mizoula/iStock Editorial via Getty Images

It’s been a rough start to the year for the major market averages, and while there have been a few sanctuaries, Shake Shack (NYSE:SHAK) has not been one of them. In fact, the stock is down 45% year-to-date, underperforming the S&P 500 (SPY) by more than 2000 basis points as we near the halfway mark of 2022. This can partially be attributed to the difficult environment for the restaurant industry but is also due to Shake Shack’s relatively slow recovery and degradation in its margin profile. With SHAK now sporting a sub $2.0 billion market cap, investors might be anxious to jump into the stock, but I still don’t see enough of a margin of safety at $40.00.

Shake Shack Menu Offerings (Company Presentation)

Just over six months ago, I wrote on Shake Shack, noting that despite the sharp correction, there was still no margin of safety to justify starting a new long position. Since then, the stock has slid another 47% and continues to be one of the worst-performing names sector-wide. This performance should not be overly surprising, given that the industry continues to see headwinds, and Shake Shack was priced for perfection heading into the year at 33x FY2022 EBITDA estimates. Let’s take a closer look at recent developments below:

Q1 Results

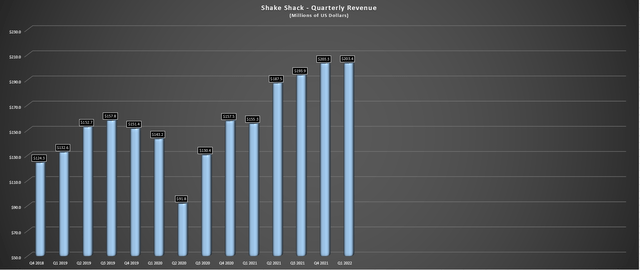

Shake Shack released its Q1 results last month, reporting quarterly revenue of $203.4 million, a 31% increase from the year-ago period. This was driven by healthy unit growth and low double-digit same-shack sales growth (10.3%), with ~$197 million in Shack sales and $6.6 million in licensing revenue. This was despite a tough January and February for the industry due to the Omicron variant, and while the pace of development has been challenging, Shake Shack added seven new domestic restaurants in the quarter, including two new drive-thru locations, with the company excited by the potential for this new concept.

Shake Shack – Quarterly Revenue (Company Filings, Author’s Chart)

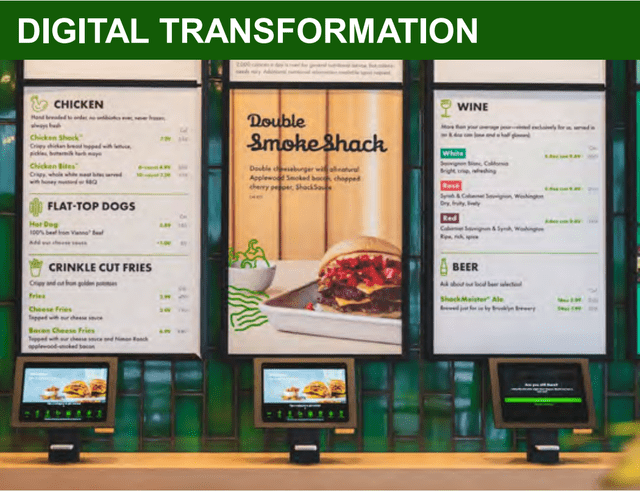

From a digital standpoint, the company continued to make progress, with 43% of sales being digital (mobile app, company website, third-party delivery), holding up relatively well despite the return to in-store dining. Meanwhile, 60% more guests have made a first-time purchase in its App and Web channels vs. last year, an encouraging statistic given that digital guest checks have been 25% higher than non-digital in Q1.

This growth was helped by App exclusive offers like early access to try the Black Truffle Burger and Buffalo Chicken sandwich. If the company is successful with these additional customer insights, it may be able to drive slightly higher frequency among its core digital customer. In addition, its digital kiosks could help with more efficient operations (re-directing labor) and slightly higher average unit volumes. Overall, this was a clear positive from the quarter, but it wasn’t all good news, unfortunately.

Shake Shack Restaurant (Company Website)

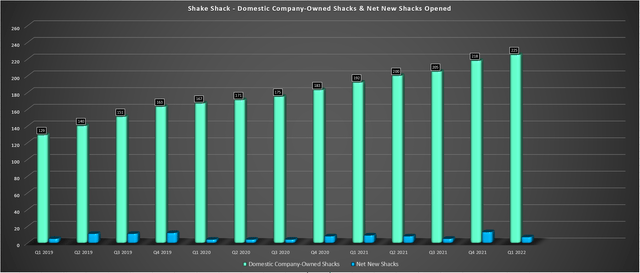

For starters, the previous outlook was for 50 new domestic restaurants in FY2022, and it’s looking like the company will be lucky to open 38, let alone its new guidance of 40-45. This is because the current outlook calls for just 13 in H1, meaning that Shake Shack would need to average 12.5 restaurants per quarter in H2 just to meet 38, let alone the mid-point of 42.5. The negative revision in development is related to construction delays, permitting delays, a lack of workers at its internet service provider to install Wi-Fi, and difficulty getting parts and restaurant equipment.

Shake Shack – Domestic Company Owned Shacks & Net New Shacks Opened (Company Filings, Author’s Chart)

Given that same-shack sales are barely up vs. 2019 levels (largely due to menu-price increases), unit growth has been a key driver of increased sales, but this new forecast has dented the 2022 system-wide sales outlook. Meanwhile, although sales might be up across the system due to steady unit growth, margins continue to trend in the wrong direction and would have come in below 15.0% in Q1 if not for a 50-basis point benefit from gift card breakage. This can be attributed to higher beef, labor, dairy, chicken, and packaging costs, with an outlook of high single-digit to low double-digit inflation and mid to high single-digit growth in starting wages in FY2022.

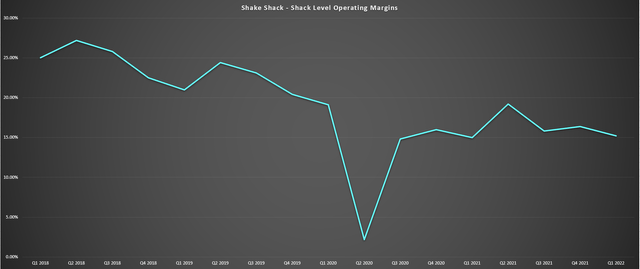

Shack Level Operating Margins (Company Filings, Author’s Chart)

As the chart above shows, these margins are well below pre-COVID-19 levels and aren’t expected to improve based on an outlook of 14% or lower margins for 2022. This is despite significant menu price increases, with Shake Shack reporting ~7% higher prices than last year and taking third-party pricing up from 10% to 15%. The good news is that the company is investing in its team members through wage increases, so while it is seeing margin pressure, it should be in a better position from a labor standpoint to support its growth. The bad news is that while the company is confident it can raise prices further, this could be more difficult than expected in a period where we could see some consumers begin to trade down a little due to a pinch in their discretionary spending budgets.

Industry-Wide Headwinds

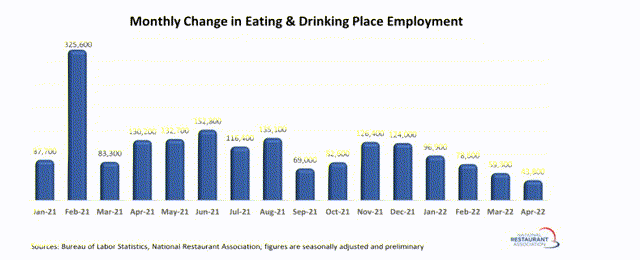

The restaurant industry has struggled since COVID-19, even if traffic has improved considerably as restrictions were relaxed and brands have been forced to be as efficient as possible. This is because while they’ve seen a traffic recovery and some productivity gains after a rough 2020, they’ve been contending with higher packaging costs/food costs due to inflation and also have had to work with a very tight labor market. In the latter case, this has led to increased wages as brands have had to ensure they can adequately staff their restaurants with a ~6% headwind from a total employment standpoint. The industry is still over 790,000 jobs (~6.4%) below pre-pandemic levels.

Monthly Change in Restaurant Employment (BLS, National Restaurant Association)

While most brands have managed to wade through these headwinds, they’re now facing another issue: a weaker consumer. This is due to rising food costs and sharply rising gas costs, with the average gas price in the United States sitting just shy of $5.00/gallon. Previously, raising menu prices to protect margins wasn’t a huge issue. Consumers had elevated savings from the pandemic lockdowns and were anxious to get back out and spend. However, protecting margins through further menu price increases could be more difficult when faced with a consumer that has a shrinking discretionary budget.

One segment with a lot to lose, given its relatively high average check, is casual dining, and I would be surprised if traffic trends didn’t wane in June as some consumers are forced to tighten their budgets. Fortunately, Shake Shack is in the quick-service/fast-casual space, which could be less affected than its casual dining peers. However, it’s a trade-up vs. traditional burger chains, similar to Five Guys, which could see some hit if consumers remain under pressure.

To be clear, I don’t expect Shake Shack’s core customers to suddenly give up the brand and trade down to McDonald’s (MCD) or Burger King. Still, less frequent visits, the odd trade-down instance, or check management (combo, but pass on the shake) are a possibility, which would reduce sales leverage. This could occur when SHAK’s margins are already struggling, a negative development. Let’s look at the valuation below to see whether the stock has priced in some recessionary risk.

Valuation

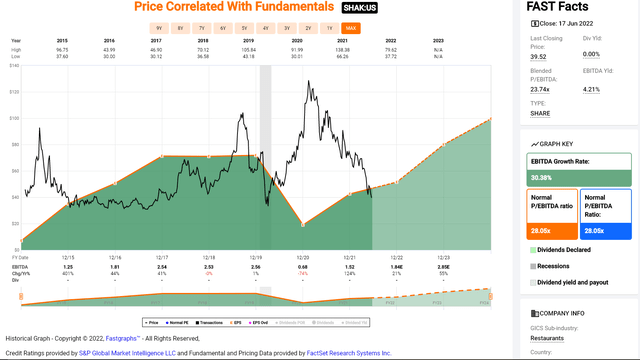

As the chart below shows, Shake Shack has historically commanded a premium valuation, trading at a much higher EBITDA multiple than its peer group, which its industry-leading unit growth can explain. However, the company could see a slight deceleration in unit growth year-over-year (38 shacks vs. 36 shacks) if its development pace doesn’t improve and margins have taken a severe beating relative to pre-COVID-19 levels. Therefore, I don’t see any reason to believe that the stock should trade anywhere near its historical multiple (28x EBITDA).

Shake Shack – P/EBITDA Multiple (FASTGraphs.com)

As it stands, Shake Shack is trading at more than 20x FY2022 EV/EBITDA estimates and continues to trade at a premium to the industry average despite its steep decline. Meanwhile, even if we use FY2023 estimates of ~$110 million, Shake Shack still trades at ~17x EV/EBITDA, which is not cheap for a company with industry-lagging margins. In fact, elsewhere in the sector, investors can buy a franchised model with much better margins like Restaurant Brands International (QSR) at ~11.5x FY2023 EBITDA estimates despite having a business model more sheltered from a recessionary environment.

This is because RBI’s core brands (Tim Hortons, Burger King) offer tremendous value, with the former being the top coffee destination in Canada and Canada’s most trusted brand. These brands could actually benefit from a trade-down effect from premium quick-service brands if we see continued pressure on consumers. Hence, with more defensive positioning, a more attractive valuation, and a much better margin profile, I see much better value in names like RBI if I did want to add exposure to the restaurant industry.

Technical Picture

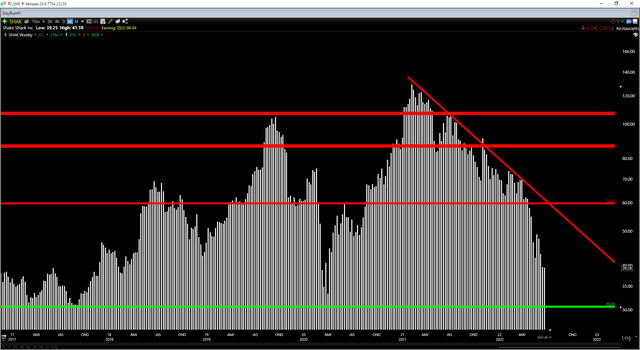

Finally, looking at the technical picture, SHAK remains in a steep downtrend and now has a new resistance level at $59.80 after this support was broken. Meanwhile, the next strong support level for the stock doesn’t come in until $30.60, suggesting the possibility of further downside before the stock finds a durable low. Based on a current share price of $39.50, translating to $20.30 in potential upside to resistance and $8.90 in potential downside to support, the stock’s reward/risk ratio comes in at 2.28 to 1.0.

SHAK Weekly Chart (TC2000.com)

While this isn’t an unattractive reward/risk ratio, which was the case as the stock entered 2022, this ratio is still well below my requirement of a 6 to 1 reward/risk ratio to justify entering new positions on small-cap stocks. This doesn’t mean that SHAK must head lower, but it would need to dip below $34.50 to become interesting from a technical standpoint. Having said that, given the more attractive names from a relative value standpoint elsewhere in the sector, I wouldn’t be in a rush to buy the dip even if the stock heads below $34.50.

Shake Shack Drive-Thru (Company Presentation)

Shake Shack may be a solid growth story from a unit growth standpoint, but it’s less clear how the company might perform if we head into a recessionary environment. Given its already underwhelming margin performance and the possibility that consumers are less anxious to trade up within quick-service, Shake Shack looks more vulnerable than some of its peers, and its profits aren’t as insulated from a franchised model (McDonald’s/RBI. To summarize, I continue to see Shake Shack as an Avoid and favor names like Agnico Eagle (AEM) and RBI, which are examples of high-quality businesses at very reasonable prices.

Be the first to comment