Gerd Harder/iStock via Getty Images

Death? It is not something we like to think about, but it is the only fundamental truth of life. We are born, we live and we die. Due to the “depressing” subject matter, very few budding entrepreneurs with venture capital funding wake up one morning and say “I want to disrupt the funeral business”. These entrepreneurs want to get into something much more exciting such as technology, social media or even flying cars. Most Investors also follow this same thought pattern. However, true value investors know that the best place to find deals is to “fish where others aren’t fishing”, which requires a contrarian approach to investing.

The interesting part of human psychology related to funerals has led to massively favorable economics in the industry. This is a business characterized by low competition, recurring customers (not the same people), and high returns on capital. In addition, the funeral industry is “Recession-proof” as it is not “discretionary” when we end our journey of life. People do not say to themselves, I’m not going to pass on this winter, due to a “poor economy”, I’m going to wait until better economic conditions. Such a thought process would be ludicrous and defy the laws of nature.

Therefore, in this post, I’m going to deep dive into the largest provider of funerals and cemetery services in North America, Service Corporation International (NYSE:SCI). I’m going to break down the business model, financials, and valuation for this contrarian stock, let’s dive in.

The Peter Lynch Connection

Peter Lynch is a billionaire and investing legend who ran the Magellan Fund at Fidelity investments during the 1980s. Lynch beat the market for over a decade and generated a spectacular, compounded annual return of 29.2%, more than double the S&P 500 return.

Peter Lynch invested in many “unpopular stocks”, with the most notable being Service Corporation International. He even mentioned the stock in his best-selling book “One Up on Wall Street”, released in 1989.

In the book, Peter Lynch highlighted that “not a single investment analyst” paid the slightest attention to the funeral stock for “over a decade”. This was due to the aforementioned reasons. Lynch highlighted that if you would have invested $10,000 into the stock in 1969 when the company was founded, you would have made $137,000 by 1987.

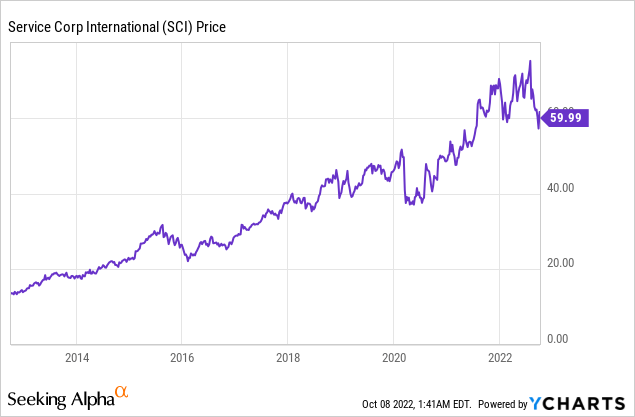

Now you may think that once, the book was released many investors would drive up the valuation and thus make it an unprofitable investment. However, I calculated that if you invested in SCI in 1989, when Lynch released his book and held it until 2022, you would have made 10 times your money. Even more shockingly the stock has racked up a gain of 72%, between the 2020 low and mid-2022 as returns continue to roar.

Business Model

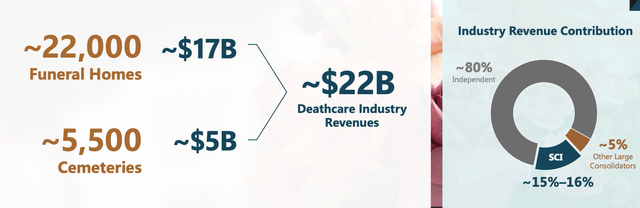

As mentioned prior, the funeral industry has a very unique set of industry characteristics. Historically, the business was characterized by many “mom and pop” shops or family businesses which were passed down through the generations. Today the industry is still very fragmented with 22,000 funeral homes and over 5,500 cemeteries across the USA. Total revenues for the industry equate to a staggering $22 billion, thus the total addressable market is huge for SCI.

Funeral Industry (Investor Presentation 2022)

SCI is the leader in the industry as the largest provider of deathcare services across 44 states, including Puerto Rico and Canada. The company started as a “mom and pop” shop similar to many others. However, the difference was SCI scaled its model and acquired many other similar businesses. These acquisitions include Alderwoods Group, Keystone North America, The Neptune Society, and many more. Over the past 5 years, SCI has invested over $770 million into “growth opportunities” which include a combination of acquisitions, new builds, and event spaces.

Acquisition Strategy (Investor Presentation)

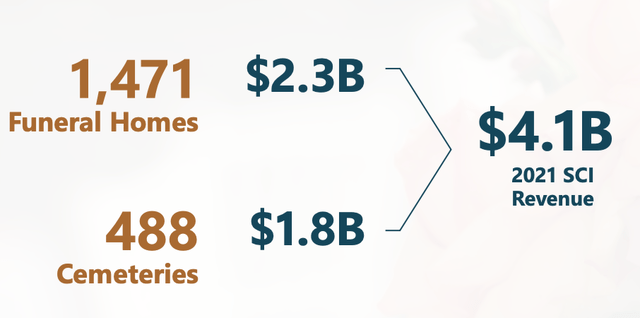

SCI now owns 1,471 funeral homes and 488 Cemeteries across North America. The business generated over $4 billion in revenue as of the full year 2021, which is astonishing.

SCI (Investor Presentation 2022)

The secret sauce of SCI is not just its aggressive acquisition strategy, but also its consistent and caring service. Like any big brand or chain, people flock to it because they have a set of expectations that they need fulfilling. A funeral is one of the most important times in a family’s life and they want to make sure it’s done right. Therefore, many families prefer the safe bet of a big brand such as SCI over a relatively unknown “mom and pop” shop. Funerals are also a very sensitive area, thus the right branding and people skills are required for success. SCI has over 25,000 associates with values aimed at compassionately supporting families.

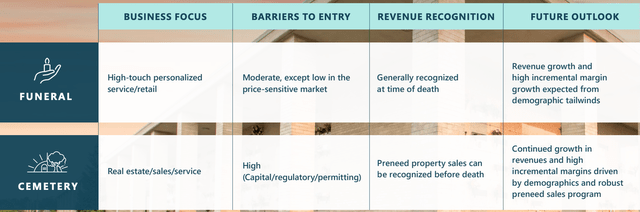

Its Funeral business has focused on a “high touch” personalized service. While its cemetery service is in the business of selling real estate (plots of land) for graves or monuments. This segment is particularly interesting due to the high barriers of entry associated with it. These include large capital requirements, in addition to regulation and permitting. A business cannot just build a new cemetery wherever it wishes, due to the sensitive subject matter, areas have to be carefully chosen and approved.

Business Model (Investor Presentation 2022)

The company’s scale also lends itself to further competitive advantages such as supply chain cost benefits and back-office efficiency. Funerals can also be expensive, due to the pricing power of the industry. However, SCI has also rolled out a direct cremation service aimed at the price-sensitive consumer, as some people just don’t have the funds to pay for an expensive service.

Modern Marketing

Despite the legacy roots of SCI, the company has continued to innovate in all areas including its digital marketing strategy. The business had nearly 200 million website visits in 2021, which was an increase from 166 million in 2020. This was driven by a new SEO (Search Engine Optimization) strategy which focused on content generation to target people at each part of the buyer journey. For example, someone may start by just searching on Google “different funeral types” in order to get an idea of costs and styles. This is part of the awareness phase of the buyer journey, thus the earlier you can connect with the customer the better the economics long term.

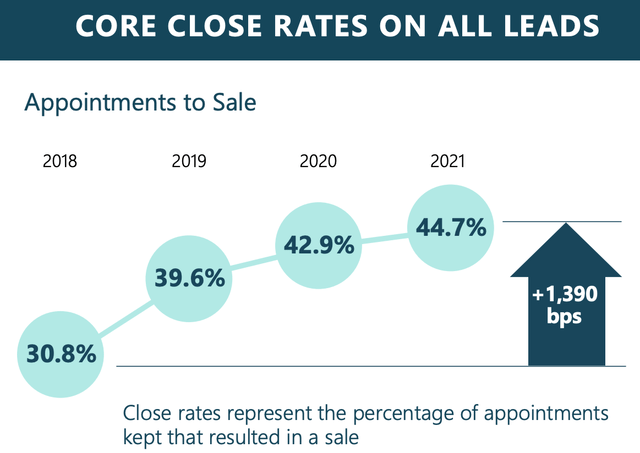

The company also uses traditional marketing/sales tactics such as referrals from families and paid lead generation efforts. The target older demographic also responds well to direct mail and seminars. Surprisingly SCI even uses Salesforce CRM (Customer Relationship Management) software combined with cutting-edge sales training. Overall, this has helped the business increase its “closing rate” from 30.8% of prospects in 2018 to 44.7% by 2021. As funerals are a sensitive area, mastering the fine line between sensitivity and a “hard sell” is an art form in itself.

Close Rates (Investor Presentation 2022)

cemetery capacity is becoming a major issue in the industry, but luckily SCI has approximately 110 years left of available plots at its current annual sale rate.

Cemetery Capacity (Investor Presentation 2022)

Growing Financials

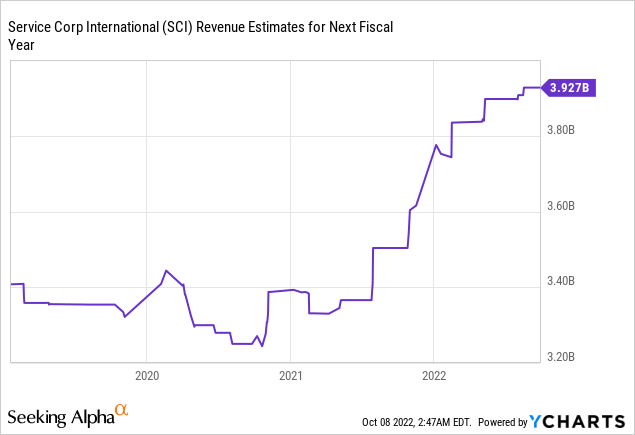

Service Corporation International generated steady financial results for the second quarter of 2022. The business generated revenue of $990.86 million, which surpassed analyst consensus estimates by $42.9 million. This is not a “high growth” company as revenues only increased by 2% year over year or $10 million, but it is consistent. The business’s number of families which have initiated funerals is 6% higher than pre-Covid levels, which the company believes is above and beyond Covid-related deaths explicitly.

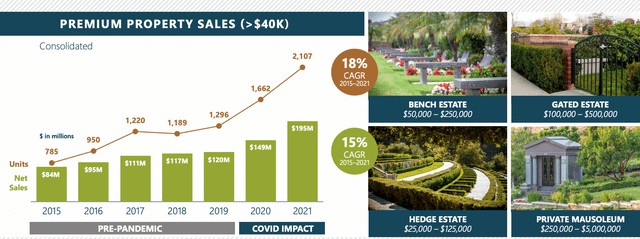

Historically, the SCI has generated a rapid 18% Compounded annual growth rate [CAGR] in the sales of its “premium property”. This includes gated estates which retail between $250k-$500k and private Mausoleums which can cost up to $5 million, which is astonishing.

Premium Property Sales (Investor Presentation 2022)

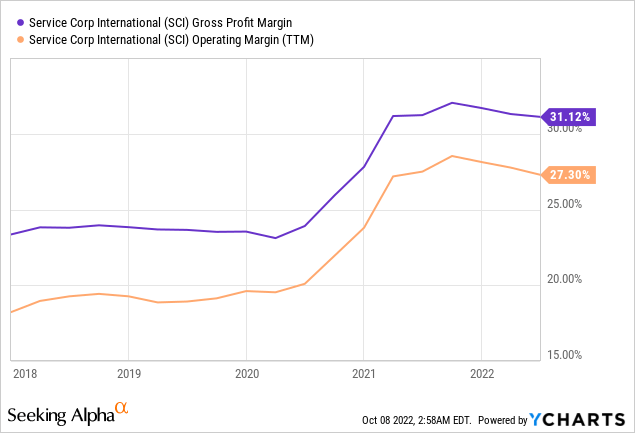

SCI is hugely profitable with an operating margin of between 23% and 27%. To put things, into perspective the industry average operating margin for a software company is 23%, thus SCI has astounding margins.

In the second quarter of 2022, SCI generated $221.2 million in operating profit which was down slightly from the $246 million generated in the equivalent quarter last year. This was driven mainly by declines in its high-margin merchandise service and Eternal Care Trust Fund.

The good news is the company generated Earnings Per Share of $0.82, which surpassed analyst estimates by $0.03 per share. EPS has increased by a substantial 45% since 2020 and 79% since 2019

Moving forward, the business is expecting solid organic revenue growth of between 5% and 7%. Management’s strategy will focus on investing 3% and 5% of its profits back into the company in the form of share buybacks, extra sales/marketing spend and debt reduction payments. Earnings per share is expected to grow by between 8% and 12% which aligns well with prior growth rates. Operating cash flow is forecasted to be between $750 million and $800 million for the full year of 2022. The business generated $473 million in adjusted cash flow in the first two quarters and thus is on track to achieve its targets.

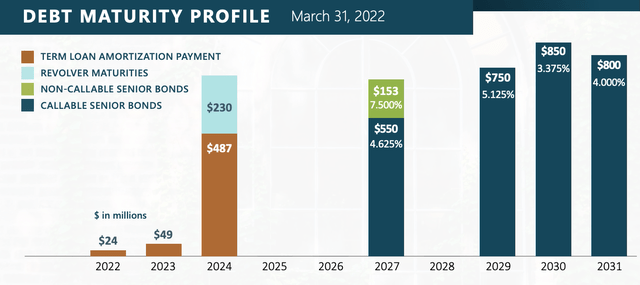

The company’s balance sheet has a fairly high amount of debt with ~$3.8 billion in long-term debt as of Q2,22. The positive is only $63.2 million is current debt, due within the next two years and thus manageable. The chart below shows the business’s overall debt maturity profile is fairly staggered past 2029 which is a positive. At the second quarter’s end, SCI had $206 million in cash and cash equivalents on its balance sheet. The company pays a forward dividend yield of 1.64%, which has grown at a nearly 12% 5-year growth rate.

Debt Maturity (Investor Presentation 2022)

Advanced Valuation

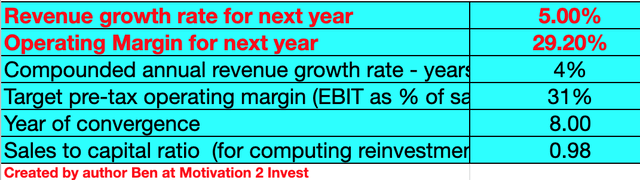

In order to value SCI, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 5% growth rate for next year and 4% over the next 2 to 5 years. This is fairly conservative and at the bottom end of guidance.

Service Corporation stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted the business’s operating margin to creep up slightly to 31%, over the next 8 years. Again, this is conservative given EPS growth rates highlighted by the company.

Service Corporation (Stock valuation 1)

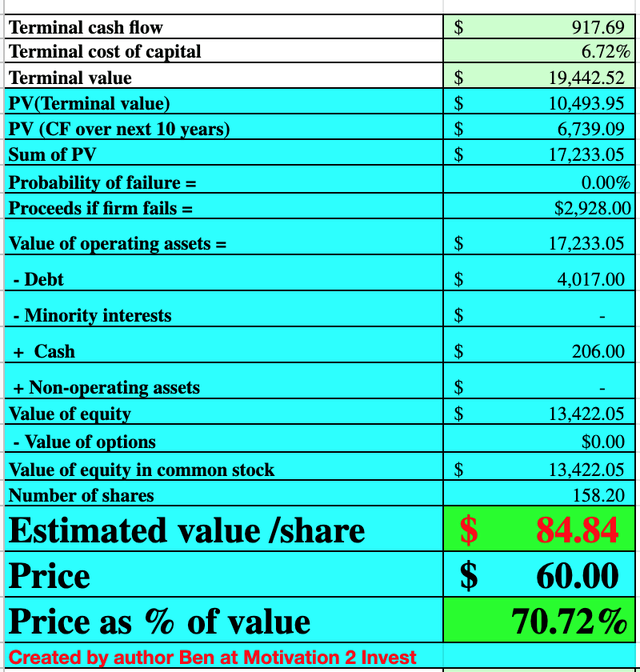

Given these factors, I get a fair value of $84.84 per share, at the time of writing the stock is ~$60 per share and thus is ~29% undervalued.

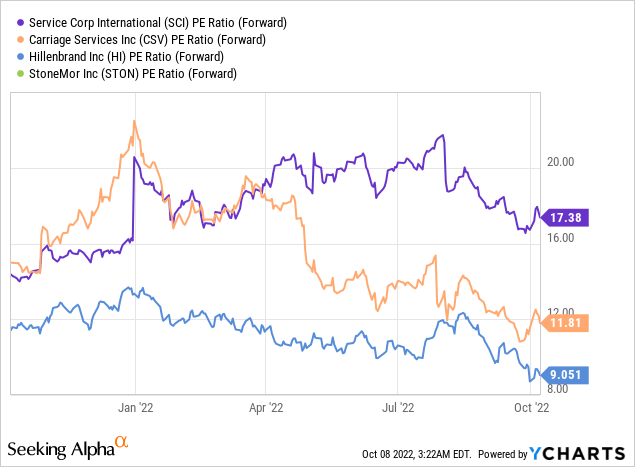

As an extra data point, SCI trades at a Price to Earnings (P/E) ratio = 17.9 which is 15% cheaper than its 5-year average. Relative to industry competitors, SCI is the most expensive. However, I believe this is justified given its dominant position and strong track record of execution.

Risks

Defining the risk section for this business was actually quite difficult. The company is relatively protected from a recession, although some customers may opt for its lower-cost, lower-margin services if finances are tight. There is competition in the industry, but there aren’t many big players with the scale economics of SCI. Inflation could squeeze margins slightly due to the cost of a coffin and rising real estate prices may also impact its acquisition strategy. Another potential risk is the slow revenue growth of the business, this is not a software company that is growing at a 50% clip, you are buying the existing cash flows.

Final Thoughts

Service Corporation International is the largest funeral provider in North America, with a strong and established brand. The business has continued to perform well over the decades prior and I expect this to continue in the future. The stock is undervalued intrinsically at the time of writing and thus could be a great buy for the long term.

Be the first to comment