Jonathan Kitchen

Thesis

The WisdomTree CBOE S&P 500 PutWrite Strategy ETF (NYSEARCA:PUTW) is a vehicle that takes advantage of the S&P 500 put options implied volatility. The fund:

[…] seeks to track the performance, before fees and expenses, of the CBOE S&P 500 Put-Write Index (PUT), a collateralized put write strategy on the S&P 500 Index. The strategy is designed to receive a premium from the option buyer by selling a sequence of one-month, at-the-money, S&P 500 Index puts (SPX puts). If, however, the value of the S&P 500 Index falls below the SPX Put’s strike price, the option finishes in-the-money the Fund pays the buyer the difference between the strike price and the value of the S&P 500 Index. The Fund’s strategy of selling cash-secured SPX Puts serves to partially offset a decline in the value of the S&P 500 Index to the extent of the premiums received.

This basically means that the ETF sells a sequence of one month at the money put options. The outcome is binary:

1. The market rallies

- the put expires without getting triggered

- the ETF pockets the premium

- the upside generated is capped by the premium received

- the premium received is larger if implied volatility is high

2. The market sells-off

- the put gets triggered

- on settlement date, the ETF pays the difference between strike price and spot price

- the ETF does not have the put buyer exercise the option and put the stock to the fund

- the downside equates the S&P 500 downside minus the premium received

If done by active managers on a dynamic basis and view, the strategy would be able to produce more substantial results. In the current automated rolling format, the maximum profit is limited but with a better downside than the S&P 500 itself. The analytics reflect that build:

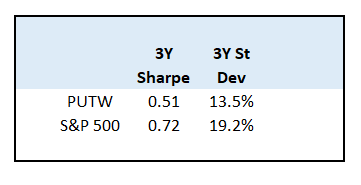

Analytics (Author)

PUTW has a lower Sharpe than the S&P 500 due to its limited upside, but a lower standard deviation due to the lower volatility.

PUTW is an interesting vehicle that takes advantage of the S&P 500 implied volatility via its put writing strategy. The ETF’s performance during a calendar year is as much dependent on the market direction as well as the velocity of a move. Slowly upwards/downwards moving markets are favorable to PUTW, while markets with violent moves in both directions do not result in encouraging results. We feel the vehicle’s standardized automated 1-month put rolling approach hampers its results, and the same strategy applied in a dynamic fashion via a CEF vehicle would be more successful (i.e., giving a portfolio manager the ability to take views, tweak tenors, not write puts when the market is overbought, etc.). It is our opinion that a retail investor would be better served by either buying the index outright here or write cash-covered puts in their own account. Only expect a 4% to 5% long-term annualized return from this ETF.

Performance

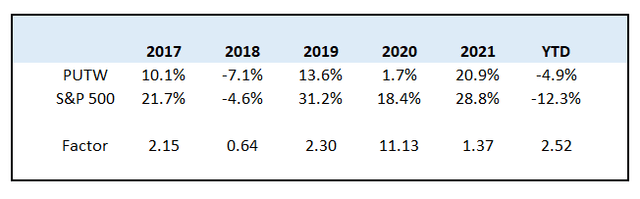

Year to date, PUTW is down only roughly -5%:

We can see that in 2022 the premiums received by the fund have been able to dampen the downside experienced by the S&P 500. If we compare the PUTW and SPY performances side by side, we can see the following:

In years with positive market performance, PUTW delivers about half of the SPY return, while in years with negative market performance the picture is mixed. We would expect something closer to what we are seeing in 2022, with PUTW providing for a more muted loss (dampened by the writing of the premiums), but the relationship is also correlated to the market timing aspect. As we mentioned above, the fact that the strategy is automatically rolling over every month with no market view approach can result in anomalies such as in 2018. If you settle losses at the lows on the put and then the market rallies violently, not only have you crystalized a substantial loss, but you also miss out on the rally.

The PUTW performance during a calendar year is as much dependent on the market direction as well as the velocity of a move. Slowly upwards/downwards moving markets are favorable to PUTW, while markets with violent moves in both directions do not result in encouraging results. We can see that in 2020 as well when PUTW significantly lags the S&P 500 due to the steepness in both moves (down in the begging of the year followed by a V-shaped recovery). Again, a more dynamically managed approach would be more beneficial here (i.e., an active approach where a portfolio manager would decide when to sell the options and the respective tenors) in our view.

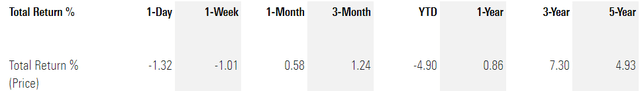

We can see that the fund has a muted annualized total return performance long term:

Long term, an investor should think about annualized total returns around 4%-5% for PUTW. The fund, by design, has very limited upside.

Holdings

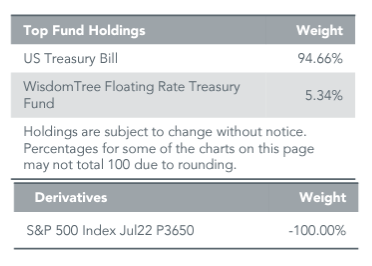

The fund has a very straightforward approach:

Holdings (Fact Sheet)

The ETF holds all of its capital in cash-like instruments such as U.S. Treasury Bills or a floating rate treasury fund. The only other holding is the current S&P 500 put, in this case, as of the last fact sheet, the July 2022 put with a strike of 3650. To note that as rates rise, the fund’s total return (all else equal) should also increase due to the fact that it receives short-term interest rates via its holdings.

Conclusion

PUTW is an ETF that tries to take advantage of the S&P 500 implied volatility by selling 1-month at the money puts on the index. The maximum upside for the strategy is the summation of the premiums received, while the downside equates the S&P 500 profile minus the premium cash received. The strategy works best in a slowly increasing/decreasing market, with steep moves in any direction increasing the basis between the fund and the index. Expect a long-term annualized total return here of 4% to 5% with a less volatile profile when compared with the S&P 500. While commendable, we feel this strategy would be better served via an active management in a CEF-like vehicle, where a portfolio manager would be able to layer some market views and avoid two sigma events where puts should not be written (for example extremely overbought markets as highlighted by a simple technical indicator such as the RSI). It is our opinion that a savvy retail investor would be better served by either buying the index outright as needed or write cash-covered puts in their own account.

Be the first to comment