha has a Quant Rating of hold on SWAV. My thesis aligns with the Quant ratings on all the parameters. The company has shown exceptional revenue growth and profit margins, but the company is overvalued at current price levels. As you see in the chart above, the company has a D- rating when it comes to valuation. Except for valuation, the company has performed exceptionally well in all other segments. I believe the company is on a significant growth track but the current price level is not a good entry point for investors.

SWAV has a market cap of $7.51 billion. The company is currently trading at $209.90, a YTD increase of 9.31%. The company has jumped 25% in last alone. The market has accounted for the exceptional quarterly results, and that can be reflected in the steep share price increase. With the FY22 EPS estimate of $1.88, the company is trading at a superficial PE multiple of 111x. I believe, given the present growth rate of the company, the PE multiple would not be the right parameter to judge the company’s valuation, but even if we calculate the PEG ratio of the firm, it still comes out to be overvalued. The company can perform exceptionally well in the long term, but current price levels are not attractive, and I recommend not taking any fresh position in the stock.

Conclusion

SWAV is on a significant growth track with multiple product approvals and business expansion. The company has experienced a significant improvement in revenue and profit margins. But the most critical factor that stands out is the company’s valuation. Despite the high growth rate across segments, the company is overvalued at current price levels. I think the investors should wait for a correction in the stock price. I assign a hold rating for SWAV after taking into consideration all these factors.

Be the first to comment