pidjoe/iStock via Getty Images

Summary of Sharp Compliance

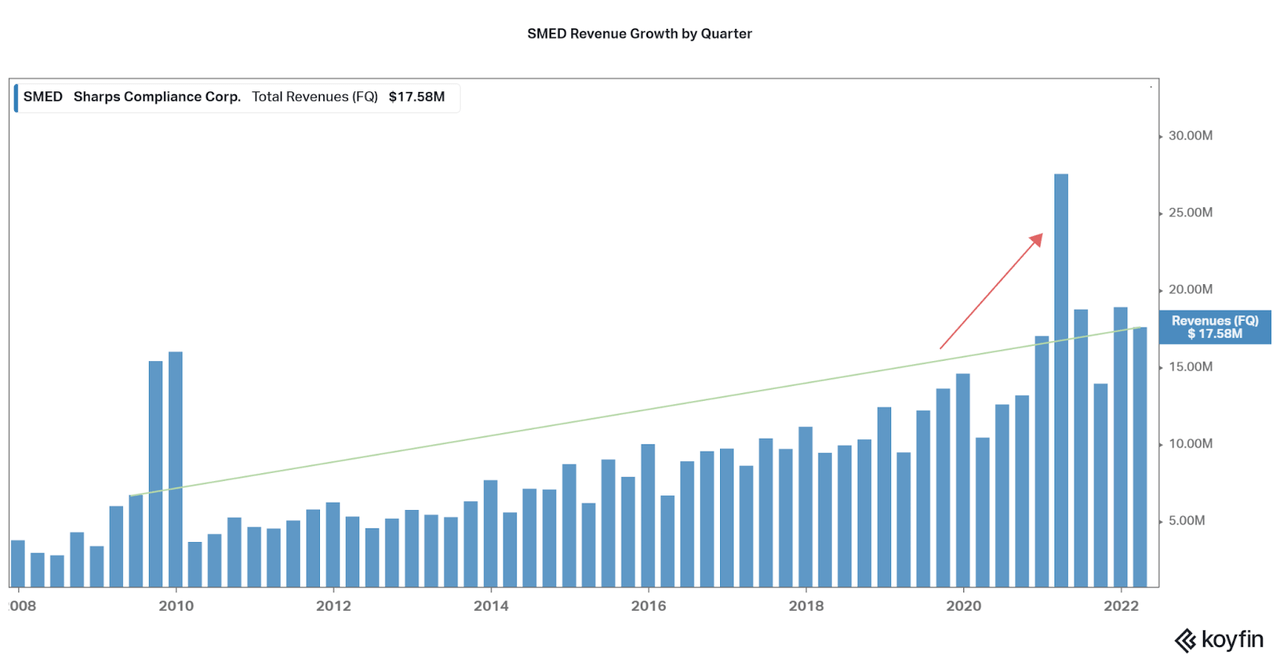

Sharps Compliance (NASDAQ:SMED) is a medical waste disposer with nationwide services. Waste is collected, either with truck routes or mail-in packaging, and brought to two incineration facilities. Thanks to partnerships with pharmacies, clinics, and other healthcare organizations, the company has exhibited steady growth over the past 10 years (12% CAGR of revenues). In particular, the company was a beneficiary of the pandemic as sales increased due to COVID waste services.

Also, the company has increased their recurring revenues thanks to a growing drug and medicine collection service that uses small, easily distributed pick up bins. This has allowed for profitability to increase substantially, and the current net income margin of over 5% is high for the health care services industry. My thesis for investing was that performance would only continue to improve as Sharps reached economies of scale and leveraged higher margin services.

While I thought organic growth would be maintained at pandemic levels for some time, 2022 has seen flat to negative YoY growth so far. This has tanked the stock price as performance has weakened. I summarize recent performance in an April article which you can read here. However, I had not begun to add shares at a lower level, so this acquisition is bittersweet for me.

Buyout Price of $170 Million

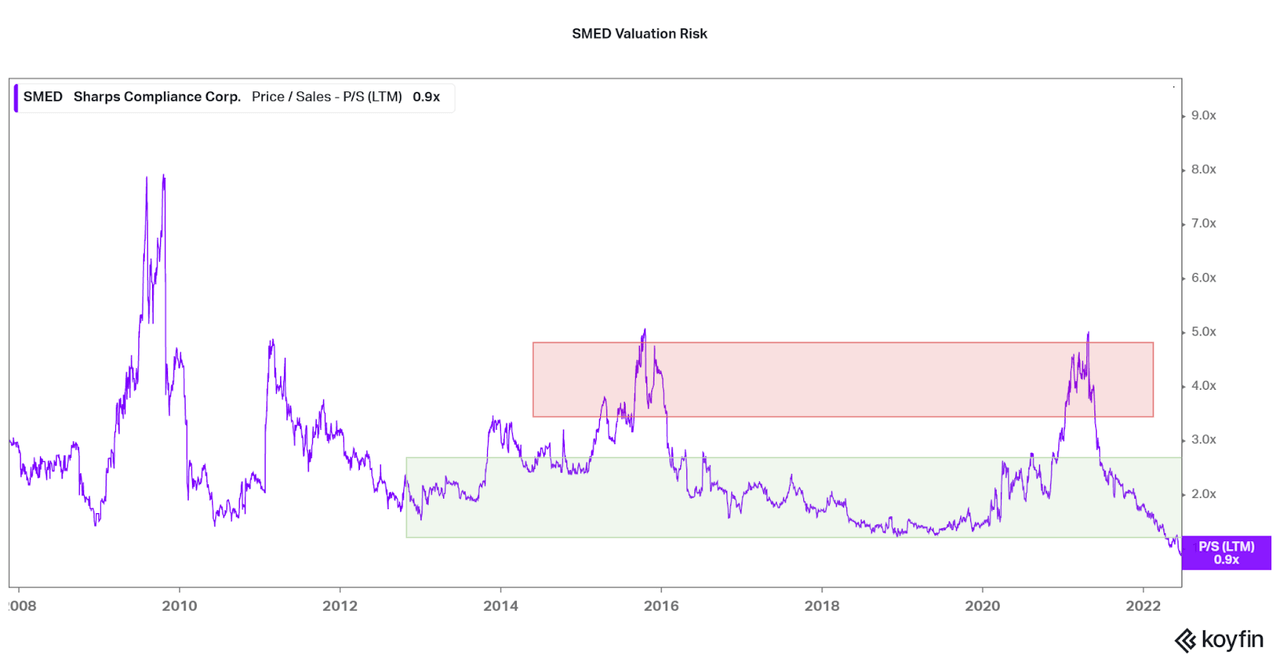

Aurora Capital has found an extremely cheap asset in Sharps. Thankfully for shareholders, the purchase price is triple the recent trading price. This brings the market cap of Sharps from a measly $55 million to over $160 million. At the same time, the deal brings the Price to Sales ratio from a trailing 0.75 to over 2.0x and highlights the extreme disparity between the share price and true value of Sharps. The company has tanked over the past year as small cap, growth assets face rising interest rate risks. While likely overblown when looking back in the future, there are a few takeaways from this investment that I will discuss.

Interestingly, the shares are currently trading a 5% discount to the deal price, indicating there remains some risk left. However, I expect the deal to conclude swiftly as the board of directors has already approved, and the purchase will be all cash. Current shareholders can sell at a minor cost in the case they would like to reallocate the capital, but where else can you find a 5% return in the next few months? As I will write about next, patience is a virtue.

My Investment Thesis Reflections

The acquisition is certainly at a favorable premium for current shareholders. However, based on my bullishness, I am even on my overall return as my initial purchase was above $10 per share. I therefore must reflect back on my original thesis to determine what went wrong. I came to three conclusions: to remain patient in regards to valuation, to be sentient of investor sentiment, and to stagger my investments more.

My major mistake in this investment was the failure to understand the risks as I rushed to purchase the company. In fact, I was blown away by a strong quarter last year, and I believe a new era of growth was being established. Unfortunately, this was not the case, and the premium valuation fell over the past year and a half. I fell into the mistake of following a bull market until the end, and I did not perform enough risk management in case of a market decline. I am sure I am not the only investor over the past two years to make this mistake, but my Sharps investment at over $10 per share is one of the worst I have made.

While I wrote an update article, a few months ago that reevaluated the company, remaining bullish, I have not begun to add at a lower cost basis as the downward trend has remained strong. Therefore, I missed out on the full benefit of this acquisition as my cost basis remains at ~$9 per share. If I had followed my recommendation of adding on a recurring basis, rather than adding all my shares between $8-13 per share, I would have been able to accumulate plenty of shares less than $8.75 per share. Now, I remain intent on focusing on the short-term cycles of the market while also staggering my investments over a longer period of time.

Koyfin

Looking at the chart below highlights the honest mistake I made. My losses would not be as bad if revenues kept up the growth rate seen last year (red arrow), but growth failed to hold. This drop-off in revenues is the reason why I wrote a secondary article with a bull rating as I believed the underlying growth rate still remained steadily moving upwards (green line). However, I also believed the valuation would remain at ~3.0 level as Sharps offered a fairly stable financial position, was investing in new products and processing capability, and was in a growing area of the market. Therefore, I believed investor sentiment would remain bullish and the valuation would remain elevated. Regardless, Aurora Capital also believes in SMED’s capabilities, and I believe investors would have seen $8.75 within a few years.

Koyfin

Sharps is a perfect case study for micro-cap investing. While good times allow for incredible growth, bad times (even in sentiment only) lead to steep losses. So, moving forward, I will have an increased focus on the inherent cyclicality of small/micro-cap assets. While direct timing will never be a perfect science, I believe recurring investments combined with risk assessment will fare better. Now is the time to be buying Sharps as market sentiment falls sharply, but unfortunately the company will be going private.

I will be taking this experience and applying it to other investments I have made, along with any new ones in the future. Remember, any stock at all-time or close to all-time highs must be considered as extremely risky, even at the risk of missing out on further upside. As with cyclicals, it is important to invest at bottoms, or when things look the worst, as this is where the most upside potential lies. I will be sure to bring this knowledge to my future articles. Although, fundamentals will always remain supreme. As Peter Lynch puts it:

There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating.

Perhaps I was taken out of my misery. Thanks for reading.

Be the first to comment