Bet_Noire/iStock via Getty Images

Discretion is the better part of valor. That definitely rings true in a bear market. When we last covered Seritage Growth Properties (NYSE:SRG) we were enamored by the prospects for the preferred shares (NYSE:SRG.PA). We liked the valuation overall for that level of equity, but we did not think the common shares warranted a long position. Specifically we said,

While we rate the common shares as neutral, we are ready to put a buy on the preferred shares and would not mind venturing into some option plays to capture the upside. We might have even gone with an outright purchase of the common shares if we thought the macro climate was more benign. But at present we still think the risks for SPX 3,200 are up and center, and we approach all long side ideas defensively.

Source: Berkshire Is Not Taking A Haircut Here

As SRG announced its plan for selling its remaining assets, the market celebrated. Initially the common shares tore far higher than SRG.PA but then the common fell back as the broader market selloff took hold. Fascinatingly, both are now up about 50% since the article date. We look at what’s going on and give you our take.

Progress To Date

Seritage sold 13 properties during the second quarter of 2022 and generated over $160 million in proceeds. It has also sold a similar amount of properties in Q3-2022 with about $100 million in net proceeds that have been directly applied against the term loan. All of that sounds excellent and it is going a long way to ensure the survival of the company. On the other hand there is some heavy skepticism based on where the stock is trading relative to the price suggested. After all, if SRG expects $18.50-$29.00 as the final value, there is a lot of upside in even the lower end of that spectrum.

Changes Since The Announcement Date

The plan was announced on July 8. Since then, the markets have moved a bit lower with the Vanguard Real Estate ETF (VNQ) down just 6%.

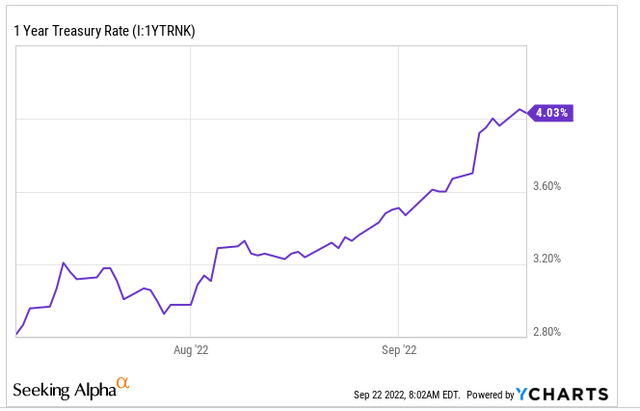

But other market conditions have deteriorated far worse. For example, the one-year Treasury rate which gives a glance at future rate hikes as well a possible terminal Fed Funds rate, has moved from 2.8% to over 4%.

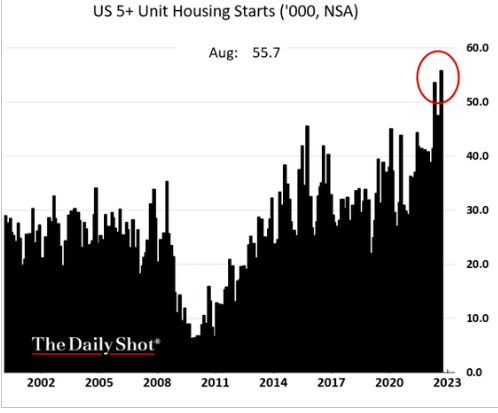

The Federal Reserve’s first future rate cut, which was projected to be in February 2023 at the time of writing the last article, has moved to September 2023 after the latest Fed meeting. Growth projections have markedly deteriorated as the Atlanta Federal Reserve’s Q3 numbers have dropped from over 2.5% GDP growth to about 0.5%. This level of marked deterioration has coincided with negatives in the capital markets as well. A few deals have been pulled in recent months and the sharp rise in interest rates has put a lot of firms on the defensive. Will they bid just as liberally on properties as they would three months back? A lot of these properties are slated for apartment developments or mixed use (residential plus retail). With multifamily units under construction surging to new highs, one can wonder what kind of asset sales will be achieved in the next 12 months under extremely tight financial conditions.

Daily Shot-Twitter

How To Play It

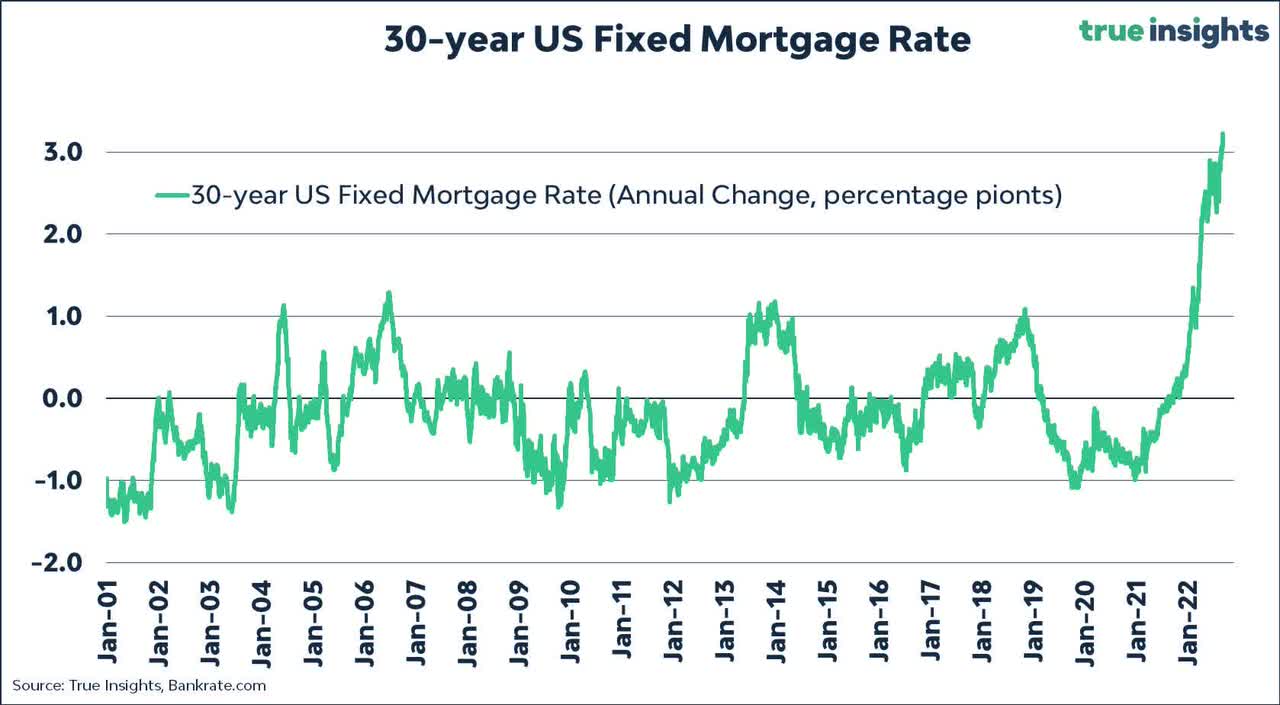

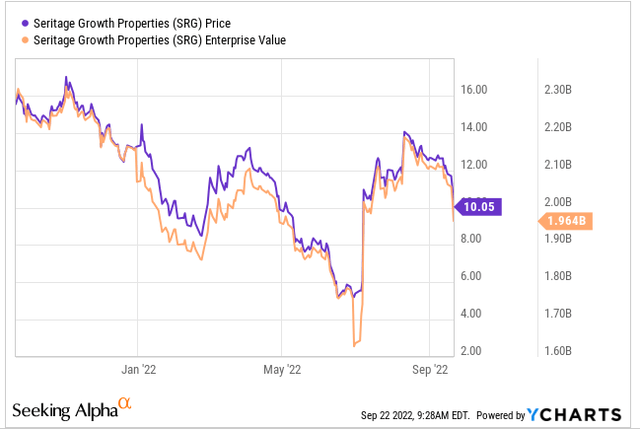

SRG had about $1.4 billion in net liabilities (total liabilities less cash) and an equity market capitalization of close to $500 million. At the $18.50 to $29.00 price band, its enterprise value would be in the $2.5-$3.0 billion range. It is not hard to envision a 20% hair cut to property prices during the steepest percentage rise in interest rates we have ever seen.

True Insights-Twitter

SRG is of course not selling single family homes, but the concept is identical in that you will see prospective buyers throw some number similar to this in their calculations of what they can pay. If you accept that we can get a 20% hair cut vs July estimates, if a modest recession materializes, your enterprise value drops in the range of $2.0 to $2.4 billion. At the low end this is very close to current enterprise value and share price.

Your $18-$29 range becomes more like $10-$18. Hence we would not play any direct long positions here on the common shares. The risk is just too great, especially after a 50% run-up.

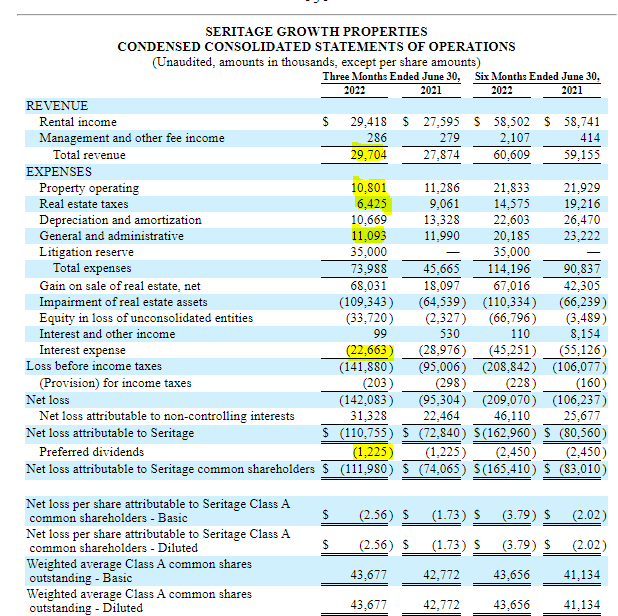

The other issue is simply a delay in getting to the same point. SRG did pay down $100 million on its debt, but even if we adjust Q2-2022 numbers (10-Q) for the lower interest expense, the cash burn remains incredibly high. We have highlighted below the numbers that go into the baseline cash burn before capex from the income statement and that works to about $80 million a year.

SRG 10-Q

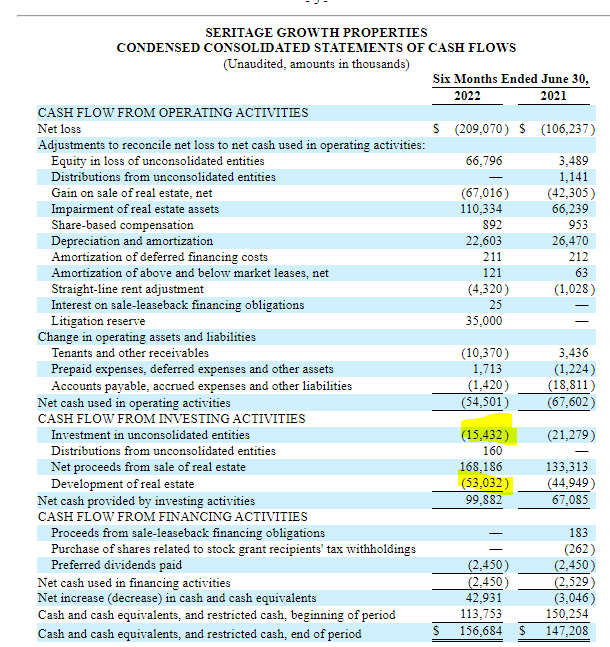

That would move to $73 million annually after the debt paydown. Capex was another $68 million in first half of the year.

SRG 10-Q

That combined burn rate of over $200 million is incredibly high (40% of common equity market capitalization) and should make bulls cautious.

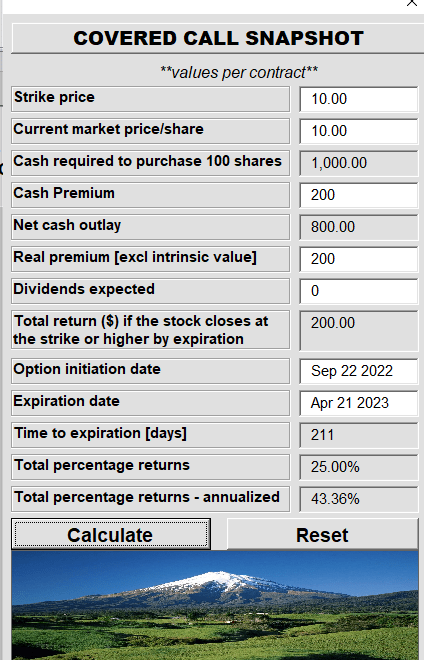

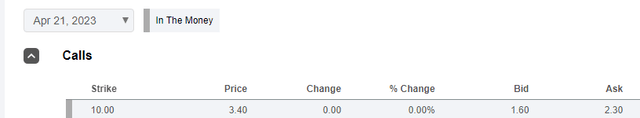

Even if you assume that the properties can be sold for $20 per share and the worst case is that it takes 1-2 years longer than the original plan, your net proceeds shrink dramatically with time. We don’t see the buffer here to play this, period. If we were forced to choose a long play here, it would be to buy the stock and sell the April 2023 covered calls.

This offers a decent annualized return even if prices stay flat.

Author’s App

Verdict

We have never seen great deals get done from the seller’s perspective during a recession. Perhaps this time will be different. But it is not an outcome we would bet on. That is why our first reaction on seeing the news was to suggest an exit on even the preferred shares as they surged to $22.50. The risk reward was no longer great after a 50% jump. We rate those as neutral for now.

At $10 on the common shares you could argue that you are being compensated for the risks. That’s possible and subjective. We have no insight into the exact prices being negotiated today on these properties, only that it is probably less than what it was three months back. We would stay out of the common, which we rate as neutral as well.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment