jetcityimage

Investment Thesis

Demand for Sherwin-Williams’s (NYSE:SHW) consumer brands is softening. Sales are declining in their international and DIY markets. But the professional painting market is still strong. I think that tailwinds in the housing market should offset these declines.

The company’s shares are trading at multiples that I feel are currently overvalued. I would wait for a discount before I would consider buying or holding shares.

Poor earnings and reduced guidance

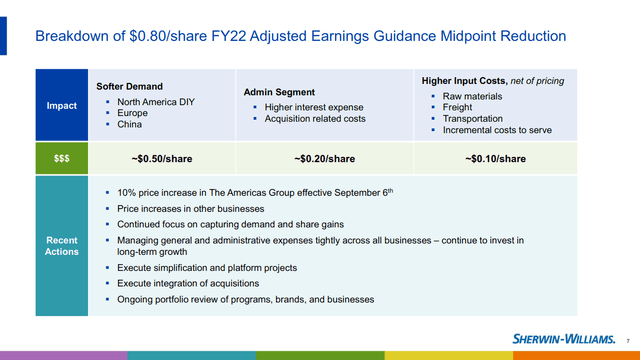

Last week, Sherwin-Williams reported results below expectations. The company missed top line and bottom line estimates before cutting guidance for the year. The company slashed its earnings estimates from $8.60 to $7.80, a 10% decrease.

Sherwin-Williams Q2 2022 Earnings Slides

Management blamed their guidance cut on softer demand across key market segments. Revenue from Sherwin-Williams’s consumer brands segment cratered by high double digits in Europe. The segment’s sales in Asia were also much lower. Most of this decline is attributed to China’s COVID lockdowns. Another headwind came from the company’s Americas Group segment, which runs Sherwin-Williams’s retail stores. Demand by DIY customers dipped by low single digits.

A lot of these drops in demand appear to be driven by economic factors. These include inflation, decreased consumer confidence, and the pandemic. There isn’t much the company can do to directly combat these declines.

The company has also been hurt by ongoing margin pressures. Over the past year, the company has reported gross margins of only 41%. This is much lower than the company’s long term targets of 45% to 48%. To combat this, management announced a 10% price hike across its retail stores. This takes effect in early September.

The company is still facing some headwinds with their ability to meet demand. Some of the strongest demand is for stains and aerosol products. These require alkyd resins, which management is having a hard time acquiring.

The demand outlook is still solid

I think the demand outlook for Sherwin-Williams shows potential for growth. The international and DIY markets are undeniably weak right now. But a large portion of the company’s revenue comes from North American professionals. This market segment seems to be holding up well.

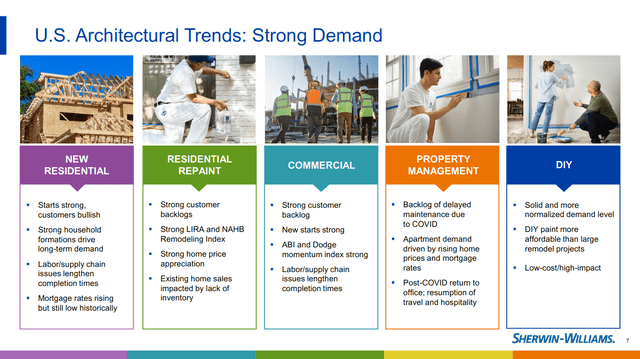

Sherwin-Williams 2022 Financial Community Presentation

The company is seeing a divergence between DIY and professional paint demand. Sales attributed to new homes and property maintenance reported a double digit increase during the quarter. Management repeated that professional paint demand is strong. Businesses in the space have a significant backlog of work.

I think there’s going to be a structural increase in new housing demand. The US is in the middle of a severe housing shortage. In the long term, I think there’s going to be a heavy acceleration in new home development. Sherwin-Williams has deep ties to homebuilders and should benefit from these trends. Management described these customer relationships in their last earnings call.

As a matter of fact, we’ve been very transparent in sharing that we’ve had these exclusive relationships with 18 of the top 20 national homebuilders… The fact is that we’ve actually grown them. Proud of our team for hanging on to the 18 of the top 20, but we’ve actually now grown that to exclusive relationship with the top 23 of the top 25, and we’re selling the majority of the remaining 2 in the top 25. So customers in this space are telling us they are confident in the balance of the year.

The new housing market is currently experiencing some headwinds due to rising rates. But weakness in this market can be offset by strength in the residential repainting and property maintenance segments. The company’s leadership also addressed these segments on the call.

But property maintenance would be the other area that we would expect to benefit. And here again, we’ve spoken about the relationships that we have. In the past, we’ve talked about the 18 of the top 20 that we have exclusive relationships. We now have exclusive relationships with 21 of the top 25.

In fact, in the top 350, we have solid agreements with 70% of them exclusive relationships with 45%. So at 45% exclusive of the top 350, while we’re pleased with that, it still offers a terrific opportunity, and again, room for growth for us.

In property management CapEx, our teams would describe that as an area that’s off the charts right now. There’s considerable amount of investment taking place as well as in the turns, which is very robust and almost acts as a bit of an annuity in the business in many ways.

I think it’s clear that Sherwin-Williams is in a position to benefit from the current housing market. Businesses in this space have a solid pipeline of new work and the ability to offset inflation. Additionally, professional painters’ largest typical expense is labor. Businesses in this segment are able to pay more for paint. As inflation decreases, Sherwin-Williams can likely keep their higher prices. As their costs come back down, their margins can bounce back to healthier levels.

I think this valuation is too risky

Even after the recent pullback, I think Sherwin-Williams shares are expensive. The company is trading at a forward P/E of 31 and a TTM EV/EBIT of 30. I think this is expensive for a company that is unlikely to see sustainable double digit revenue growth. I’m not sure how much the company can expand its margins, either. For a company with this profile, I wouldn’t be willing to pay more than 20 times EV/EBIT.

Since 2017, Sherwin-Williams has generated about $9 billion in free cash flow. During the same period, the company spent $7.3 billion buying back its own shares, $2.1 billion on its dividends, and $500 million on acquisitions. While I like companies that return cash to shareholders, I don’t think this rate is sustainable in the long term.

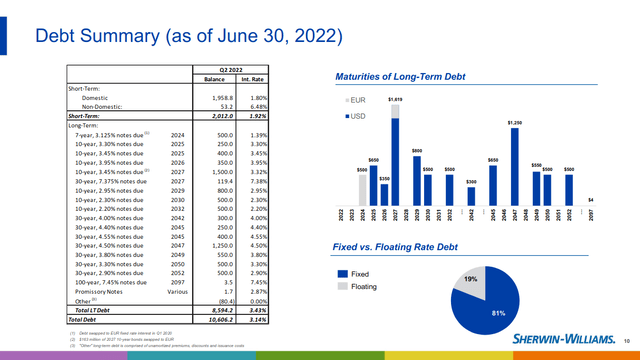

Sherwin-Williams Q2 2022 Earnings Slides

The company’s debt is another concern. Sherwin-Williams has $10.6 billion in total debt, which is about 3.5 times their TTM EBITDA. This is well above the company’s long term target of 2.0 to 2.5 times. The debt is low interest, at a weighted average of 3.14%. This isn’t a threat to the company, but paying it off will most likely redirect some cash flow and reduce returns.

Final Verdict

Sherwin-Williams has a strong moat in a solid industry. The company has deep ties to professional painters. This should reduce its exposure to broader economic headwinds. But I feel that shares are currently overvalued when looking at the company’s long-term growth prospects. I’d wait for a pullback before I’d buy or hold shares.

Be the first to comment