Khanchit Khirisutchalual

ServiceNow (NYSE:NOW) released second quarter earnings results that reflected much of what was expected of the company. Sure, the macro headwinds have had some impact, but the enterprise tech company has shown that its products remain as mission-critical as ever. The company is generating positive cash flows and has a cash-rich balance sheet. While the stock is not trading nearly as cheap as many tech peers, the stock remains as buyable as ever.

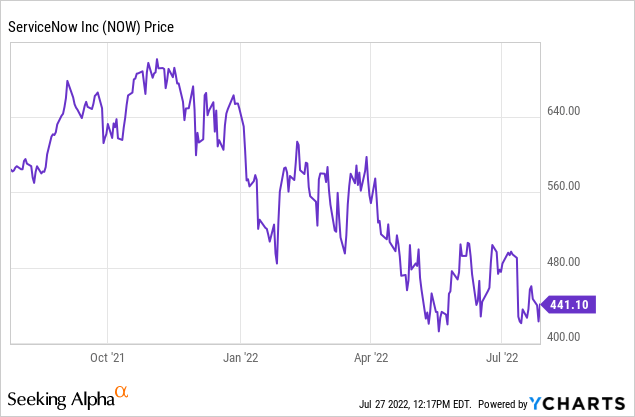

NOW Stock Price

NOW has had a difficult year, peaking around $707 per share and recently trading hands at around $438 per share.

I last covered NOW in June when I discussed the potential for enterprise tech to roar higher. That thesis has not quite played out yet, though enterprise tech earnings have remained resilient in spite of macro headwinds.

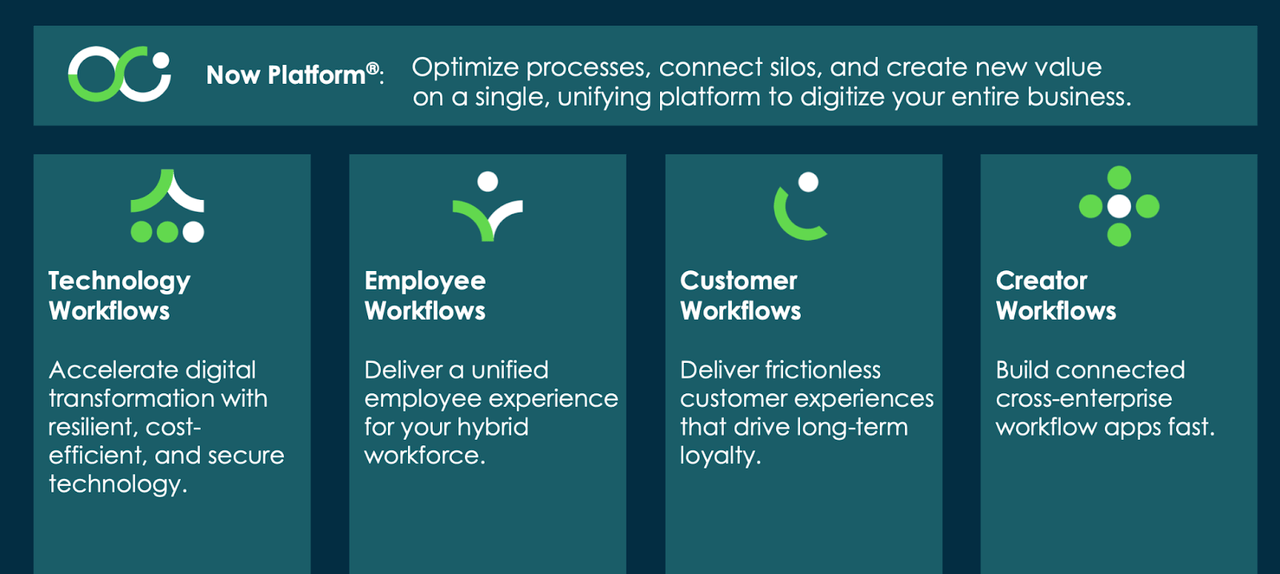

What is ServiceNow?

NOW is an enabler of digital workflows.

NOW Investor Presentation

That concept is best explained with examples. NOW’s customers might use its products to assist their own customers with automated customer service.

ServiceNow

They might also use the products to assist their employees – helping to boost their productivity.

ServiceNow

NOW is helping companies automate workflows – helping to improve productivity and reduce costs. NOW is enabling the digital world of the future.

NOW Stock Key Metrics

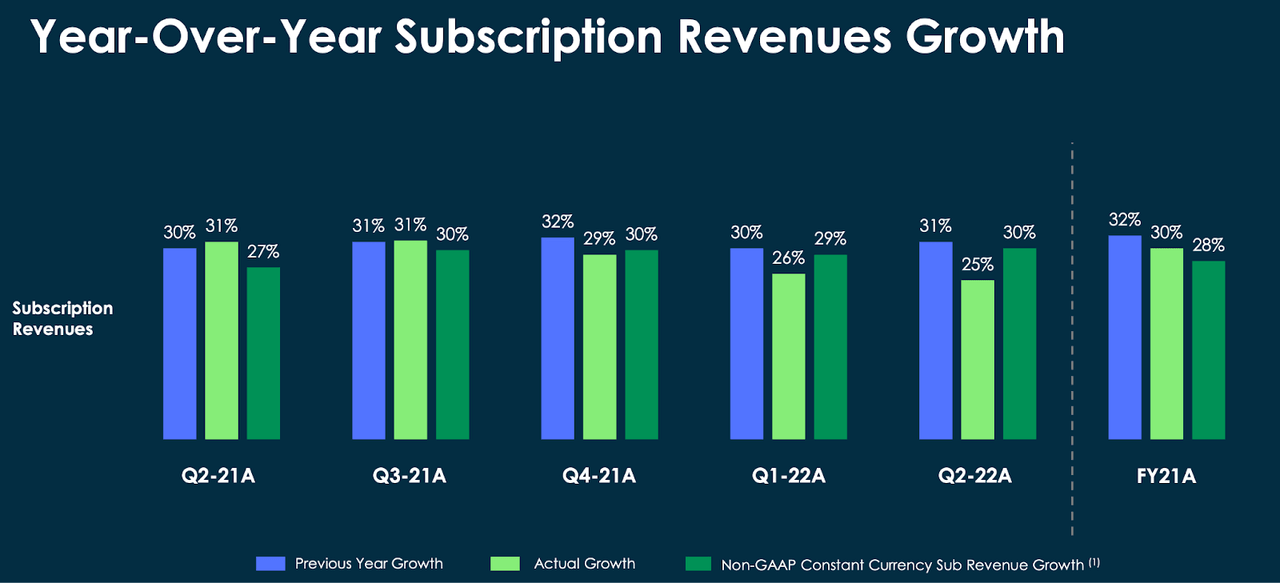

In the second quarter NOW delivered robust 25% subscription revenue growth.

2022 Q2 Presentation

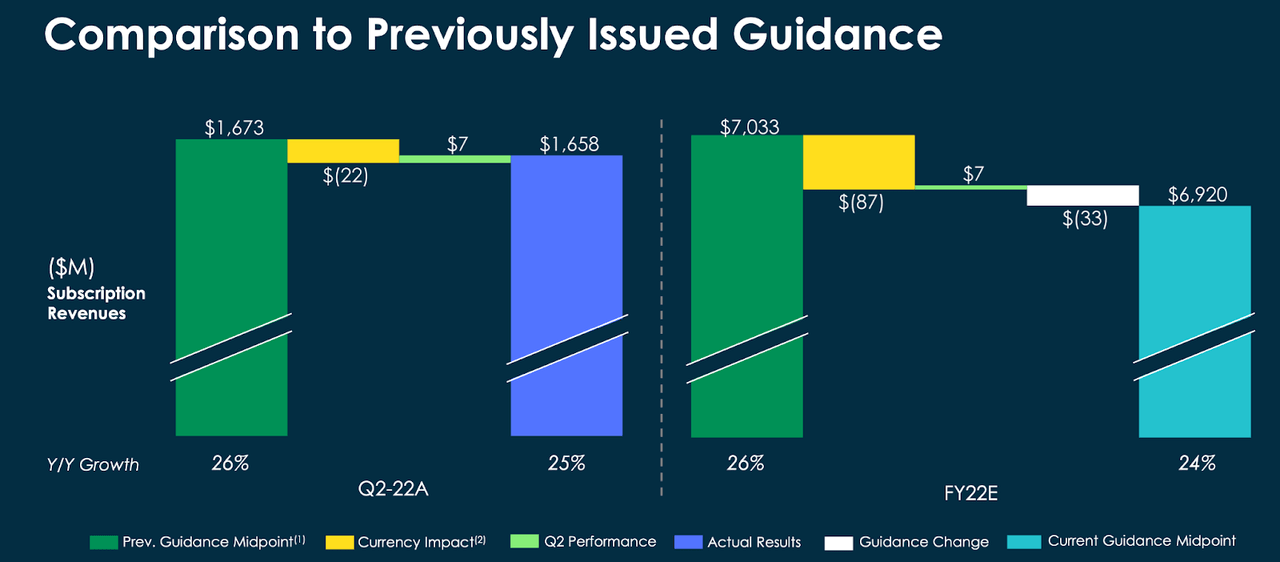

While that figure fell short of previous guidance, the company notes that currency fluctuations had an outsized impact – excluding currency fluctuations the company did outperform in the quarter.

2022 Q2 Presentation

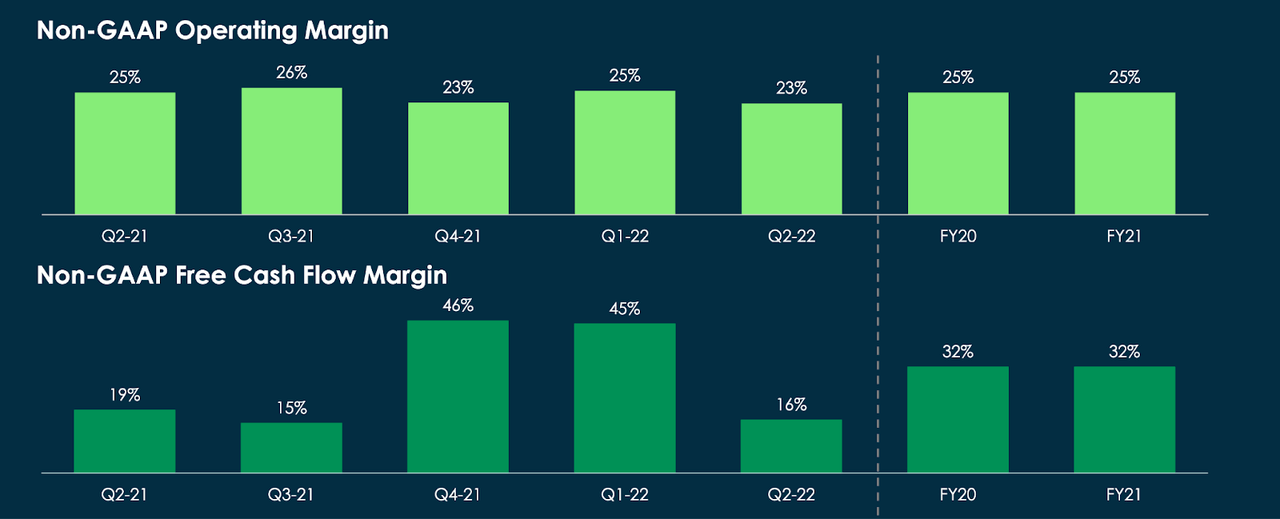

The company continued to deliver solid profit margins, with non-GAAP operating margins standing at 23%. I note that operating margin is more reliable than free cash flow margin because the latter includes deferred revenues.

2022 Q2 Presentation

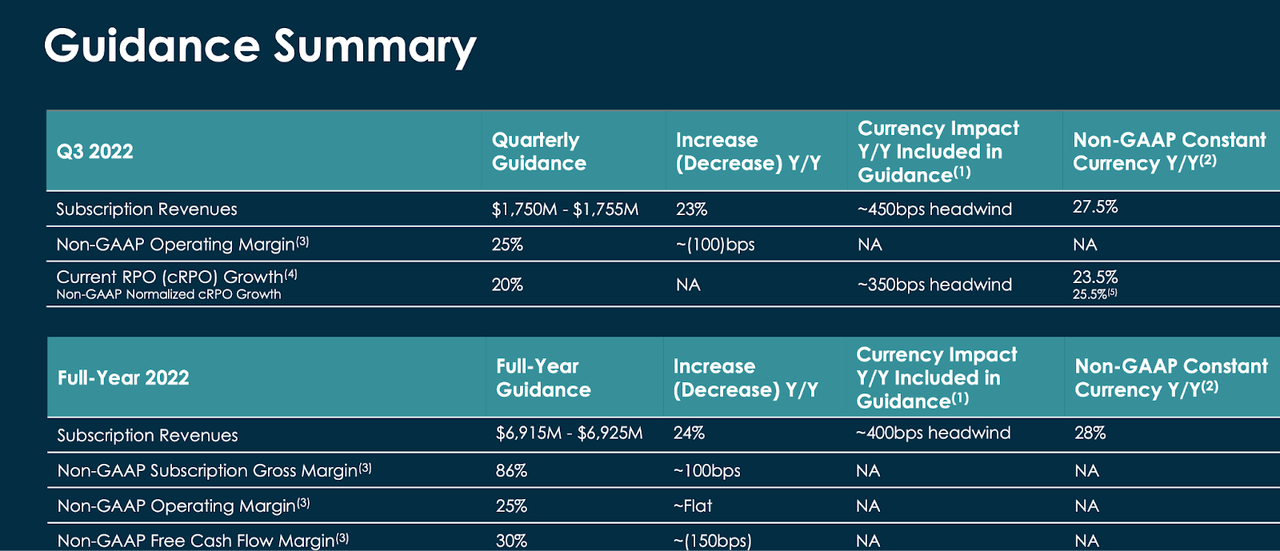

The company did reduce full-year revenue guidance from $7.04 billion to $6.925 billion, though the bulk of that revision is due to currency headwinds.

2022 Q2 Presentation

NOW ended the quarter with $2.4 billion in net cash. While not a perfect quarter, the results greatly resembled those of the past and may suggest that the struggling stock price is not reflecting the underlying fundamentals.

Is NOW Stock a Buy, Sell, or Hold?

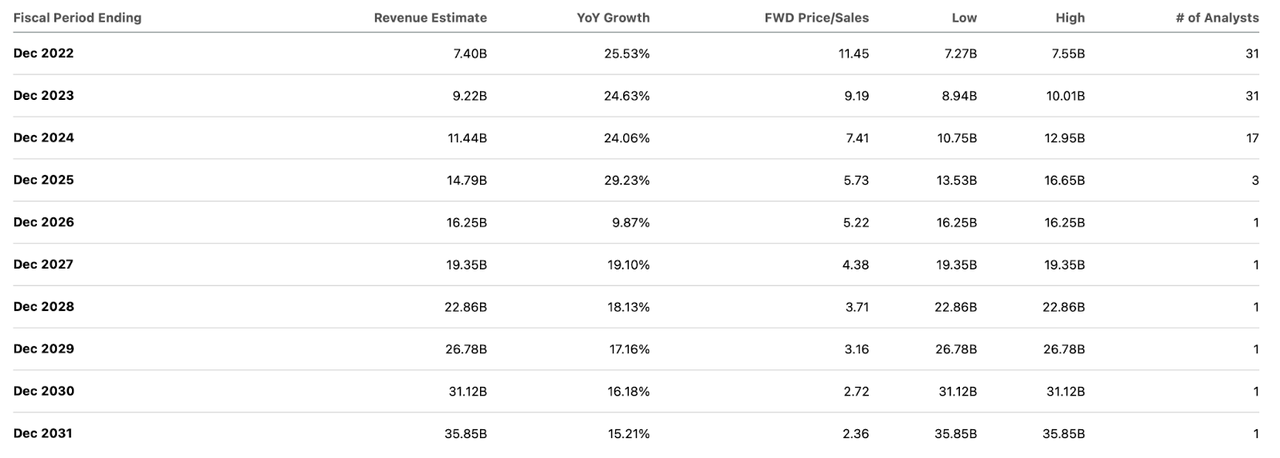

Even after the crash in tech stocks, NOW still commands a rich multiple, trading at around 11x forward sales. The company is expected to sustain strong growth over the coming decade.

Seeking Alpha

I could see NOW achieving 30% long-term net margins. Applying a 1.5x price to earnings growth ratio (‘PEG ratio’), NOW might trade at 6.8x sales by 2031, implying a stock price of $1,252 or 11.5% compounded annual returns over the next 9.5 years. That should be enough to outperform the broader market, though it’s arguably not so exciting considering the deeply discounted valuations frequently seen in the tech sector. Investors may appreciate NOW’s net cash balance sheet, positive cash generation, and digital-enablement secular growth story. In this market, clarity has earned and deserves a premium (but separately one can argue if the premium is overdone). Given the valuation, a key risk to consider is that of multiple contraction. If the market sours on sentiment regarding NOW, then I can see valuations falling to as low as 7x sales based on where comparables trade – implying 40% potential downside. Another risk is that of slowing growth – consensus estimates may prove aggressive if NOW is unable to achieve its guided growth outlook. I rate the stock a buy but emphasize that one may be able to find more compelling opportunities elsewhere in the sector.

Be the first to comment