magicmine/iStock via Getty Images

A few months ago, I wrote an cautious initiation article on Pulmonx Corporation (NASDAQ:LUNG). After reviewing the company’s reports and financials, I was concerned about the company’s valuation and slow adoption rate. Also, the fact that insiders have been continuously selling shares gave me cause for concern.

Fast forward to today, and the latest Q3 earnings report have validated my concerns. Investors punished the company with a 50%+ crash as the company disappointed on its revenue guidance.

Trading at only ~$50 million EV, I think Pulmonx becomes an interesting take-out candidate. I can envision a larger medical devices conglomerate paying a significant premium to shareholders to acquire Pulmonx and turning it into a profitable business by squeezing out its bloated SG&A. I would rate LUNG a speculative buy at this point.

Brief Company Overview

Pulmonx Corporation is a commercial stage medical device company primarily in the business of selling its Zephyr Endobroncial Valves and the associated screening and management software. The Zephyr Valve is a treatment for patients with severe emphysema, a form of chronic obstructive pulmonary disease (“COPD”).

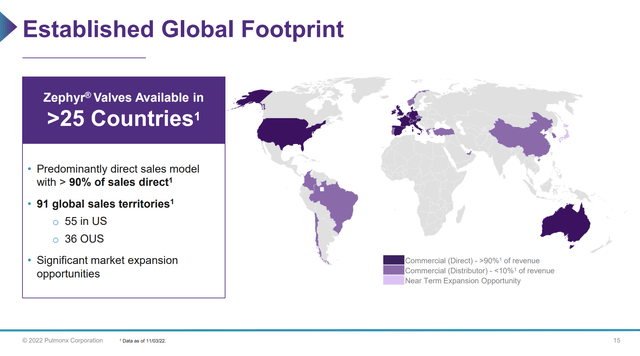

Pulmonx received FDA approval for its Zephyr Valve technology in 2018 and began commercial production shortly afterwards. Pulmonx chose to implement a costly direct sales model to sell its Zephyr valves and associated software (Figure 1).

Figure 1 – LUNG chose a costly direct sales model (LUNG Investor Presentation)

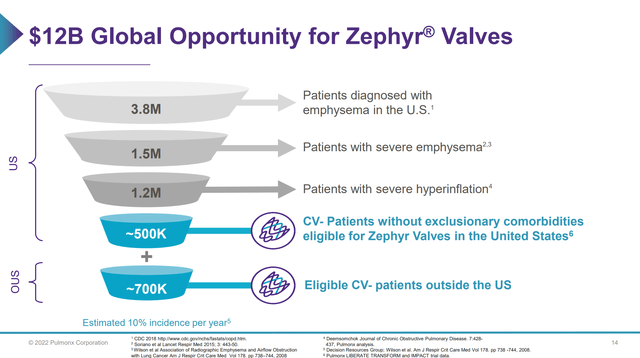

According to Pulmonx management, the Zephyr Valve is a $12 billion market opportunity and it wanted to capture as much of the value as possible (Figure 2).

Figure 2 – LUNG sees a big market opportunity (LUNG Investor Presentation)

Main Concern Is The Growth Rate

My main concern with the Pulmonx story was that its growth trajectory was far too slow compared to its infrastructure buildout. In my initiation article, I wrote:

While the sales ramp up has been disappointing, the company has not slowed down its infrastructure buildout. Pulmonx grew SG&A 26% YoY in the latest quarter, far above the 17% revenue growth. In fact, management expects full year expenses of $100-105 million, a 23% growth rate YoY at the midpoint.

The net result is that the company is not expected to break even in the near term. Even if we assume operating expenses were to be held constant at $24 million (Q1/2022 levels), revenue will have to grow to $131 million to break even, assuming a stable 75% gross margin. Unless Pulmonx can achieve a step change in its sales adoption curve, the company is highly unlikely to break even in 2023 either.

Third Quarter Results Confirm Slow Growth

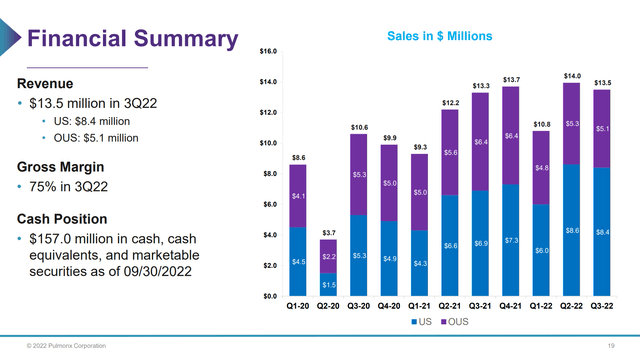

The latest quarterly earnings report did little to assuage my growth concerns. In Q3/2022, revenues for Pulmonx only grew 2% YoY to $13.5 million. In fact, Q3/2022 revenues represented a 4% QoQ decline in revenues, definitely not what investors wanted to see from a ‘high growth’ medical devices company (Figure 3).

Figure 3 – LUNG revenues by quarter (LUNG Investor Presentation)

Pulmonx blamed the weak revenue figures on “a more pronounced summer seasonality effect than has been seen in years past”.

Outlook Not Much Better

In my opinion, the piece of news that really spooked investors and caused the stock to crash more than 50% was its revenue outlook for 2022 and 2023. As part of the quarterly release, Pulmonx lowered the revenue guidance for 2022 to $51.5 to $52.5 million, from $55 to $60 million previously. The company also provided initial guidance for 2023 revenue growth of ~20% on the earnings call.

Given YTD revenues were $38.3 million, this implies Q4/F22 revenues of only $13.2 to $14.2 million, which would be 0% growth YoY at the midpoint. Furthermore, 20% growth in 2023 would suggest ~$62 million in revenues. This figure is a) a bit of a stretch given the implied YoY growth rate of 0% for Q4/F22, and b) not much sequential growth given Q3/F22 annualizes to $54 million and the implied Q4/F22 range annualizes to $52.8 to $56.8 million.

What Could Be Behind The Slow Adoption Rate?

One question investors need to ask is, if the Zephyr Valve technology is so revolutionary and unique, why hasn’t the adoption rate been faster? When Pulmonx first came public, the company blamed the slow adoption rate on COVID-19 impacting surgeries. Now that COVID restrictions are gone, the company is blaming hospital staff shortages. Could the real reason be something else?

I believe there are two main reasons for the slow adoption of the Zephyr Valve technology. First, we must understand that although valve therapy is minimally invasive, it still poses significant risks to patients. For example, according to a Cleveland Clinic Journal of Medicine article reviewing valve therapy, Pneumothorax was a serious complication that occured in 9% to 34% of patients who were involved in 7 clinical studies (5 using Zephyr, 2 using Spiration) on valve therapy. Furthermore,

Other complications included COPD exacerbations, arrhythmia, pneumonia, respiratory failure, empyema, hemoptysis, chest pain, valve expectoration or migration, bronchial trauma, and bronchial torsion. Importantly, death related to postprocedural pneumothorax was reported in some trials.

Therefore, it is understandable that doctors treating physically fragile patients with severe emphysema are hesitant to try valve therapies.

Close Competitor Is A Medical Conglomerate

Also, as I highlighted in my prior article, Pulmonx’s Zephyr Valve is not unique. Olympus Medical, a subsidiary of Japanese conglomerate Olympus Corp. (OTCPK:OCPNY), produces the Spiration Valve, a direct competitor to Pulmonx’s Zephyr Valve. Both Zephyr and Spiration valves are FDA approved and eligible for reimbursement. The difference is, Olympus Medical is a trusted brand name in the medical devices industry with over 100 years of history (Figure 4). I would not be surprised if doctors prefer to use Olympus’ Spiration Valve instead of Pulmonx’s Zephyr Valve.

Figure 4 – Olympus Medical has a long history of minimally invasive products (medical.olympuscanada.com)

Valuation Is Now Reasonable

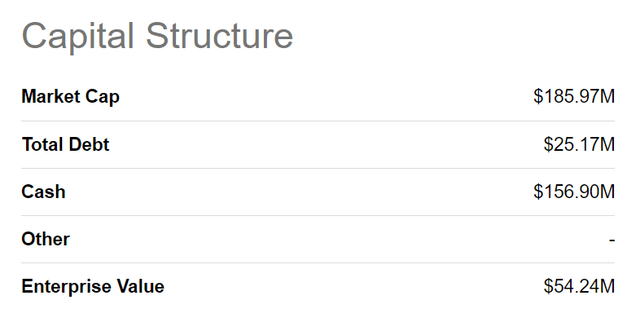

Currently, Pulmonx has a $186 million market cap vs. $157 million in cash and $25 million in debt, for an enterprise value of $54 million. This is a far cry from the $420 million in EV when I first wrote about the company. Pulmonx is now trading at roughly 1x EV/Rev vs. over 7x EV/Rev previously (Figure 5).

Figure 5 – LUNG valuation is now reasonable (Seeking Alpha)

What Is The Endgame?

If the market for pulmonary valves is indeed limited, as suggested by Pulmonx’s inability to gain traction, then management needs to have a serious think about their options. I believe the best course of action is to put the company up for sale, and try to return some value to beleagured shareholders.

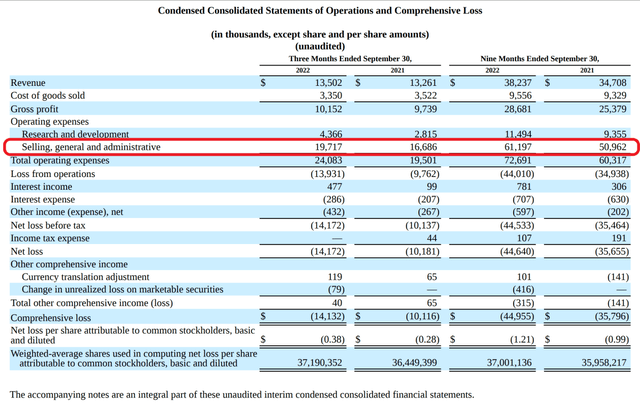

Recall, the company is forecasting operational expenses of $98 to $100 million for 2022. Realistically, successful medical devices companies like Medtronic (MDT) have SG&A as a % of revenues of 35-40%. So if a medical devices conglomerate was selling the Zephyr Valve, they should be spending only $20-25 million in SG&A (assuming $55 to 60 million in global revenues). While Pulmonx’s R&D expenses may need to be maintained, the company’s $80+ million in run-rate SG&A ($61.2 million annualizes to $81.6 million) can probably be cut by 3/4 by a potential acquiror (Figure 6).

Figure 6 – LUNG has a bloated SG&A structure (LUNG Q3/2022 10Q Report)

I can definitely see a scenario where a medical devices conglomerate like Boston Scientific (BSX) offer $7.50 / share for Pulmonx (50% upside for shareholders). This would equate to ~$280 million in market cap, but only $150 milion in EV, or ~2.5x EV/Revenues. In exchange, BSX can cut 70% of the SG&A to a $25 million run-rate, plus $15 million in run-rate R&D expense. Based on ~$60 million in revenues, the financial model could generate $20 million in operating profits, or 7.5x EV/operating profits.

Note, I have no knowledge of any pending M&A discussions and the above example is purely hypothetical. With $157 million in cash, Pulmonx can continue the current business model for another year or two before cash runs out. However, I would recommend management and the board act sooner rather than later, as the clock is literally ticking.

Conclusion

Pulmonx’s latest Q3 results validated my concerns on the growth rate of the Zephyr Valve business. Poor outlook by management caused the stock to crash more than 50% post the earnings report. At this point, I think Pulmonx’s valuation becomes interesting, as I can envision a large conglomerate being able to squeeze out significant SG&A synergies from Pulmonx’s bloated cost structure. I would venture a speculative buy on the company at current valuations.

Be the first to comment