vm

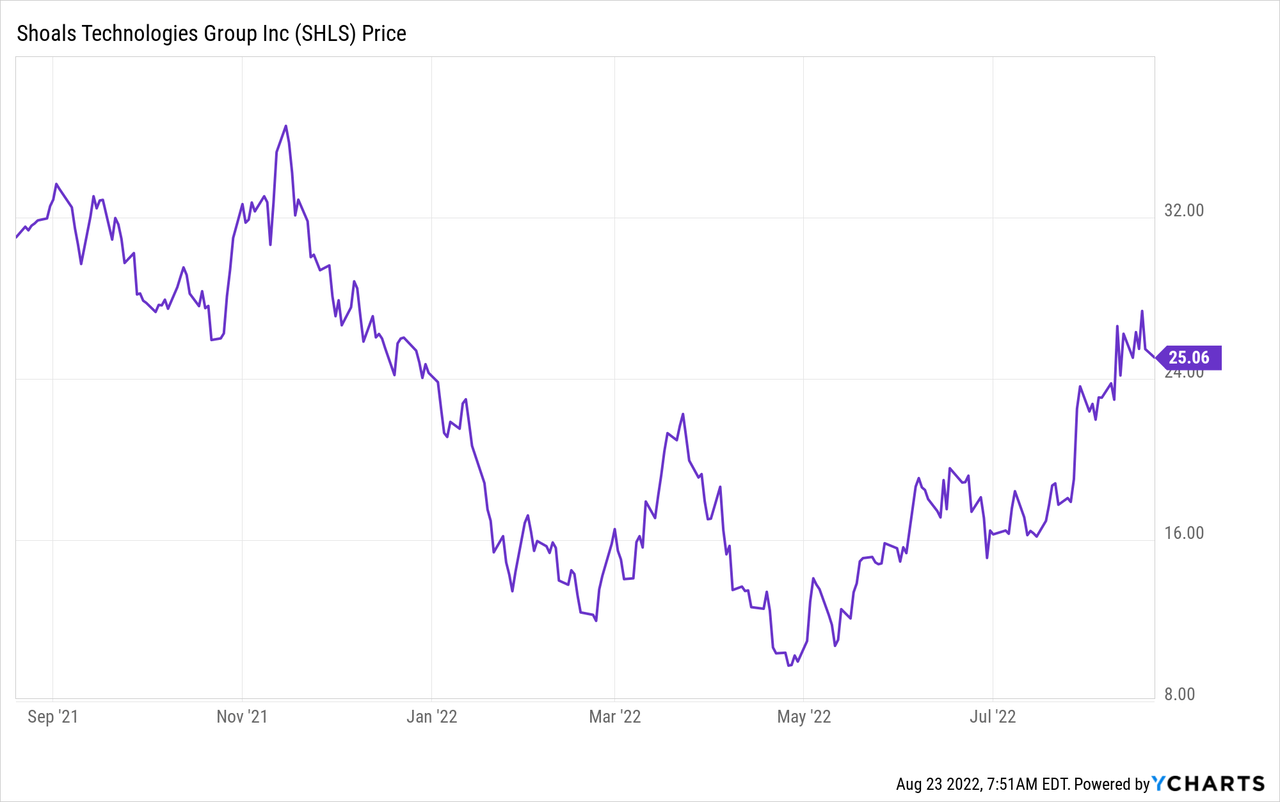

Shoals Technologies Group, Inc. (NASDAQ:SHLS) reported its second quarter results after the bell on Thursday. The results largely met expectations, leading to a relatively muted market response. Since the April lows, the stock price is up 150%, with gains of 11% booked since my last article alone (less than a month ago). Even after this aggressive run-up, I am still bullish on the company as a vital, overlooked enabler of the renewable transition. Shoals is a dark horse in the solar industry.

Q2 Results

Shoals reported revenues of $73.5M (+23.1% Y/Y), while GAAP EPS came to $8.81M or $0.04. Both of those figures increased sequentially. Operating Cash Flow (OCF) was $19M, a record for the company since its IPO. This was primarily a result of a lower working capital impact.

As a quick comparison, in Q1, OCF was impacted by a $38.7M decrease in working capital. On the whole, Shoals produced $17.8M in free cash flow over Q2, bolstering the cash position and allowing management to pay down a small portion of debt. In that regard, this was a rare quarter. Investors should expect the company to predominantly be a cash user rather than a producer as they continue to reinvest for global expansion. However, Shoals is unlikely to see a decrease in working capital to the same extent as in the first quarter. Back on the Q1 conference call, management actually expected to see further decreases in working capital for the following quarters:

I think when we look at our working capital requirements just going through the next two quarters, we see ourselves as a use of working capital really going through Q2 and early in Q3. And as we start to exit Q3 and into Q4, we start to see those working capital needs come down. So as we look out, there may be a short drop in the end of Q2, early Q3, but certainly coming out of that in Q4

This didn’t come to fruition in Q2 as working capital increased by $2.7M.

Shoals’ growth is underpinned by a strong backlog that rose by $25M over the last quarter. This reflected the continued strong demand for Shoals’ suite of solutions. This will continue to build as Shoals expands both internationally and into new segments.

Higher Component Sales and Battery

The growth in Q2, like Q1, was driven heavily by components sales growth. This is reflective of both the growth in new customers and increased shipments for battery storage. Component sales are typically lower margin than full system solutions but are the key starting point for onboarding new customers. A lot of the company’s existing customers use just a few components. Therefore, there isn’t just an untapped opportunity for those who use purely homerun conventional electrical balance of systems (“EBOS”) solutions but also with existing component customers.

77% of revenues still come from higher margin system solutions, which allowed Shoals to achieve a gross margin of 38.9%. In Q2 ’21 Shoals saw significantly higher gross margins of 42.8%, which was due to an exceptionally high mix of BLA (system solution) sales – that quarter gives investors an insight into the type of profitability Shoals could achieve as the EBOS and solar market continues to develop.

Shoals’ move into Battery and electric vehicle (“EV”) storage is part of the company’s plan to expand its Total Addressable Market (TAM) which complements the growth in market share in solar that Shoals is already achieving. The growth contribution of Shoals’ EBOS battery segment is coming off the back of the big push to expand its TAM. Shoals acquired ConnectPV in 2021 as part of this push, and it’s good to see these initiatives starting to pay off as the company ships a number of key components to suppliers.

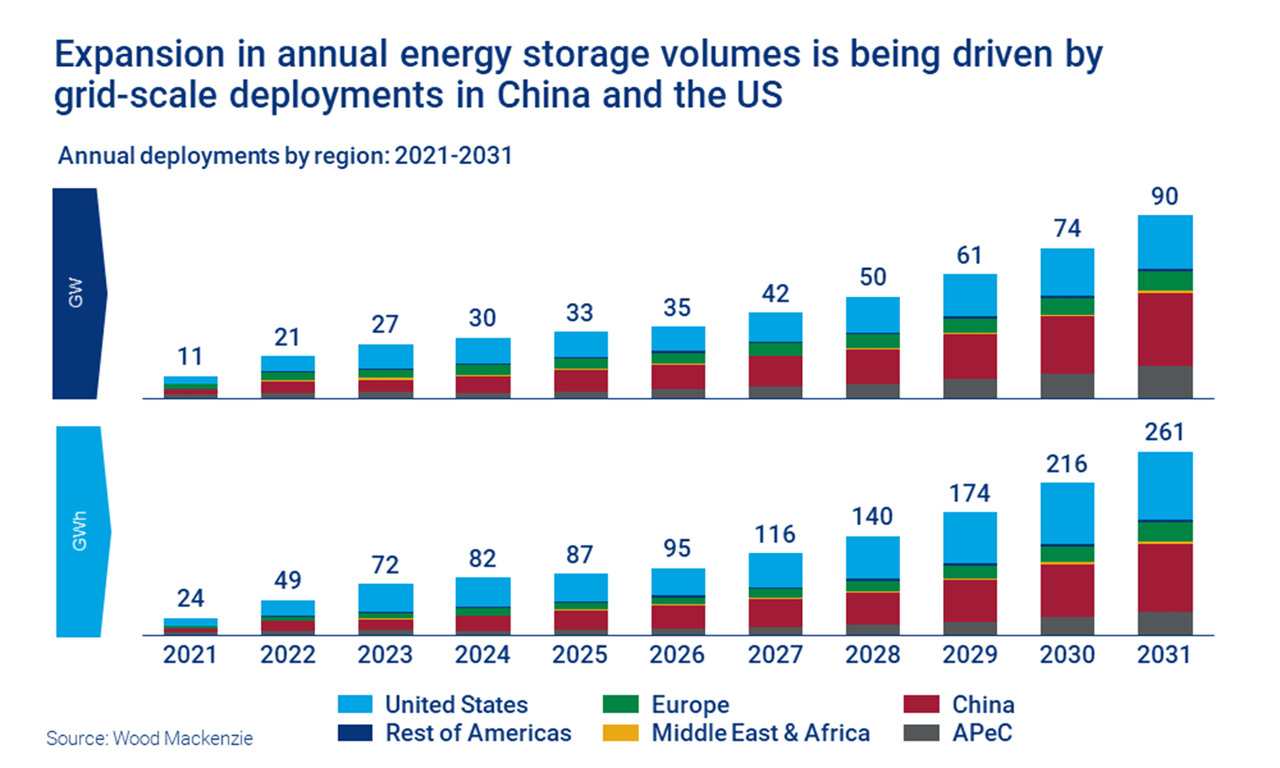

The opportunity in battery storage cannot be understated. In Shoals’ original S1 filing, the company outlined its belief that solar projects with battery storage will spend approximately 55% more on EBOS components than solar projects without it, massively increasing Shoals’ potential sales with those partners. Those more valuable projects (or potential customers) are also increasing in number. 10.2 GW of solar energy projects will be installed or retrofit with battery energy storage in the U.S. from 2021 to 2023, according to Wood Mackenzie, while demand for energy storage will expand nearly nine-fold over the next decade.

Wood Mackenzie

Conclusion

The trend is your friend, and that couldn’t be more true for Shoals. The EBOS manufacturer holds the strongest position in one of the fastest-growing segments in the solar industry. The company’s strong and growing backlog demonstrates the increased demand that the company is experiencing for its suite of solutions. Shoals is benefiting from strong tailwinds at the moment, and they will strengthen moving forward as solar capacity increases across the world and the EV/battery storage market starts to evolve. Buy.

Be the first to comment