Michael M. Santiago

Thesis

The Goldman Sachs Group, Inc. (NYSE:GS) stock’s performance has exceeded our expectations since we urged investors to capitalize on its late September pessimism to add exposure.

Accordingly, GS has outperformed the S&P 500 (SPX) (SP500) since our previous update, posting a price gain of nearly 30% compared to SPX’s 9.4% uptick. It has also significantly outperformed its 5Y and 10Y total return CAGR of 12.4% and 14.2%.

Hence, GS has continued to leverage its post-earnings momentum as its valuation normalized. We believe the market has re-rated GS as it didn’t anticipate a severe recession could be in the cards. We highlighted previously that GS’ valuation was configured for a recessionary environment pre-Q3 earnings.

However, the recent release of the Fed’s minutes corroborated the consensus view that a 50 bps rate hike is likely in the upcoming December FOMC meeting. While a higher terminal rate is expected, the market remains tentative over the extent of the revision in median projections.

Notwithstanding, it appears that the Fed remains confident that a recessionary could be avoidable (Fed’s staff minutes see a recession as 50/50). Moreover, the Fed is likely moving into data dependency mode in H1’23 as it slows its rate hikes cadence. As such, it could lift the uncertainties in investment banking, as the market could garner more confidence over the widening spreads as it parses the end of the Fed’s rate hikes.

Therefore, we believe the market has attempted to reflect the optimism in Goldman Sachs’ most critical revenue and profitability driver, as it recently restructured its business segments.

While it’s not expected to lead to significant operational changes, we parse that there could be upward revisions to the consensus estimates.

However, we assess that the normalization in GS’ valuation has dramatically reduced the appeal of adding GS at these levels. Its price action also suggests caution, with a healthy pullback welcome after a remarkable momentum surge.

Revising from Buy to Hold.

GS: Consensus Estimates Seem Too Gloomy

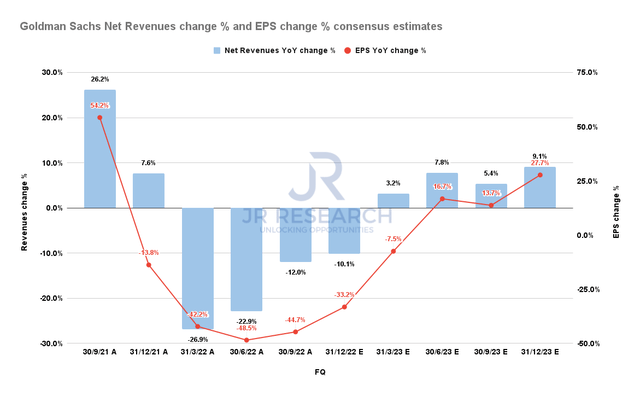

Goldman Sachs Net revenue change % & EPS change % consensus estimates (S&P Cap IQ)

Wall Street analysts revised Goldman Sachs’ net revenues and EPS estimates downward after its Q3 card, seeing increased macro risks that could crimp its Investment Banking segment.

While the modeling indicates that the worst is likely over for the bank, its earnings could only return to growth in H2’23.

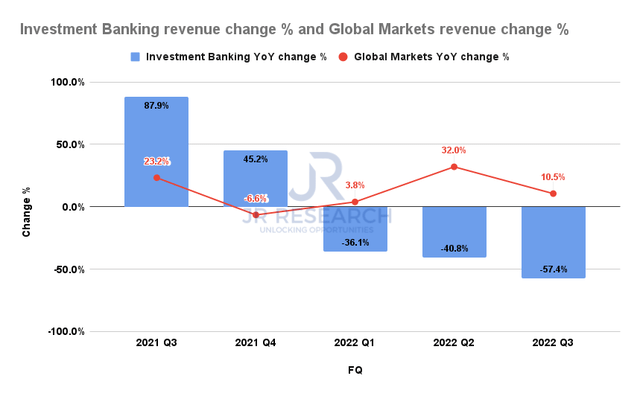

Goldman Sachs Global Banking & Markets Revenue change % (Company filings)

Notwithstanding, the Street’s concerns are understandable. As seen above, GS posted a decline in Investment Banking revenue of 57% in FQ3, worse than FQ2’s 41% downtick. Furthermore, Global Markets’ revenue increased by just 10.5%, down from Q2’s 32% growth.

As such, the Street forecasted an FY22 EPS growth of -42.6% and an FY23 EPS growth of 9.9%. Notably, these estimates are way below the bank’s past five years’ performance.

Furthermore, analysts’ estimates for S&P 500’s Investment Banking (IB) industry indicate that Goldman Sachs’ analysts could have gotten too pessimistic over CEO David Solomon & team’s execution. Notably, the IB industry is expected to post an FY22 earnings growth of -18.4% and an FY23 earnings growth of 14.3% (according to Refinitiv data).

Hence, we postulate that analysts have likely pulled out their bear case for Goldman Sachs, expecting the investment banking environment to remain highly challenging. Furthermore, Solomon also didn’t help matters, as he telegraphed a tepid outlook in its FQ3 earnings commentary, likely attempting to de-risk the bank’s execution through FY23. Solomon added:

[The] global economy continues to face significant headwinds. Inflation remains high. Central banks are raising interest rates at a pace not seen in decades. Meanwhile, equity markets are well off the recent highs. Geopolitical instability and energy shocks are an ongoing concern, and GDP growth expectations are declining. Many of these trends accelerated towards the end of the quarter. As we head into the fourth quarter, my sense is that the outlook will remain unsettled, though economic performance will vary by region. I also expect volatility to persist as markets continue to digest these factors. (Goldman Sachs FQ3’22 earnings call)

But The Market Re-rated GS Anyway

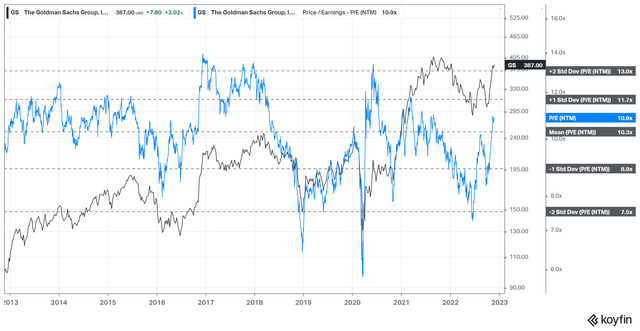

GS NTM normalized P/E valuation trend (Koyfin)

Despite the analysts’ estimates cuts, the market re-rated GS through November. As a result, GS last traded at an NTM normalized P/E of 10.9x, ahead of its 10Y average of 10.3x. It reached a low of 8.4x in September, which we highlighted in our previous article that the market reflected a recessionary base case.

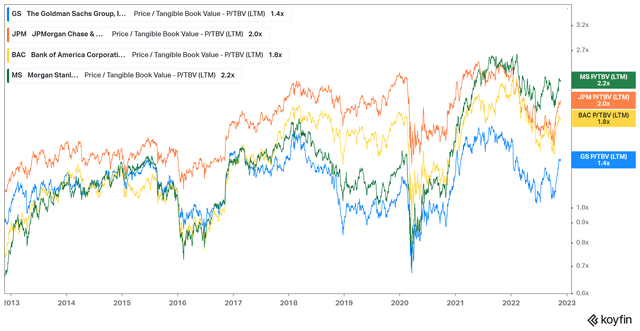

GS TTM Tangible Book value per share multiple valuation trend (Koyfin)

Moreover, GS’ TTM tangible book value multiples have also normalized above its 10Y averages, reaching 1.4x. However, it remains below its peers, with Morgan Stanley (MS) stock’s multiple looking increasingly expensive. While we don’t expect GS’ multiple to reach its banking peers’ valuation, given its IB risks, the broad re-rating in financials has benefited it.

Is GS Stock A Buy, Sell, Or Hold?

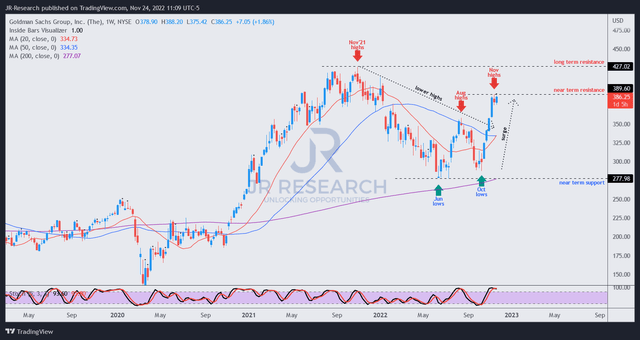

GS price chart (weekly) (TradingView)

While the re-rating in GS is welcome as it outperformed the SPX, we believe the recent surge could have taken it too far ahead.

As seen above, the momentum spike has breached the 50-week moving average, potentially signaling a change in trend moving ahead.

However, investors need to be cautious with the spike from its September lows. Therefore, we postulate that the subsequent pullback will allow us to evaluate whether GS could retake its bullish bias and urge investors to remain patient.

Coupled with valuations that seem more well-balanced, we revise GS from Buy to Hold for now.

Be the first to comment