Khanchit Khirisutchalual

ServiceNow (NYSE:NOW) has proven itself to be one of the highest quality tech stories in the market today. Combining a clear-cut digital transformation growth story with robust free cash flow, NOW offers investors a way to invest in a tech stock without the typical unprofitability risk. After the tech crash, NOW stock is also offering compelling value, though it admittedly trades at a rich premium to more beaten-down peers. I continue to find the stock highly buyable here.

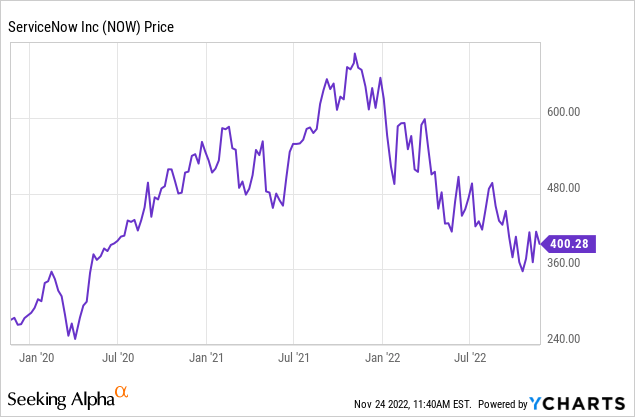

NOW Stock Price

The tech stock crash appears to have hit almost all tech stocks indiscriminately, caring little about the strength of the growth story or profit margins.

I last covered NOW stock in July where I rated the stock a buy on account of the resilient fundamentals. While macro will undoubtedly eventually impact the company’s results, the long term digital transformation growth thesis remains intact.

NOW Stock Key Metrics

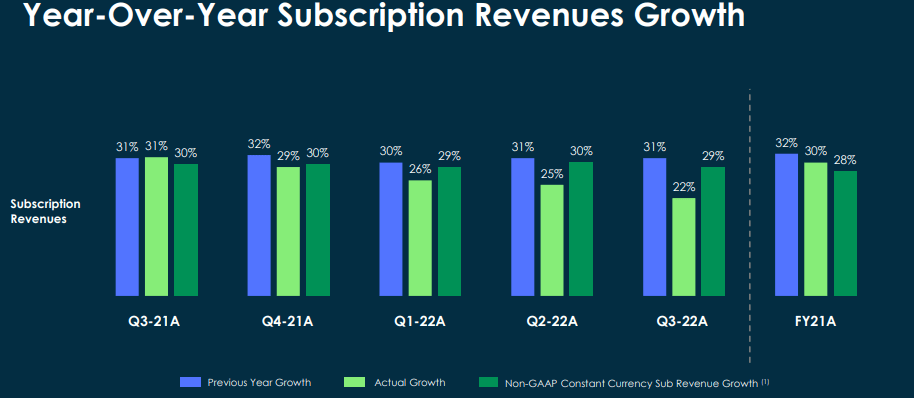

The latest quarter saw revenue growth decelerate meaningfully to 22% but like many other tech peers, growth was heavily impacted by currency fluctuations. On a constant currency basis, revenues grew by 29% YOY.

2022 Q3 Presentation

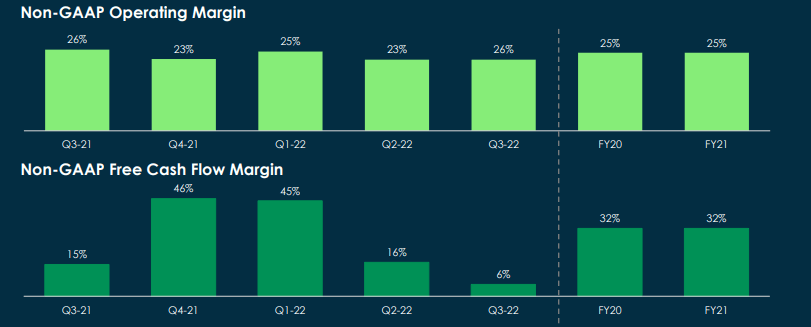

NOW continued to generate strong margins, with non-GAAP operating margin standing at 26% in the quarter. Free cash flow margin was less but that is mainly due to the seasonality of cash collection. Free cash flow margin typically outpaces operating margin due to prepayment of multi-year plans.

2022 Q3 Presentation

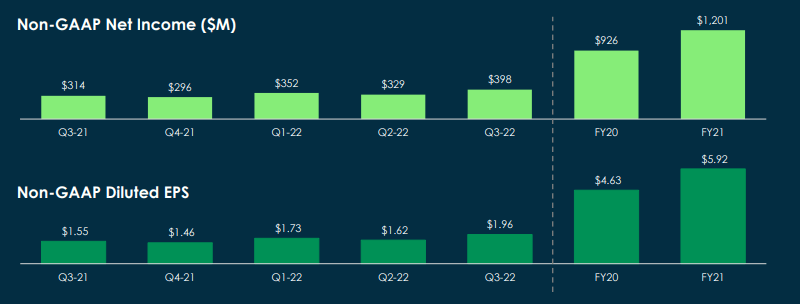

NOW also generated a 21.7% non-GAAP net margin. Stock-based compensation makes up around 90% of non-GAAP income, so this figure is not yet equivalent to GAAP profits. That said, positive non-GAAP profits help to reduce financial liquidity risk.

2022 Q3 Presentation

NOW ended the quarter with $5.4 billion of cash versus $1.5 billion of debt.

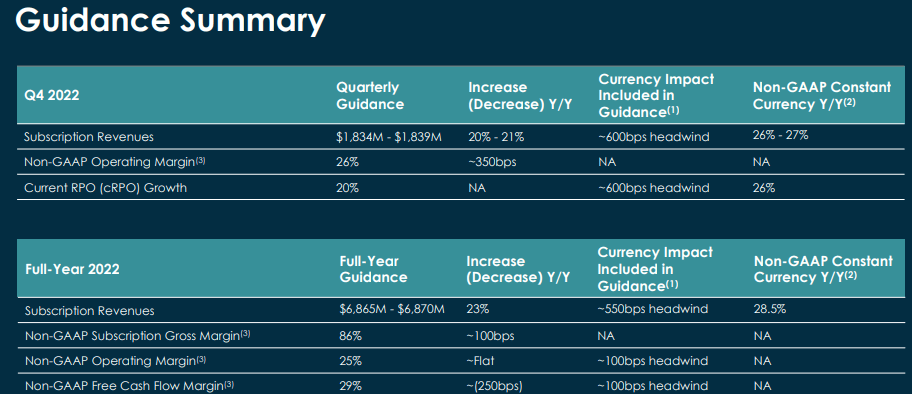

Looking ahead, NOW expects to report up to 21% YOY revenue growth which includes a 600 bps impact from currency.

2022 Q3 Presentation

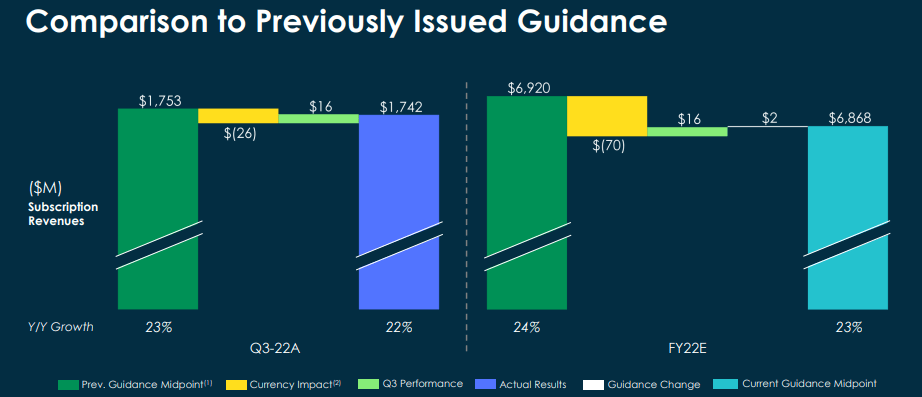

Just to illustrate the moving parts to guidance, the stronger dollar and outperformance in the third quarter were the main drivers behind the adjustment in guidance.

2022 Q3 Presentation

On the conference call, management acknowledged some macro impact but also noted that they may be experiencing less impact than peers due to the core importance of boosting customer productivity. Weak economies don’t make companies focus less on productivity – it arguably makes productivity all the more important, making NOW’s products mission-critical. Management noted that while customers are looking at deals closer, they are still closing deals strongly.

Is NOW Stock A Buy, Sell, or Hold?

Why is NOW able to show such resilient fundamentals? It all comes down to the core product. NOW is an enabler of digital workflows.

2022 Q3 Presentation

What is a digital workflow? Here’s one example. A tech company might onboard a new employee. NOW makes it possible to present every new employee with an automated onboarding workflow – spanning from training to receiving new equipment. NOW is powering the digital transformation.

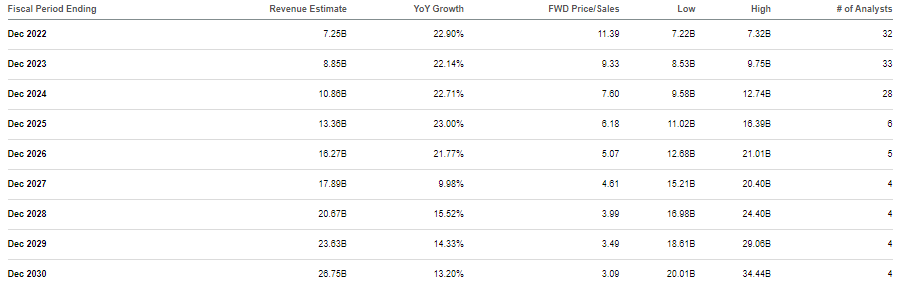

NOW’s resilient fundamentals, as well as Wall Street’s confidence in the growth story have led the stock to sustain a premium even after the crash. The stock is trading at 11x sales – a lofty multiple considering that top-line growth is expected to hover around the mid 20s moving forward.

Seeking Alpha

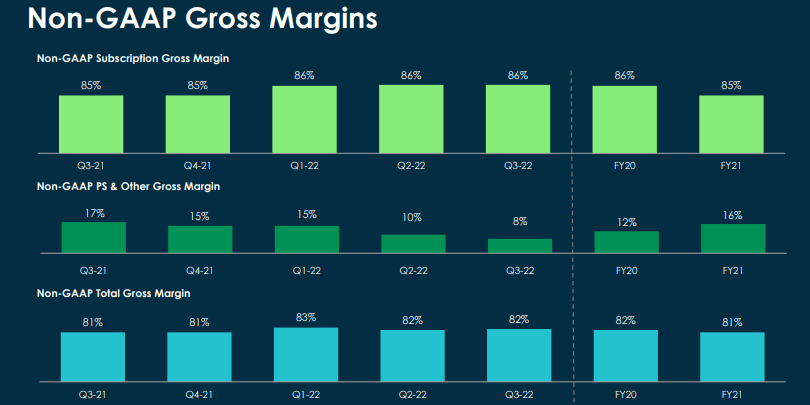

NOW is not yet generating robust profits, but that may change soon. Operating leverage is core to the tech thesis – to put it simply, NOW creates one software product which can be shared by multiple customers. Gross margins remain high at around 86%.

2022 Q3 Presentation

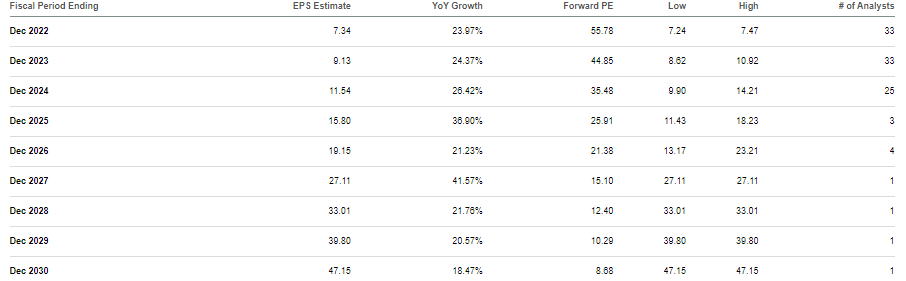

Those high gross margins suggest that the bottom-line should grow much faster than revenues over the long term, and that is seen in consensus estimates.

Seeking Alpha

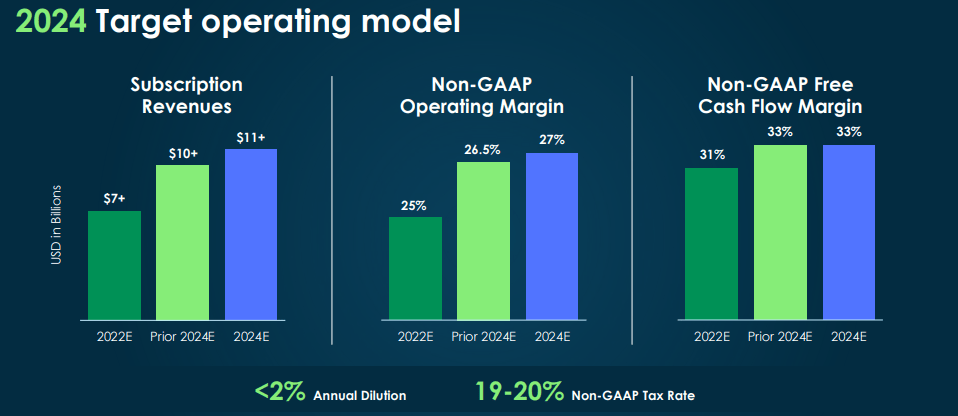

At its 2022 Investor Day, NOW guided for at least $11 billion in revenues by 2024 and $16 billion by 2026 – consensus estimates are similar.

2022 Investor Day

I can see the company sustaining at least 30% net margins over the long term. Based on 20% growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at 9x sales in 2026, representing a stock price of $736 per share or 16% compounded returns over the next 4 years. I wouldn’t be surprised if the stock commands a PEG ratio in excess of 1.5x and I note that the above calculation does not take into account any earnings generated every year.

What are the key risks? We have seen many tech companies lower their long term guidance targets. It is possible that NOW will have to reduce its target as well. I expect such an event to lead to a dramatic re-rating of the stock downwards as tech peers of a similar growth cohort are typically trading at around 4x-6x sales – representing as much as 50% downside. The rich valuation also lends itself to greater volatility – ironically the relative lower volatility that NOW has shown as compared to more beaten-down tech peers may imply greater future volatility, as there is more “room” in the valuation to fall. I have discussed with Best of Breed Growth Stocks subscribers that a select portfolio of beaten-down quality tech stocks is my preferred way to take advantage of the tech stock crash. While the near-term picture remains cloudy, I continue to find NOW highly buyable here.

Be the first to comment