Doralin Tunas/iStock via Getty Images

Thesis

The bear market we are currently experiencing is spreading fear among investors, with many looking to even avoid exploring new investments altogether. As the economy is likely to enter a recession, exposure to a cyclical, industrial business like Sherwin-Williams (NYSE:SHW) might seem counterintuitive. Yet, markets have already dropped enough to lead to believe that, barring some extreme outlier event, the rough road ahead has been priced in. In that sense, considering the financial strength and outlook of the company, an attractive entry point might be available.

Business Overview

Continuing its 100+ year legacy (founded in 1866), Sherwin-Williams Company is a global leader in manufacturing, distributing, and selling paint, coatings, and other related products. The company caters to industrial, professional, and retail customers primarily across North and South America.

The company maintains three distinct reporting segments. The Americas Group includes more than 4,800 company-operated specialty stores, servicing architectural and industrial paint contractors, as well as homeowners for DIY projects.

The majority of the products the stores market is produced by manufacturing facilities in the Consumer Brands Group. This segment is responsible for the manufacturing process and supports the company’s operations around the world with new product research and development, manufacturing, distribution, and logistics. Approximately 62% of the Consumer Brands Group’s sales in 2021 represented intersegment transfers of products.

Finally, the Performance Coatings Group develops and sells industrial coatings for a variety of applications, including wood finishing, general industrial use automotive refinish, marine applications, and more. All other business activities are presented in the supporting Administrative segment. -10K Report

Macroeconomic Environment

SHW’s business is both cyclical and seasonal. Cyclicality relates to the industrial attributes of the business, as sales improve or deteriorate with economic activity and industrial production fluctuations. In terms of seasonality, increases in sales traditionally occur during the second and third quarters. Periods of economic downturn, however, can alter these patterns.

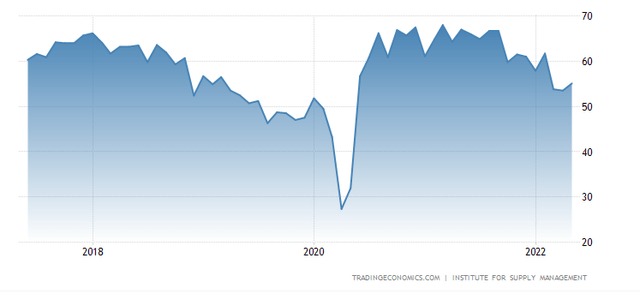

During the first half of 2022, major macroeconomic headwinds, including inflation, supply chain disruptions and soaring energy prices have sentiment deteriorating with a growing number of analysts now expecting the U.S. economy to enter into a recession. Taking a peek at the ISM Manufacturing New Orders Index, despite a noticeable drop in the recent months, the indicator appears to hold on above the 50 points level. Developments over the next couple of months both in terms of inflation and manufacturing activity will be key to whether recession fears will materialize.

Stock Performance

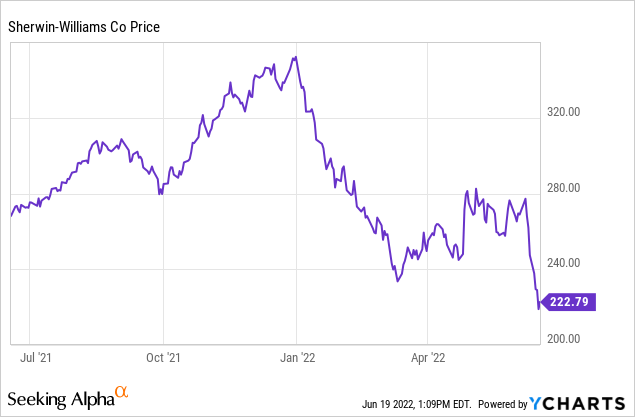

After an impressive run-up in 2022 to reach $352 per share, 2022 has been all downhill, with the stock retreating more than 36% from all-time highs. With levels of uncertainty remaining as high as they have been for the past 15 years, more volatility likely lies ahead. Even though it could be argued that a recession is already being priced in the stock market, still, especially for a company with heavy industrial exposure, slowing economic activity and decreasing industrial output might hurt the stock further. Currently, SHW trades at $222.79 ($56.7B market cap) and pays a small yet noticeable 1.1% dividend yield.

Financial Strength & Prospects

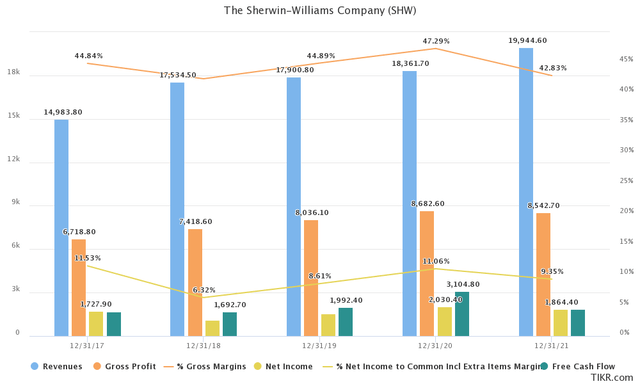

Despite Sherwin-Williams being an established, mature company, revenue has grown at 10 and 5-year CAGRs of 8.4% and 11.0%. Gross margins have stayed above the 40% level, significantly higher than sector averages. Wide margins offer the company some room to maneuver as prices and input costs increase due to inflationary pressures. Net income has shown less consistency, growing only marginally from 2017. Free cash flow, however, has overshot earnings 3 out of the 5 past fiscal years, indicating SHW’s operating efficiency.

On the balance sheet side, liquidity appears a bit weak with current and quick ratios of 0.88 and 0.47, considering, however, the implications of major supply chain disruption in the build-up of inventory and other current assets. The capital structure of the company remains fairly conservative, with long-term debt accounting for 39% of total assets. That said, SHW’s debt balance is not insignificant and interest payments have sizable implications on the income statement.

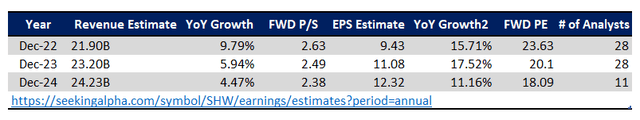

Analysts remain fairly optimistic for the near term, forecasting mid-single digit revenue growth, through 2024, where the company is expected to generate 24.23B in sales. EPS growth is expected higher, compensating for slower increases in the large five years. In 2024, EPS of $12.32 are forecasted, implying 15% annual increases until then.

When it comes to shareholder value appreciation, Sherwin’s dividend, while small, comes with a respectable growth record and prospects. With 24 consecutive years of increases in the books and a 15.3% 5-year CAGR dividend growth, long-term investors are unlikely to be disappointed. The payout ratio also remains low, at 29%. Shares outstanding have also been decreasing, expanding owners’ stake in the business. Since 2015, weighted average shares outstanding have decreased from 283M to 258M, as of the last filing.

The Valuation Perspective

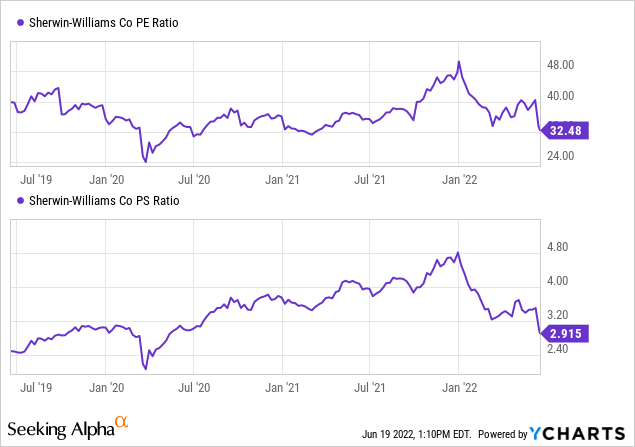

Despite the consistency in revenue growth and elevated analysts’ estimates for the midterm, SHW has not been immune to the selling pressures fazing the stock market. As a result, valuation multiples have contracted, now standing below 3-year averages, indicating the possibility of an attractive entry point. Despite a P/E of 32.48x TTM, which looks rather expensive, on a forward basis, SHW trades at 23.6x earnings. While still above market averages, the FWD P/E is even significantly lower than pre-pandemic levels.

Another reason for elevated P/E multiples is the company’s cash flow generating capacity. As mentioned before, FCF generation remains strong, despite elevated CAPEX spending. As more and more investors focus on reliable cash flow-producing businesses, wider-than-average valuation multiples could be acceptable going forward. Moreover, on a P/S basis, trading at 2.9x (around pre-pandemic levels) SHW looks reasonably valued.

Final Thoughts

All things considered, despite its vulnerability to the downturn of the business cycle, Sherwin-Williams represents a sound choice for investors looking for exposure towards industrials and materials over the long term. Valuations have returned to reasonable levels, while financial performance and future outlook inspire confidence. Currently, I would rate the stock as a buy.

Be the first to comment