designer491/iStock via Getty Images

Seritage Growth Properties (NYSE:SRG) is a stock that we have followed for a long, long time. It is fair to say that we have never ever gotten over the problems with the company to reach a bullish verdict. In fact, every single call has been either bearish or neutral.

TIPRANKS

We won’t make any apologies for that, as the company has failed to deliver on multiple different levels. What we want to look at, though, is the current risk-reward after the last little meltdown and see if we can finally make the jump over the hump.

Income Properties Dream Is Dead

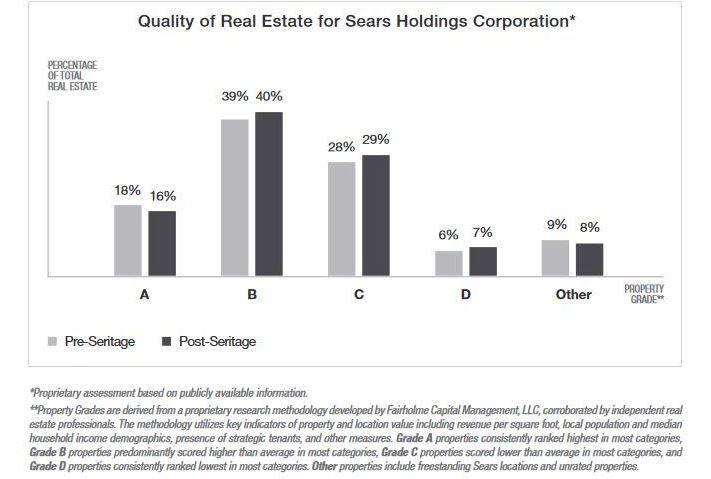

SRG morphing into some premier class A mall owner was the idea that was floated around when it was listed. We never bought into that for two reasons. The first being that we saw its properties as B to B+ at best. This was in fact stated by one of the biggest bulls on Sears Holdings (OTCPK:SHLDQ) and SRG, Bruce Borowitz.

Seritage Presentation By Bruce Berkowitz

The second being that the final value, even in the best case scenario, was not worth it. This was considering that we could buy Class A mall operators like Simon Property Group (SPG) at exceptionally low funds from operations (FFO) multiples. So if we applied an 8X-10X FFO multiple to SRG’s best case, we saw that the stock would not justify even the $40 it traded at, at the highs. That dream has been abandoned, with the firm now moving away from the REIT structure and focusing on asset sales.

All About Accelerated Asset Sales

The 10-Q made a cute mention about the “going concern” analysis. The clock is now on.

In addition to the $85.0 million of assets referenced above under contract, the Company is currently marketing or about to bring to market for sale, assets with an estimated fair value of $636.3 million, which would, if sold, allow the Company to meet the $640 million Term Loan Facility principal pay down required to extend the facility. While these assets are intended for sale, and the Company believes that they will close before the maturity, there is no assurance that these assets will be under contract within the one-year timeframe in which the outstanding balance from the Term Loan Facility will need to be factored into the Company’s going concern analysis.

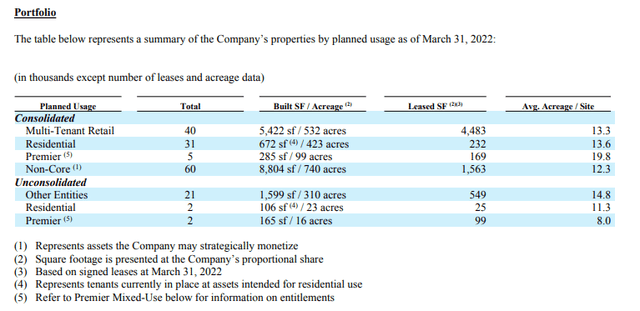

Over the past several years, we have seen SRG successfully sell over $1.5 billion of properties by disposing about 120 properties. There are 161 proprieties left.

SRG Supplementary Q1-2022

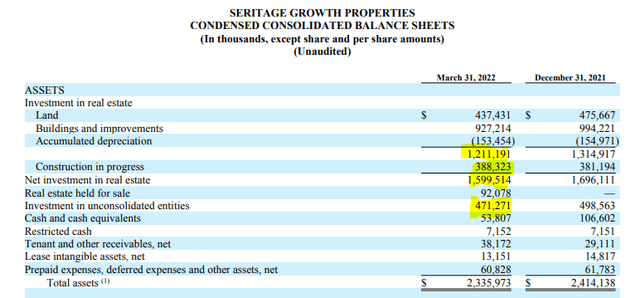

In general, SRG was selling its lower quality properties while developing its best projects first. Considering the property cost inflation that we have seen over the last 5 years and capex poured in to these projects (well over a $1 billion), it would be very difficult to argue that these remaining 161 properties are not worth well above the $1.5 billion mark. Another way to see this is to take the GAAP values on the balance sheet and go from there. Historical cost is likely understating the potential by a large amount, and SRG has generally reported large gains on sales versus these values. But even using those numbers, including the very real $400 million of construction in progress, we get to some decent buffer versus their $1.4 billion term loan from Berkshire Hathaway (BRK.A) (BRK.B).

SRG Supplementary Q1-2022

Why We Are Still Cautious

SRG equity is deep in junk bond territory. Bulls may disagree, but when your total NOI cannot cover half your interest expense, you would probably be lucky to get a CCC from the rating agencies. The market is also now incredibly hostile. NGL Energy Partners LP (NGL) is in a favorable sector and has EBITDA interest coverage of almost 2.0X. Its bonds maturing in 15 months still yield almost 14%. We think that SRG can pull this asset sale off and the risk to reward has now finally tilted in the favorable category. So we think a $10 price target with a mildly bullish view is feasible. But let us not equate this with a “hand over fist” or a lay up.

Where There Are Better Deals

Seritage Growth Properties 7% CUM PFD SR A (NYSE:SRG.PA) is the best choice here. With a 62% upside to par, the preferred stock beats our SRG price target upside of 44%. It also beats it with far less risk. There are also a few unlikely, but possible scenarios that SRG actually takes a loss, while the preferred shares actually get redeemed at par. SRG.PA currently yields 11.33%, so it offers a large bonus for the next year over and above the expected returns of 62%. Of course, investors must always consider that the dividend could be stopped. The firm is no longer a REIT, and those preferred shares were an outlet to pay any taxable gains in the form of dividends. Still, a cut is unlikely as it would cause panic within the shareholder base. The shares also cost the company only $4.9 million a year, so a cut is unlikely to really help anything that ails them at present. Those dividends are also cumulative, so a cut is not helpful if the plan is to start returning capital to common shareholders down the line. There is the sideshow here of the case against SRG brought on by SHLDQ. We see that as a possible risk, but mainly to the common shares, as any settlement should be modest and will not derail the preferred shares par value.

The other choice would be a call-spread. Buying the January 2023 $7 calls and selling the $11 calls for a $1 net premium would be our way to go.

Seeking Alpha

This creates a breakeven of $8.00 and a maximum upside return of 300% in case the deal is announced over $11.00. We don’t think the maximum value is over $15 in the very best case, so this setup appears a good choice versus going long the stock. In that case, the best return would be 115% in the journey from $6.94 to $15.00. But the risks of that are far higher.

Verdict

SRG has some compelling long side plays now. While we rate the common shares as neutral, we are ready to put a buy on the preferred shares and would not mind venturing into some option plays to capture the upside. We might have even gone with an outright purchase of the common shares if we thought the macro climate was more benign. But at present we still think the risks for SPX 3,200 are up and center, and we approach all long side ideas defensively.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment