Brett_Hondow/iStock Editorial via Getty Images

There’s value to be had in pure-play REITs, as a singular focus does away with distractions while enabling management to hone in and perfect their skill set. This simplicity also makes them easier to value. Perhaps that’s why Realty Income Corp. (O) spun off Orion Office REIT (ONL) last year to focus more on its retail side.

This brings me to Four Corners Properties Trust (NYSE:FCPT) which focuses on the retail service space. This article highlights why FCPT appears to be attractive at the current price for income and growth, so let’s get started.

Why FCPT?

Four Corners Property Trust is a net lease REIT whose restaurant portfolio is leased to major brands such as Olive Garden, Chili’s and Red Robin. At present, the company has ownership interests in 954 properties that are diversified across 46 states in the continental U.S.

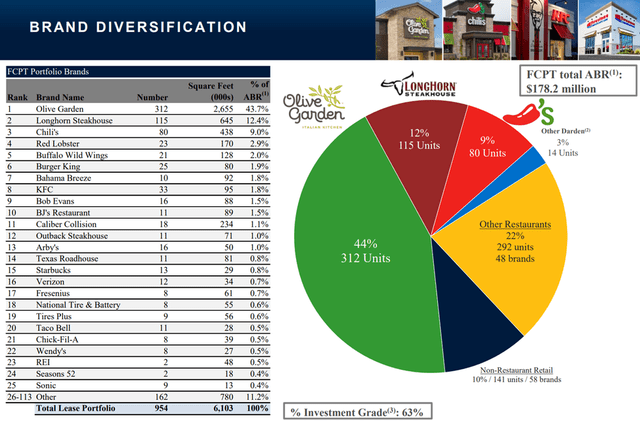

It was spun-off from Darden Restaurants (DRI) back in 2015, and since then, has reduced its exposure from 100% to 68%. As shown below, FCPT is primarily exposed to well-known brands such as Olive Garden, LongHorn Steakhouse, and Chili’s, which combine to make up 65% of its annual base rent.

FCPT Portfolio Mix (Investor Presentation)

A key advantage of FCPT is its triple-net leases, in which the tenant is responsible for paying property taxes, insurance, and maintenance. This results in higher margins for the company compared to other real estate sectors, and is reflected by FCPT’s 75.6% operating margin (with depreciation addback) over the trailing twelve months, sitting well above the ~65% range for shopping center REITs. Over time, I would expect for FCPT’s op margin to trend in the 80-90% range as it continues to scale up.

Meanwhile, FCPT is demonstrating solid fundamentals, with a 99.9% occupancy rate with a weighted average remaining lease term of 9.0 years, putting it on par with the ~10 years of peers Realty Income Corp. and National Retail Properties (NNN). It collected 99.7% of its rents in the first quarter, and saw respectable 12.9% and 8.1% YoY rental revenue and FFO per share growth.

This was driven by a combination of both internal and external growth through accretive acquisitions, with 18 properties acquired during the first quarter for $42 million and an average cash yield of 6.7% and remaining lease term of 7.6 years.

Looking forward, FCPT maintains plenty of flexibility to continue its growth trajectory. This is reflected by $308 million in available liquidity, of which $58 million is in cash and $250 million is on undrawn capacity on its revolving line of credit. This is also supported by reasonably low leverage with net debt to EBITDAre of 5.7x, and notably, Fitch recently upgraded FCPT by one notch to a solid BBB flat credit rating.

Also encouraging, management is positioning the company towards the growing medical retail segment, as this segment currently represents 33% of its active acquisition pipeline, with much of the rest (51%) comprised of casual dining properties.

Risks to FCPT include macroeconomic uncertainty, which could impact its tenants. I see the impact, if any, as being muted, however, considering their low price points. In addition, higher interest rates could raise FCPT’s cost of debt. This could also benefit FCPT in that it pushes highly levered competitors out of the bidding process, as the CEO noted during Q&A session of the recent conference call:

We found a few opportunities that I would describe as we have been hanging around the hoop on deals, where the seller had gone with a more levered buyer and as that levered buyers’ debt repriced, the original buyer dropped out, and we were able to pick up properties on the rebound.

I see value in FCPT at the current price of $26.40, after the recent drop from the $30-level. At present, FCPT trades at a reasonable forward P/FFO of 16.35, sitting well below its normal P/FFO of 19.5 in recent years. It also sports a 5.0% dividend yield that’s well covered by an 83% payout ratio (based on first quarter FFO/share of $0.40).

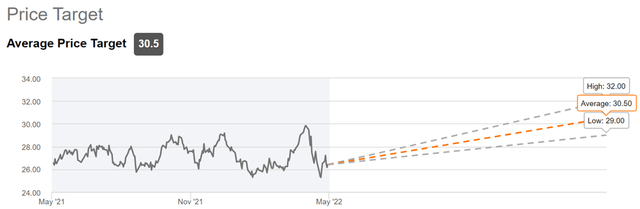

Sell side analysts have a consensus Buy rating with an average price target of $30.50. This translates to a potential one-year total return of 21% including dividends.

FCPT Price Target (Seeking Alpha)

Investor Takeaway

FCPT is a quality net lease REIT with a diversified portfolio of well-known tenants. Its strong fundamentals and balanced capital structure provide plenty of support for future growth, and management has shown its willingness to adapt its property acquisitions towards new categories. I believe the current share price offers an attractive entry point for dividend and value investors.

Be the first to comment