Design Cells/iStock via Getty Images

Last year I wrote four articles on the prospects for major microbiome company Seres Therapeutics (NASDAQ:MCRB), and this year I’ve written two more articles. Surely that’s enough, but here I am again with another update. My reason for yet another article is to respond to a critical article recently published by Sage Advisors. A real strength of Seeking Alpha is that different viewpoints about companies get aired regularly. For biotech investment in particular this often leads to very different interpretations of what is reality for companies that are not profitable and burning cash. This describes Seres accurately and yet I argue that dramatic change (for the better) may be close. If I’m correct this is an opportunity for substantial capital gain in the near term that’s substantially derisked. Here I explain why.

Sage Advisors has three principal concerns about Seres. These revolve around the size of the market for C. difficile recurrence (small?) and competition (crowded?), along with Seres potential lack of a pipeline beyond SER-109.

Recurrent C. difficile infection is not a small market

The CDC has a useful website concerning C. difficile infection. C. difficile is a bacteria that causes severe diarrhea and inflammation of the colon. People are at most risk if they are taking antibiotics. It’s a big deal for hospitals and aged care facilities. Immunocompromised people are at special risk. In fact C. difficile is the No. 1 healthcare-associated infection in the US (and it’s a global problem). The CDC states that one in six people who have had a C. difficile infection will become reinfected within two to eight weeks.

Recurrent C. difficile is a major medical problem for hospitals and aged care facilities. Both of these markets are huge. I’ve given some indication of the market in an earlier article.

Is Seres Therapeutics really ahead of the pack?

Any healthcare problem that involves major costs to the healthcare system has companies interested in developing solutions. Addressing recurrent C. difficile infection is such a problem.

Sage Advisors indicated a group of companies seeking to develop products in this area. There are several fine companies with products under development, but I don’t see that these companies have the competitive advantages that Seres enjoys at this stage.

Four of the companies that Sage Advisors highlight include:

1. Acurx Pharmaceuticals (ACXP) has an interesting small molecular weight new class of antibiotic, Ibezapolstat, which has fast track FDA designation for treating C. difficile infection. Initial results are striking but involve just 10 patients. New drug chemistries need to be shown to be safe before they get FDA approval.

2. Ferring is a Swiss company that’s owned by a single shareholder. The company has a microbial suspension that’s delivered via an enema. This is an interesting company which could be competitive, although mode of delivery of the product might be less attractive to US patients than the Seres pills.

3. Adiso Therapeutics is a clinical stage biopharma company with strong academic connections in Ireland, Scotland, Australia and the US. Its ADA024 product is a single strain live biotherapeutics which modulates inflammation. It’s manufactured from a clonal bacterial isolate. It’s an oral product in Phase 1b trial for C. difficile recurrence.

4. Destiny Pharma (DEST:LON) has an oral formulation NTCD-M3 which is a non-toxigenic strain of C. difficile which is claimed to compete with normal C. difficile and hence prevents C. difficile infection after antibiotic treatment has ceased. The non-toxigenic strain is claimed to temporarily colonize the gut while the microbiome gets re-established after antibiotic treatment for C. difficile infection. The claim is that reinfection by C. difficile is substantially suppressed in a Phase 2 trial. The company is preparing for a Phase 3 trial.

Emerging companies are not the only players interested in C. difficile, but it’s becoming a bit of a graveyard with now two major pharma companies failing in Phase 3 trials. Pfizer is the latest to fail with a C. difficile vaccine strategy which missed its primary endpoint in a March 2022 announcement. The goal was to prevent occurrence of primary C. difficile infection after three doses of the Pfizer vaccine, which involves genetically modified versions of the C. difficile toxins A and B. Pfizer hasn’t given up because secondary endpoints of reduced severity of C. difficile infection and prevention of medically attended C. difficile infection suggest a possible path for success of the vaccine. However the hoped for protection from infection is not at this stage a possibility.

Before Pfizer, Sanofi (SNY) gave up on its C. difficile vaccine development after its Phase 3 trial failed to prevent primary C. difficile infection after three doses of its vaccine.

The path to market for SER-109

The partnership between BioNTech (BNTX) and Pfizer (PFE) in developing a new generation mRNA vaccine for addressing the COVID pandemic, has shown the power of bringing together outstanding innovation (BioNTech) with manufacture and global marketing (Pfizer) of Comirnaty, which has been one of two highly successful COVID vaccines in the West.

I’ve discussed elsewhere the power of the Nestle partnership that Seres has consolidated through global marketing rights for C. difficile recurrence and also inflammatory bowel disease with Nestle Health Science subsidiary Aimmune Therapeutics. Seres also has another partnership with Bacthera, which is a JV between Chr. Hansen (OTCPK:CHYHY) and Lonza (OTCPK:LZAGY) with strong expertise in anaerobic bacterial culture.

Does Seres have a pipeline problem?

The short answer is of course Seres has a pipeline problem because it doesn’t even have its first product yet. The pipeline will solidify when it does have a product and it can mitigate the endless need for cash that unprofitable biotechs have. From the above discussion about SER-109 and C. difficile reinfection, the first product seems close.

Seres Ulcerative Colitis program (Ser-287 and SER-301) has struggled, but so did SER-109 until they worked it out. A feature of the Ulcerative Colitis program is that if success with clinical trials is achieved, the product is already partnered with Nestle’s gastrointestinal subsidiary Aimmune Therapeutics. This is highly unusual.

Seres raises $100 million in direct stock offering

Very recently Seres raised $100 million in a direct stock offering, which caused me some dismay initially. I really don’t like biotech companies that wait until their stock price is really damaged before raising cash at a discount, which tends to drive the share price lower. This seemed at first sight to be a perfect example of letting your friends in at a massive discount to real value (the price was $3.15/share) at a time when there’s likely to be a substantial uplift in price with FDA approval for a major drug seemingly close. It seemed like a dilution that existing shareholders (me included) don’t need.

However on closer reading of the announcement, perhaps it’s a little more complicated. The explanation concerning use of funds raised revealed more details. The net proceeds from the offering are ~$96.8 million.

Here’s the use of funds statement: The Company intends to use the net proceeds from the Offering for commercial readiness and manufacture of SER-109 for the U.S. market, including expanding longer-term commercial manufacturing capacity, advancing the clinical development of SER-109 for the EU market, and other general corporate and working capital purposes. The Company believes that its existing cash, cash equivalents and investments, together with the net proceeds from the Offering, will fund its operations for at least 12 months from the date of the prospectus related to the Offering filed with the Securities and Exchange Commission (the “SEC”) on June 30, 2022.”

This puzzled me because I was aware that FDA approval of SER-109 triggers a $125 million payment from Nestle. So why raise an additional $100 million? The above release explains that the $125 million payment is expected in the first half of 2023, but there’s no certainty that the company will receive these funds. Perhaps the anticipated FDA approval has more wrinkles to come and so the company is raising $100 million as a precaution? It looks like there is a further $25 million available under an existing loan term subject to FDA approval of SER-109. So if the company receives FDA approval it shall have raised $100 million that will not be needed for the purpose proposed. In today’s mad world maybe that’s prudent. It does indicate that the company seems not to worry too much about existing shareholder dilutions. Existing shareholders didn’t get a chance to participate (other than a select few).

The named investors are the usual suspects, being experienced funds who know what they’re doing in this space. Investors of note are Seres founder (in 2012) Noubar Afeyan’s Flagship Pioneering and Nestle Health Science. Nestle has a major commitment to SER-109 and inflammatory bowel disease therapies through two commercialisation agreements, one for the rest of the world (ex US and Canada) ($120 million upfront and potential total value of $1.9 billion and a second (July 2021) for the US and Canadian markets.

The good news is that since the announcement about the $100 million fund raise, Seres share price has risen (latest close $4.05). Having a further additional $150 million after FDA approval would take Seres runway significantly beyond the next 12 months, perhaps assisting other projects in the Seres portfolio.

Challenges

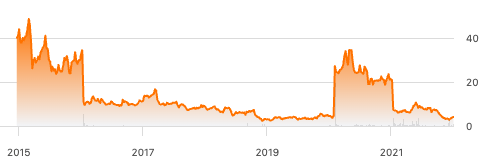

The Seres chart below shows the history of the company since listing in June 2015. Starting out full of hope about unlocking the field of microbiomics, the company rode high through until June 2016, when a setback occurred with the failure of a Phase 2 trial of SER-109 and the share price fell from $34 to $10. There followed a long period in the wilderness until Seres reported good results for a Phase 3 trial of SER-109 in August 2020, which took the share price from under $4 to $24 and then $34. The share price then drifted back to $20 before crashing again to ~$7, this time on a failed Ulcerative Colitis Phase 2 trial of SER-287 in July 2021. This price crash was eerily similar to the setback with SER-109’s failed Phase 2 trial in 2016. Since then the share price has declined, although with a small increase in November 2021. Really good confirmatory news from another Phase 3 trial showing a second excellent outcome for SER-109 on C. difficile recurrence in June 2022, but it barely moved the share price from a year low of $2.50. The share price remains in the doldrums at $4.05 although there are signs that the very recent capital raising (at $3.15/share, see above) might bring new confidence in the stock.

MCRB stock price since listing on NASDAQ (Seeking Alpha)

Investors not paying attention might conclude that this is a stock to be avoided as it is down 80% year on year.

The future of Seres hinges on either of two different kinds of developments

The first involves approval of SER-109 for treating reinfection of C. difficile and sale in global markets. I’ve indicated previously that Seres has a big advantage over other companies seeking to bring a treatment for recurrent C. difficile to market because it has a major company that has invested $100s of millions in acquiring global marketing rights and also preparing to launch the product upon receiving global approvals. The advantage that this brings to Seres should not be underestimated, but the actual bottom line impact on Seres is a little hard to discern at this time. As I’ve indicated above I think that a successful product for C. difficile recurrent infection has substantial markets in hospitals and aged care. If that gets the company profitable, this has to move the share price substantially.

The other possibility for share price recovery involves good results its Ulcerative Colitis program (i.e., a comeback from a failed Phase 2 trial in the way that the company came back from its failed Phase 2 trial of SER-109). Sage Advisors was pessimistic about this but Seres seems confident that it can see a way forward through analysis of the failed trial results. Success in Ulcerative Colitis would open up a huge market concerning inflammatory bowel disease.

Sage Advisors sees a third (but distant) possibility in another bacterial infection product, SER-155, which is at an early stage of development for bloodstream and antimicrobial-resistant bacterial infections and GvHD (Graft versus Host Disease).

Conclusion

Seres Therapeutics is not your usual emerging biotech stock for a number of reasons. Firstly, it is the flagship company that has pioneered the emerging medical field of microbiomics. Secondly, it could be the company to succeed in receiving FDA approval for the first microbiomics product. Thirdly, its development of SER-109 for treating C. difficile reinfection has created a logical path for development of other microbiomics products, specifically in the area of inflammatory bowel disease. It has not yet succeeded in an Ulcerative Colitis (UC) product, but the company is confident that it’s on the right track. Fourthly, Seres has locked in global marketing of not only SER-109 for C. difficile reinfection, but also for UC products with Nestle Health Science, involving Nestle’s gastroenterology (GI) subsidiary Aimmune Therapeutics. This has involved hundreds of millions of dollars of payments for global marketing rights and now direct investment in Seres. I think the Seres/Nestle partnership seems similar to the partnership that BioNTech formed with Pfizer in successful development and marketing of the COVID mRNA vaccine Comirnaty.

The four reasons I’ve given for being interested in Seres, when taken together, make a compelling reason for biotech investors with an appetite for risk to be interested. I’ve recently increased my investment in Seres.

I’m not a financial advisor but I’ve been in the biotech industry in various roles, mostly in innovation and startups for a long time. I hope that my perspective is helpful to you and your financial advisor in assessing risky biotech investment in these challenging times.

Be the first to comment